United States Alternative Protein Ingredients Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Alternative Protein Ingredients Market Trends & Summary

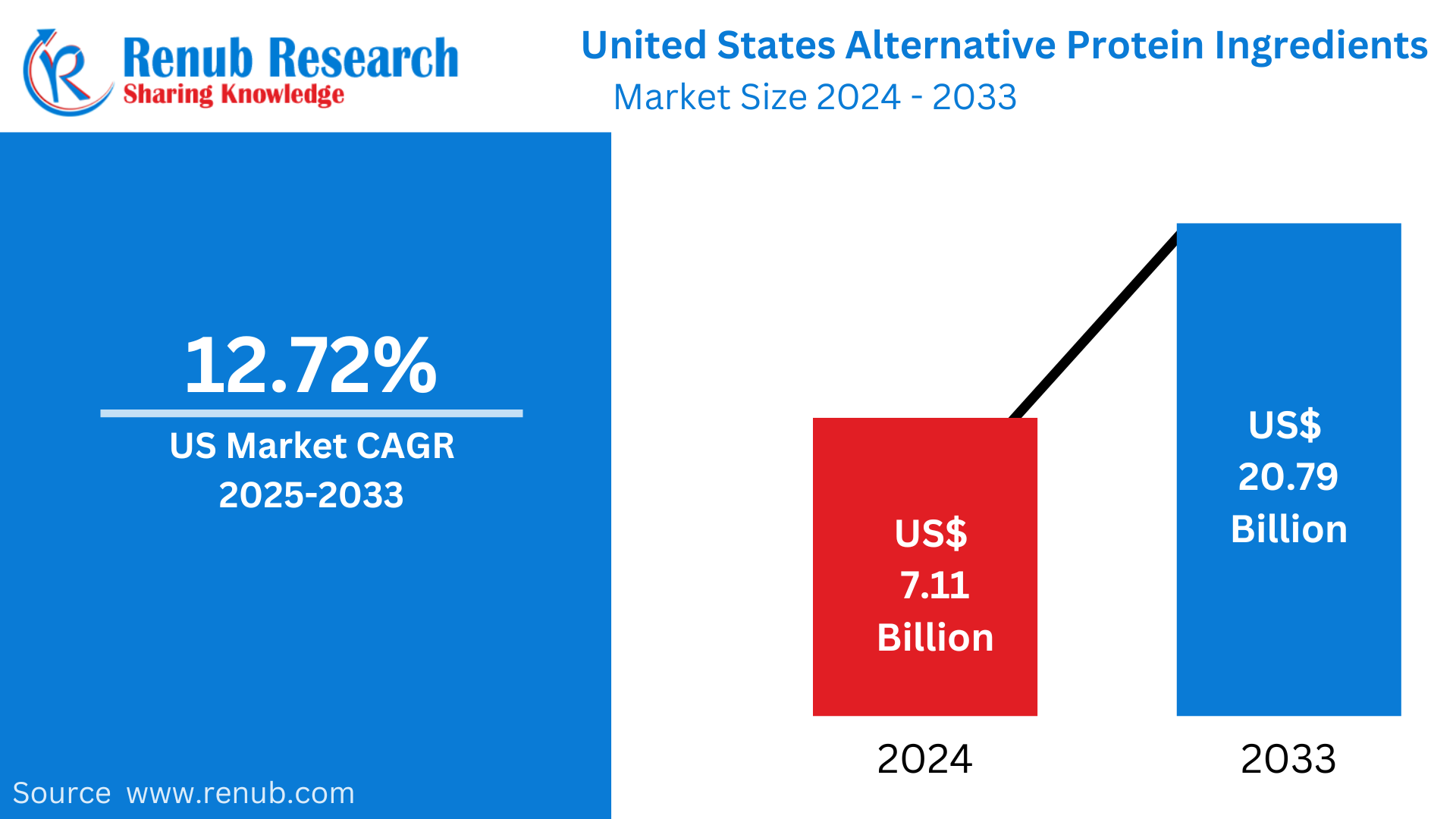

The US Alternative Protein Ingredients Market is expected to expand substantially to USD 20.79 billion by 2033 from USD 7.11 billion in 2024, with a growth rate of 12.72% between 2025 and 2033. This is fueled by the growing demand for plant-based and sustainable protein sources among consumers, improvements in food technology, and enhanced health awareness. The growth in the market is also complemented by alternative protein products innovation.

The report United States Alternative Protein Ingredients Market Forecast covers by Source Type (Plant-Based Proteins (Wheat, Rice, Oats, Soy, Pea, Lupine, Chickpea, Others, Potato, Almond, Potato, Other), Insect-Based Proteins (Coleoptera, Lepidoptera, Hymenoptera, Orthoptera, Hemiptera, Diptera, Others), Microbial-Based Proteins (Algae, Bacteria, Yeast, Fungi, Precision Fermentation Protein, Dairy Proteins (Casins or Whey), Egg Proteins, Others), Application (Food & Beverage, Animal Feed, Dietary Supplements, Others), Region and Company Analysis 2025-2033.

United States Alternative Protein Ingredients Market Outlooks

Alternative protein ingredients are unconventional sources from plants, insects, algae, fungi, and cultured cells. These proteins are environmentally friendly alternatives to animal proteins, which are used in meat substitutes, dairy substitutes, and protein supplements. Soy, peas, lentils, chickpeas, mycoprotein, and precision-fermented proteins are some of the most popular alternative protein sources. They offer essential nutrients while minimizing the environmental footprint of traditional meat production.

In the USA, alternative protein ingredients are becoming extremely popular due to heightened awareness of health issues, concern about the environment, and ethics toward animal well-being. Growing adoption of plant-based diets like vegetarian, vegan, and flexitarian has contributed significantly to demand for plant proteins. Food companies put a lot of money into research and development for developing premium, tasty, nutritious protein substitutes. Additionally, fast-food chains and grocery stores now offer a variety of plant-based meat and dairy products, making alternative proteins more accessible to mainstream consumers. The trend continues to grow as innovation and consumer acceptance increase.

Growth Drivers in the United States Alternative Protein Ingredients Market

Rising Consumer Demand for Plant-Based Diets

The growing shift toward plant-based diets in the U.S. is a major driver of the alternative protein ingredients market. Consumers are increasingly opting for vegetarian, vegan, and flexitarian lifestyles due to health benefits, environmental sustainability, and ethical concerns related to animal welfare. The availability of plant-based meat alternatives, dairy substitutes, and protein-enriched snacks has further accelerated this trend. Major food chains and retailers have expanded their plant-based product offerings, making alternative proteins more accessible to mainstream consumers and driving market growth. Sept 2022 - The Plant Based Foods Association (PBFA) has launched The Plant Based Foods Institute (PBFI), a non-profit organization aligned with PBFA’s mission to improve the food system.

Advancements in Food Technology and Innovation

Technological advancements in food processing and biotechnology have significantly improved alternative protein products' taste, texture, and nutritional profile. Companies invest in precision fermentation, cellular agriculture, and extrusion technologies to create high-quality, sustainable protein sources. Improved food technology allows for the creation of plant and laboratory-grown proteins that are similar to conventional meat and dairy, which is more attractive to consumers. These advancements are propelling the expansion of the U.S. alternative protein market. February 2024, Califia Farms launched Califia Farms Complete, a plant-based milk protein, amino acids, and lower sugar than dairy milk, produced from chickpea, pea, and fava bean proteins.

Environmental and Sustainability Issues

Increasing worries about climate change, deforestation, and water usage linked to animal agriculture have prompted consumers and companies to look for sustainable protein alternatives. Alternative proteins, including plant-based, insect-based, and cultured proteins, have a lower carbon footprint and use fewer resources in production. Government policies encouraging sustainability and corporate efforts to minimize environmental footprint have further boosted the market. As more consumers prioritize eco-friendly food choices, the demand for alternative protein ingredients rises. July 2023, The PLANT Act has been introduced in Congress to secure USDA support for plant-based diets, which could save billions in healthcare costs and combat climate change.

Challenges in the United States Alternative Protein Ingredients Market

High Production Costs and Price Sensitivity

Despite growing demand, alternative protein ingredients often remain more expensive than conventional animal proteins due to high production and research costs. Developing new protein sources, such as lab-grown meat or algae-based proteins, requires significant investment in biotechnology and infrastructure. Additionally, scaling up production while maintaining affordability presents a challenge for manufacturers. Many consumers, particularly price-sensitive ones, still opt for traditional protein sources, limiting the widespread adoption of alternative proteins.

Consumer Acceptance and Taste Preferences

Although alternative proteins are gaining popularity, there are still consumers who are reluctant to accept them because of taste, texture, and cultural factors. Most plant-based and insect-based proteins are unable to match the sensory perception of conventional meat and dairy. Misinformation or distrust of lab-grown and insect-based proteins also influences consumer acceptance. To counter this, companies need to enhance product quality, marketing, and consumer education on the advantages of alternative proteins.

United States Wheat Plant-Based Proteins Market

Wheat proteins, including wheat gluten and seitan, are commonly used as meat alternatives in American plant-based foods. Wheat proteins offer high protein content and chewy texture that closely resembles the real meat, hence being a desired ingredient among vegetarian and vegan foods. The popularity of wheat proteins has increased because of the rise in plant-based product development. Nevertheless, the issue of gluten intolerance and celiac disease has brought alternative proteins into the spotlight.

United States Soy Alternative Protein Ingredients Market

Soy protein continues to lead the U.S. alternative protein market because of its versatility, price, and nutritional value. Soy protein is found in soy milk, tofu, meat alternatives, and protein bars and is a central component of plant-based diets. Non-GMO and organic soy protein demand is increasing due to health-conscious consumers. Soy allergy and deforestation concerns associated with soy cultivation pose challenges to market growth.

United States Coleoptera Alternative Protein Ingredients Market

Coleoptera, or beetles and beetle larvae, is becoming increasingly considered as an alternative protein source within the U.S. They are high in protein, essential amino acids, and healthy fats. They take much less resource to farm than traditional livestock, making them a resilient protein source. Still, consumer resistance and regulatory issues with food products that contain insects are hindering widespread adoption of the product in the American market.

United States Diptera Alternative Protein Ingredients Market

Diptera, like flies and their larvae (black soldier flies), are gaining importance as a source of protein in animal feed and human nutrition. Insects contain high-quality protein and are being cultured with organic waste, thus rendering them environment-friendly. The pet food and livestock sectors are beginning to adopt insect proteins, although their human consumption is still restricted by cultural attitudes and regulations. Future growth can be spurred through enhanced awareness and product development.

United States Algae Alternative Protein Ingredients Market

Proteins derived from algae, like spirulina and chlorella, are becoming increasingly popular because of their high nutrient profile and sustainability. Algae proteins provide high contents of amino acids, vitamins, and antioxidants using limited cultivation resources. Algae proteins are also being used on a large scale in plant-based meat substitutes, dietary supplements, and functional foods. With increasing demand for cleaner, plant-based protein sources among consumers, algae-based ingredients will grow exponentially in the U.S. market.

United States Yeast Alternative Protein Ingredients Market

Yeast proteins, especially those from nutritional yeast and yeast extracts, are increasingly becoming an integral part of alternative protein solutions. The proteins contain a natural umami taste, which makes them suitable for meat substitutes and plant-based milk products. Yeast proteins are also rich in essential nutrients such as B vitamins. With the evolution of food technology, yeast-based proteins are likely to increase in the U.S. alternative protein market.

United States Alternative Processed Meat Food & Beverage Market

The alternative processed meat market in the U.S. is growing as consumers look for healthier and more sustainable alternatives to meat. Plant-based burgers, sausages, and deli meats are being stocked in supermarkets and restaurants in greater numbers. Beyond Meat and Impossible Foods have been at the forefront of the industry with pioneering products that resemble traditional beef. Continued product innovation and growing investment in plant-based meat alternatives fuel market growth.

United States Alternative Animal Feed Protein Ingredients Market

Alternative protein sources are revolutionizing the U.S. animal feed sector. Insect-based, algae-based, and plant-based proteins are being included in livestock, aquaculture, and pet food diets. Alternative protein sources provide environmentally sustainable substitutes for soybean and fishmeal feeds, decreasing environmental impact and enhancing feed efficiency. Increasing worries about the sustainability of standard feed ingredients drive the adoption of alternative proteins for animal nutrition higher.

East United States Alternative Protein Ingredients Market

The eastern United States is a key region for alternative protein innovation, with high market demand in cities such as New York, Boston, and Washington, D.C. Consumers in these markets focus on health-focused eating, sustainability, and plant-based diets. The presence of major food tech players and research institutions also propels market growth. The retail availability of alternative protein products and restaurants facilitates ongoing growth in the region.

West United States Alternative Protein Ingredients Market

The western United States is a leader in the alternative protein industry, with California at the forefront of innovation in plant-based and cell-based proteins. Silicon Valley is a hub for alternative protein startups, with investment in food technology. The high concentration of health-oriented consumers and favorable regulatory climate are factors driving the high growth of plant-based foods. West Coast retail chains and fast-food chains are increasing their alternative protein products, accelerating market development.

United States Alternative Protein Ingredients Market Segments

Source Type

Plant-Based Proteins

- Wheat

- Rice

- Oats

- Soy

- Pea

- Lupine

- Chickpea

- Others

- Potato

- Almond

- Potato

- Other

Insect-Based Proteins

- Coleoptera

- Lepidoptera

- Hymenoptera

- Orthoptera

- Hemiptera

- Diptera

- Others

Microbial-Based Proteins

- Algae

- Bacteria

- Yeast

- Fungi

- Precision Fermentation Protein

- Dairy Proteins (Casins or Whey)

- Egg Proteins

- Others

Application

- Food & Beverage

- Animal Feed

- Dietary Supplements

- Others

Region

- East

- West

- North

- South

All the Key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Revenue

Key Players Analysis

- Beyond Meat

- Impossible Foods Inc.

- Archer Daniels Midland (ADM)

- Cargill Inc.

- Roquette Frères

- Tyson Foods Inc.

- Ingredion Incorporated

- Novozymes

- Kerry Group

- DuPont Nutrition & Biosciences

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Source Type, Application and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Alternative Protein Ingredients Market

6. Market Share

6.1 By Source Type

6.2 By Application

6.3 By Region

7. Source Type

7.1 Plant-Based Proteins

7.1.1 Wheat

7.1.2 Rice

7.1.3 Oats

7.1.4 Soy

7.1.5 Pea

7.1.6 Lupine

7.1.7 Chickpea

7.1.8 Others

7.1.9 Potato

7.1.10 Almond

7.1.11 Potato

7.1.12 Other

7.2 Insect-Based Proteins

7.2.1 Coleoptera

7.2.2 Lepidoptera

7.2.3 Hymenoptera

7.2.4 Orthoptera

7.2.5 Hemiptera

7.2.6 Diptera

7.2.7 Others

7.3 Microbial-Based Proteins

7.3.1 Algae

7.3.2 Bacteria

7.3.3 Yeast

7.3.4 Fungi

7.3.5 Precision Fermentation Protein

7.3.5.1 Dairy Proteins (Casins or Whey)

7.3.5.2 Egg Proteins

7.3.5.3 Others

8. Application

8.1 Food & Beverage

8.2 Animal Feed

8.3 Dietary Supplements

8.4 Others

9. Region

9.1 East

9.2 West

9.3 North

9.4 South

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 Beyond Meat

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development

12.1.4 Revenue

12.2 Impossible Foods Inc.

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development

12.2.4 Revenue

12.3 Archer Daniels Midland (ADM)

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development

12.3.4 Revenue

12.4 Cargill Inc.

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development

12.4.4 Revenue

12.5 Roquette Frères

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development

12.5.4 Revenue

12.6 Tyson Foods Inc.

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development

12.6.4 Revenue

12.7 Ingredion Incorporated

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development

12.7.4 Revenue

12.8 Novozymes

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development

12.8.4 Revenue

12.9 Kerry Group

12.9.1 Overview

12.9.2 Key Persons

12.9.3 Recent Development

12.9.4 Revenue

12.10 DuPont Nutrition & Biosciences

12.10.1 Overview

12.10.2 Key Persons

12.10.3 Recent Development

12.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com