United Kingdom Energy Drinks Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited Kingdom Energy Drinks Market Trends & Summary

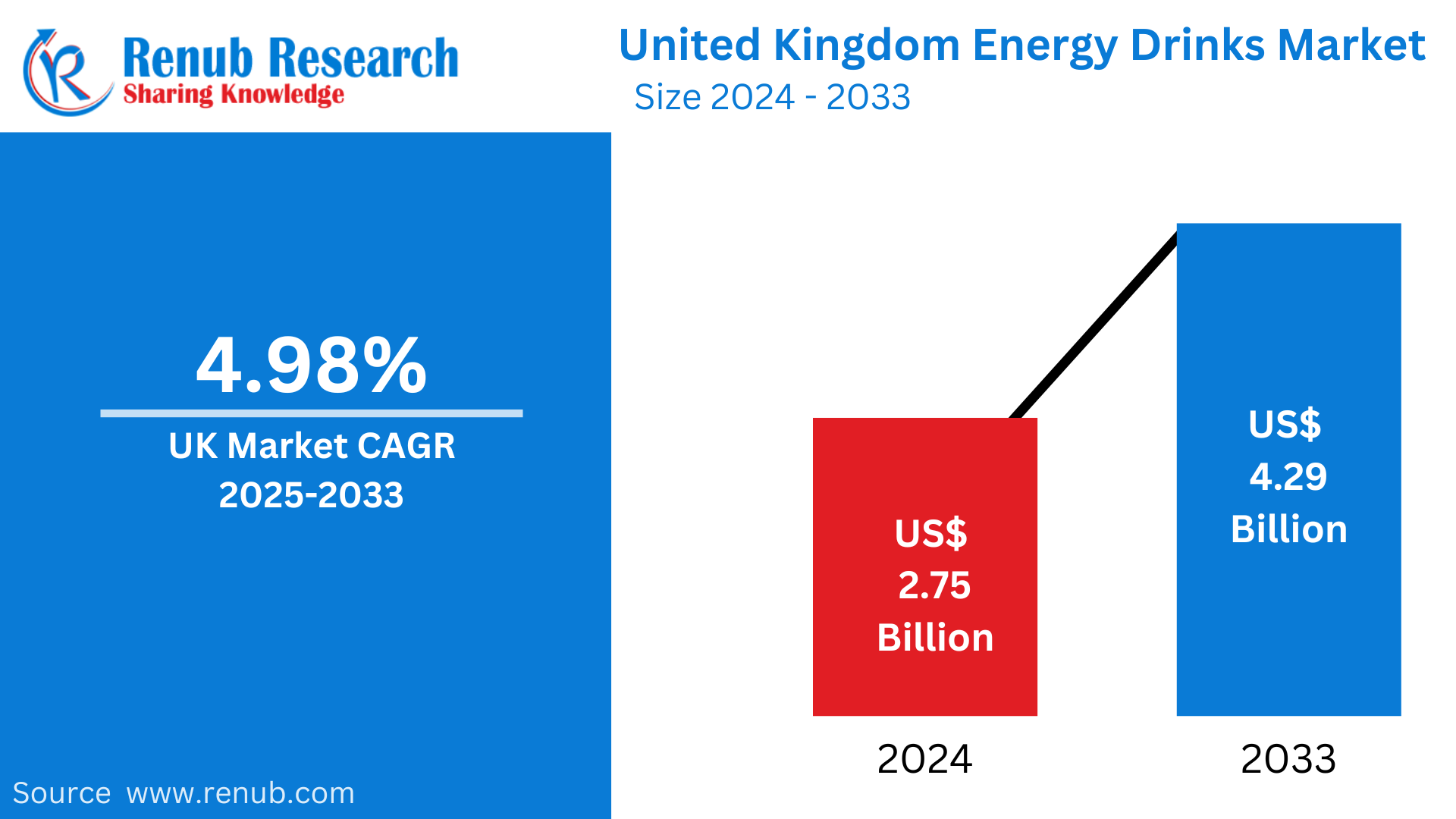

United Kingdom Energy Drinks is expected to reach US$ 4.29 billion by 2033 from US$ 2.75 billion in 2024, with a CAGR of 4.98 % from 2025 to 2033. The market is being driven by a number of factors, such as shifting customer preferences and tastes, an increase in the need for convenient food products, and the widespread availability of products through a variety of distribution channels, such as physical and online retailers.

The report United Kingdom Energy Drinks Market Forecast covers by Packaging Type (Can, PET Bottle), Product (Non-organic, Organic, Natural), Target Consumer (Teenagers, Adults, Geriatric Population), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialist Stores, Online Retail Stores, Other), Region (London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and the Humber, East Midlands, Others) and Company Analysis 2025-2033

United Kingdom Energy Drinks Industry Overview

Due to growing consumer demand for convenient, functional beverages, the energy drink market in the UK has grown significantly in recent years. Younger populations, especially those between the ages of 18 and 34, are increasingly turning to energy drinks as a rapid way to increase their energy and alertness. The market is dominated by companies like Red Bull, Monster, and PepsiCo's Rockstar, but smaller and niche brands are also growing and serving certain consumer demands like natural, organic, or low-sugar ingredients. Consumers who are busy and health-conscious are using energy drinks as a quick and effective way to keep energized throughout the day, which is driving the market's rise.

The sector does, however, confront difficulties, especially in view of the mounting worries about the negative health effects of high sugar and caffeine content. Stricter rules on energy drink marketing, particularly with regard to sales to minors and health warnings, have been introduced by regulatory agencies in response. Additionally, there is a discernible trend toward low-calorie and sugar-free products as customers grow more health concerned. Notwithstanding these obstacles, the market for energy drinks in the UK is still strong due to continuous product development and the demand for functional drinks that stimulate the body and mind. As the market develops, the increasing desire for healthier substitutes and the ongoing growth of the energy drink category beyond conventional products will probably influence the industry's future.

Super Natural Energy, touted as the strongest natural energy drink in the world, was released in July 2024 by Tenzing, a UK firm. Compared to their original beverage, the Fiery Mango variation has a significant boost in caffeine content, with 60 mg per 100ml. Similarly, Acti+ launched their new renewable energy drinks in the UK in April 2024, with varieties like Strawberry & Dragon Fruit and Peach & Apricot. These beverages were created to offer natural energy and health advantages because they contain nootropics, vital vitamins, minerals, and no added sugar.

Growth Drivers for the United Kingdom Energy Drinks Market

Developments in Product Offerings

To attract customers and set themselves apart from competitors, businesses in the nation are always coming up with new flavors, compositions, and packaging designs. Low-calorie and sugar-free options are emerging as a result of consumers' growing desire for healthier options. Additionally, consumers who seek a more natural energy boost find energy drinks that contain natural and organic components like ginseng, guarana, and green tea extract intriguing. Convenience and environmental friendliness are also being improved by advancements in packaging, such as cans with resealable lids and sustainable materials. These developments guarantee that energy drinks will always be popular and relevant. In 2024, Lucozade plans to launch the Blucozade range, which will comprise Lucozade Alert Blue Rush, Lucozade Sport Blue Force, and Lucozade Energy Blue Burst.

Developments in Production Technology

Manufacturing innovations are making it possible for brands to satisfy the growing demand from consumers in the UK by providing more effective, economical, and scalable solutions. Energy drinks' natural constituents are better preserved when innovative processing techniques are used, improving their quality and flavor. More environmentally friendly, durable, and convenient solutions are being made possible by advancements in packaging technology. Additionally, the increasing use of new manufacturing technologies, such as automation and AI-powered quality assurance, is improving production efficiency and consistency, ensuring higher-quality products. These improvements enable businesses to provide a greater variety of products while reducing production costs.

Hell Energy launched Hell Energy AI in 2024, claiming to be the first energy drink created with artificial intelligence in the United Kingdom. The new type has no preservatives, extra vitamins and amino acids, and a tutti-frutti and berry flavor blend. From designing the can to inventing the recipe and testing the flavor, the AI was involved in every step of the drink's creation.

Rising Demand for Convenience

The market for energy drinks in the UK is mostly driven by consumers' growing need for convenience. Customers are looking for quick and simple ways to sustain their energy levels throughout the day due to their increasingly hectic lifestyles. For those who require a quick energy boost during lengthy workdays, long travels, or in between activities, energy drinks provide a practical, portable choice. Students, professionals, and young adults with busy schedules who need a quick pick-me-up are especially in need of this. As a result, consumers seeking efficiency in their beverage selections are increasingly turning to energy drinks. Energy drinks are a desirable option in today's hectic environment since they can be consumed rapidly without requiring preparation or a lot of time.

Challenges in the United Kingdom Energy Drinks Market

Sugar Content

One major issue facing the UK energy drink sector is the growing desire for sugar-free or low-sugar alternatives. Consumers who care about their health are becoming more aware of the harmful effects of consuming large amounts of sugar, which is driving up demand for healthier substitutes. The sugar tax and other government programs aimed at lowering sugar consumption have also pushed companies to develop and rework their goods. To meet this increasing demand, energy drink manufacturers are now concentrating on providing sugar-free, low-calorie, or naturally sweetened choices. Although these modifications address consumer health concerns, they also make it more difficult to preserve the product's flavor and potency. In order to provide the energy-boosting effects that consumers anticipate from energy drinks, brands must strike a balance between using healthier ingredients.

Competition from Alternatives

The market for traditional energy drinks in the UK is seeing increasing competition from the emergence of alternative functional beverages like herbal teas, cold brews, and natural energy boosters. Due to worries about the high levels of caffeine and sugar in conventional energy drinks, consumers are increasingly turning to these alternatives for a more natural, less artificial energy boost. Products that provide more balanced, long-lasting energy with fewer health hazards, such as herbal teas, yerba mate, and cold brew coffee, are becoming more and more popular. Health-conscious consumers looking for clean-label products with fewer artificial additives will also find these substitutes appealing. Energy drink companies must contend with these new alternatives while preserving their market share as consumer demand for these drinks rises.

United Kingdom Energy Drinks Market Overview by Regions

By Region, the United Kingdom Energy Drinks market is divided into London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and the Humber, East Midlands, Others.

London Energy Drinks Market

Because of the city's fast-paced lifestyle and diversified customer base, London has one of the biggest and most vibrant energy drink markets in the UK. Energy drinks are a popular choice because of the large population of young professionals, students, and fitness fanatics who have a high desire for instant energy-boosting solutions. The industry is dominated by big worldwide brands like Red Bull, Monster, and PepsiCo's Rockstar, but smaller and boutique brands—especially those that provide natural or sugar-free options—are increasingly becoming more popular. Energy drink use is further fueled by London's thriving nightlife and hospitality scenes, particularly in bars and nightclubs. However, there are obstacles, such as rising health consciousness and changes in regulations pertaining to sugar content, which force firms to innovate and adjust to changing consumer preferences.

East of England Energy Drinks Market

The market for energy drinks in the East of England is expanding due to rising customer demand for portable, convenient energy sources. Cities with sizable student populations and active populations, such as Cambridge, Norwich, and Ipswich, are major forces behind this growth. Energy drinks are becoming a popular option for people who lead hectic lives and need immediate energy boosts, especially professionals and young individuals. Despite the dominance of well-known global brands like Red Bull and Monster, growing health consciousness has also led to an increase in demand for natural, low-sugar, and healthier alternatives. Energy drinks are becoming commonplace at local stores and gyms, which are important distribution channels. Regulations pertaining to sugar and health concerns, however, continue to pose difficulties for the sector.

Scotland Energy Drinks Market

The market for energy drinks in Scotland has been steadily expanding due to rising demand, particularly from young adults and active customers, for quick and easy energy boosts. Cities with high concentrations of students and working professionals, such as Glasgow and Edinburgh, are important locations for the consumption of energy drinks. The market is dominated by well-known brands like Red Bull and Monster, but consumers are becoming more interested in healthy options like natural and low-sugar energy drinks. The growing popularity of wellness and fitness has raised demand for goods that enhance both mental and physical performance. But issues like health risks associated with excessive sugar and caffeine levels and laws governing marketing to children are forcing companies to come up with new, healthier formulas and environmentally friendly methods.

Yorkshire and the Humber Energy Drinks Market

Due to the region's active population and rising need for rapid energy fixes, the market for energy drinks in Yorkshire and the Humber is expanding gradually. Energy drink usage has increased in major cities like Leeds, Sheffield, and Bradford, especially among young adults, professionals, and students looking for a midday energy boost. The industry is led by well-known international brands like Red Bull and Monster, but there is also rising demand for healthy substitutes like natural and low-sugar energy drinks. Demand has been further boosted by the fitness craze, as athletes and gym-goers increasingly choose energy drinks. However, the market is confronted with health issues because to the high levels of sugar and caffeine, which forces businesses to rework their goods to accommodate shifting consumer tastes.

United Kingdom Energy Drinks Market Segments

Packaging Type

- Can

- PET Bottle

Product

- Non-organic

- Organic

- Natural

Target Consumer

- Teenagers

- Adults

- Geriatric Population

Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specalist Stores

- Online Retail Stores

- Other

Region

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and the Humber

- East Midlands

- Others

All the Key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Revenue

Key Players Analysis

- Suntory Holdings Limited

- Red Bull GmbH

- Monster Energy Company

- The Coca-Cola Company

- GlaxoSmithKline PLC

- Global Trade Holdings Co., Ltd.

- PepsiCo Inc.

- Max Muscle Nutrition

- TSI Consumer Goods GmbH

- Nestle SA

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Packaging Type, Product, Target Consumer, Distribution Channel and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United Kingdom Energy Drinks Market

6. Market Share Analysis

6.1 By Packaging Type

6.2 By Target Consumer

6.3 By Distribution Channel

6.4 By Region

7. Packaging Type

7.1 Can

7.2 PET Bottle

8. Product

8.1 Non-organic

8.2 Organic

8.3 Natural

9. Target Consumer

9.1 Teenagers

9.2 Adults

9.3 Geriatric Population

10. Distribution Channel

10.1 Supermarkets/Hypermarkets

10.2 Convenience Stores

10.3 Specalist Stores

10.4 Online Retail Stores

10.5 Other

11. Region

11.1 London

11.2 South East

11.3 North West

11.4 East of England

11.5 South West

11.6 Scotland

11.7 West Midlands

11.8 Yorkshire and the Humber

11.9 East Midlands

11.10 Others

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Key Players Analysis

14.1 Suntory Holdings Limited

14.1.1 Overview

14.1.2 Key Person

14.1.3 Recent Developments

14.1.4 Revenue

14.2 Red Bull GmbH

14.2.1 Overview

14.2.2 Key Person

14.2.3 Recent Developments

14.2.4 Revenue

14.3 Monster Energy Company

14.3.1 Overview

14.3.2 Key Person

14.3.3 Recent Developments

14.3.4 Revenue

14.4 The Coca-Cola Company

14.4.1 Overview

14.4.2 Key Person

14.4.3 Recent Developments

14.4.4 Revenue

14.5 GlaxoSmithKline PLC

14.5.1 Overview

14.5.2 Key Person

14.5.3 Recent Developments

14.5.4 Revenue

14.6 Global Trade Holdings Co., Ltd.

14.6.1 Overview

14.6.2 Key Person

14.6.3 Recent Developments

14.6.4 Revenue

14.7 PepsiCo Inc.

14.7.1 Overview

14.7.2 Key Person

14.7.3 Recent Developments

14.7.4 Revenue

14.8 Max Muscle Nutrition

14.8.1 Overview

14.8.2 Key Person

14.8.3 Recent Developments

14.8.4 Revenue

14.9 TSI Consumer Goods GmbH

14.9.1 Overview

14.9.2 Key Person

14.9.3 Recent Developments

14.9.4 Revenue

14.10 Nestle SA

14.10.1 Overview

14.10.2 Key Person

14.10.3 Recent Developments

14.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com