United States Medical Ceramics Market Size and Share Analysis - Growth Trends and Forecast Report 2024-2032

Buy NowUnited States Medical Ceramics Market Trends & Summary

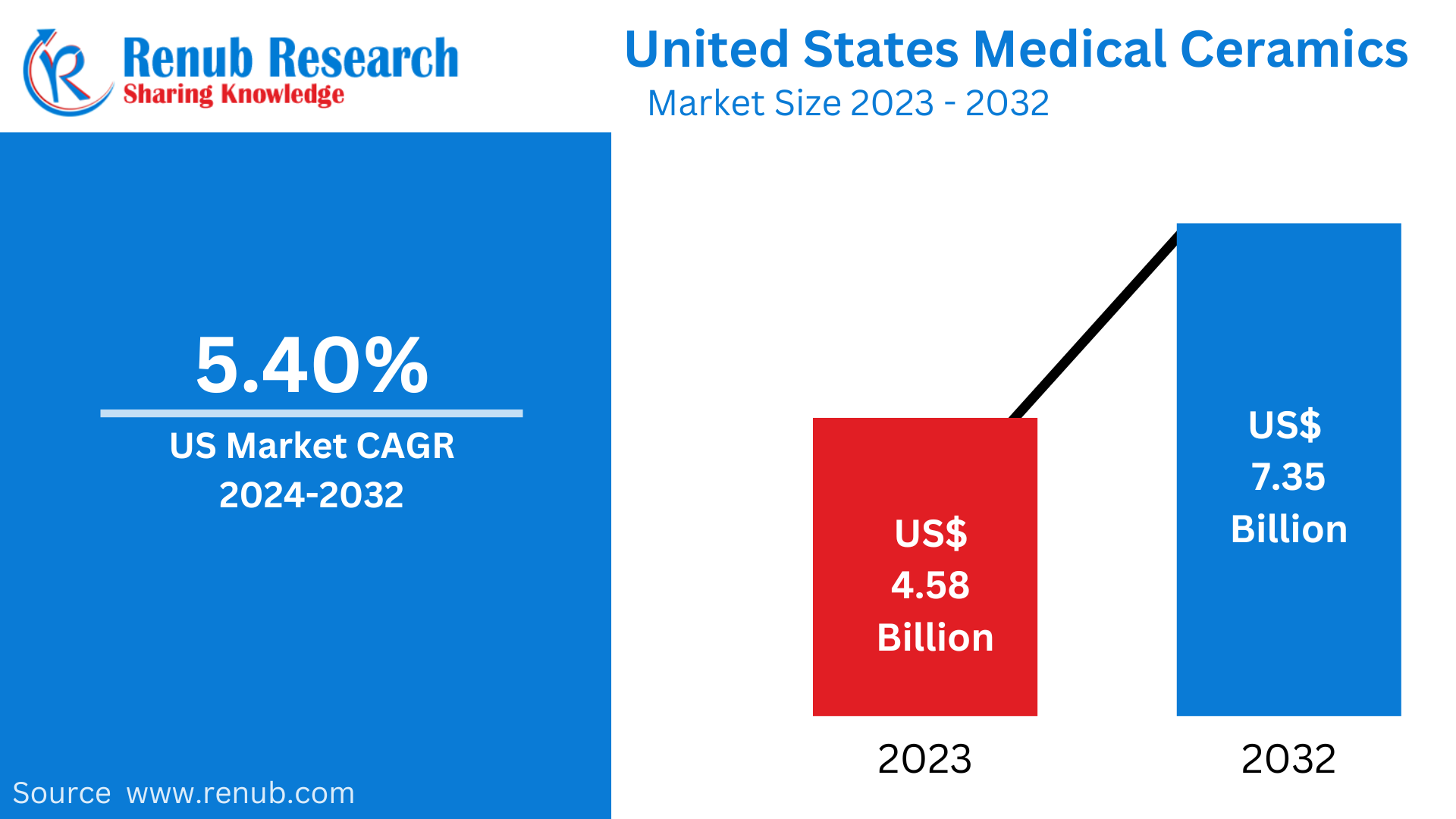

United States medical ceramics market is expected to be around US$ 7.35 billion making it a US$ 4.58 billion in 2023. This growth puts it in a compounded annual growth rate of 5.40% during 2023-2032. Due to the development in medical technology; especially in the areas of orthopedics and dentistry.

United States Medical Ceramics Market Report by Material Types (Bioinert, Bioactive, Bioresorbable, Piezo Ceramics), Application (Surgical Instruments, Plastic Surgery, Orthopedic, Dental) and Country Analysis 2024-2032.

United States Medical Ceramics Market Outlooks

Medical ceramics are innovative materials used in the health care facilities since they are characterized by high density, biocompatibility, and mechanical properties. It includes inorganic non-metal compositions like alumina, zirconia and hydroxyapatie, which are developed as per higher medical specifications. Its properties of the materials make them suitable for such uses as dental implants, and orthopedic applications, surgery and diagnostics tools among others. These materials are meant to be compatible with human tissue, to be durable and resistant to wear and corrosion to give long lasting performance.

In USA, the medical ceramics has found a wide application in almost all the medical specialties. In dentistry, they are applied in crown, bridges and implants since they are aesthetic and are also strong. Some of these uses are orthopedic; for instance, joint replacement like the hip and knee replacement; in these cases, ceramics are used for their highest strength to wear ratios. Such uses as in the diagnostic imaging and surgical implements also improves on accuracy and efficiency. By incorporating medical ceramics on these applications, it denotes constant improvement of health technology and services.

Growth Driver of the United States Medical Ceramics Market

Technological Advancements in Medical Devices

The United States medical ceramics market is primarily influenced by the improvements of medical device technologies. Advances in material science as well as in manufacturing technology have made possible the development of advanced ceramics having superior characteristics; such as biocompatibility and mechanical characteristics. Novel technologies, for instance, 3-dimensional printing and nano technologies can facilitate in the manufacture of better and superior quality medical implants and surgical equipment. These technological enhancements enhance the formulation; of complex and technologically developed medical products that in turn demands advanced medical ceramics in the ever-developing field of healthcare requirements such as dental implants, orthopedic applications, among others. June 2024: Lithoz commences another new 3D printed ceramic serial production dimension in USA.

Rising Incidence of Chronic Diseases.

One of the major drivers of growth in the United States medical ceramic market is the rise in incidences of chronic diseases. Chronic diseases such as arthritis, osteoporosis, and cardiovascular diseases call for surgical procedures that use medical ceramics used for fabrication of implants and prosthetics. These materials are appreciated for their strength, durability and non-toxicity, that make them suitable for the treatment of chronic diseases, requiring long-term treatment. With the constantly increasing number of chronic diseases, the requirement for the use of high-performance medical ceramics also increases, thereby increasing the market and developing the healthcare industry. According to the US Department of Health and Human Services, CDC, by Feb 2024, about 65. 9% of the population of the US is likely to have been diagnosed at least one primary chronic disease (i. e., heart disease, cancer, diabetes, obesity, hypertension and etc).

Aging Population

Prominent trends such as increase in the geriatric population in the United States are boosting the medical ceramic market. With the population of elderly people growing through time, there is an increased need for artificial limbs and organs and other parts of the body as well as products like Orthopedic Implants and Instruments for Bone Surgery which caters for issues like joint breakages and aging bone. Medical ceramics are used in orthopedic implants, dental prosthetics and others because medical ceramics are known to be hard wearing and biocompatible. The continued quest for ways and means to enhance the quality of life of everyone especially senior citizens is the main factor that is able to fuel the growth of the medical ceramic market mainly due to the availability of new materials that are required in the healthcare sector. The population of Americans age 65 and older is expected to rise from 58 million in 2022 to 82 million in 2050, an increase of 47%; the proportion of people in the United States age 65 and older is expected to grow from 17% to 23%, according to the Population Reference Bureau.

Challenges in the US Medical Ceramics Market

High Manufacturing Costs and Complex Production Processes

Medical ceramics are manufactured with advanced techniques and high-quality raw materials, increasing the cost of production. Added to this, the complexity involved in precision machining and stringent quality control increases costs. Moreover, research and development to improve biocompatibility and durability increase the cost. These factors make medical ceramics expensive, limiting their widespread adoption, especially in cost-sensitive healthcare sectors. Companies must balance cost-efficiency while maintaining high performance, which remains a significant challenge for manufacturers in the U.S. market.

Regulatory Compliance and Approval Delays

Strict regulatory challenges from the FDA and other agencies are major issues for the U.S. medical ceramics industry. New ceramic-based medical devices require extensive testing, clinical trials, and documentation to obtain approvals, which significantly prolong product development timelines. Any changes in the regulatory guidelines make market entry more complicated and increases compliance costs. These regulatory challenges create barriers for new companies and slow innovation, affecting the overall growth of the market.

United States Orthopedic Medical Ceramic Market

The orthopedic medical ceramic industry in the United States is growing, specifically for orthopedic implant applications. Joint replacement procedures, spinal surgeries and bone graft are some of surgical applications of medical ceramics since they are biocompatible, remain strong for a long time and do not wear out easily. Even as the population of aging population in the U.S grows, the incidences of bone related diseases including arthritis, especially osteoarthritis, surge leading to increased orthopedic surgeries. Further, escalated health care expenditure and reimbursement policies supporting orthopedic surgeries prompt market growth. As new technologies are being developed, it can therefore be forecasted that the orthopedic medical ceramic market in the U. S. will increase further in the future. As much as 42,514 people died in fatal car accidents on America roads in 2022; this boosted the medical ceramic business revenue.

United States Bioinert Medical Ceramics Market

Bioinert medical ceramics, such as zirconia and alumina, are used in orthopedic implants, dental applications, and prosthetics because of their excellent biocompatibility and mechanical strength. These ceramics do not react with bodily tissues, which reduces the risk of inflammation or rejection. The U.S. market for bioinert ceramics is expanding due to an aging population and increasing demand for joint replacement surgeries. Advances in materials science and surface modifications are further enhancing their longevity and functionality. However, the expensive nature of these implants with added complexities in manufacturing continues to remain a challenge for their broader acceptance in the medical arena. June 2022, The U.S. FDA has announced that CeramTec's latest ceramic total knee arthroplasty device is a Breakthrough Device. It's good news for the company.

United States Bioactive Medical Ceramics Market

Bioactive medical ceramics, such as hydroxyapatite and bio-glass, are the key biomaterials in bone grafting, dental implants, and tissue engineering. They naturally bond to the host bone through a process of regeneration and healing. This increasing preference for bioactive ceramics in orthopedic and dental procedures propels demand for these materials in the U.S. Further, research in regenerative medicine is adding new fields of applications for bioactive ceramics. However, brittleness and cost-effective large-scale production are issues that must be confronted with a view to maximizing their usage within the clinical field.

United States Surgical Instruments Medical Ceramics Market

Medical ceramics are increasingly being used in surgical instruments given their resistance to wear, corrosion, and high temperatures. Ceramic-coated scalpels, forceps, and drill bits offer higher precision and durability than the best metal instruments. The U.S. market for surgical ceramics is growing as hospitals and healthcare providers seek high-performance materials for complex surgeries. Moreover, ceramic instruments provide reduced friction and improved sterilization, making them ideal for medical applications. However, the high cost of ceramic surgical tools and competition from metal-based alternatives may slow widespread adoption.

United States Plastic Surgery Medical Ceramics Market

The demand for medical ceramics in plastic surgery is thereby gaining pace because of the biocompatibility and aesthetic benefits. The manufacturers use ceramic materials in facial implants, bone reconstruction, and cosmetic dentistry to improve patients' results. They are a favorite choice for reconstructive surgeries for their excellent congruent representation of bone, as well as soft tissue. The U.S. cosmetic surgery trend and advancements in ceramic biomaterials are fuelling growth in the market. However, the high cost and specialized expertise required for ceramic-based implants pose challenges for broader accessibility in the plastic surgery segment.

United States Medical Ceramic Company Analysis

The top companies in the United States Medical Ceramic Market are CeramTec GmbH, Kyocera Corporation, Morgan Advanced Materials, 3M, DSM, NGK Spark Plug Co. Ltd, DePuy Synthes, Zimmer Biomet Holding Inc, Straumann, and BioMérieux SA.

United States Medical Ceramic Company News

On May 29, 2024, Himed and Lithoz launched a new Bioceramics Center of Excellence™ (BCoE) at Himed's New York headquarters. The BCoE will focus on R&D using bioceramics for medical device manufacturers and provide analytical services to support rapid prototyping.

In April 2024, Kyocera established a new company called KYOCERA Fine ceramics Medical GmbH (KFMG) as part of its expansion and growth strategy.

In November 2023, Watlow® opened a new Ceramic Technology Center at its St. Louis headquarters to develop new materials solutions for its advanced thermal management systems. The center is a $6 million, 12,000-square-foot conversion of available factory space and will initially create 10-15 new high-tech jobs, with the potential for more in the future.

United States Medical Ceramics Market Segments

Material Types - Market segmented into 4 Viewpoints

- Bioinert

- Bioactive

- Bioresorbable

- Piezo Ceramics

Application - Market segmented into 4 Viewpoints

- Surgical Instruments

- Plastic Surgery

- Orthopedic

- Dental

All the Key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments & Strategies

- Product Portfolio & Product Launch in Last 1 Year

- Revenue

Company Analysis

- CeramTec GmbH

- Kyocera Corporation

- Morgan Advanced Materials

- 3M

- DSM

- NGK Spark Plug Co. Ltd

- DePuy Synthes

- Zimmer Biomet Holding Inc

- Straumann

- BioMérieux SA

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Medical Ceramics Market

6. Market Share – United States Medical Ceramics Market

6.1 By Material Types

6.2 By Application

7. Material Types – United States Medical Ceramics Market

7.1 Bioinert

7.2 Bioactive

7.3 Bioresorbable

7.4 Piezo Ceramics

8. Application – United States Medical Ceramics Market

8.1 Surgical Instruments

8.2 Plastic Surgery

8.3 Orthopedic application

8.4 Dental Application

9. Porter's Five Forces Analysis

9.1 Threat of New Entry

9.2 The Bargaining Power of Buyer

9.3 Threat of Substitution

9.4 The Bargaining Power of Supplier

9.5 Competitive Rivalry

10. SWOT Analysis

10.1 Strengths

10.2 Weaknesses

10.3 Opportunities

10.4 Threats

11. Key Players Analysis

11.1 CeramTec GmbH

11.1.1 Overviews

11.1.2 Key Person

11.1.3 Recent Developments & Strategies

11.1.4 Product Portfolio & Product Launch in Last 1 Year

11.1.5 Revenue

11.2 Kyocera Corporation

11.2.1 Overviews

11.2.2 Key Person

11.2.3 Recent Developments & Strategies

11.2.4 Product Portfolio & Product Launch in Last 1 Year

11.2.5 Revenue

11.3 Morgan Advanced Materials

11.3.1 Overviews

11.3.2 Key Person

11.3.3 Recent Developments & Strategies

11.3.4 Product Portfolio & Product Launch in Last 1 Year

11.3.5 Revenue

11.4 3M

11.4.1 Overviews

11.4.2 Key Person

11.4.3 Recent Developments & Strategies

11.4.4 Product Portfolio & Product Launch in Last 1 Year

11.4.5 Revenue

11.5 DSM

11.5.1 Overviews

11.5.2 Key Person

11.5.3 Recent Developments & Strategies

11.5.4 Product Portfolio & Product Launch in Last 1 Year

11.5.5 Revenue

11.6 NGK Spark Plug Co., Ltd.

11.6.1 Overviews

11.6.2 Key Person

11.6.3 Recent Developments & Strategies

11.6.4 Product Portfolio & Product Launch in Last 1 Year

11.6.5 Revenue

11.7 DePuy Synthes

11.7.1 Overviews

11.7.2 Key Person

11.7.3 Recent Developments & Strategies

11.7.4 Product Portfolio & Product Launch in Last 1 Year

11.7.5 Revenue

11.8 Zimmer Biomet Holding Inc.

11.8.1 Overviews

11.8.2 Key Person

11.8.3 Recent Developments & Strategies

11.8.4 Product Portfolio & Product Launch in Last 1 Year

11.8.5 Revenue

11.9 Straumann

11.9.1 Overviews

11.9.2 Key Person

11.9.3 Recent Developments & Strategies

11.9.4 Product Portfolio & Product Launch in Last 1 Year

11.9.5 Revenue

11.10 BioMérieux SA

11.10.1 Overviews

11.10.2 Key Person

11.10.3 Recent Developments & Strategies

11.10.4 Product Portfolio & Product Launch in Last 1 Year

11.10.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com