United States Automotive Robotics Market Report Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Automotive Robotics Market Trends & Summary

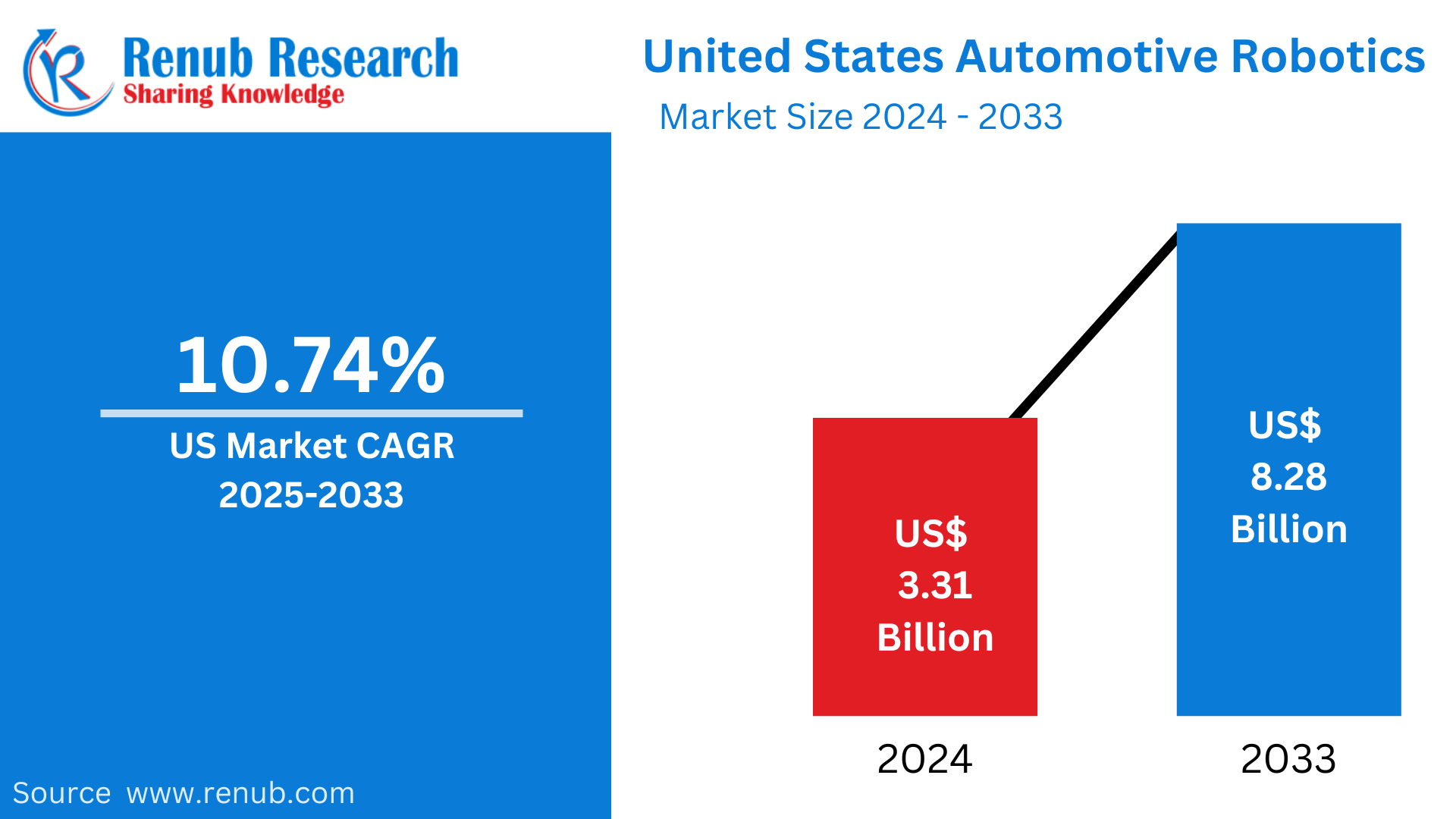

The United States automotive robotics industry is anticipated to expand enormously, reaching US$ 3.31 billion by 2024, and is estimated to reach US$ 8.28 billion by 2033, expanding at a CAGR of 10.74% during 2025-2033. This expansion is fuelled by advances in automation, rising use of AI-based robotics, and the need for precision manufacturing, enhancing efficiency and lowering costs of production in the automotive industry.

United States Automotive Robotics Market Report By Component (Sensors, Controller, End Effector, Robotic Arm, Drive, Others), Types (Articulated, Cartesian, Scara, Cylindrical, Others), By Application (Welding, Material Handling, Painting, Cutting, Others), Company Analysis 2025-2033

United States Automotive Robotics Market Outlooks

Automotive robotics is a term used to describe automated processes in car manufacturing, assembly, and quality inspection. The robots carry out a range of operations including welding, painting, assembling parts, material handling, and inspection with great accuracy and speed. Sophisticated robotics coupled with AI and machine learning increase production capacity, minimize errors, and enhance safety in the workplace by executing difficult and dangerous tasks.

Automotive robots are commonly used in the United States by industry leaders and suppliers to streamline productivity and ensure global competitiveness. The evolution of electric and autonomous cars has further pushed the demand for robot automation in battery production, lightweight material handling, and intelligent production lines. Collaborative robots (cobots) are also more commonly applied to work alongside humans to enhance manufacturing flexibility. With increasing investments in Industry 4.0, U.S. automakers continue to incorporate more and more robotics for predictive maintenance, real-time data analysis, and tailored production, ensuring greater efficiency, cost savings, and enhanced quality of products in the automotive industry.

Growth Drivers in the U.S. Automotive Robotics Market

Growing Automation in Vehicle Production

The U.S. automotive sector increasingly uses automation to make the process more efficient, accurate, and cost-effective. Robotics play an important role in making manufacturing processes more efficient, minimizing human errors, and increasing production rates. Robots are utilized by automakers for welding, painting, material handling, and assembly, delivering consistent quality and reducing waste. As there is a trend towards electric vehicles (EVs) and advanced automotive components, manufacturers are making significant investments in advanced robotics to achieve maximum production efficiency and ensure global competitiveness. In July 2024, Massimo Group, a producer of powersports vehicles and pontoon boats, said that it was adding a new automated assembly robot line at its 376,000 square foot Garland, Texas, factory. This will aid the manufacture of ATV and UTV vehicles.

Embracing AI and Machine Learning in Robotics

Artificial intelligence (AI) and machine learning are revolutionizing automobile robotics in America by making predictive maintenance, real-time analysis, and adaptive automation possible. AI-driven robots are able to detect faults, streamline workflow, and minimize downtime at manufacturing facilities. Machine vision technology improves quality assurance by detecting subtle imperfections in-vehicle parts. The integration of AI in robotics enhances efficiency, safety, and smart automation, making it a major growth driver in the U.S. automotive robotics market. Jan 2025, NVIDIA launched NVIDIA Cosmos™, a platform with cutting-edge generative world models, tokenizers, guardrails, and an accelerated video processing pipeline to advance physical AI systems such as autonomous vehicles and robots.

Increasing Demand for Electric and Autonomous Vehicles

Increased adoption of electric and autonomous vehicles in America drives the need for advanced automotive robotics. The production of EVs needs high precision in battery fabrication, handling lightweight materials, and complex wiring processes, which robots can handle efficiently. Autonomous cars also need complex sensor integration and testing, aided by robotic automation. With the growing EV market and self-driving technology, manufacturers spend money on robotics to drive production efficiencies and satisfy increasing customer demand. April 2024, Waymo begins charging for robotaxi rides in Los Angeles beginning Wednesday, taking the country's autonomous car experiment further.

Obstacles in the US Automotive Robotics Market

Heavy Upfront Cost and Maintenance Charges

The use of robotics in car manufacturing involves a huge capital outlay in robotic arms, sensors, controllers, and software integration. Maintenance, software upgrades, and qualified personnel for programming and running the robots add to the cost, making it even more expensive. Small and medium-sized manufacturers cannot afford to implement robotics because of high initial costs, which hinder market expansion. While automation enhances long-term productivity, the high initial investment is a major hindrance.

Workforce Displacement and Skills Gap

The use of robotics by the U.S. automotive sector has raised fears of job loss, especially in labor-intensive manufacturing positions. Although robotics open up opportunities for high-level jobs in maintenance and programming, not enough highly skilled professionals are available to operate robotic systems. There is a challenge in shifting from manual labor to automation, involving reskilling and training of the workforce, which challenges organizations to find a balance between human labor and robotic incorporation.

United States Automotive Robotics Sensors Market

Sensors are essential in auto robotics, which allow real-time data capture, accurate control, and manufacturing safety. In America, there is increasing demand for sophisticated sensors including LiDAR, infrared, and machine vision sensors as their application contributes to enhanced robotic precision. These sensors assist robots to sense objects, calculate distances, and facilitate hassle-free automation. With the trend of automotive production moving towards automation and artificial intelligence, high-performing robotic sensors are increasingly sought after.

United States Automotive Robotics Controller Market

Robotic controllers are the minds of automotive robotics, controlling movement, coordination, and task execution. Automakers in the U.S. are increasingly investing in AI-based controllers to maximize automation efficiency. Sophisticated controllers enable real-time decision-making, adaptive learning, and predictive maintenance. The move towards smart factories and Industry 4.0 fuels innovation in robotic controllers, allowing robots, sensors, and production systems to communicate seamlessly for enhanced efficiency.

United States Automotive Robotics Articulated Market

Articulated robots are some of the most widely applied in the manufacturing of vehicles in the U.S. and are highly flexible and accurate. Multi-jointed robotic arms carry out complex processes like welding, assembly, and material handling with great precision. Their ability to operate within tight spaces and manipulate complex vehicle parts places them at the core of contemporary production lines. Growing usage of articulated robots increases efficiency, lowers costs, and increases the scalability of production in the U.S. automotive industry.

United States Automotive Robotics Cartesian Market

Cartesian robots, or gantry robots, move on linear axes and are commonly applied to material handling, cutting, and accurate component placement. In the United States, automotive companies utilize Cartesian robots for high-speed and high-precision operations, especially engine assembly and part packaging. Their stiff structure and controlled motion provide repeatability and reliability in manufacturing. Cartesian robots are an essential part of the industry as automation requirements grow.

United States Automotive Robotics Welding Market

Welding is a vital automotive manufacturing process, and robotics has greatly enhanced its efficiency and accuracy. Robotic welding is utilized extensively in the U.S. for metal joining, providing standardized welds, and minimizing manufacturing defects. Computer vision and AI-enabled automated welding systems provide more accuracy and uniformity. Due to the greater production of electric vehicles and light car frames, robotic welding is a major area of investment by automakers.

United States Automotive Robotics Cutting Market

Automotive manufacturing is critical in automotive manufacturing, processing metal, plastic, and composite materials. The U.S. robotic cutting systems offer precision and high-speed cutting of car engines, panels, and frames. Laser-cutting robots, however, are notable for their increased accuracy and efficiency. With demand for lightweight and aerodynamic designs of vehicles, robotic cutting technology is advancing further, leading to increased adoption of the technology on automotive production lines.

Top US Automobile Robotics Market Company News

July 2024, Rapyuta Robotics Inc., a top logistics solution provider, is introducing its newest product, 'Rapyuta ASRS (Automated Storage and Retrieval Systems),' to the U.S. market. With an established history of success in Japan, the Rapyuta ASRS boasts their award-winning multi-agent coordination and control algorithms, cutting-edge materials, and modular design. This state-of-the-art system provides uncompromised picking productivity and efficient storage of inventory, with the ability to scale up or reconfigure as the needs of the business evolve.

May 2024, Comau is leading the Power of Automation with new digital-led, advanced robotic and robust AI-powered automation solutions, which it will showcase at Automate, North America's premier automation exhibition.

Sept 2024, The first of the TOMA™ range of products – and its philosophy – is a palletizing offering that boasts the best available interface, combining industrial strength and usability with collaborative robotics.

February 2024, OMRON Automation Americas, a world leader in industrial automation solutions, is excited to introduce the MD Series of autonomous mobile robots (AMR). The new series is engineered to deliver more efficiency on the production floor, further enhancing OMRON's portfolio of autonomous robots to serve a broader range of part and material transport applications.

July 2024, FANUC America, the world's leading robotics and automation systems company, officially opened its new 650,000 square foot West Campus facility in Auburn Hills, Michigan. The expansion adds more than 2 million square feet of footprint in Michigan and is in line with FANUC America's strategic investment strategy to fund and facilitate industrial automation in North America.

June 2024, Rockwell Automation, Inc. releases additional partnerships with NVIDIA to accelerate the creation of safer, smarter industrial AI mobile robots.

United States Automotive Robotics Market Segments

Component

- Sensors

- Controller

- End Effector

- Robotic Arm

- Drive

- Others

Types

- Articulated

- Cartesian

- Scara

- Cylindrical

- Others

Application

- Welding

- Material Handling

- Painting

- Cutting

- Others

All the Key players have been covered from 5 Viewpoints:

- Overview

- Key persons

- Recent Development

- Revenue

Key Players Analysis

- ABB

- FANUC CORPORATION

- Yaskawa Electric Corporation

- Omron Adept Robotics

- Kawasaki Robotics

- Harmonic Drive System

- Nachi-Fujikoshi Corp.

- KUKA Robotics

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Types, By Components, By Application and By Regions |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. United States Automotive Robotics Market

6. Market Share Analysis

6.1 By Types

6.2 By Components

6.3 By Application

7. Component

7.1 Sensors

7.2 Controller

7.3 End Effector

7.4 Robotic Arm

7.5 Drive

7.6 Others

8. Types

8.1 Articulated

8.2 Cartesian

8.3 Scara

8.4 Cylindrical

8.5 Others

9. Application

9.1 Welding

9.2 Material Handling

9.3 Painting

9.4 Cutting

9.5 Others

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 ABB

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 FANUC CORPORATION

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Yaskawa Electric Corporation

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Omron Adept Robotics

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Kawasaki Robotics

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Harmonic Drive System

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Nachi-Fujikoshi Corp.

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 KUKA Robotics

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com