United States Alcoholic Beverages Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Alcoholic Beverages Market Trends & Summary

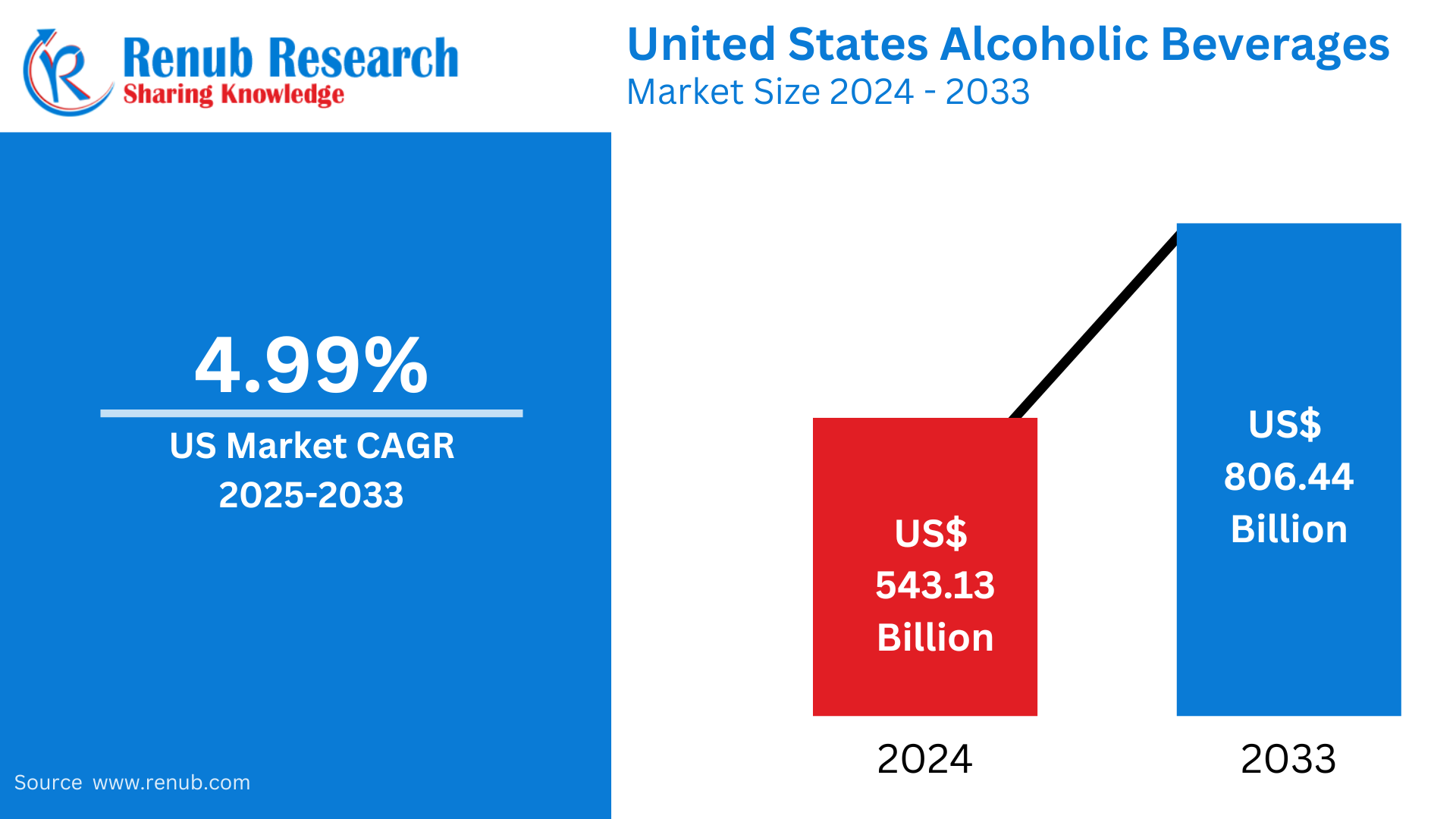

United States alcoholic beverages market is expected to reach US$ 806.44 billion in 2033. The United States alcoholic beverages market was at US$ 543.13 billion in 2024, with a growth rate of 4.99% during 2025 and 2033. This will be due to increasing demand among consumers for craft beers, premium spirits, and healthy alcoholic products. Increased social consumption and product-line innovation also augment the growth curve.

The report United States Alcoholic Beverages Market & Forecast covers by Type (Beer, Distilled Spirits, Wine, and Others), Packaging (Glass Bottle, Tin, and Plastic Bottle), Distribution Channel (Convenience Stores, On Premises, Liquor Stores, Grocery Shops, Internet Retailing, and Supermarkets), States and Company Analysis 2025-2033.

United States Alcoholic Beverages Industry Outlooks

Alcoholic beverages are those beverages that contain ethanol, which is obtained by fermenting grains, fruits, or vegetables. They are available in the form of beer, wine, spirits, and liqueurs. The alcohol content varies from beverage to beverage. Beer contains 4-6% alcohol, wine contains around 12-15%, and spirits contain up to 40% or more. These beverages have been consumed for centuries for social and ceremonial purposes.

In the United States, alcoholic beverages are widely consumed in various settings, such as social gatherings, celebrations, and dining experiences. Beer remains the most popular alcoholic beverage for casual and sporting events. Wine is commonly enjoyed with meals, while spirits are favored in cocktails and social occasions. Alcoholic drinks also play a significant role in the hospitality industry, with bars, restaurants, and pubs offering diverse drink options. The craft alcoholic beverage industry is also on the rise, which can provide consumers with more variety and innovation.

Growth Driver in United States Alcoholic Beverages Market

Craft Alcoholic Beverages

Craft beers, artisanal spirits, and small-batch wines have been key drivers in alcohol sales in the united states. Consumers are looking for unique products that are locally sourced and high-quality. This shift in market trend for craft and premium products has altered the market and puts the breweries, distilleries, and wineries in a position of having to respond to change. Beverage craftiness is seen as a step higher toward quality and authenticity, attracting younger consumers with very discriminating palates who reward diversity of flavors and innovations.

Increasing Health Consciousness and Low-Alcohol Options

As health-conscious consumers are focusing on wellness, the demand for low-alcohol, lower-calorie, and alcohol-free beverages has increased. The increase in light beers, organic wines, and hard seltzers is a result of this trend. These options appeal to people who want to indulge in the social benefits of drinking without sacrificing their health objectives. This growing interest for healthier alcoholic choices, especially in millennials and Gen Z, has reshaped the market and influenced brands to create new, healthy products.

E-commerce and Direct-to-Consumer Sales

The rapid growth of e-commerce and DTC sales channels has dramatically influenced the alcohol sales in united states. U.S. consumers are now able to buy their preferred drinks online; delivery services in many states continue to expand. Online platforms can be used for discovering new brands, special editions, and niche products. Subscription services for craft beers, wines, and spirits are also available and help consumers to discover personalized picks. E-commerce has made alcohol more accessible, and this factor has contributed to the growth in the market.

Challenges in United States Alcoholic Beverages Market

Regulatory and Legal Challenges

There are various hurdles in the U.S. alcoholic beverages market through stringent regulations at state and federal levels regarding alcohol production, distribution, and sales. Different states present a complex compliance pattern for manufacturers and retailers with regard to the restrictions on age, tax, and distribution channels. Moreover, the growing scrutiny in the areas of advertisements and marketing, mainly focusing on underage drinking and health-related issues, is a major challenge for brands to increase their franchise. The constant market challenge is navigating these regulations while ensuring consumer safety.

Increasing Non-Alcoholic Beverages Market

The non-alcoholic and low-alcohol alternatives are gaining popularity and thus challenging the traditional alcoholic beverages market. Health-conscious consumers, especially among the younger generations, are opting for alcohol-free options such as mocktails, kombucha, and sparkling waters. These drinks provide social experiences without the negative health effects associated with alcohol. This competition gets sharper with consumers paying more attention to wellness and moderation. In these scenarios, beer brands have no other choice but to innovate and diversify.

United States Beer Market

The US beer market happens to be among the largest as well as diversified markets in the world, courtesy of a highly vibrant beer culture, increasing demand for consumer-preferred beers, and innovation brewing. Beer remains the largest alcoholic drink in the nation, with very strong demand both in domestic brands and imported beers. The microbrewery industry is growing increasingly, with high-quality craft beer brewing. Apart from lagers and ales, hard seltzers, low-alcohol beers are among the popular brews. Continued changes in consumer preference for healthier drinks, high-end beers, e-commerce distributors increase the boundaries of the fruit flavored alcoholic beverage market.

United States Glass Bottle Alcoholic Beverages Trends

The United States glass bottle alcoholic beverages trends is growing steadily, driven by increasing consumer preference for premium and environmentally friendly packaging. Glass bottles are highly valued for preserving the quality and taste of alcoholic beverages, particularly in sectors like wine, spirits, and craft beers. The rise in eco-consciousness has also led to a preference for recyclable and sustainable packaging. The other attraction is the high-end or luxurious connotation, which goes hand in hand with the perception of premium products. As consumers turn toward sustainability and premiumization, the glass bottle usage is projected to be still very dominant in the U.S. alcoholic beverages market.

United States Alcoholic Beverages Supermarkets Market

The supermarket market for alcoholic beverages in the United States is a big part of alcohol, pushed by consumer convenience and the trend of shopping for alcohol in mainstream grocery stores. Supermarkets offer consumers a full range of alcoholic products, including beer, wine, spirits, and ready-to-drink beverages catering to different tastes and budgets. Growth in this market is experienced due to increases in the size of supermarket chain stores, expanding alcohol-selling aisles, along with increased consumers' demand in craft beers, organic wines, as well as fine spirits. Another factor is a promotion and discount through e-commerce systems that deliver commodities to home.

California Alcoholic Beverages Market

The California alcoholic beverages market is one of the largest and most dynamic in the United States, driven by the state's diverse population, strong wine culture, and increasing demand for premium products. Known for its world-renowned wine production, particularly from regions like Napa Valley and Sonoma, California is a key player in the global wine industry. Craft beer production has been thriving in the state as well, with thousands of craft breweries providing specialty and innovative products. Spirits, especially artisanal and craft, are also finding acceptance. E-commerce and home delivery have further expanded accessibility to alcoholic beverages. California Market for Alcoholic Beverages is characterized by a mix of old favorites and new trends, including health-conscious and eco-friendly packaging, which makes it an epicenter for alcohol innovation.

New York Alcoholic Beverages Market

The New York alcoholic beverages market is one of the most influential and diverse in the United States due to the huge population of the state, robust urban centers, and strong cultural influence. This makes New York a significant hub for domestic as well as international alcohol brands; there is huge demand for premium and craft products. The state boasts a lively beer culture, with many microbreweries and craft beer bars for an increasingly interested consumer base. New York also boasts a very strong wine scene, thanks to the Finger Lakes and Long Island wine regions. The market is also strong in spirits, particularly in the cocktail culture of cities like New York City. With health-conscious drinking and sustainability on the rise, the market is transforming with low-alcohol, low-sugar, and eco-friendly products. E-commerce and delivery services have opened access to alcoholic beverages, which continues to fuel growth in the market.

New Jersey Alcoholic Beverages Market

New Jersey's alcoholic beverages market is characterized by a diverse consumer base, strong demand for premium products, and a growing craft alcohol scene. From commercial beer brands and wines to local spirits, this state has got it all. New Jersey craft beer industry grows rapidly, thanks to the increase in microbreweries and the taprooms supplying unique and localized products. The state gets an added edge from the ease of access that comes with locating close to surrounding regions like Finger Lakes and newly emerging New Jersey wine industry. As consumers' preferences turn toward healthier, low-alcohol, and sustainable options, the market continues to evolve. Consumers can now have alcoholic beverages brought to their doors through e-commerce and home delivery services, available throughout the state. New Jersey's market remains healthy, powered by premiumization, local production, and interest in innovative alcoholic beverages.

United States Alcoholic Beverages Market Segments

Type – Market breakup in 4 viewpoints:

1. Beer

2. Distilled Spirits

3. Wine

4. Others

Packaging – Market breakup in 3 viewpoints:

1. Glass Bottle

2. Tin

3. Plastic Bottle

Distribution Channel – Market breakup in 6 viewpoints:

1. Convenience Stores

2. On Premises

3. Liquor Stores

4. Grocery Shops

5. Internet Retailing

6. Supermarkets

States – Market breakup of 29 States:

1. Below 10 Years California

2. Texas

3. New York

4. Florida

5. Illinois

6. Pennsylvania

7. Ohio

8. Georgia

9. New Jersey

10. Washington

11. North Carolina

12. Massachusetts

13. Virginia

14. Michigan

15. Maryland

16. Colorado

17. Tennessee

18. Indiana

19. Arizona

20. Minnesota

21. Wisconsin

22. Missouri

23. Connecticut

24. South Carolina

25. Oregon

26. Louisiana

27. Alabama

28. Kentucky

29. Rest of United States

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Anheuser-Busch

2. Altria

3. Boston Beer

4. Constellation Brands Inc.

5. Diageo

6. Molson Coors

7. Pernod Ricard SA

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Packaging, Distribution Channels and States |

| Countries Covered | 1. California 2. Texas 3. New York 4. Florida 5. Illinois 6. Pennsylvania 7. Ohio 8. Georgia 9. New Jersey 10. Washington 11. North Carolina 12. Massachusetts 13. Virginia 14. Michigan 15. Maryland 16. Colorado 17. Tennessee 18. Indiana 19. Arizona 20. Minnesota 21. Wisconsin 22. Missouri 23. Connecticut 24. South Carolina 25. Oregon 26. Louisiana 27. Alabama 28. Kentucky 29. Rest of United States |

| Companies Covered | 1. Anheuser-Busch 2. Altria 3. Boston Beer 4. Constellation Brands Inc. 5. Diageo 6. Molson Coors 7. Pernod Ricard SA |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the U.S. alcoholic beverages market by 2033?

-

What was the market size of the U.S. alcoholic beverages market in 2024?

-

What is the expected annual growth rate of the U.S. alcoholic beverages market between 2025 and 2033?

-

Which segment of alcoholic beverages is expected to dominate the U.S. market: beer, distilled spirits, wine, or others?

-

How has the demand for craft alcoholic beverages influenced the U.S. market?

-

What role does health consciousness play in shaping the U.S. alcoholic beverages market?

-

How has e-commerce impacted alcohol sales in the U.S.?

-

What are the challenges faced by the U.S. alcoholic beverages market due to regulatory and legal issues?

-

Which U.S. state has the largest alcoholic beverages market and why?

-

How has the trend towards sustainable packaging, like glass bottles, influenced the U.S. alcoholic beverages industry?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Alcoholic Beverages Market

6. Market Share

6.1 Type

6.2 Packaging

6.3 Distribution Channel

6.4 States

7. Type

7.1 Beer

7.2 Distilled Spirits

7.3 Wine

7.4 Others

8. Packaging

8.1 Glass Bottle

8.2 Tin

8.3 Plastic Bottle

9. Distribution Channel

9.1 Convenience Stores

9.2 On Premises

9.3 Liquor Stores

9.4 Grocery Shops

9.5 Internet Retailing

9.6 Supermarkets

10. States

10.1 California

10.2 Texas

10.3 New York

10.4 Florida

10.5 Illinois

10.6 Pennsylvania

10.7 Ohio

10.8 Georgia

10.9 New Jersey

10.10 Washington

10.11 North Carolina

10.12 Massachusetts

10.13 Virginia

10.14 Michigan

10.15 Maryland

10.16 Colorado

10.17 Tennessee

10.18 Indiana

10.19 Arizona

10.20 Minnesota

10.21 Wisconsin

10.22 Missouri

10.23 Connecticut

10.24 South Carolina

10.25 Oregon

10.26 Louisiana

10.27 Alabama

10.28 Kentucky

10.29 Rest of United States

11. Porter’s Five Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players

13.1 Anheuser-Busch

13.1.1 Overview

13.1.2 Recent Development

13.1.3 Revenue

13.2 Altria

13.2.1 Overview

13.2.2 Recent Development

13.2.3 Revenue

13.3 Boston Beer

13.3.1 Overview

13.3.2 Recent Development

13.3.3 Revenue

13.4 Constellation Brands Inc

13.4.1 Overview

13.4.2 Recent Development

13.4.3 Revenue

13.5 Diageo

13.5.1 Overview

13.5.2 Recent Development

13.5.3 Revenue

13.6 Molson Coors

13.6.1 Overview

13.6.2 Recent Development

13.6.3 Revenue

13.7 Pernod Ricard SA

13.7.1 Overview

13.7.2 Recent Development

13.7.3 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com