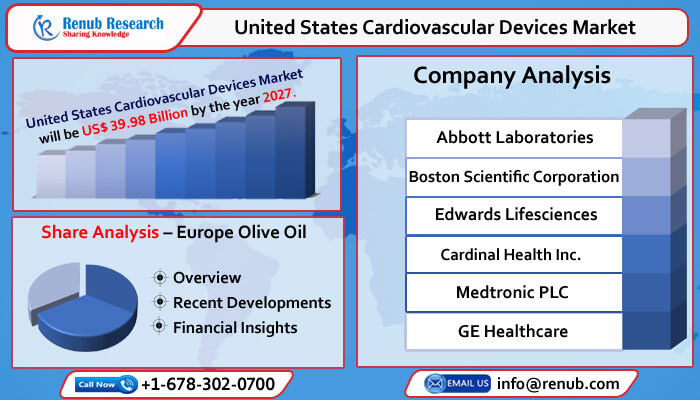

United States Cardiovascular Devices Market will be US$ 39.98 Billion by 2027, Impelled by Established Healthcare Infrastructure & Increasing Numbers of Minimally Invasive Procedures

21 Feb, 2022

According to the latest report by Renub Research, “United States Cardiovascular Devices Market Forecast 2021-2027, Industry Trends, Growth, Impact of COVID-19, Opportunity Company Analysis” United States Cardiovascular Devices Market Size was US$ 25.34 Billion in 2020. Cardiovascular diseases, or CVDs in the United States, have continued to be considered among the top pain counts of the medical application. Additionally, with conditions like stroke or IHD (ischemic heart disease) adding heavily to death and disability, cardiovascular devices and their consequence in heart-related therapies are quickly being brought into the spotlight in the country. Further, fatalities caused due to CVDs have been rising steadily over the years.

According to a study by Communicable Disease Center (CDC), one of the major operating components of the Department of Health and Human Services and recognized as the nation's premier health promotion, prevention, and preparedness agency, claims heart attack to be the principal cause of death for men, women, and people of most significant racial and ethnic groups in the United States. Consequently, these alarming situations are a testament that the U.S. need to implement cost-effective health devices and therapies designed to mitigate the risk of CVDs. Wherein development and deployment of effective and advanced medical devices is a crucial part of these efforts.

Move Towards Minimally Invasive Treatment Solutions:

In the United States, minimally invasive surgical procedures, especially in the cardiovascular discipline, have continued to gain favour over the years due to myriad benefits like minimal damage to the body, less pain, and lower risk of complications correlated to open operations. Drawn initially to match in the mid-90s, the MIS procedures accompanied the realization of the preeminent coronary artery and heart valve bypass employing the least access routes.

Further, the preference for minimally invasive procedures is driven by advancements in cardiovascular medical device technologies. These developments are instrumental in positioning minor invasive procedures as the operating method of choice. They rely heavily on catheters and other specialized medical equipment to be injected into the body through tiny cuts for therapeutic intrusions and demonstrative measures.

For instance, innovative discoveries like smart balloon catheter systems are decked with electronics, sensors and mechanisms. The intelligent technology is consistently redesigned to deliver ablation therapy, blood flow data, haematological data and electrical instigation through a single device. In September 2020, a unit of researchers led by technicians at Northwestern University and George Washington University outlined a balloon catheter system. It was implemented with flexible and stretchable patterns of electrode actuators and sensors and pressure and temperature sensors. These are frequently used in minimally invasive ablations or surgeries in operating conditions such as heart arrhythmias.

The Emergence of Sophisticated and Innovative Cardiac Ablation Devices:

As the burden of cardiovascular ailments in the United States medical realm remains to grow over the years, the adoption of superior treatment technologies will behold a significant upsurge, creating productive growth roads for the cardiovascular device industry in the years ahead. By Device Type, Renub Research holds meaningful existence of devices like Peripheral Vascular Device, Prosthetic Heart Valves, Cardiac Rhythm Management Device, Cardiac Assist Devices, Cardiovascular Surgery Devices, External Defibrillators, Clot Management Devices and Cardiovascular Prosthetic Devices in the United States Cardiovascular Devices Market. Wherein, the rising prevalence of atrial fibrillation is an essential contributor to the popularity of these devices. Remarkably, in cardiac ablation device technologies, the products are inscribing an ever-increasing demand for minimally invasive ablation procedures and discovery.

For example, in June 2020, Boston Scientific launched the DIRECTSENSE technology in the United States as a tool intended to monitor the impact of radiofrequency energy delivery through cardiac ablation processes. Similarly, in 2020, Abbott restarted its LIFE-BTK clinical trial to assess the safety and effectiveness of its new Esprit BTK Everolimus-Eluting Resorbable Scaffold System. This is the advancing investigational device exemption (IDE) trial in the United States to assess an utterly bio-resorbable stent to heal blocked arteries underneath the knees, or critical limb ischemia (CLI), in people undergoing the first stages of peripheral artery disease (PAD).United States Cardiovascular Devices Market will grow with a CAGR of 6.7% during 2021-2027.

The evident reinforcement of the cardiovascular devices market is hinged through key end-users like Hospitals, Cardiac Diagnostic Centres and Ambulatory Surgical centres factoring the risk of CVDs and related health problems are recognized today on a grander scale the region. Further, the market growth can be attributed to a thriving healthcare recognition through visibility on the internet, private hospital heart plans and public outreach plans from government bureaus like the CDC. In addition, consumers are alert to the symptoms of developing a heart disorder, the need for early diagnosis and available treatment options. The fast-expanding geriatric population base will only fuel the potential of the medical devices sector.

Consequently, heart disease is the preeminent instigator of death in the United States, affecting a large population in the United States each year. Precisely, more than millions of Americans are living with some form of cardiovascular disease or stroke. In addition to the rising pervasiveness of CVD, there is a surge in comorbidities, which involves chronic pain, arrhythmias, diabetes and depression, and are more widespread in the elderly medicare groups. Given the expected uptick in CVD, comorbidities, and blended analysis and medication, the financial strain of CVD also is expected to expand, with the determined direct cost of CVD in the US.

The consequence of COVID-19 Pandemic against Cardiovascular Device Industry:

Amidst the first half of 2020, the COVID-19 pandemic has negatively impacted the cardiovascular devices industry. The Coronavirus has modified the production of cardiovascular devices businesses as there was a postponement of elective procedures. Only those cardiovascular projects were analyzed, which were critical; others have been suspended and limited since the commencement of the global pandemic.

Another factor negatively influencing the industry was the deterioration in the analysis of cardiovascular diseases as the healthcare devices were being redirected to Coronavirus patients. However, the monthly revenues of cardiovascular devices companies rebounded in H2 2020 and are back on track.

Market Summary:

- Device Type - We have covered the market comprising of Cardiac Rhythm Management Device, Peripheral Vascular Device, Prosthetic Heart Valves, Cardiac Assist Devices, Cardiovascular Surgery Devices, External Defibrillators, Clot Management Devices, Cardiovascular Prosthetic Device, Others.

- End–Users - We have studied the market Hospitals, Cardiac Diagnostic Centres, and Ambulatory Surgical Centre existing as end users in the United States Cardiovascular Devices

- Company - We have studied the company by Company Overview, Recent Development and Financial Insights of following companies Abbott Laboratories, Boston Scientific Corporation, Edwards Life sciences, Cardinal Health Inc., Medtronic PLC, and GE Healthcare.

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com