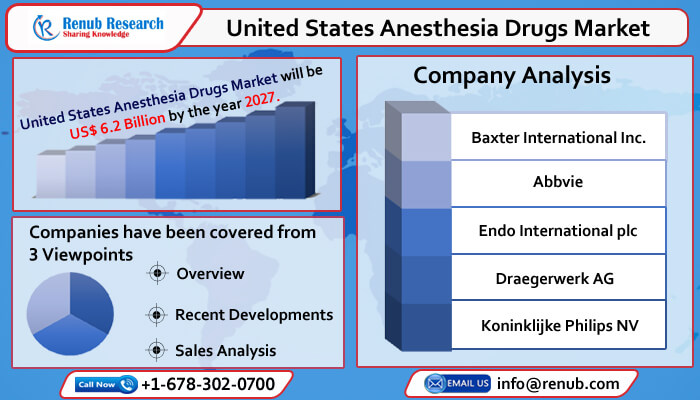

United States Anesthesia Drugs Market to Reach USD 6.2 Billion by 2027, Propelled by Increasing Geratic Population and increasing Cases of Cardiovascular Diseases

12 Mar, 2022

As per the latest report by Renub Research titled "United States Anesthesia Drugs Market, Size, Forecast 2022-2027, Share, Growth, Industry Trends, Impact of COVID-19, Opportunity Company Analysis" United States Anesthesia Drugs Market Size was US$ 4.9 Billion by 2027. In the United States, anesthesia drug is one of the milestones in the pharmaceutical industry, which benefits patients with painless treatment and impossible to perform surgery. The US is home to bigwigs in the pharmaceutical sector to increase their stakes in the United States market. Anesthesia meant the condition of holding sensation blocked or temporarily taken away. This authorizes the patient to undergo surgery and other procedures without distress and pain they would otherwise experience. Anesthesia drugs are used while performing surgical procedures to control pain, heart rate, blood pressure, breathing, rhythm, and blood flow.

Top Impacting Factors:

Notwithstanding, the United States anesthesia drug market is driven by the rising number of surgeries, the growing aging population with increasing chronic conditions, and advancements in anesthesia technologies. As per the statistics provided by the (ASPS) American Society of Plastic Surgeons, in 2019, nearly 16.3 Million cosmetic minimally-invasive procedures and 1.8 Million cosmetic surgical were performed in the United States.

Furthermore, the demand for various anesthetics goes hand-in-hand with the performed surgical procedures. The application of anesthetics in general surgeries is anticipated to contribute significantly to the market's growth in the United States. Further, new anesthesia drugs are being developed, which is predicted to propel market growth. For instance, in 2020, Medova and the New York School of Regional Anesthesia (NYSORA) entered a partnership to introduce SAFIRA (SAFer Injection for Regional Anesthesia) in the United States.

COVID-19 Impact on Anesthesia Drugs Industry:

In the United States, the demand for anesthesia drugs seen a slight drop in 2020 due to the emergence of the pandemic situation, cancelled surgeries or leading to delayed. With the emergence of COVID-19, the United States faced extreme shortages of vital anesthesia drugs, mainly canceled surgeries, dexmedetomidine, midazolam, Propofol, and neuromuscular blocking agents. Most of the surgeries were delayed, and only acute surgical emergencies were managed. Thus, the COVID-19 has an unfavorable impact on the United States anesthesia drugs industry. As a result, numerous players are ramping up their production of anesthesia drugs. For instance, in 2020, Hikma Pharmaceutical introduced a new product, "Propofol Injectable Emulsion" in the United States.

General Inhalation Anesthesia is the Leading Segments in the United States Anesthesia Market

Based on type, the United States anesthesia drugs market includes the General Inhalation Anesthesia Drugs market, General Intravenous Anesthesia Drugs Market, and Local Anesthesia Drugs Market. General Inhalation Anesthesia Drugs Market holds a considerable market share; the inhaled anesthetics include desflurane, isoflurane, sevoflurane, and others that enhance inhibit excitatory synaptic activity and inhibitory postsynaptic channel activity. General intravenous anesthesia drugs are less costly and do not need expensive machines for administration. Moreover, intravenous anesthesia drugs result in undersized cardiovascular depression and better postoperative analgesia.

Besides, general intravenous anesthesia is the leading segment in the United States Anesthesia Market. Fospropofol Disodium, Propofol, Benzodiazepines Class, Ketamine, Methohexital Sodium, Pentobarbital, Etomidate, and Fentanyl are generally utilized general intravenous anesthesia in the United States. Propofol drug is one of the most frequently used general anesthetics in surgeries among these anesthesia drugs. It is utilized as a sedative for critical care (including COVID-19) in the ICU. It is used to maintain procedural sedation, initiate general anesthesia, etc. In 2020, the United States (FDA) Food & Drug Administration approved the usage of Fresenius Propoven 2% emulsion to maintain sedation in COVID-19 patients (16 years and above) requiring mechanical ventilation.

Competitive Landascape

The United States anesthesia drugs market is highly competitive and consists of several major players. Most of the anesthesia drugs trade is generic and are available at a low cost. The key players include Draegerwerk AG, Abbvie, Baxter International Inc., Endo International plc, and Koninklijke Philips NV.

Market Summary:

- Types – Renub Research Report covers United States Anesthesia Drugs Market by type in the 3 viewpoints (General Inhalation Anesthesia Drugs market, General Intravenous Anesthesia Drugs Market and Local Anesthesia Drugs Market)

- United States Anesthesia Drugs Market – This has been further break-up in 8 segments: Propofol, Benzodiazepines Class (Diazepam and Midazolam), Fospropofol Disodium, Ketamine, Methohexital Sodium, Pentobarbital, Etomidate, Fentanyl

- United States General Inhalation Anesthesia Drugs Market – This has been further break-up in 4 segments: Sevoflurane, Desflurane, Isoflurane, Others

- United States Local Anesthesia Drugs Market – This has been further break-up in 7 segments: Bupivacaine, Ropivacaine, Lidocaine, Chloroprocaine, Prilocaine, Benzocaine, Other Local Anesthetics

- All the major players have been covered from 3 Viewpoints (Overview, Recent Development, and Revenue Analysis) Draegerwerk AG, Abbvie, Baxter International Inc., Endo International plc, and Koninklijke Philips NV.

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com