United States Baby Food and Infant Formula Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Baby Food and Infant Formula Market Trends & Summary

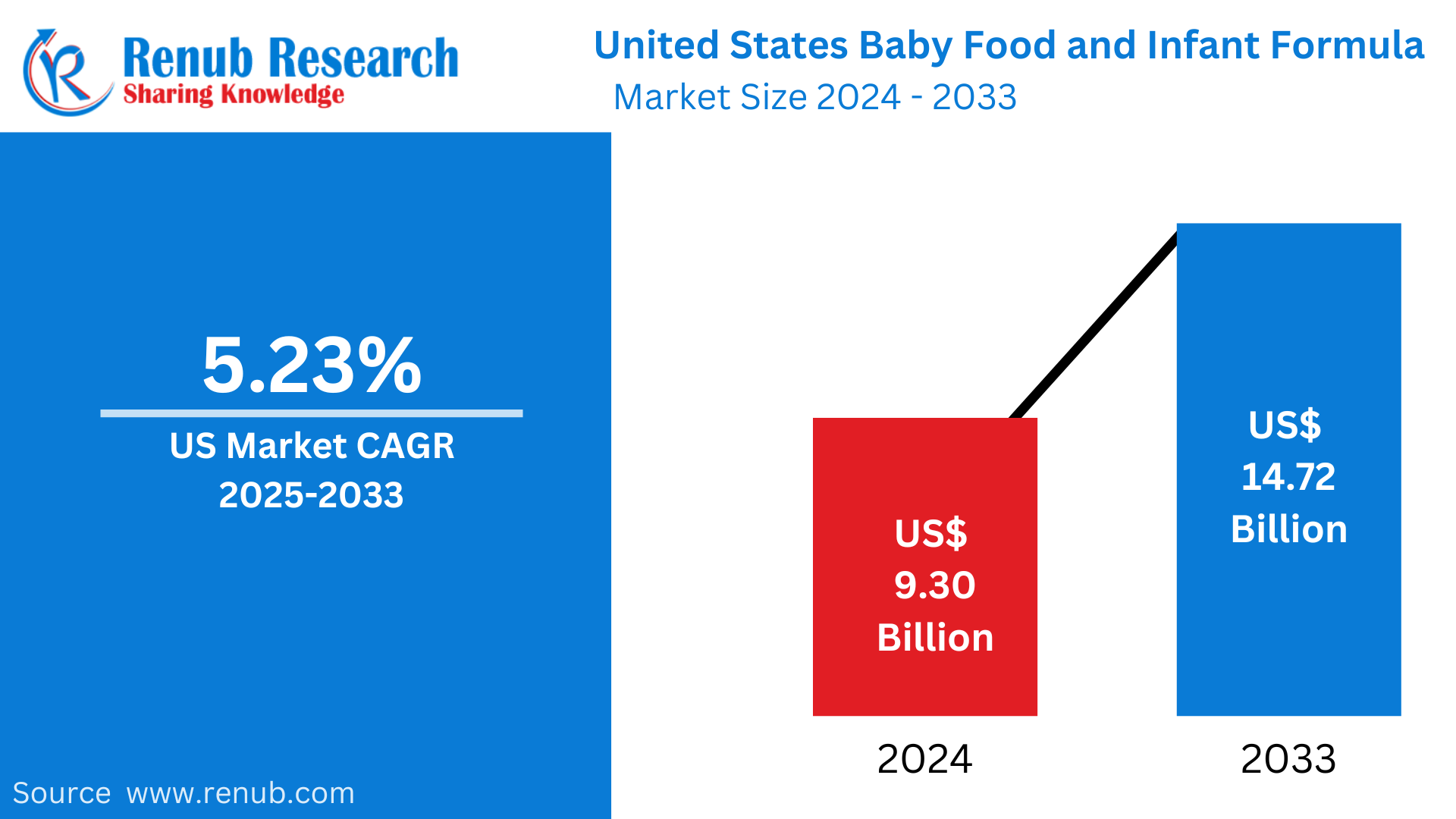

United States baby food and infant formula industry is expected to grow to US$ 14.72 billion by 2033 from US$ 9.30 billion in 2024 at a CAGR of 5.23% between 2025 and 2033. It is fueled by growing parental interest in infant nutrition, the rise of organic and premium baby foods, and development in formula ingredients and production technologies.

United States Baby Food and Infant Formula Market Report by Types – Europe Baby Food and Infant Formula Market (Milk Formula, Dried Baby Food, Prepared Baby Food, Others), Distribution Channel (Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Others), and Company Analysis 2025-2033

United States Baby Food and Infant Formula Market Outlooks

Baby food refers to soft, easily digestible food products designed for infants and young children. These include purees, cereals, snacks, and ready-to-eat meals, providing essential nutrients for a child’s growth and development. Infant formula, on the other hand, is a specially designed milk substitute for babies who are not breastfed or require additional supplementation. It contains proteins, carbohydrates, fats, vitamins, and minerals to support infant nutrition.

In the United States, infant formula and baby food are responsible for healthy growth of infants. Due to hectic lives, working parents opt for easy-to-consume and healthy baby food. Moreover, rising awareness regarding organic and natural products has fueled demand for high-end baby food. Infant formula is especially necessary for working mothers, premature infants, or special-needs infants. The industry keeps expanding through product formulation breakthroughs, government regulations on safety, and expanding concerns regarding infants' health and nutrition.

Driving Forces in United States Baby Food and Infant Formula Market

Increase in Parental Awareness of Baby Nutrition

Informed parents seeking high-quality baby food and infant formula have spurred demand as mothers and fathers increase their awareness regarding the significance of early childhood nourishment. With greater exposure to nutritional studies, caregivers look for products that contain essential vitamins, minerals, and probiotics. Organic and non-GMO lines are especially popular among health-savvy parents. Brain development, gut health, and immune system support continue to drive demand, propelling innovation in the formulation of products. In January 2025, the FDA released draft guidance is designed to assist the manufacturers and processors of Low Moisture Ready-to-Eat (LMRTE) human foods, such as powdered infant formula, in meeting demands for current good manufacturing practices, hazard analysis, and risk-based preventive controls to provide a safe and sanitary food supply.

Growing Demand for Convenience and Ready-to-Use Products

With busy lifestyles and an increasing number of working parents, the demand for convenient, ready-to-use baby food and infant formula is on the rise. Single-serving pouches, on-the-go snacks, and easy-to-mix formula options cater to parents looking for nutritious yet time-efficient feeding solutions. This trend has led to an expansion in online and retail availability, boosting overall market growth. In Aug 2024, Abbott made public its extension of its Pure Bliss™ by Similac® family of organic, and European-formulated infant formulas that provide parents with a variety of products to suit particular formula tastes.

Expanding Retail and E-Commerce Channels

The quick growth of retail and distribution channels for e-commerce has increasingly made infant formula and baby food readily available to consumers. Large chains of retailers, supermarkets, and websites provide a range of products, allowing parents to compare reviews, ingredients, and prices prior to buying. Subscription delivery services have also become more popular, offering parents an easy and hassle-free means of ordering necessary infant nutrition products.

Challenges in United States Baby Food and Infant Formula Market

Regulatory Challenges and Product Safety Issues

The U.S. Food and Drug Administration (FDA) regulates baby food and infant formula tightly to guarantee safety and nutritional standards. Manufacturers have to adhere to strict standards on ingredient sourcing, levels of contamination, and packaging. Recalls and fears over contaminants, like heavy metals, have made customers more vigilant, and it becomes challenging for brands to uphold trust and credibility.

High Competition and Pricing Pressure

The infant formula and baby food industry is very competitive with many established brands and new entrants competing for market share. Organic and premium products are pricey, making them unaffordable for low-income households. Moreover, retailers' private-label brands provide affordable alternatives, putting pricing pressure on established brands and requiring constant innovation to keep customers loyal.

United States Milk Formula Baby Food Market

The milk formula segment is a major part of the baby food market, serving infants who need breast milk substitutes. Sold in various formulations—standard, organic, and special formulas for sensitive digestion—this segment remains on the rise as parents increasingly turn to formula feeding. Advances in nutritional ingredients, such as DHA and prebiotics, promote infant development and fuel consumer demand.

United States Dried Baby Food Market

Dried baby food, whether in the form of cereals or powdered meals, is still a constant presence in infant nutrition. It is popular due to its long shelf life, simple storage, and high nutrient density. As organic and fortified varieties gain popularity, manufacturers are coming out with added probiotics, iron, and fiber in dried baby food for the purpose of maintaining digestive as well as brain health in infancy.

United States Baby Food and Infant Formula Pharmacies Market

Pharmacies are one of the predominant distribution channels for infant formula and baby food, providing trusted and prescription-based specialist formulas. Pharmacies are primarily used by parents looking for medical-grade nutrition, hypoallergenic formulas, or diet-specific baby food. Exclusive product accessibility and pharmacist referrals are the causes of the stable growth in this segment.

United States Baby Food and Infant Formula Convenience Stores Market

Convenience stores offer immediate access to baby food and formula staples, meeting parents' needs for emergency or last-minute shopping. While variety is typically narrower than at supermarkets, convenience stores are crucial in maintaining baby food availability in urban and suburban areas.

United States Baby Food and Infant Formula Market

The U.S. infant formula and baby food market is growing steadily, propelled by higher consumer awareness of infant nutrition, urbanization, and innovation in organic and fortified offerings. Consumers are concerned with quality, safety, and convenience, contributing to rising demand for preservative-free, clean-label, and plant-based formats. Players in the industry concentrate on product diversification and improved supply chain initiatives to deliver on consumers' expectations.

Northeast United States Baby Food and Infant Formula Market

Northeastern states with urban centers like New York and Boston have the largest demand for premium and organic infant food brands. People from this region believe in sustainability and therefore drive higher sales of sustainably packaged food products and naturally sourced baby foods. Affluent consumers drive up sales of high-end and specialty infant formula brands.

Midwest United States Baby Food and Infant Formula Market

In the Midwest, access and affordability dictate market trends. Parents in the region demand affordable yet nutrient-dense baby foods. Retail chains and discount stores hold sway over sales, as e-commerce penetration increases, making rural consumers aware of more varied products and availability.

South United States Baby Food and Infant Formula Market

The South of the U.S. is home to a multi-faceted consumer base with varying demand for premium organic labels and low-priced formulas. High birth rates in the region provide steady market growth. Supermarkets and grocery stores are still prevalent sales channels, followed by e-commerce.

Western United States Baby Food and Infant Formula Market

The Western United States, including California and Washington, experiences strong demand for natural, organic, and plant-based infant food products. Focused on health and wellness, parents here prefer non-GMO, preservative-free options. New product innovations, such as plant-based and allergen-free formulas, continue to dominate the market trends.

United States Infant Formula and Baby Food Market Segments

Types

- Milk Formula

- Dried Baby Food

- Prepared Baby Food

- Others

Distribution Channel

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Others

Region

- Northeast

- Midwest

- South

- West

All the Key players have been covered from 5 Viewpoints:

- Overview

- Key persons

- Recent Development

- Revenue

Key Players Analysis

- Abbott Laboratories

- Kraft Heinz Company

- Hero Group

- Hain Celestial Group, Inc.

- Nestlé

- Lactalis (Stonyfield Farm, Inc.)

- Reckitt Benckiser Group plc

- Danone

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Products, By Distribution Cannel and By Regions |

| Regions Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. United States Baby Food and Infant Formula Market

6. Market Share Analysis

6.1 By Types

6.2 By Distribution Channel

6.3 By Regions

7. Types

7.1 Milk Formula

7.2 Dried Baby Food

7.3 Prepared Baby Food

7.4 Others

8. Distribution Channel

8.1 Supermarkets and Hypermarkets

8.2 Pharmacies

8.3 Convenience Stores

8.4 Others

9. Region

9.1 Northeast

9.2 Midwest

9.3 South

9.4 West

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Abbott Laboratories

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Kraft Heinz Company

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Hero Group

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Hain Celestial Group, Inc.

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Nestlé

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Lactalis (Stonyfield Farm, Inc.)

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Reckitt Benckiser Group plc

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Danone

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com