United Arab Emirates Red Meat Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited Arab Emirates Red Meat Market Trends & Summary

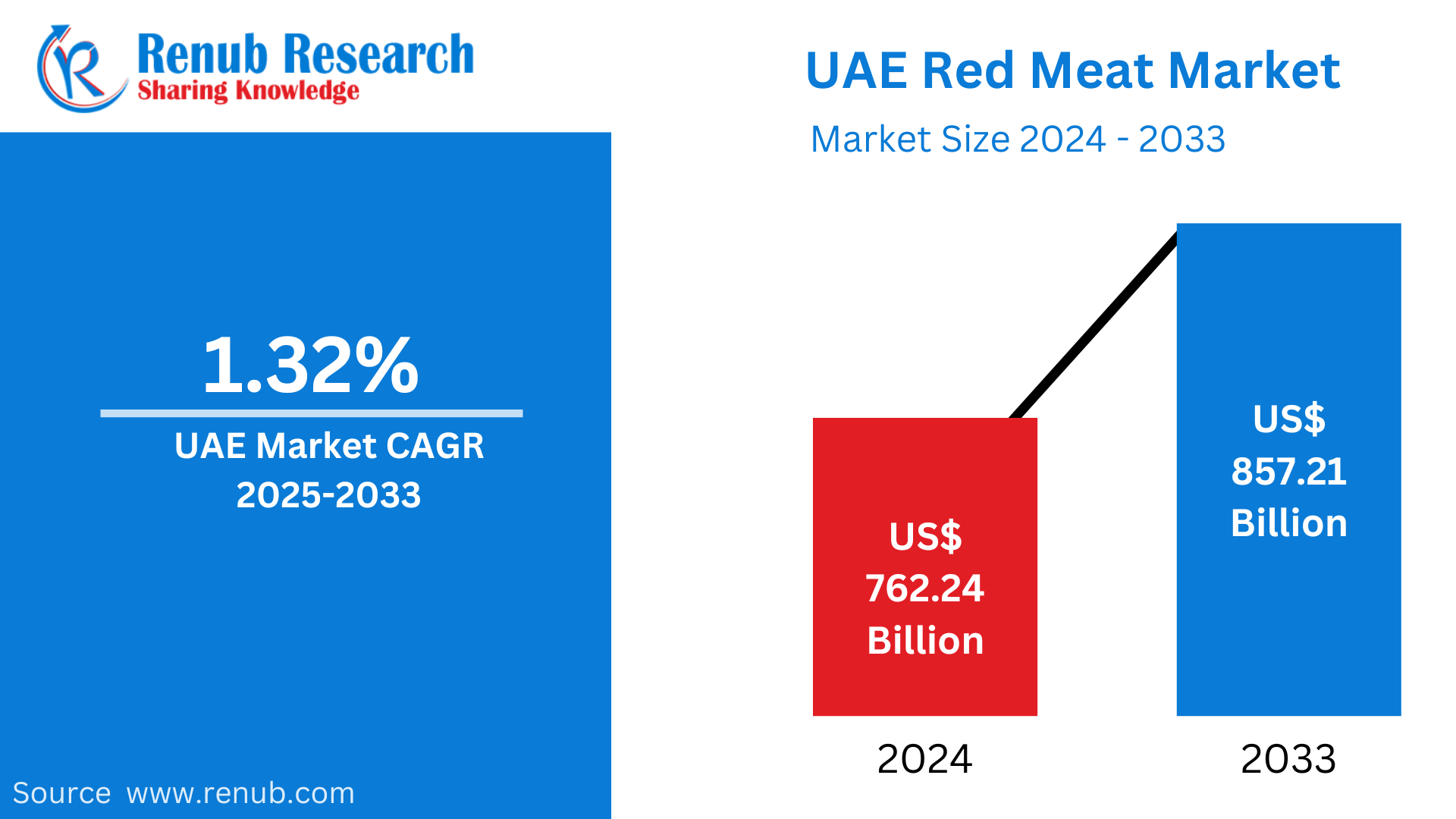

United Arab Emirates Red Meat Market is expected to reach US$ 857.21 billion by 2033 from US$ 762.24 billion in 2024, with a CAGR of 1.32% from 2025 to 2033. Growing urbanization, high tourism, a rich culinary culture, government support for food security, shifting dietary preferences, and rising demand for premium, halal, and sustainably sourced meat products are the main drivers of the UAE's red meat business.

United Arab Emirates Red Meat Market Report by Type (Lamb, Beef, Pork, Mutton, Others), Form (Canned, Fresh / Chilled, Frozen, Processed), Distribution Channel (Convenience Stores, Online Channel, Supermarkets and Hypermarkets, Others), Countries and Company Analysis 2025-2033

United Arab Emirates Red Meat Industry Overview

Rising demand and the necessity for a variety of meat products have made the United Arab Emirates' (UAE) red meat business a major part of the nation's larger food market. The United Arab Emirates, one of the fastest-growing economies in the area, has seen a steady increase in both its population and tourism, which has increased demand for red meat. As a result of a fusion of Western culinary trends and traditional Middle Eastern cuisines, the nation's consumers are beginning to favor premium meat, including both beef and lamb. The UAE's expanding expat population has also added to the diversity of tastes, which has raised demand for high-quality and various meat options.

Despite the strong demand, the UAE has difficulties producing red meat on its own because it depends so heavily on imports, especially from nations like Australia, New Zealand, and Brazil. Through programs like encouraging sustainable farming methods and setting up key facilities for storing meat, the government has concentrated on guaranteeing food security. The market for red meat is also seeing a change toward halal-certified goods, which better suit the cultural and religious tastes of the vast majority of Muslims. With advancements in online retail, packaging, and transportation, the business is well-positioned for future expansion, opening up access to premium red meat for a wider range of UAE consumers.

The UAE's thriving tourism and hospitality industry is a key demand driver and has a substantial impact on the red meat market. With more restaurants and cafes than any other city in the MENA region—roughly 13,000 in 2023—Dubai has become the global center of cuisine. With 88.52% of the population (8.92 million) in 2022 being expatriates, the UAE's demographic makeup has produced a varied culinary scene that accommodates a range of global tastes and preferences. Both traditional Middle Eastern meat meals and world culinary options have evolved as a result of this cosmopolitan setting, especially in the upscale restaurant market.

Growing customer awareness and preferences are driving a major shift in the meat sector toward premium and high-quality meat products. 84% of UAE customers are actively working to reduce their intake of artificial additives, indicating a pronounced desire for premium, natural beef products. The demand for premium, organic, and grass-fed meat types has surged as a result of this trend, and suppliers and retailers are increasing their premium meat selections to cater to this burgeoning market. Price dynamics have a significant impact on consumption trends; in 2022, beef will still be around 29% less expensive than mutton, solidifying its status as a more cost-effective protein source.

Growth Drivers for the United Arab Emirates Red Meat Market

Increasing Population and Urbanization

Both natural population growth and the flood of foreigners drawn to the UAE by its booming economy have contributed to the country's steady population growth. As more people need food to meet their dietary demands, the demand for red meat products has increased as a result of this demographic development. Another important factor influencing shifting purchasing patterns is urbanization. As more individuals relocate to urban areas, their lifestyles change and their disposable income rises, giving them more access to high-end foods like red meat. Additionally, people in cities prefer to eat a wider variety of foods, which increases the consumption of red meats like beef, lamb, and specialty cuts, which propels market expansion.

Culinary Diversity and Tourism

The UAE's red meat market has been significantly impacted by its status as a top international travel destination. Many of the varied culinary tastes brought forth by the inflow of foreign visitors involve red meat. The UAE is a cosmopolitan center with a sizable expat population that contributes their own eating customs and tastes, increasing demand for a broad range of meat products, including specialty and premium cuts from many countries. Additionally, tourists frequently look for both foreign and local Middle Eastern red meat options, which gives local suppliers and importers the chance to satisfy changing customer expectations and grow the red meat business.

Shifting Consumer Preferences

High-quality red meat is becoming more and more popular among UAE consumers, who particularly like premium cuts like lamb and beef. As customers become more conscious of sustainability, ethical sourcing, and food quality, they are becoming pickier about the meat they buy. Meat that satisfies certain requirements, such as halal certification, which is in line with the religious and cultural customs of the majority Muslim population, is becoming more and more in demand. Demand for sustainably and ethically produced beef is rising as a result of consumers' growing interest in items with ethical sourcing. In order to accommodate these shifting tastes, manufacturers and merchants are modifying their products, which helps the market grow and become more streamlined.

Challenges in the United Arab Emirates Red Meat Market

Dependency on Imports

The market for red meat in the United Arab Emirates is largely dependent on imports because local output is very low because of the country's severe climate and scarcity of agricultural land. The majority of the demand is met by major suppliers including Australia, Brazil, and New Zealand. But because of its reliance on foreign markets, the UAE is susceptible to changes in global supply chains, unstable geopolitical conditions, and possible trade restrictions. The consistent supply of red meat may be disrupted by events like natural catastrophes, trade restrictions, or economic difficulties in exporting nations, which could result in shortages. Furthermore, price increases from these nations may raise expenses for both merchants and customers, increasing market susceptibility to outside shocks and compromising long-term price stability.

Rising Meat Prices

Red meat prices have significantly increased in the United Arab Emirates due to global variables such growing feed costs, shifting fuel prices, and the effects of climate change. Customers pay more for beef products as a result of these increased expenses, which strain household budgets. These price increases put retailers' ability to maintain profitability while maintaining competitive prices in jeopardy. In order to control expenses, some customers might look for less expensive protein substitutes, such as chicken or plant-based solutions. The sector may find it challenging to sustain steady development if the rising cost of red meat slows consumption and dampens demand, especially among price-sensitive demographics.

Production will be boosted by the adoption of measures to improve cattle commercialization

Between 2021 and 2022, the UAE's beef production increased at a rate of 4.98%. The main cause of the increase in supply is the rise in the quantity of cattle and buffaloes that are killed for meat. In the United Arab Emirates, 74,638 cow heads were killed for beef production in 2020; this number rose by 2.94% to 76,833 cattle heads in 2021. The nation has reduced its imports of live cattle as a result of the rise in domestic output. The trade value of live cattle imports in 2021 was USD 5.88 million, a 65.7% drop from USD 17.756 million in 2020.

The import of premium beef kinds from other nations, which are priced 150% to 180% higher than average quality, is making it harder for local cattle farmers to compete. For several things, UAE consumers are renowned for placing a higher value on quality than price. Because of their significantly increased customer demand, the UAE's food service industry is willing to pay a premium price for these imports.

United Arab Emirates Red Meat Market Segments

Type

- Lamb

- Beef

- Pork

- Mutton

- Others

Form

- Canned

- Fresh / Chilled

- Frozen

- Processed

Distribution Channel

- Convenience Stores

- Online Channel

- Supermarkets and Hypermarkets

- Others

All the Key players have been covered from 4 Viewpoints

- Overview

- Key Persons

- Recent Development

- Revenue

Key Players Analysis

- Albatha Group

- BRF S.A.

- Freshly Frozen Foods Factory LLC

- JBS SA, Najmat Taiba Foodstuff LLC

- Siniora Food Industries Company

- Tanmiah Food Company

- The Savola Group.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Type, By Form and By Distribution Channel |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

- What is the projected market size of the UAE red meat market?

- What are the key factors driving the growth of the UAE red meat market?

- Which types of red meat are most popular in the UAE?

- How does tourism impact the UAE red meat industry?

- What are the preferred forms of red meat in the UAE market?

- What are the main distribution channels for red meat in the UAE?

- How does the UAE ensure food security in the red meat sector?

- What challenges does the UAE red meat market face?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. United Arab Emirates Red Meat Market

6. Market Share Analysis

6.1 By Type

6.2 By Form

6.3 By Distribution Channel

7. Type

7.1 Lamb

7.2 Beef

7.3 Pork

7.4 Mutton

7.5 Others

8. Form

8.1 Canned

8.2 Fresh / Chilled

8.3 Frozen

8.4 Processed

9. Distribution Channel

9.1 Convenience Stores

9.2 Online Channel

9.3 Supermarkets and Hypermarkets

9.4 Others

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Albatha Group

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 BRF S.A.

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Freshly Frozen Foods Factory LLC

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 JBS SA

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Najmat Taiba Foodstuff LLC

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Siniora Food Industries Company

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Tanmiah Food Company

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 The Savola Group

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com