United Kingdom Smart Toilet Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUK Smart Toilet Market Trends & Summary

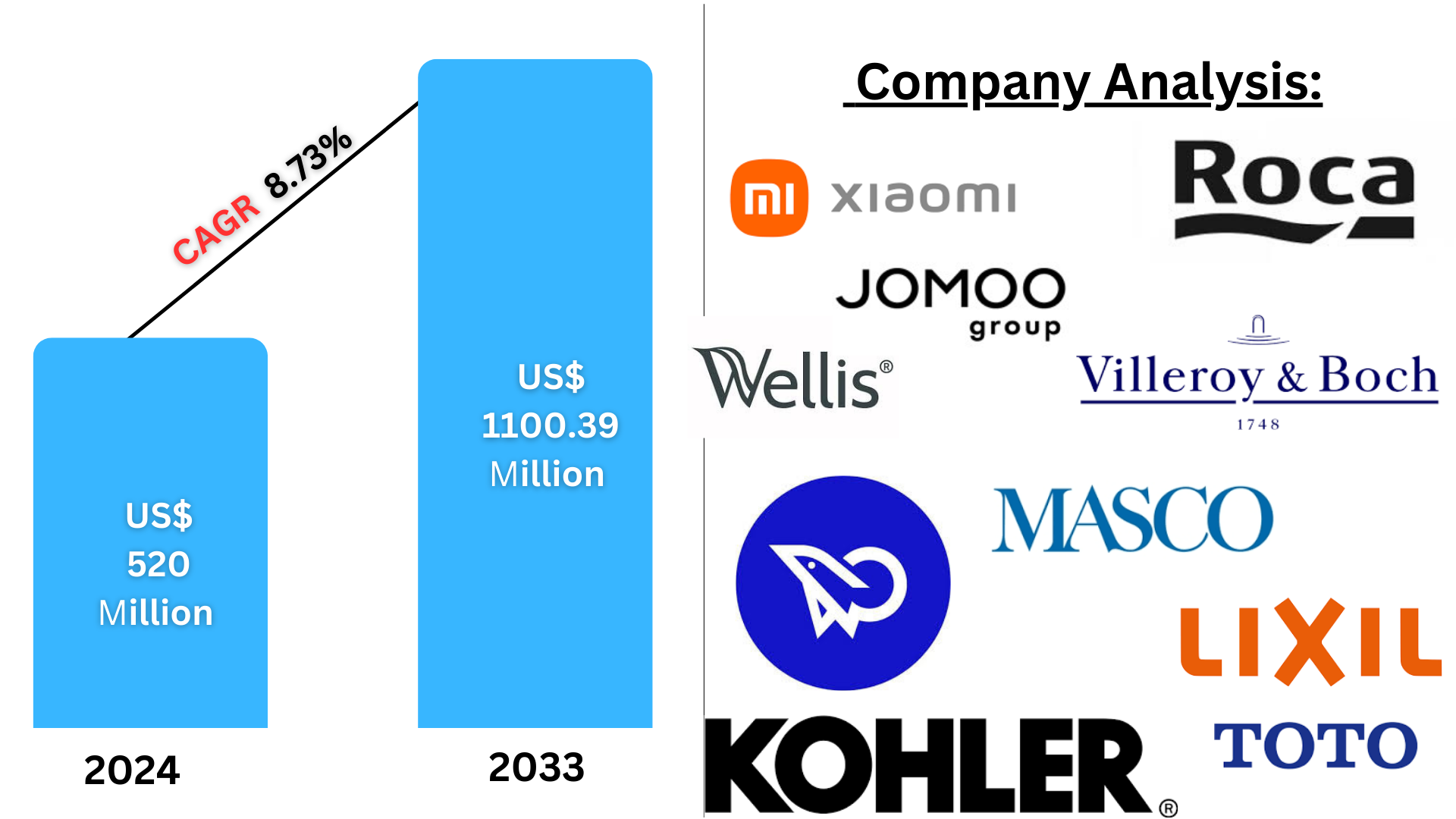

The UK smart toilet market is expected to reach a revenue of US$ 1100.39 million in 2033, up from US$ 520 million in 2024. The growth comes from rising customer interest in improved bathroom technologies, water-saving elements, and greater hygiene. On a compound annual growth rate of 8.73% for the period of 2025-2033, the market mirrors changing values for smart home technology.

The report UK Smart Toilet Market Forecast covers by Product (Integrated Smart Toilet, Smart Toilet Seats), Toilet Type (Floor-Mount, Wall Hung), End User (Residential, Commercial), Distribution Channel (Store-Based Sales, Supermarkets/Hypermarkets, Specialty Stores/Showrooms, Others, Online/E-Commerce), Region (East, West, North, South), Company 2025-2033.

UK Smart Toilet Market Outlooks

A smart toilet is a technologically advanced bathroom fixture that possesses features like automatic flushing, heated seats, water-saving devices, self-cleaning capabilities, deodorizers, and bidet systems. Smart toilets are hygienic, comfortable, and convenient as they integrate motion sensors, touchless flushing, and customized settings. Most smart toilets are also energy-efficient, lessening water and electricity usage.

Smart toilets are becoming popular in the United Kingdom as awareness of hygiene and sustainability increases. They are used extensively in contemporary homes, luxury hotels, and commercial facilities to improve user comfort. Their water-saving properties serve to satisfy the UK's environmental sustainability requirements. In the process, their touch-free operation minimizes the transmission of germs, hence their suitability for healthcare institutions and high-density public places. The booming trend of smart homes also encouraged more people to adopt such toilets, as they integrate smoothly with home automation systems, providing a contemporary and efficient bathroom solution for British consumers.

Growth Drivers for the UK Smart Toilet Market

Increasing Awareness of Hygiene and Sanitation

Increasing emphasis on hygiene and sanitation is one of the key drivers for the demand for smart toilets in the UK. Users are increasingly aware of the health consequences of conventional toilets and are gravitating towards touchless, self-cleaning, and bidet-fitted intelligent toilets. The COVID-19 pandemic also promoted this trend with increasing numbers of homes and business enterprises investing in intelligent toilet systems to improve cleanliness and minimize germs. April 2022, The UK "Support to Improved Water and Sanitation in Rural Areas" (£50.6 million; 2012-2021) offered hygiene kits to 47,050 families, handwashing stations to 255 public facilities, WASH services to 250 schools, and water treatment chemicals to 21 municipalities.

Water and Energy Efficiency Regulations

The UK government has been proactively encouraging water saving through regulation and incentives. Eco-friendly smart toilets with water-saving flush systems fit in perfectly with sustainability objectives. Smart toilets utilize dual-flush technology, and they consume less water than their conventional counterparts. As energy-efficient buildings gain priority, the demand for smart toilets that come equipped with energy-conserving heating devices and automatic systems also increases. In the UK, the team assisted an All-Party Parliamentary Group inquiry on the connection between antimicrobial resistance (AMR) and poor WASH access in healthcare facilities in least developed countries. This resulted in a report on WASH's relevance to preventing AMR, launched at a parliamentary reception in February 2023. In January 2024, the International Development Select Committee incorporated the team's evidence within its sexual and reproductive health report, calling for more funding in WASH. Most recently, on World Water Day in 2024, the UK team released its 'Manifesto for Water,' listing important WASH actions for the next UK government.

Growth in Smart Home Integration

As smart home technologies have taken off in the UK, there has been strong demand for smart toilets that complement home automation systems. Smart toilets now come equipped with voice-control features, connectivity via apps, and user programmable settings to offer a luxury and convenient bathroom experience. High-income families and luxury property developers are particularly interested in this trend as they try to integrate leading-edge technology in contemporary bathroom design. April 2023, Roca unveiled the In-Wash® Insignia shower toilet, with improved comfort and hygiene through superior digital and customized features.

Issues in the UK Smart Toilet Market

High Initial Cost and Installation Complexity

One of the main challenges facing the UK smart toilet industry is the substantial initial cost of buying and installing these high-tech fixtures. In contrast to standard toilets, smart toilets need professional installation, typically involving electrical and plumbing adjustments. The complexity reduces the availability of smart toilets for price-sensitive consumers and discourages mass adoption, particularly in older houses that can have extensive upgrade needs.

Limited Consumer Awareness and Adoption

Although smart toilets have advantages, consumer perception in the UK is low relative to other smart home devices. The unawareness of the features and benefits of smart toilets is prevalent among most individuals, causing them to be reluctant to transition. Slow adoption rates are also promoted by cultural tendencies to hold on to traditional toilet systems and not want to alter ingrained bathroom customs.

UK Integrated Smart Toilet Market

Integrated smart toilet refers to all-in-one toilet units with in-built bidets, automatic flush, and self-cleaning capacity. The toilets are increasingly popular among contemporary homes and upscale real estate complexes. Increasing demand for minimalist bathroom styles has promoted the integrated models that minimize the requirement for additional bidet attachments with more functionality.

UK Smart Toilet Seats Market

Smart toilet seats provide an inexpensive, DIY-friendly option for smart toilet installation compared to entire smart toilet units. Smart toilet seats feature elements such as heating seats, bidet capabilities, and touch control, enabling people to enhance the functionality of their current toilets without having to change the entire unit. The accessibility and affordability of smart toilet seats make them well-liked in the UK by homeowners seeking partial smart toilet installations. October 2024, TOTO launched the NEOREST NX, a high-end smart toilet featuring advanced features such as auto-flush, heated seats, air cleaning, and self-cleaning. The model also features TOTO's iconic eWater+ technology, which utilizes electrolyzed water to purify the bowl.

UK Smart Toilet Wall-Hung Market

Wall-mounted smart toilets are gaining popularity in modern UK bathroom designs because of their minimalist, space-efficient design. They are mounted on the wall, which offers a modern look and better cleaning. They are gaining traction in urban locations where small living spaces demand creative bathroom solutions. Also, their integration with smart home systems is making them desirable for high-end residential and commercial applications.

UK Commercial Smart Toilet Market

Smart toilets are becoming increasingly popular in commercial environments like hotels, office complexes, airports, and shopping centers. Companies are adopting smart toilets to improve customer experience, ensure better hygiene, and lower upkeep expenses. Touchless flush, seat sanitizing automatically, and water efficiency are some of the features that make smart toilets perfect for densely populated areas, promoting sustainability and compliance with regulations. September 2021, Geberit launched the AquaClean Mera, an upscale smart toilet for home and business applications. It features premium technologies such as WhirlSpray shower technology, odour removal, and easy-to-use remote control for customized settings.

UK Smart Toilet Store-Based Market

Conventional home improvement stores, such as bathroom showrooms and specialty home improvement stores, are a dominant channel for the distribution of smart toilets in the UK. Shoppers prefer brick-and-mortar outlets where they can visit various models, seek advice from experts, and compare functions prior to making a purchase. Popular brands typically exhibit their high-end smart toilet series in specific areas of such stores.

UK Smart Toilet Supermarkets/Hypermarkets Market

Hypermarkets and supermarkets are also becoming convenient buying options for mid-range smart toilet seats and models. Retail chain giants tend to carry bathroom fittings in their home improvement department, making it easy for consumers to get affordable and easy-to-mount smart toilet options. These chains also provide finance schemes and deals, increasing the sales further.

West UK Smart Toilet Market

The western part of the UK, with cities such as Bristol and Cardiff, is witnessing high growth in the adoption of smart toilets. The demand is driven by high-income families, luxury apartment complexes, and green urban projects. Growing investment in smart infrastructure and new housing developments also contributes to the growth of the smart toilet market in this region.

East UK Smart Toilet Market

East UK, such as the cities of Cambridge and Norwich, is witnessing an increase in the market for smart toilets as a result of increased home automation trends and growing environmentally friendly consumer behavior. Water-conserving bathroom equipment demand is strong, with the region being keen on environmentally friendly housing solutions. The fact that the region has advanced research institutions and a highly educated population further adds to the consistent use of smart toilet technology.

United Kingdom Smart Toilet Market Segments

Product

- Integrated Smart Toilet

- Smart Toilet Seats

Toilet Type

- Floor-Mount

- Wall Hung

End User

- Residential

- Commercial

Distribution Channel

- Store-Based Sales

- Supermarkets/Hypermarkets

- Specialty Stores/Showrooms

- Others

- Online/E-Commerce

Region

- East

- West

- North

- South

All the Key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Revenue

Key Players Analysis

- Kohler Co.

- TOTO Ltd.

- Xiaomi

- Roca Sanitario S.A.U.

- LIXIL Corporation

- Duravit AG

- Masco Corporation

- Wellis Inc.

- Villeroy & Boch Group

- JOMOO KITCHEN & BATH CO.LTD.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Product, Toilet Type, End User, Distribution Channel and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United Kingdom Smart Toilet Market

6. Market Share

6.1 By Product

6.2 By Toilet Type

6.3 By End-User

6.4 By Distribution Channel

6.5 By Region

7. Product

7.1 Integrated Smart Toilet

7.2 Smart Toilet Seats

8. Toilet Type

8.1 Floor-Mount

8.2 Wall Hung

9. End User

9.1 Residential

9.2 Commercial

10. Distribution Channel

10.1 Store-Based Sales

10.1.1 Supermarkets/Hypermarkets

10.1.2 Specialty Stores/Showrooms

10.1.3 Others

10.2 Online/E-Commerce

11. Region

11.1 East

11.2 West

11.3 North

11.4 South

12. Porter’s Five Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Company Analysis

14.1 Kohler Co.

14.1.1 Overview

14.1.2 Key Persons

14.1.3 Recent Development

14.1.4 Revenue

14.2 TOTO Ltd.

14.2.1 Overview

14.2.2 Key Persons

14.2.3 Recent Development

14.2.4 Revenue

14.3 Xiaomi

14.3.1 Overview

14.3.2 Key Persons

14.3.3 Recent Development

14.3.4 Revenue

14.4 Roca Sanitario S.A.U.

14.4.1 Overview

14.4.2 Key Persons

14.4.3 Recent Development

14.4.4 Revenue

14.5 LIXIL Corporation

14.5.1 Overview

14.5.2 Key Persons

14.5.3 Recent Development

14.5.4 Revenue

14.6 Duravit AG

14.6.1 Overview

14.6.2 Key Persons

14.6.3 Recent Development

14.6.4 Revenue

14.7 Masco Corporation

14.7.1 Overview

14.7.2 Key Persons

14.7.3 Recent Development

14.7.4 Revenue

14.8 Wellis Inc.

14.8.1 Overview

14.8.2 Key Persons

14.8.3 Recent Development

14.8.4 Revenue

14.9 Villeroy & Boch Group

14.9.1 Overview

14.9.2 Key Persons

14.9.3 Recent Development

14.9.4 Revenue

14.10 JOMOO KITCHEN & BATH CO., LTD.

14.10.1 Overview

14.10.2 Key Persons

14.10.3 Recent Development

14.10.4 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com