United States BOPIS Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States BOPIS Market Trends & Summary

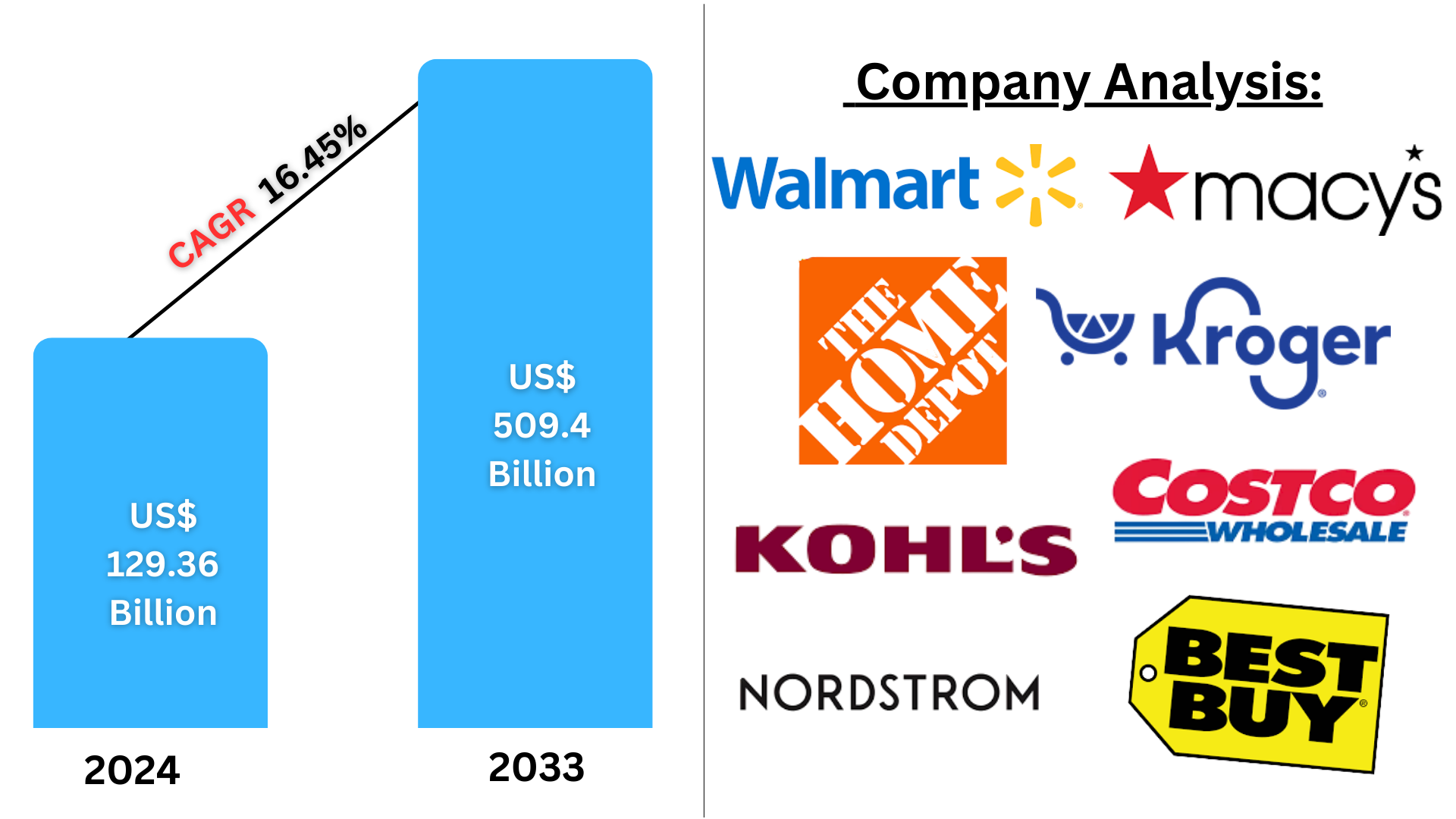

The United States BOPIS market size is expected to grow at an impressive compound annual growth rate of 16.45% between 2025 and 2033. This market, estimated at US$ 129.36 billion in the year 2024, will reach US$ 509.4 billion by the end of 2033. This reflects an enormous surge in demand for this convenient shopping model over the next decade.

The report United States BOPIS Market & Forecast covers by Product Category (Auto and Parts, Food and Beverage, Apparel and Accessories, Health and Personal Care and Beauty, Computer and Consumer Electronics, Office Equipment and Supplies, Toys and Hobby, Furniture and Home Furnishing, Books/Music/Video, Other), Payment Method (Digital Wallet, Credit Card, Debit Card, Account-to-Account (A2A), Buy Now, Pay Later (BNPL), Cash on Delivery, Prepay, Other - Incl. Cryptocurrency) and Company Analysis 2025-2033.

United States BOPIS Market Outlooks

BOPIS is a shopping method where customers can buy items online and pick them up at a physical retail location. This option has gained much popularity in the United States because it is convenient, flexible, and cost-effective for consumers. BOPIS eliminates shipping delays, provides an instant alternative to in-store shopping, and offers a quicker, more cost-effective way for consumers to obtain their products.

BOPIS is utilized by large retailers in the USA across different industries, such as fashion, electronics, home goods, and groceries. It caters to the needs of consumers who do not want to wait for long delivery times or pay delivery fees but still prefer to shop online. Moreover, it boosts foot traffic in stores, which can be a source of upsell opportunities. The satisfaction of customers is also improved since BOPIS ensures product availability and faster collection times. Overall, BOPIS enhances the omnichannel experience of shopping because it makes shopping online with an in-store pickup as quick and easy.

Drivers of US BOPIS Market Growth

Convenience to Customers

BOPIS has grown in popularity lately because of convenience. As many customers live very busy lifestyles, they do prefer shopping online instead of waiting for shipping. BOPIS enables them to browse, purchase, and pick up their items at their convenience, often the same day. Retailers have adapted by offering efficient in-store pickup systems that make the process faster and more reliable. These ease of use and time-saving conveniences drive BOPIS growth, particularly in urban and busy areas. In 2022, over 268 million individuals shopped online in the United States, representing more than 80% of the total population. This massive number clearly demonstrates the vast adoption of e-commerce, emphasizing how online shopping has become a crucial part of the daily lives of American consumers.

Advancements in Technology and Integration

The inclusion of advanced technology in retail systems has significantly contributed to the growth of the BOPIS market. Retailers are increasing app usage and inventory management as well as real-time tracking to assist customers. The technology provides an easier ordering and pickup system to make the least number of mistakes and wait times. Better analytics allow retailers to know how to use their demand and have the supplies ready for when they arrive. This will help make BOPIS processes more efficient and attractive, thus further opening up this market.

Expansion of Omnichannel Retailing

As retailers evolve their omnichannel strategies, BOPIS has emerged as a vital component. Blending online and in-store experiences helps retailers create a seamless shopping journey. BOPIS also enhances customer engagement because it enables customers to engage with digital and physical retail environments. This omnichannel strategy also enhances customer satisfaction and inspires repeat visits and purchases. Many brands and significant retail chains are leveraging BOPIS to build customer loyalty and fuel growth in a highly competitive retail environment. Best Buy revealed a new app called Best Buy Envision in April 2024. The app is only available on the Apple Vision Pro and assists users in planning their ultimate home technology setup.

Challenges in the United States BOPIS Market

Logistical and Operational Challenges

Though convenient, BOPIS can pose huge logistical and operational challenges. Retailers must ensure that their inventory management systems coordinate with online orders so as to avoid stockouts or delays. Moreover, the customers visit the stores at designated times to pick their orders, which can be overwhelming for in-store operations, thus creating inefficiencies or dissatisfaction among the customers. Retailers should also train the staff to be prompt and accurate in handling BOPIS orders, which at times may bring operational complexities, especially during periods of high demand.

Customer Experience and Wait Times

A significant challenge for the BOPIS market is to make sure that customer experience is smooth and efficient. Customers expect the pickup process to be smooth and efficient, and long wait times can quickly transform positive experiences into negative ones. The retailers need to ensure that the stores are adequately staffed to process the pickup orders and that the pickup process is well-organized. Delays in processing orders or poor communication regarding order readiness can negatively impact customer satisfaction, leading to fewer repeat customers and potential lost sales.

United States BOPIS Food and Beverage Market

The BOPIS model in the food and beverage sector is rapidly gaining traction in the United States. Consumers are increasingly utilizing BOPIS for grocery shopping, as it saves time and eliminates the need for delivery fees. Many grocery stores and large chains now offer BOPIS services, allowing customers to purchase fresh food, beverages, and pantry staples online and pick them up at their convenience. The demand for safer, contactless shopping experiences also drives this trend. BOPIS in food and beverage is increasing as retailers expand their services to accommodate this change in consumer behavior. Nov 2023, Phononic and Vidir Solutions have partnered to develop the Vidir Powered Carousel, an innovative automated buy-online-pick-up-on-site (BOPIS) solution. This system combines Phononic's actively-cooled refrigerator and freezer totes with Vidir's vertical lift, enabling grocers to stage frozen, chilled, and ambient orders centrally with efficiency.

United States BOPIS Health and Personal Care and Beauty Market

With the health and personal care and beauty markets, BOPIS is a relatively appealing choice among the U.S. population of consumers who want to purchase products, such as skincare, hair care, and cosmetics, without waiting for delivery. The most basic appeal is through BOPIS, and they present it to customers to order items online in store. This is especially helpful for products that need to be tested or recommended, like cosmetics or personal care products. The growth of this segment is further supported by the increasing demand for personalized experiences, allowing consumers to pick up their items quickly after browsing online.

United States Apparel and Accessories BOPIS Market

BOPIS in the United States apparel and accessories market is experiencing rapid adoption, as it provides convenience to customers searching for fashion items. The purchases are increasing in clothing and accessories, which are picked at the local store where they were bought. Department stores and fashion chains are adopting BOPIS as an easily quick service by which customers can get their preferred products immediately without waiting for shipping. The model is also appealing to customers who require goods in a hurry or want to try on apparel before buying them.

United States BOPIS Digital Wallet Market

The BOPIS digital wallet market in the U.S. is growing with an increasing number of consumers desirous of contactless, cashless purchases at the point of collection of online orders. Digital wallets such as Apple Pay and Google Pay will become the future preferred payment at BOPIS, which enables fast and safe transactions. Digital payments have made customers' lives so much easier at checkout. On arrival at a store, shoppers can pay for their orders swiftly. As a result of digitization, an increasing number of retailers are allowing these wallets through their BOPIS systems and are making it easier to complete transactions for customers with zero friction.

United States BOPIS Credit Card Market

The credit card market, in this regard, is also growing as more U.S. shoppers are paying for orders they placed online to pick up at stores using their credit cards. Credit card payments have become more popular for BOPIS as it is convenient and secure. Credit card companies also provide rewards and cashback benefits that motivate customers to shop online using their cards. This has increased credit card transactions for BOPIS orders and further increased the market because both retailers and customers find convenience and incentives under the system.

United States BOPIS Market Segments

Product Category

1. Auto and Parts

2. Food and Beverage

3. Apparel and Accessories

4. Health and Personal Care and Beauty

5. Computer and Consumer Electronics

6. Office Equipment and Supplies

7. Toys and Hobby

8. Furniture and Home Furnishing

9. Books/Music/Video

10. Other

Payment Method

1. Digital Wallet

2. Credit Card

3. Debit Card

4. Account-to-Account (A2A)

5. Buy Now, Pay Later (BNPL)

6. Cash on Delivery

7. Prepay

8. Other - Incl. Cryptocurrency

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Key Players

1. Walmart

2. Home Depot Inc.

3. The Kroger Co

4. Macy’s

5. Kohl’s

6. Costco Wholesale Corporation

7. Best Buy Co., Inc.

8. Nordstrom Inc

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Category and Payment Method |

| Product Category Covered |

1. Auto and Parts |

| Companies Covered |

1. Walmart |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

- What is the projected market size of the U.S. BOPIS market by 2033?

- What is the expected CAGR of the U.S. BOPIS market from 2025 to 2033?

- What factors are driving the growth of the U.S. BOPIS market?

- How does BOPIS enhance convenience for customers?

- Why has BOPIS gained popularity among busy consumers?

- How does BOPIS help retailers increase foot traffic in stores?

- What role does omnichannel retailing play in the growth of BOPIS?

- How has technology improved the efficiency of BOPIS operations?

- What are the main challenges retailers face when implementing BOPIS?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States BOPIS Market

6. Market Share Analysis

6.1 By Product Category

6.2 By Payment Method

7. Product Category

7.1 Auto and Parts

7.2 Food and Beverage

7.3 Apparel and Accessories

7.4 Health and Personal Care and Beauty

7.5 Computer and Consumer Electronics

7.6 Office Equipment and Supplies

7.7 Toys and Hobby

7.8 Furniture and Home Furnishing

7.9 Books/Music/Video

7.10 Other

8. Payment Method

8.1 Credit Card

8.2 Debit Card

8.3 Account-to-Account (A2A)

8.4 Buy Now, Pay Later (BNPL)

8.5 Cash on Delivery

8.6 Prepay

8.7 Other - Incl. Cryptocurrency

9. Porter’s Five Forces Analysis

9.1 Bargaining Power of Buyers

9.2 Bargaining Power of Suppliers

9.3 Degree of Rivalry

9.4 Threat of New Entrants

9.5 Threat of Substitutes

10. SWOT Analysis

10.1 Strength

10.2 Weakness

10.3 Opportunity

10.4 Threat

11. Key Players Analysis

11.1 Walmart

11.1.1 Overview

11.1.2 Key Persons

11.1.3 Recent Development & Strategies

11.1.4 Revenue Analysis

11.2 Home Depot Inc.

11.2.1 Overview

11.2.2 Key Persons

11.2.3 Recent Development & Strategies

11.2.4 Revenue Analysis

11.3 The Kroger Co

11.3.1 Overview

11.3.2 Key Persons

11.3.3 Recent Development & Strategies

11.3.4 Revenue Analysis

11.4 Macy’s

11.4.1 Overview

11.4.2 Key Persons

11.4.3 Recent Development & Strategies

11.4.4 Revenue Analysis

11.5 Kohl’s

11.5.1 Overview

11.5.2 Key Persons

11.5.3 Recent Development & Strategies

11.5.4 Revenue Analysis

11.6 Costco Wholesale Corporation

11.6.1 Overview

11.6.2 Key Persons

11.6.3 Recent Development & Strategies

11.6.4 Revenue Analysis

11.7 Best Buy Co., Inc.

11.7.1 Overview

11.7.2 Key Persons

11.7.3 Recent Development & Strategies

11.7.4 Revenue Analysis

11.8 Nordstrom, Inc.

11.8.1 Overview

11.8.2 Key Persons

11.8.3 Product Portfolio

11.8.4 Recent Development & Strategies

11.8.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com