United States Cardiovascular Devices Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Cardiovascular Devices Market Trends & Summary

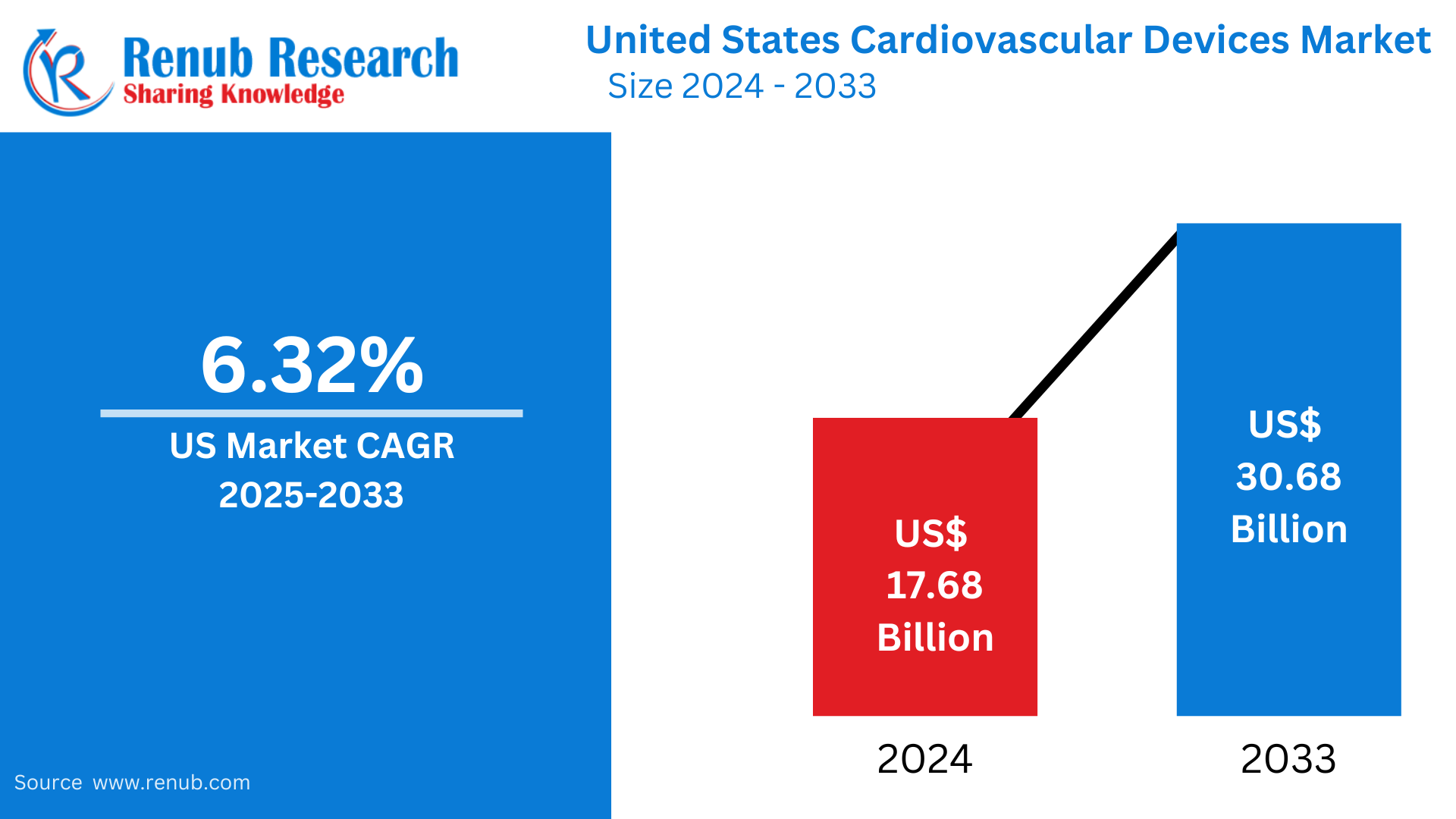

The United States cardiovascular devices market size is expected to grow from US$ 17.68 billion in 2024 to US$ 30.68 billion by 2033 at a compound annual growth rate (CAGR) of 6.32% during the forecast period 2025-2033. This can be attributed to the increasing incidence of cardiovascular diseases, improvement in device technology, increasing adoption of minimally invasive procedures, and rising demand for diagnostic and therapeutic devices across healthcare settings.

The report United States Cardiovascular Devices Market & Forecast covers by Device Type (Diagnostic and Monitoring, Therapeutic and Surgical), Application (Coronary Artery Disease (CAD), Cardiac Arrhythmia, Heart Failure, Others), End-User (Hospitals and Clinics, Ambulatory Surgical Centers, Diagnostic Centers, Cardiac Catheterization Laboratories, Others), States and Company 2025-2033.

United States Cardiovascular Devices Market Outlook

Cardiovascular devices are medical instruments used to diagnose, monitor, and treat cardiovascular diseases (CVDs) that affect the heart and blood vessels. These devices include diagnostic tools like electrocardiograms (ECGs), echocardiograms, imaging systems, and therapeutic devices such as stents, pacemakers, defibrillators, and heart valves. Cardiovascular devices are essential in managing conditions such as coronary artery disease, arrhythmias, heart failure, and hypertension.

Cardiovascular diseases are still a leading cause of death in the United States, and these devices are necessary for proper diagnosis and treatment. Stents open blocked arteries, pacemakers and defibrillators regulate heart rhythms in patients with arrhythmias, and advanced imaging systems allow doctors to assess heart function. Wearable devices and remote monitoring technologies enable continuous tracking of heart health. The growing aging population and increasing prevalence of lifestyle-related risk factors, such as obesity and smoking, drive the demand for cardiovascular devices. As innovations continue to evolve, the devices are improving patient outcomes and quality of life in the U.S.

Increasing Prevalence of Cardiovascular Diseases Growth Driver in the United States Cardiovascular Devices Market

A growing trend in cardiovascular diseases in the United States has become a significant growth driver for the cardiovascular devices market. Millions of Americans suffer from CVDs, such as coronary artery disease, heart failure, and arrhythmias, and therefore demand more diagnostic and therapeutic devices. Advanced cardiovascular devices such as stents, pacemakers, and defibrillators have remained a critical need in healthcare settings because of the population that is aging and lifestyle-related risk factors, such as obesity, hypertension, and diabetes. With this, more health care providers are resorting to these devices in a quest to enhance patient outcomes and to effectively manage chronic cardiovascular conditions. In 2022, 702,880 people died from heart disease. That's 1 in every 5 deaths.

Technological Innovation in Cardiovascular Devices

Technological advancements play an essential role in boosting the U.S. cardiovascular devices market. Technological advancement such as minimally invasive procedures, robotic-assisted surgeries, and wearable heart monitoring devices enhance the efficacy and acceptance of cardiovascular treatments. Newer-generation stents, extended battery life pacemakers, and AI-powered diagnostic tools can be used for highly specific, personalized care. All of these advancements improve the efficiency of diagnosis and treatment while reducing recovery times and further boost the adoption of cardiovascular devices in hospitals and clinics all over the U.S.

Government Initiatives and Healthcare Funding

Government initiatives and increased funding for healthcare are the key growth drivers for the cardiovascular devices market in the United States. Funding through policies initiated under the Affordable Care Act and funding for heart disease research have opened up better access to advanced healthcare technologies. In addition, programs that focus on cardiovascular health improvement, such as the CDC's Million Hearts initiative, emphasize early detection, prevention, and treatment of CVDs. Reimbursement and insurance coverage for cardiovascular procedures are also becoming more accessible, which motivates hospitals and clinics to invest in new devices. All these factors have contributed to the continued growth and adoption of cardiovascular devices.

Barriers in the United States Cardiovascular Devices Market

Expensive Advanced Cardiovascular Devices

One of the big challenges of this market in the United States is that some of these advanced cardiovascular devices are very expensive. Advanced technology often includes something like a minimally invasive stent, which is associated with very high prices, which can put robotic-assisted surgical tools, among other things, out of range for some healthcare facilities and certainly some patients, especially if they belong to smaller hospitals or have low budgets located in a more rural region. Furthermore, though insurance may cover up to some of the costs, patients pay out-of-pocket for significant portions, which may deter widespread applications of these devices.

Government and Approval Issues

The timeline for FDA approval of these cardiovascular devices in the United States is lengthy and complicated. Many clinical trials and regulatory requirements imposed by the FDA have to be met by such manufacturers to ensure that such products are safe and will work effectively. This may lead to a delay in bringing new devices to the market. Additionally, the research, development, and regulatory compliance expenses are quite high, and thus add to the overall expense for the manufacturers. This will lead to a slowdown in innovation and decreased availability of the most advanced cardiovascular solutions to the healthcare providers.

United States Cardiovascular Diagnostics And Monitoring Devices Market

Diagnostic and monitoring devices have dominated the United States cardiovascular devices market. This is due to their significant role in controlling and preventing sickness. The tools enable medical practitioners to diagnose cardiac conditions, monitor patients' health, and investigate the effectiveness of treatment. Given the rise in cardiovascular diseases, the need for diagnostic equipment is continually increasing. From ECG machines to portable heart monitors, they enable early detection and proactive control over cardiovascular conditions, thus contributing to their growth in the United States cardiovascular device market.

United States Coronary Artery Disease Cardiovascular Devices Market

Coronary artery disease happens to be one of the most conventional applications for the United States cardiovascular devices market as it significantly influences public health. It thus drives a wide range of cardiac devices for diagnosis, management and even treatment of CAD. Including stents and angioplasty balloons for revascularisation to superior imaging technology coronary angio, the various machines align with the complex needs for most patients living with CAD, bringing awareness into further development of revolutionary cardiovascular technologies in the market.

United States Diagnostic Centers Cardiovascular Devices Market

Diagnostic facilities are among the most used in the United States cardiovascular devices market because of their pivotal role in cardiovascular fitness evaluation and control. These facilities house diverse diagnostic devices, including echocardiography machines, stress tests, and cardiac catheterization labs, allowing for comprehensive assessment and accurate analysis of cardiac conditions. With early detection and specific evaluation essential in cardiovascular care, diagnostic centers are important hubs for patient assessment, propelling their full-size usage in the market.

California Cardiovascular Devices Market

California is one of the distinguished players in the United States cardiovascular devices market. This is due to its robust healthcare surroundings and revolutionary panorama. Home to renowned research institutions, clinical facilities, and enterprise leaders, California fosters conducive surroundings for developing and commercializing modern cardiovascular technology. The state's lively biotechnology zone and strategic collaborations among academia and enterprise continue to contribute to ongoing improvements in cardiovascular care, solidifying California's recognition as a vital hub in the cardiovascular devices market.

New York Cardiovascular Device Market

The New York cardiovascular device market is growing with the increasing prevalence of cardiovascular diseases (CVDs) and an aging population. With CVDs being the leading cause of death in the state, there is a growing demand for advanced diagnostic and treatment devices, such as stents, pacemakers, defibrillators, and imaging systems. Technological advancements like minimally invasive procedures and wearable heart monitoring devices drive market growth. Increased healthcare access, government initiatives, and robust healthcare infrastructure support adopting these devices. The New York market is expected to grow further with innovative cardiovascular solutions that improve patient care and outcomes.

Washington Cardiovascular Device Market

The Washington cardiovascular device market is growing due to the increasing prevalence of CVDs and the development of medical technology. With CVDs accounting for the highest morbidity and mortality in the state, the demand for cardiovascular devices such as stents, pacemakers, defibrillators, and diagnostic imaging tools is growing. The adoption of minimally invasive procedures and wearable devices for heart monitoring is also driving market growth. Additionally, government health initiatives and a well-developed healthcare infrastructure support the use of these advanced cardiovascular solutions. The Washington market will continue to rise with time as innovative devices advance the outcomes of patients and the quality of care.

Florida Cardiovascular Device Market

Florida's cardiovascular device market is also growing since CVDs have been recognized as one of the leading causes of death in the state. There is growing demand for the advanced cardiovascular devices, which include stents, pacemakers, defibrillators, and diagnostic imaging equipment, as the population ages. Technological innovations, including minimally invasive procedures and wearable heart monitoring devices, are driving market growth. Established healthcare infrastructure in Florida and initiatives taken by the government to improve the prevention and treatment of heart disease promote extensive adoption of these devices. Advances in cardiovascular care should further boost the market going forward.

Major Players

The leading companies in the United States cardiovascular devices market are Abbott Laboratories, Boston Scientific Corporation, Edwards Lifesciences, Cardinal Health Inc., Medtronic PLC, GE Healthcare, Johnson & Johnson Services, Inc., and Siemens Healthcare GmbH.

Device type – Market breakup in 2 viewpoints:

1. Diagnostic and Monitoring Devices

2. Therapeutic and Surgical Devices

Application – Market breakup in 4 viewpoints:

1. Coronary Artery Disease (CAD)

2. Cardiac Arrhythmia

3. Heart Failure

4. Others

End-User – Market breakup in 5 viewpoints:

1. Hospitals and Clinics

2. Ambulatory Surgical Centers

3. Diagnostic Centers

4. Cardiac Catheterization Laboratories

5. Others

States – Market of 29 States Covered in the Report:

1. California

2. Texas

3. New York

4. Florida

5. Illinois

6. Pennsylvania

7. Ohio

8. Georgia

9. New Jersey

10. Washington

11. North Carolina

12. Massachusetts

13. Virginia

14. Michigan

15. Maryland

16. Colorado

17. Tennessee

18. Indiana

19. Arizona

20. Minnesota

21. Wisconsin

22. Missouri

23. Connecticut

24. South Carolina

25. Oregon

26. Louisiana

27. Alabama

28. Kentucky

29. Rest of the United States

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Abbott Laboratories

2. Boston Scientific Corporation

3. Edwards Lifesciences

4. Cardinal Health Inc.

5. Medtronic PLC

6. GE Healthcare

7. Johnson & Johnson Services, Inc.

8. Siemens Healthcare GmbH.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Device Type, Application, End-User and States |

| Countries Covered | 1. California 2. Texas 3. New York 4. Florida 5. Illinois 6. Pennsylvania 7. Ohio 8. Georgia 9. New Jersey 10. Washington 11. North Carolina 12. Massachusetts 13. Virginia 14. Michigan 15. Maryland 16. Colorado 17. Tennessee 18. Indiana 19. Arizona 20. Minnesota 21. Wisconsin 22. Missouri 23. Connecticut 24. South Carolina 25. Oregon 26. Louisiana 27. Alabama 28. Kentucky 29. Rest of the United States |

| Companies Covered | 1. Abbott Laboratories 2. Boston Scientific Corporation 3. Edwards Lifesciences 4. Cardinal Health Inc. 5. Medtronic PLC 6. GE Healthcare 7. Johnson & Johnson Services, Inc. 8. Siemens Healthcare GmbH. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected growth rate (CAGR) for the U.S. cardiovascular devices market from 2025 to 2033?

-

What is the expected market size of the U.S. cardiovascular devices market in 2033?

-

Which factors are driving the growth of the cardiovascular devices market in the U.S.?

-

What are the two main categories of cardiovascular devices in the U.S. market?

-

Which type of cardiovascular devices is the leading category in terms of market share?

-

What role do technological innovations play in the growth of the U.S. cardiovascular devices market?

-

How are government initiatives and healthcare funding contributing to market growth?

-

What are the key challenges faced by the U.S. cardiovascular devices market, especially concerning device costs?

-

What specific cardiovascular condition is driving the demand for devices like stents and pacemakers?

-

Which state in the U.S. is considered a significant player in the cardiovascular devices market, and why?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Cardiovascular Devices Market

6. Market Share

6.1 By Device Type

6.2 By Application

6.3 By End User

6.4 By States

7. Device Type

7.1 Diagnostic and Monitoring Devices

7.2 Therapeutic and Surgical Devices

8. Application

8.1 Coronary Artery Disease (CAD)

8.2 Cardiac Arrhythmia

8.3 Heart Failure

8.4 Others

9. End User

9.1 Hospitals and Clinics

9.2 Ambulatory Surgical Centers

9.3 Diagnostic Centers

9.4 Cardiac Catheterization Laboratories

9.5 Others

10. States

10.1 California

10.2 Texas

10.3 New York

10.4 Florida

10.5 Illinois

10.6 Pennsylvania

10.7 Ohio

10.8 Georgia

10.9 New Jersey

10.10 Washington

10.11 North Carolina

10.12 Massachusetts

10.13 Virginia

10.14 Michigan

10.15 Maryland

10.16 Colorado

10.17 Tennessee

10.18 Indiana

10.19 Arizona

10.20 Minnesota

10.21 Wisconsin

10.22 Missouri

10.23 Connecticut

10.24 South Carolina

10.25 Oregon

10.26 Louisiana

10.27 Alabama

10.28 Kentucky

10.29 Rest of the United States

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Abbott Laboratories

13.1.1 Overview

13.1.2 Recent Development

13.1.3 Revenue Analysis

13.2 Boston Scientific Corporation

13.2.1 Overview

13.2.2 Recent Development

13.2.3 Revenue Analysis

13.3 Edwards Lifesciences

13.3.1 Overview

13.3.2 Recent Development

13.3.3 Revenue Analysis

13.4 Cardinal Health Inc.

13.4.1 Overview

13.4.2 Recent Development

13.4.3 Revenue Analysis

13.5 Medtronic PLC

13.5.1 Overview

13.5.2 Recent Development

13.5.3 Revenue Analysis

13.6 GE Healthcare

13.6.1 Overview

13.6.2 Recent Development

13.6.3 Revenue Analysis

13.7 Johnson & Johnson Services, Inc.

13.7.1 Overview

13.7.2 Recent Development

13.7.3 Revenue Analysis

13.8 Siemens Healthcare GmbH

13.8.1 Overview

13.8.2 Recent Development

13.8.3 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com