United States Biscuits Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Biscuits Market Trends & Summary

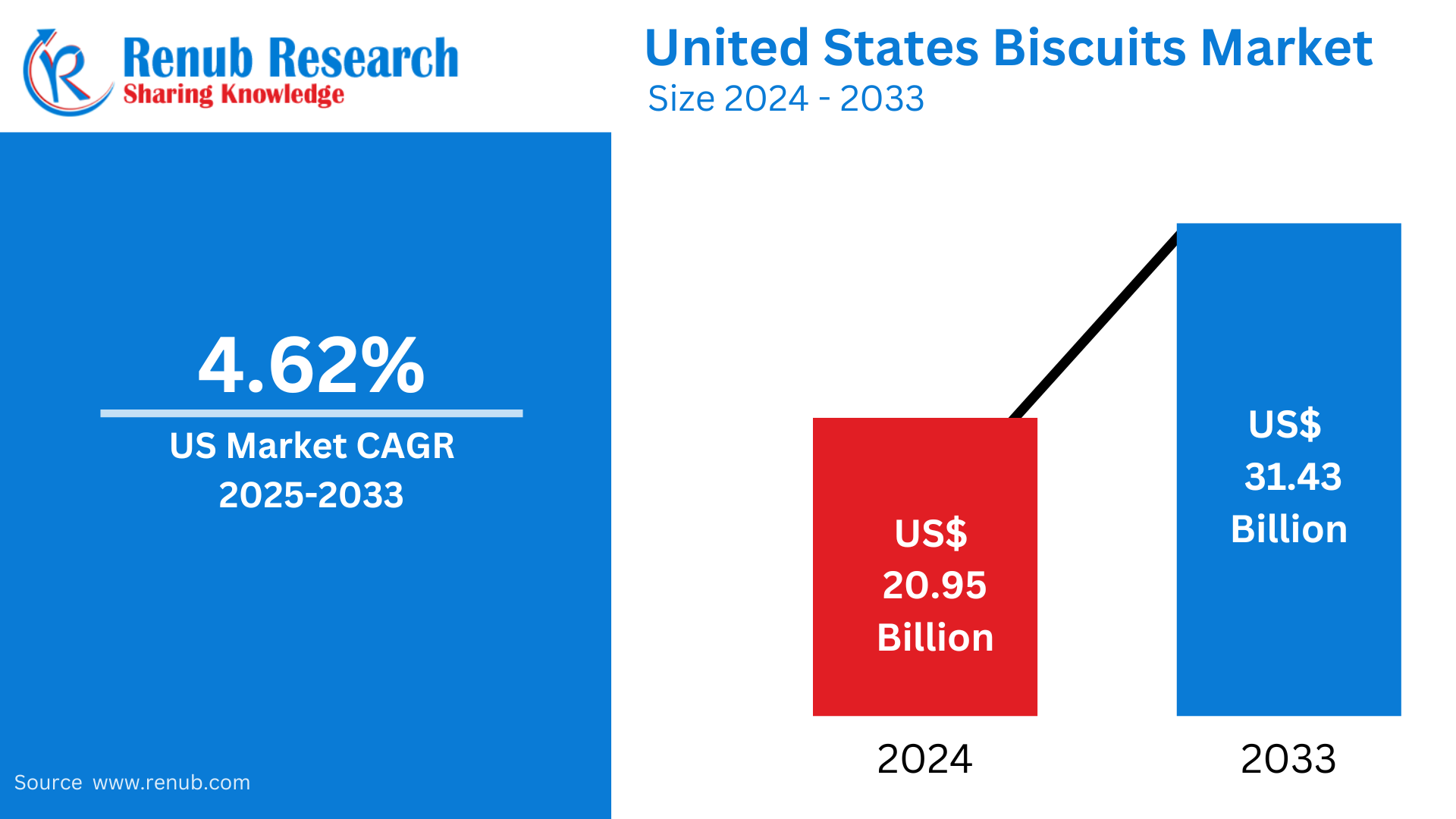

The United States Biscuits Market, which was worth US$ 20.95 billion in 2024, is expected to expand at a CAGR of 4.62% from 2025 to 2033, reaching US$ 31.43 billion by 2033. This growth opportunity stems from increased demand for healthier snacks, premium biscuits, and new flavors. The growing consumer trend towards gluten-free, organic, and high-fiber biscuits further widens market opportunities nationwide, making it a promising venture for potential investors.

The report United States Biscuits Market Forecast covers by Product (Cookies, Filled/Coated Biscuits, Crackers, (Flat Crackers, Saltine Crackers, Filled Crackers, Graham Crackers), Cream Wafers, Others), Type (Organized, Unorganized), Source (Oats, Wheat, Millets, Others), Distribution channel (Specialist Retail Stores, E-commerce, Convenience Stores, Supermarkets, Others), Region and Company Analysis 2025-2033.

United States Biscuits Market Outlooks

US biscuits are baked flour items, frequently soft and flaky, more like scones or bread rolls, not the hard cookies biscuits in other nations. They are usually prepared with flour, baking powder, butter, and milk, resulting in a light and airy texture. US biscuits are commonly eaten as a breakfast food, side dish, or snack, frequently accompanied by gravy, butter, honey, or jam.

In America, biscuits are a highly versatile food, applied in many ways to suit diverse consumer tastes. They accompany Southern-style foods with fried chicken, sausage gravy, or eggs, and also appear in sandwiches with ham, cheese, or bacon fillings. The trend towards healthy eating has prompted the development of whole grain, gluten-free, and high-protein biscuits to appeal to a broader consumer base. Moreover, frozen and pre-packaged biscuits have also grown in demand for their convenience. Whether consumed at home, restaurant or as grab-and-go food, biscuits present a diverse and fascinating gastronomic experience.

Drivers of Growth in the United States Biscuits Market

Increased Demand for Healthy and Functional Biscuits

American consumers are increasingly turning to healthful snack foods, causing demand to rise for whole grain, high-fiber, gluten-free, and protein-fortified biscuits. Increased demand for vegan and organic diets has also driven innovation in natural sweetener biscuits, plant-based ingredients, and fortified nutrients. Low-sugar, keto, and probiotic-enriched biscuits are being introduced by several brands targeting health-conscious consumers, enabling market growth. Feb 2023, Sweet Loren's is releasing gluten-free breakfast biscuits with 19 grams of whole grains, 4 grams of protein, 3 grams of fiber, and B vitamins per serving. These Non-GMO Project verified, plant-based biscuits are also dairy-free, peanut-free, and tree nut-free, using straightforward ingredients for breakfast or snacks.

Development of Premium and Indulgent Biscuits

Premium biscuits, such as gourmet, artisanal, and luxury, develop well as consumers look for indulgence and novelty flavors. Demand for chocolate-coated, nut-stuffed, and foreign ingredient biscuits is increasing. Numerous firms are launching limited-time flavors and global biscuit types, targeting consumers searching for better quality and better taste experiences. Nov 2024, Bimbo Bakeries USA extends its Entenmann's brand by introducing Big Chunk cookies, found in chocolate, mint chocolate, and salted caramel chocolate flavors. These soft and chewy, square-shaped cookies consist of semisweet chocolate and are contained in eight individually wrapped bags per bag.

Expansion of Online and Convenience Store Retailing

The growth in e-commerce and convenience stores has increased the availability of biscuits to consumers. Online channels provide direct-to-consumer (DTC) sales, subscription boxes, and bulk discounts, driving sales. Convenience stores, on the other hand, offer mobile convenience, driving demand for single-serve and mobile biscuit packs.

Challenges in the United States Biscuits Market

Increasing Raw Material Costs

The price of key ingredients like wheat, sugar, butter, and cocoa has gone up, which has driven up the production costs for biscuit companies. Disruptions in supply chains and volatility in commodity prices have further put pressure on profit margins, making it challenging for brands to keep prices competitive.

Competition from Alternative Snack Products

Biscuits have intense competition from protein bars, granola bars, and healthful snack foods such as nuts and dried fruit. Classic biscuits need to innovate and brand themselves to maintain market share with consumers focused on nutrition, convenience, and low-calorie foods.

United States Cookies Biscuits Market

The cookies category continues to lead the U.S. biscuits market, fueled by traditional favorites such as chocolate chip, oatmeal raisin, and peanut butter cookies. Growing demand for organic, sugar-free, and gluten-free cookies has prompted brands to launch healthier options. The market is also supported by the growth of indulgent and stuffed cookies, providing consumers with premium snacking experiences. For example, in January 2024, Kellanova launched CHEEZ-IT extra crunchy with two distinct flavors. These consist of crunchy, bold cheddar and crunchy, sharp white cheddar.

United States Cream Wafers Biscuits Market

Cream-filled wafer biscuits is a favorite snacking segment with vanilla, chocolate, strawberry, and hazelnut flavors luring consumers. On-the-go consumption and alternative desserts are key to the broad consumption of biscuits. The low-calorie and high-protein wafer biscuits trend also increases the segment's popularity among fitness-conscious consumers.

United States Organized Biscuits Market

The market for organized biscuits comprises mass-market manufacturers and branded players such as Nabisco, Pepperidge Farm, and Keebler. Such players have strong distribution networks, brands, and marketing, to their advantage. The rising private-label trend within supermarkets has also increased competition with retailers offering budget-friendly but premium biscuit flavors.

United States Oats Biscuits Market

Oats-based biscuits are becoming more popular because of high fiber, heart-friendly benefits, and natural sweetness. Health-conscious buyers looking for wholesome, low-calorie snacks opt for oats-based biscuits compared to conventional flour-based biscuits. The segment is growing with the development of protein-enriched, sugar-free, and digestive oat biscuits to target the health-conscious segment.

United States Wheat Biscuits Market

Whole wheat biscuits are favored by consumers seeking nutrition-packed snacks with fiber and minerals. The trend towards clean-label consumption has led to increased preference for wheat biscuits free of artificial additives and preservatives. The launch of organic and multigrain wheat biscuits further consolidate this segment of the market.

United States Biscuits Convenience Stores Market

Convenience stores are instrumental in impulse buying of biscuits with single-serve packs, travel-sized biscuits, and upscale snack biscuits. Growing numbers of gas stations, mini-marts, and city convenience stores have stimulated sales of grab-and-go biscuit items, especially among students and busy professionals.

United States Biscuits Supermarkets Market

Supermarkets and hypermarkets represent the largest segment of biscuit sales, selling different brands, flavors, and bulk packaging. People like buying family packs and promotional offers from stores such as Walmart, Target, and Kroger. Increasing competition in this retail segment is also coming from expanding private-label supermarket biscuit brands.

East United States Biscuits Market

Eastern U.S. contains a diverse range of consumers having strong preferences towards classic and newer flavors of biscuits. Organic, low-sugar, and gluten-free biscuits demand in states such as New York and Massachusetts have been driven by health-conscious customers. Urban marketplaces are witnessing a rise in popularity for international and ethnic styles of biscuits.

West United States Biscuits Market

Health trends and sustainability movements heavily influence the Western U.S. market, including California and Washington. Consumers prefer plant-based, protein-packed, and keto-friendly biscuits. The West also sees strong online retail growth, with brands leveraging direct-to-consumer (DTC) sales channels.

North United States Biscuits Market

The Northern U.S. market, such as Illinois and Minnesota, heavily requires seasonal and indulgent biscuits, especially in winter. Holiday-themed biscuits and flavored shortbread cookies experience higher sales. The market also gains from high-end artisanal biscuit brands catering to gourmet consumers.

South United States Biscuits Market

The South loves traditional biscuits, primarily buttermilk biscuits and Southern-style biscuits. Flaky, savory biscuits accompanied by gravy and fried chicken continue to be in demand. Sweet biscuit types, such as honey and cinnamon biscuits, are also gaining popularity. The South's growing retail networks and drive-through markets are behind steady growth in biscuit sales.

United States Biscuits Market Segments

Product

1. Cookies

2. Filled/Coated Biscuits

3. Crackers

• Flat Crackers

• Saltine Crackers

• Filled Crackers

• Graham Crackers

4. Cream Wafers

5. Others

Type

- Organized

- Unorganized

Source

- Oats

- Wheat

- Millets

- Others

Distribution Channel

- Specialist Retail Stores

- E-commerce

- Convenience Stores

- Supermarkets

- Others

Region

- East

- West

- North

- South

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Company Analysis

- Mondelēz International

- Britannia Industries

- Kellanova

- United Biscuits

- PARLE

- General Mills Inc.

- Nestlé

- The Campbell's Company

- Ferrero

- PARTNERS

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Type, Source, Distribution channel and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected growth rate of the U.S. biscuits market from 2025 to 2033?

-

How much was the U.S. biscuits market valued at in 2024?

-

What factors are driving the increasing demand for healthier biscuits in the U.S. market?

-

Which type of biscuits leads the U.S. market in terms of demand?

-

What are some examples of premium and indulgent biscuits that are gaining popularity in the U.S.?

-

How has the rise of online retail and convenience stores impacted biscuit sales?

-

What challenges are faced by companies in the U.S. biscuits market due to rising raw material costs?

-

Which region in the U.S. has seen a growing preference for organic and gluten-free biscuits?

-

What health trends are influencing the growth of the oats-based biscuits segment in the U.S. market?

-

How do seasonal and indulgent biscuits contribute to the market demand in the Northern U.S.?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Biscuits Market

6. Market Share

6.1 By Product

6.2 By Type

6.3 By Source

6.4 By Distribution channel

6.5 By Region

7. Product

7.1 Cookies

7.2 Filled/Coated Biscuits

7.3 Crackers

7.3.1 Flat Crackers

7.3.2 Saltine Crackers

7.3.3 Filled Crackers

7.3.4 Graham Crackers

7.4 Cream Wafers

7.5 Others

8. Type

8.1 Organized

8.2 Unorganized

9. Source

9.1 Oats

9.2 Wheat

9.3 Millets

9.4 Others

10. Distribution Channel

10.1 Specialist Retail Stores

10.2 E-commerce

10.3 Convenience Stores

10.4 Supermarkets

10.5 Others

11. Region

11.1 East

11.2 West

11.3 North

11.4 South

12. Porter’s Five Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Company Analysis

14.1 Mondelēz International

14.1.1 Overview

14.1.2 Key Persons

14.1.3 Recent Development

14.1.4 Revenue

14.2 Britannia Industries

14.2.1 Overview

14.2.2 Key Persons

14.2.3 Recent Development

14.2.4 Revenue

14.3 Kellanova

14.3.1 Overview

14.3.2 Key Persons

14.3.3 Recent Development

14.3.4 Revenue

14.4 United Biscuits

14.4.1 Overview

14.4.2 Key Persons

14.4.3 Recent Development

14.4.4 Revenue

14.5 PARLE

14.5.1 Overview

14.5.2 Key Persons

14.5.3 Recent Development

14.5.4 Revenue

14.6 General Mills Inc.

14.6.1 Overview

14.6.2 Key Persons

14.6.3 Recent Development

14.6.4 Revenue

14.7 Nestlé

14.7.1 Overview

14.7.2 Key Persons

14.7.3 Recent Development

14.7.4 Revenue

14.8 The Campbell's Company

14.8.1 Overview

14.8.2 Key Persons

14.8.3 Recent Development

14.8.4 Revenue

14.9 Ferrero

14.9.1 Overview

14.9.2 Key Persons

14.9.3 Recent Development

14.9.4 Revenue

14.10 PARTNERS

14.10.1 Overview

14.10.2 Key Persons

14.10.3 Recent Development

14.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com