United States Cosmetics Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Cosmetics Market Trends & Summary

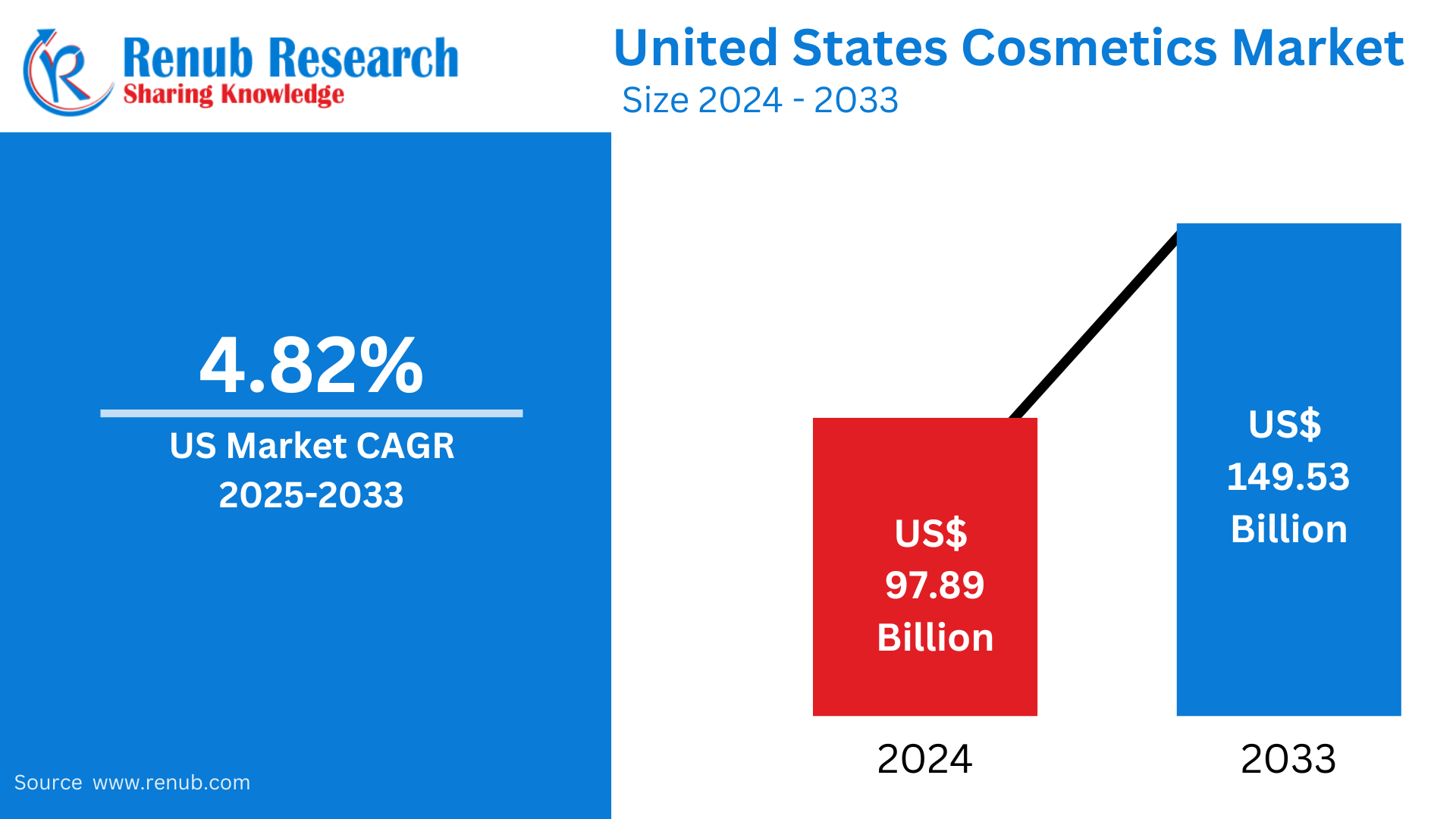

United States Cosmetics market is projected to be at about US$ 149.53 Billion in 2033 with a growth from US$ 97.89 Billion in 2024 during the period spanning 2025-2033, and with an absolute CAGR of 4.82% throughout 2025 to 2033. Increasing premium beauty demand by the consumers, the growth of the concept of skincare awareness, the rising adaptation of green cosmetics along with other new and sustainable innovations supported through improvements in e-commerce and digital marketing.

The report United States Cosmetics Market & Forecast covers by Product Types (Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, and Others), Gender (Men, Women, and Unisex), Distribution Channel (Supermarkets/hypermarkets, Specialty Store, Pharmacies, Online Sales, and Others), and Company Analysis 2025-2033

United States Cosmetics Market Outlooks

Cosmetics are products designed to enhance or alter the appearance of the skin, hair, nails, and overall physical features. They include a wide range of items such as skincare products, makeup, haircare, fragrances, and personal care items. In the United States, cosmetics play a significant role in daily routines, with individuals using them to improve personal aesthetics, boost confidence, and express their individuality. The market is very diversified, including products for various age groups, skin types, and preferences.

Some of the common skincare products used to maintain healthy skin include moisturizers, sunscreens, and anti-aging creams. Makeup products like foundation, lipsticks, and eyeshadows are popular to enhance facial features. Haircare products such as shampoos, conditioners, and styling gels are also crucial for hair health and styling needs. Cosmetics are not only used for personal care but also in professional fields, such as the entertainment and fashion industries. In the U.S., innovation, sustainability, and natural ingredients are still shaping the cosmetics market. The United States cosmetics market is booming, with companies adapting to changing trends and customer expectations. According to the NCBI, 92.5% read about the safety warnings of cosmetic products before they were used, and only 39.5% knew of the organization responsible for the cosmetic industry.

Growth Drivers in the United States Cosmetics Market

Consumer Demand for Clean Beauty Products

There is growing consumer demand for cosmetics free from harmful chemicals and toxins that represent an increase in awareness related to health and ingredient transparency. Products labeled as "clean," "vegan," or "cruelty-free" are increasing in popularity among US consumers. This demand for safer, more natural ingredients has challenged beauty brands to create eco-friendly and sustainable products. The clean beauty trend is particularly driven by millennials and Gen Z, with 43% of this age group preferring natural skincare, compared to 31% of the general US consumer population.

Social Media and E-Commerce Influence

Social media sites like Instagram, YouTube, and TikTok have significantly changed the beauty and cosmetics market in the United States. Influencers and beauty vloggers play an important role in influencing consumer preferences and purchases. These platforms give consumers real-time reviews of products, tutorials, and recommendations, which deepen the connection between brands and their audience.

In addition, the increased availability of online sales has made the process of buying cosmetics less strenuous. The store comes to the shopper with the convenience of home delivery and virtual tryouts. This development allows brands to reach a wider audience while improving the effectiveness of their marketing strategies. According to Tinuiti data released in June 2023, a total of 37% of US beauty shoppers start their searches on Amazon and not on others such as Walmart (23%), retailer websites (9%), and search engines (8%). Therefore, this goes to show just how much beauty is shifting online.

Personalization and Inclusivity in Cosmetics

The rising demand for inclusive and customized beauty products is one of the main growth drivers in the US market. Consumers are increasingly seeking products that cater to a diverse array of skin types, tones, and specific concerns, leading to a monumental shift in the beauty landscape. As the call for inclusivity grows louder, beauty brands are responding by expanding their product lines to encompass a wider spectrum of offerings.

For this, it produces an incredible scale of skincare product arrays, foundations, and cosmetics provided in a rich variety of different shades to truly celebrate the unicity of one's beauty. Plus, many other brands are implementing personalization via bespoke skincare services, such as serums, and tailored procedures, based upon comprehensive analyses from each customer about their skin. By focusing on these individualized approaches, companies not only increase customer satisfaction but also deepen loyalty and ensure that every customer feels heard and understood throughout their beauty journey.

Challenges in the United States Cosmetics Market

Regulatory and Compliance Challenges

The cosmetics industry in the US faces significant regulatory hurdles, as manufacturers must comply with stringent guidelines set by the Food and Drug Administration (FDA) and other regulatory bodies. These regulations ensure the safety and efficacy of cosmetics, but they can be costly and time-consuming for companies to navigate. Brands need to keep pace with changing legislation, particularly over claims such as "organic," "natural," or "cruelty-free." As the demand for clean and sustainable beauty products continues to rise, it is challenging for companies in the cosmetics industry to balance maintaining compliance with preserving the integrity of their product formulations.

High Competition and Market Saturation

The United States has a very competitive cosmetics industry. There are so many brands that fight for consumers' attention. Because of both new and existing companies' continued innovation to gain more market share, the market becomes saturated. Smaller or emerging businesses can be hard-pressed to differentiate themselves and gain retail relationships, while larger corporations can overwhelm the industry with massive marketing spends. Consumers are becoming fussy and demanding unique, customized products. In light of an increasingly competitive arena, business houses need to continually innovate, invest in marketing, and obtain the element of differential product, thereby keeping the interest of customers alive and holding them to the brand.

United States Hair Care Products Market

The US hair care products market is growing steadily. Consumers are seeking specialized, high-quality products. All products for shampoos, conditioners, hair treatments, and styling products come within this category. With people learning more about hair health, products containing natural ingredients such as organic oils, vitamins, and plant extracts are highly sought after. Another reason the industry is evolving is due to individualized hair care products, for example, shampoos and conditioners specific to certain hair types and problems. Social media and e-commerce influencers have become crucial factors in determining consumer trends and what people will buy. July 2024, Aeterna unveiled its all-natural, Made in Italy haircare brand in the United States. Two brothers from Italy, co-founders Stefano and Guido Spacagna, own and operate the popular Spacagna Italian Hair Design salon on Miracle Mile in Miami, FL.

United States Makeup and Color Cosmetics Market

The United States makeup and color cosmetics market is booming as demand for new, high-performance beauty products continues to increase. This market encompasses foundations, lipsticks, eyeliners, eyeshadows, blushes, and other color cosmetics that enhance the beauty of the individual. More and more consumers are opting for products with long-lasting wear, skin benefits, and different shades. Due to the rising awareness of inclusivity, companies have started catering to a large variety of skin tones. Social media and the beauty influencer on platforms such as Instagram and TikTok drive trends and consumer choices. Demand for green and clean beauty products is driving the future of the market.

United States Women Cosmetics Market

The United States women's cosmetics market is huge and expanding rapidly. More women are focusing on beauty and self-care. Skincare, makeup, and personal care products are their primary purchases in the category, and they want innovative and high-quality ones. There is increased interest in natural, cruelty-free, and clean beauty products since women are keen on the content of their cosmetics. The market is also witnessing a shift towards personalisation as companies create bespoke skincare and makeup to fit different needs. Beauty influencers through social media channels are the significant players in making purchasing decisions and defining beauty trends.

United States Pharmacies Cosmetics Market

The cosmetics market in US pharmacies has greatly improved. More people buy beauty and personal care products at pharmacies during their prescription pickups. This trend is arising because shopping for cosmetics together is convenient, and most people concentrate on self-care. Pharmacies are being equpped with more products, including premium dermatologist-approved brands, to lure customers into reliable and practical options. Pharmacy stores also see an increased demand for beauty products that are related to health consciousness, such as those containing natural or organic ingredients.

United States Cosmetics Market Segments

Product Types – Market breakup in 5 viewpoints:

1. Skin and Sun Care Products

2. Hair Care Products

3. Deodorants and Fragrances

4. Makeup and Color Cosmetics

5. Others

Gender – Market breakup in 3 viewpoints:

1. Men

2. Women

3. Unisex

Type – Market breakup in 5 viewpoints:

1. Supermarkets/hypermarkets

2. Specialty Store

3. Pharmacies

4. Online Sales

5. Others

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Coty Inc.

2. Procter & Gamble

3. The Estee Lauder Companies Inc.

4. Colgate-Palmolive Company

5. Johnson & Johnson Services Inc.

6. Revlon Inc.

7. Mary Kay Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Products Type, Gender, and Distribution Channel |

| Products Type Covered |

1. Skin and Sun Care Products |

| Companies Covered |

1. Coty Inc. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the United States Cosmetics Market by 2033?

-

What is the expected compound annual growth rate (CAGR) for the market from 2025 to 2033?

-

How has the demand for clean beauty products influenced the U.S. cosmetics market?

-

What are the major growth drivers in the United States Cosmetics Market?

-

How has social media and e-commerce influenced consumer behavior in the cosmetics market?

-

What challenges are companies in the U.S. cosmetics market facing in terms of regulatory compliance?

-

Which product types are included in the United States Cosmetics Market analysis?

-

What impact has the rise of personalization and inclusivity had on the cosmetics market?

-

Which companies are leading the U.S. cosmetics market, and what are their contributions?

-

How are U.S. pharmacies influencing the cosmetics market, particularly with premium and dermatologist-approved products?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Cosmetics Market

6. Market Share

6.1 By Products Type

6.2 By Gender

6.3 By Distribution Channel

7. Products Types

7.1 Skin and Sun Care Products

7.2 Hair Care Products

7.3 Deodorants and Fragrances

7.4 Makeup and Color Cosmetics

7.5 Others

8. Gender

8.1 Men

8.2 Women

8.3 Unisex

9. Distribution Channels

9.1 Supermarkets/hypermarkets

9.2 Specialty Store

9.3 Pharmacies

9.4 Online Sales

9.5 Others

10. Porter’s Five Forces

10.1 Bargaining Power of Buyer

10.2 Bargaining Power of Supplier

10.3 Threat of New Entrants

10.4 Rivalry among Existing Competitors

10.5 Threat of Substitute Products

11. SWOT Analysis

11.1 Strengths

11.2 Weaknesses

11.3 Opportunities

11.4 Threats

12. Key Players Analysis

12.1 Coty Inc.

12.1.1 Overviews

12.1.2 Recent Developments

12.1.3 Revenues

12.2 Procter & Gamble

12.2.1 Overviews

12.2.2 Recent Developments

12.2.3 Revenues

12.3 The Estee Lauder Companies Inc.

12.3.1 Overviews

12.3.2 Recent Developments

12.3.3 Revenues

12.4 Colgate-Palmolive Company

12.4.1 Overviews

12.4.2 Recent Developments

12.4.3 Revenues

12.5 Johnson & Johnson Services Inc.

12.5.1 Overviews

12.5.2 Recent Developments

12.5.3 Revenues

12.6 Revlon, Inc.

12.6.1 Overviews

12.6.2 Recent Developments

12.6.3 Revenues

12.7 Mary Kay Inc

12.7.1 Overviews

12.7.2 Recent Developments

12.7.3 Revenues

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com