United States Biodiesel Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Biodiesel Market Trends & Summary

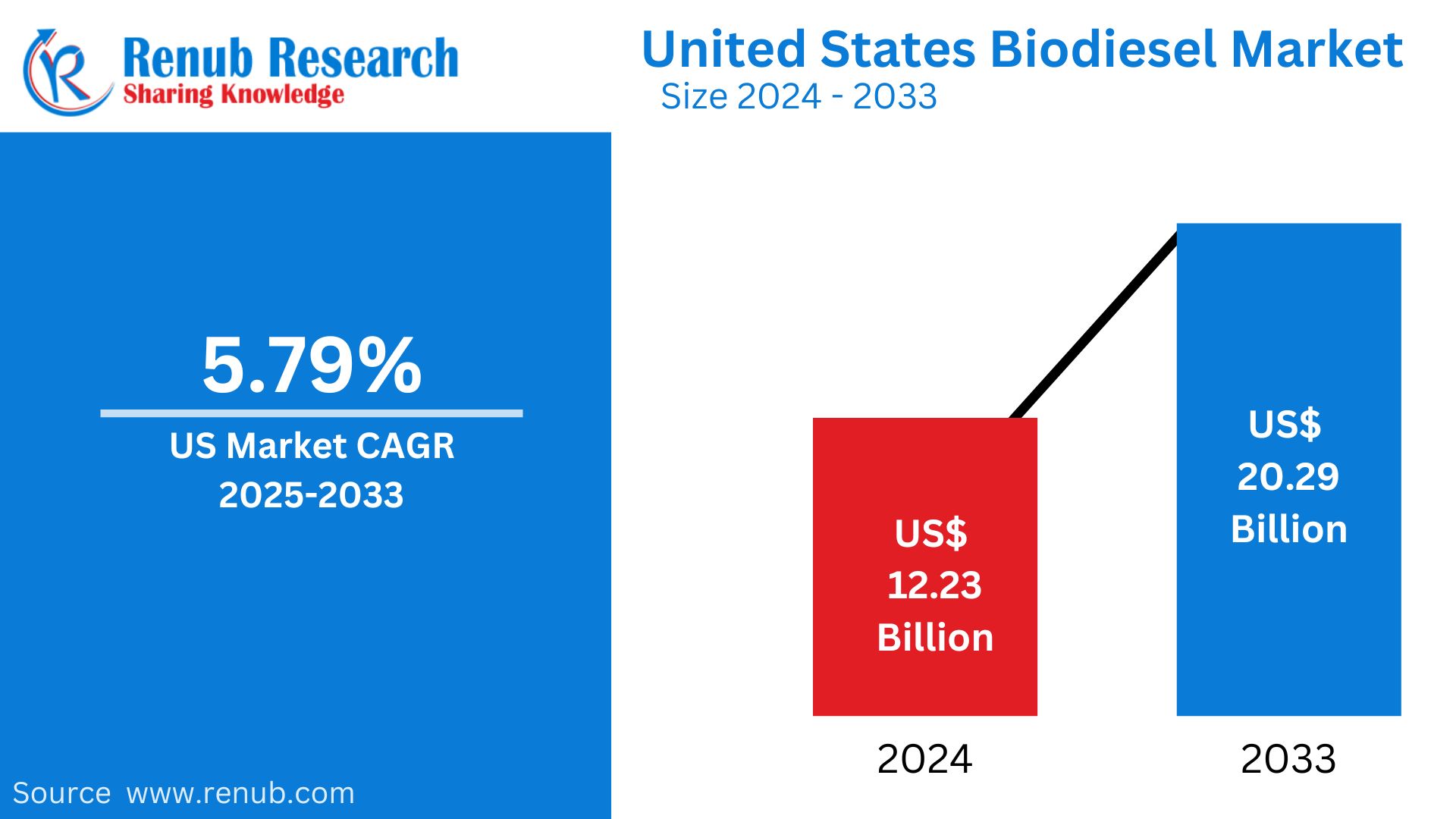

The United States biodiesel market is expected to expand at a large scale, reaching US$ 20.29 billion in 2033 from US$ 12.23 billion in 2024, with a CAGR of 5.79% from 2025 to 2033. This expansion is based on growing demand for renewable energy, government incentives for biofuels, and a move towards sustainable fuel options. Growing environmental issues and technology advancements also help drive market growth.

United States Biodiesel Market Report by Application (Fuel, Power Generation, Others), Feedstock (Vegetable Oil, Animal Fats), States and Company Analysis 2025-2033

United States Biodiesel Market Outlooks

Biodiesel is a biodegradable, renewable fuel made from vegetable oils, animal fats, or recycled cooking grease. It is an environmentally friendly substitute for petroleum diesel and can be utilized in current diesel engines with minimal or no adjustments. Biodiesel is usually mixed with petroleum diesel in different proportions, e.g., B5 (5% biodiesel) and B20 (20% biodiesel), or utilized in its pure state as B100.

In the United States, biodiesel is also extensively applied in transportation, agriculture, and the industrial sector. It fuels trucks, buses, and marine vessels, lowering greenhouse gas emissions as well as fossil fuel dependence. The agricultural industry is also helped by biodiesel through powering farm machinery, while fleets of government and the commercial sector use it to achieve sustainability targets. Biodiesel is also employed in home heating systems (bioheat) and as a substitute fuel in power production. With renewable energy policies and federal incentives encouraging its use, biodiesel remains a key player in the clean energy revolution in the U.S.

Growth Drivers in United States Biodiesel Market

Government Policies and Renewable Fuel Standards (RFS)

The U.S. government is a major driver of biodiesel market growth through policies such as the Renewable Fuel Standard (RFS). This law requires refiners of fuel to mix a portion of renewable fuels, such as biodiesel, into their fuel supply. Federal and state incentives, such as tax credits and grants, also promote the use of biodiesel. Initiatives like the Biodiesel Tax Credit (BTC) make biodiesel more cost-effective, further increasing consumption and production. These regulations, which are designed to cut carbon emissions and enhance energy independence, are major forces driving the growing demand for biodiesel in the United States. Dec 2023, The EPA must establish volume requirements for the Renewable Fuel Standard (RFS) for 2023-2025 under the Clean Air Act, including cellulosic biofuel, biomass-based diesel, advanced biofuel, and total renewable fuel. This move entails a second addendum standard covering the judicial remand of the 2016 rulemaking and a number of regulatory adjustments to enhance the RFS program, especially in relation to biogas. The EPA is not finalizing provisions for the production of RINs from renewable electricity at this moment.

Increasing Demand for Low-Carbon and Sustainable Fuels

With growing concerns about climate change and carbon emissions, industries and consumers alike in the U.S. are making a turn towards cleaner energy options. Biodiesel, which has a huge emissions reduction advantage over petroleum diesel, is becoming increasingly popular in the transportation, agricultural, and industrial markets. Corporations and governmental fleets are increasingly using biodiesel to achieve sustainability objectives. Moreover, countries with aggressive emissions cut-off targets like California and Washington are promoting biodiesel consumption, fueling business growth. The increasing demand for green fuels makes biodiesel a leading contender for shifting to sustainable energy. The U.S. Department of Energy (DOE) has published its "Pathways to Commercial Liftoff" report, where it emphasized the capability of sustainable aviation fuel (SAF) to greatly reduce the carbon footprint of the aviation industry. The report examines the preparedness of different SAF production technologies and provides recommendations for public and private sectors to make the U.S. a leader in SAF production by 2030.

Technological Advancements in Biodiesel Production

Ongoing technological advancements in biodiesel production are increasing efficiency and reducing costs, driving market growth in the U.S. Improved processing technologies, including transesterification and hydrotreated vegetable oil (HVO) technology, enhance biodiesel yield and quality. Scientists also seek to develop alternative feedstocks such as algae-based and waste-derived biodiesel to further increase production capacity. Enhanced refining processes make biodiesel more compatible with conventional diesel engines, leading to greater adoption by industries. With advancing technology and declining production costs, biodiesel grows into a competitive and potential substitute for conventional fossil fuels, boosting its market share. In 2023, Be8 moved into the US market and made investments in technology for biofuel production and a cereal-based ethanol venture. The firm wants to create a global tech company with a specialization in renewable energies.

Challenges in the United States Biodiesel Market

Feedstock Price Volatility

Production costs for biodiesel are greatly affected by feedstock prices, such as vegetable oils and animal fats. Price volatilities in soybean, canola, and other crops contribute to the cost of biodiesel, making it less competitive with traditional diesel when feedstock prices increase. Furthermore, supply chain disruptions in the global supply base, severe weather, and changes in agricultural policies also contribute to feedstock price volatility. This is a real challenge for biodiesel manufacturers since it influences production volume and profitability.

Competition from Other Renewable Fuels

Though biodiesel is the prime alternative fuel, other renewable energy options like renewable diesel, electric vehicles (EVs), and hydrogen fuel cells are increasingly posing competition to it. Renewable diesel, especially, has seen increased usage because it is chemically similar to petroleum diesel and can be integrated into existing infrastructure without any hassles or modifications. Government incentives for EV use and better battery technologies also pose a threat to biodiesel consumption in the long term. In order to sustain market share, the biodiesel sector needs to keep innovating and resolve issues of cost, efficiency, and scalability.

United States Fuel Biodiesel Market

The United States fuel biodiesel market is growing because of increasing demand for cleaner fuels for transportation and industrial use. Biodiesel is widely blended with petroleum diesel to lower carbon emissions and enhance engine efficiency. Numerous commercial fleets, public transport networks, and government agencies are progressively using biodiesel blends like B20 in order to achieve sustainability objectives. The trucking and logistics industries are also major consumers, taking advantage of biodiesel's lower sulfur level and lower greenhouse gas emissions. With federal policy encouraging renewable fuels and technology improvement in biodiesel production, the U.S. fuel biodiesel market is poised for further expansion.

United States Vegetable Oil Biodiesel Market

Vegetable oils, including soybean, canola, and corn oil, are some of the major feedstocks used in biodiesel production in the U.S. The renewability and availability of these oils render them the choice of biodiesel producers. Rising production of oilseed crops and technology advancements in oil extraction have fueled the steady expansion of the vegetable oil biodiesel market. Government support for domestic biofuels and agriculture also increases demand. Still, price volatility of vegetable oils based on international market forces and weather conditions is an issue for this category of the biodiesel sector.

United States Animal Fats Biodiesel Market

Animal fats, tallow, and used cooking greases are affordable feedstocks to produce biodiesel in the U.S. The industry is advantaged by increased interest in waste-to-energy applications since recycling of animal fats keeps waste away and helps in promoting sustainability. Rendering plants and food processing units provide high volumes of animal fats, enabling biodiesel manufacturers to reduce costs over vegetable oil-based biodiesel. Moreover, animal fats have a high energy return, making them a cost-effective fuel source. As waste use and alternative feedstocks are promoted through environmental policies, the animal fats biodiesel industry is anticipated to expand in the U.S.

California Biodiesel Market

California is the leader in the U.S. biodiesel industry because of its stringent environmental regulations and efforts to curb carbon emissions. The Low Carbon Fuel Standard (LCFS) promotes the consumption of renewable fuel, such as biodiesel, to reduce greenhouse gas emissions. California's extensive transportation sector, namely trucking and public transit, widely utilizes biodiesel blends such as B20. Biodiesel use is also beneficial to California's agricultural sector for tractors and farm equipment. With robust state subsidies and a shift towards cleaner energy sources, Californian demand for biodiesel continues to increase and is an important market for producers of biofuel. Apr 2022, BDI-BioEnergy International has commissioned a cutting-edge biodiesel production facility in Bakersfield, California.

New York Biodiesel Market

New York's market for biodiesel is growing with the state chasing ambitious clean energy and emissions cutting policies. The use of biodiesel in municipal fleets and public transportation has been a key growth driver. New York also has biodiesel mandates for home heating oil (Bioheat®), which has grown demand in residential and commercial space heating applications. The high population density in the state and emphasis on clean energy solutions are other drivers for market growth. As New York forges ahead in advancing renewable energy and diminishing dependence on fossil fuels, the biodiesel market will continue to expand in different sectors.

Washington Biodiesel Market

The Washington state is an expanding biodiesel market, facilitated by renewable fuel policies and the demand for minimizing carbon emissions. The Clean Fuel Standard of the state encourages the use of biodiesel in transportation and industrial applications. Washington's robust agricultural sector offers plenty of feedstocks, including canola and soybean oil, for local biodiesel production. Moreover, significant shipping and logistics sectors in the state are blending biodiesel with their fuel to meet environmental regulations. With rising investments in renewable energy infrastructure and robust government backing, Washington's biodiesel market is expected to grow steadily over the next few years.

New Jersey Biodiesel Market

New Jersey's biodiesel industry is growing as the state encourages clean energy technologies and alternative fuel use. Biodiesel finds extensive use in transportation, municipal fleets, and residential heating. The state's location near ports and distribution facilities also improves the availability of biodiesel for commercial trucking and logistics companies. Moreover, policies favoring renewable fuel blending and emissions control are fueling demand. New Jersey's emphasis on enhancing air quality and decreasing dependence on petroleum-based fuels further supports the biodiesel industry. As clean energy objectives continue to change, biodiesel is likely to be a key player in the state's energy transformation.

United States Biodiesel Market Segments

Application

- Fuel

- Power Generation

- Others

Feedstock

- Vegetable Oil

- Animal Fats

States

- California

- Texas

- New York

- Florida

- Illinois

- Pennsylvania

- Ohio

- Georgia

- New Jersey

- Washington

- North Carolina

- Massachusetts

- Virginia

- Michigan

- Maryland

- Colorado

- Tennessee

- Indiana

- Arizona

- Minnesota

- Wisconsin

- Missouri

- Connecticut

- South Carolina

- Oregon

- Louisiana

- Alabama

- Kentucky

- Rest of United States

All the Key players have been covered from 3 Viewpoints:

- Overview

- Recent Development

- Revenue

Key Players Analysis

- Archer Daniels Midland Company

- FutureFuel

- Neste’s

- Renewable Energy Group, Inc.

- Bunge Global SA

- Wilmar

- Shell

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Application, Feedstock and States |

| States Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the U.S. biodiesel industry by 2033?

-

What is the expected compound annual growth rate (CAGR) of the biodiesel market from 2025 to 2033?

-

What are the primary feedstocks used in biodiesel production in the U.S.?

-

How does the Renewable Fuel Standard (RFS) impact the U.S. biodiesel market?

-

What are the main drivers behind the growth of biodiesel consumption in the United States?

-

What challenges does the U.S. biodiesel market face, particularly concerning feedstock prices?

-

Which states are leading in biodiesel production and consumption?

-

How does biodiesel compare to other renewable energy sources like renewable diesel and electric vehicles (EVs)?

-

What role does government policy play in shaping the U.S. biodiesel market?

-

Which key companies are involved in the U.S. biodiesel market, and what are their contributions?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Biodiesel Market

6. Market Share

6.1 Application

6.2 Feedstock

6.3 States

7. Application- United States Biodiesel Market

7.1 Fuel

7.2 Power Generation

7.3 Others

8. Feedstock- United States Biodiesel Market

8.1 Vegetable Oil

8.2 Animal Fats

9. States

9.1 California

9.2 Texas

9.3 New York

9.4 Florida

9.5 Illinois

9.6 Pennsylvania

9.7 Ohio

9.8 Georgia

9.9 New Jersey

9.10 Washington

9.11 North Carolina

9.12 Massachusetts

9.13 Virginia

9.14 Michigan

9.15 Maryland

9.16 Colorado

9.17 Tennessee

9.18 Indiana

9.19 Arizona

9.20 Minnesota

9.21 Wisconsin

9.22 Missouri

9.23 Connecticut

9.24 South Carolina

9.25 Oregon

9.26 Louisiana

9.27 Alabama

9.28 Kentucky

9.29 Rest of United States

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 Archer Daniels Midland Company

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue

12.2 FutureFuel

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue

12.3 Neste’s

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue

12.4 Renewable Energy Group, Inc.

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue

12.5 Bunge Global SA

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue

12.6 Wilmar

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue

12.7 Shell

12.7.1 Overview

12.7.2 Recent Development

12.7.3 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com