United States Dental Market By Segments, Types, Expenses, End Users (Private, Public), Company Analysis, Forecast

Buy NowUnited States Dental Market Outlook

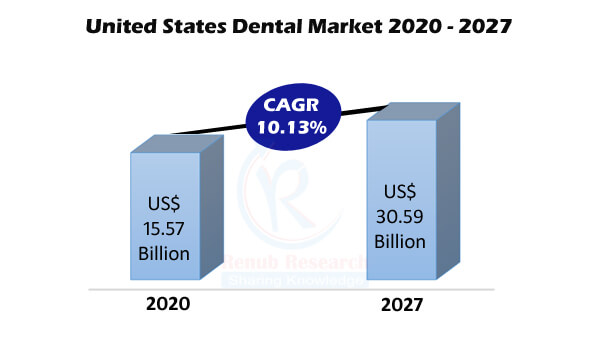

United States Dental Market is expected to be USD 30.59 Billion by 2027. The factors that are expected to drive the demands of the dental equipment industry in the USA are:

• Cosmetic surgery

• The ageing of the American population

• Advancement in dental procedure due to advanced technology

Some other factors may include poor oral hygiene, smoking habits, diabetes. Moreover, the demands of prosthetic, preventive and surgical dentistry will also contribute to this market. However, the lack of proper reimbursement and the high cost of dental procedures hinder the market growth.

Dental equipments are the tools that help to treat, examine, manipulate and restore any oral ailments. In the United States, there has been a surge in the number of dental implant and surgeries performed due to the growing ageing populace. The most common dental procedures include root canal, periodontal, bonding, and fillings. As per research analysis, the market of the dental market in the United States was worth US$ 15.57 Billion in 2020.

COVID-19 effect on United States Dental Industry

Dentistry is facing its most challenging time in recent history with the outbreak of coronavirus disease. The COVID-19 pandemic has effectively closed approximately 198 thousand dental doctors and active dentists in the USA. Since dental surgeons are at the highest risk of contracting the Coronavirus, with the pandemic still at large, the USA's dental market will not be able to revive in its pre-pandemic phase in 2021. But with the speeding of COVID vaccine shots, we expect the USA dental market to start recovering from the second half of 2021. According to this report, United States Dental Industry will grow at a staggering CAGR of 10.13% during 2020-2027.

As per the American Dental Association 2019

• Approx 42% of American adults 30 years or above have periodontitis.

• Around 7.8% of American has severe periodontitis.

As per a survey of 2017 by American Academy of Cosmetic Dentistry:

• Approx 99.7% of American believes that a smile is an important social asset.

• 96% of American believes that an attractive smile makes the opposite sex attract.

• Around 74% believe that, the unattractive smile may hamper career growth.

Renub Research latest report “United States Dental Market by Segments (Preventive, Restorative, Implants, Titanium, Zirconium, Prosthetics, Endodontics, Orthodontics, Equipment), Types (Dental Radiology Equipments, Dental Lasers, Systems & Parts, Laboratory Machines, Hygiene Maintenance Device, Other Equipments), Expenses (Private Insurance, Out of Pocket, Medicaid, Public Health, Others), End Users (Private, Public), Company (Danaher Corporation, Dentsply Sirona, Henry Schein, Zimmer Holdings Inc., Biolase)” provides a complete analysis of Dental Market in United States.

Segments – Dental Market breakup from 9 viewpoints

• Preventive

• Restorative

• Implants

• Titanium

• Zirconium

• Prosthetics

• Endodontics

• Orthodontics

• Equipment

Types – Dental Equipments Market breakup from 6 viewpoints

• Dental Radiology Equipments

• Dental Lasers

• Systems & Parts

• Laboratory Machines

• Hygiene Maintenance Device

• Other Equipments

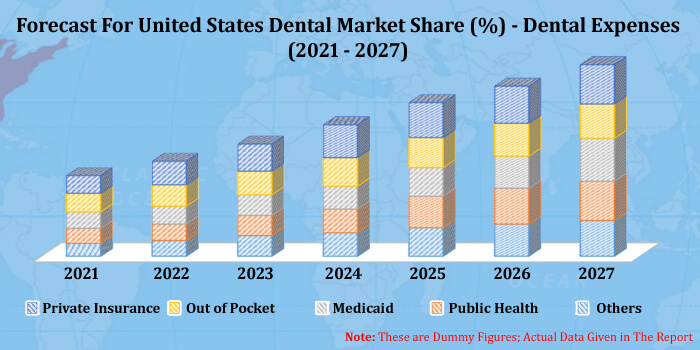

Dental Expenses – Market breakup from 5 viewpoints

• Private Insurance

• Out of Pocket

• Medicaid

• Public Health

• Others

End Users - Dental breakup from 2 viewpoints

• Private

• Public

All companies have been covered from 3 Viewpoints

• Overview

• Initiatives

• Sales

Company Analysis

• Danaher Corporation

• Dentsply Sirona

• Henry Schein

• Zimmer Holdings Inc.

• Biolase

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

4.3 Opportunities

5. United States Dental Market

6. Market Share – United States Dental Market

6.1 Segments

6.2 Dental Equipment Types

7. Segments – United States Dental Market

7.1 Preventive

7.2 Restorative

7.3 Implants

7.3.1 Titanium

7.3.2 Zirconium

7.4 Prosthetics

7.5 Endodontics

7.6 Orthodontics

7.7 Equipment

8. Types – United States Dental Equipments Market

8.1 Dental Radiology Equipments

8.2 Dental Lasers

8.3 Systems & Parts

8.4 Laboratory Machines

8.5 Hygiene Maintenance Device

8.6 Other Equipments

9. Dental Expenses – United Dental Market

9.1 Private Insurance

9.2 Out of Pocket

9.3 Medicaid

9.4 Public Health

9.5 Others

10. End Users - United States Dental Market

10.1 Private

10.2 Public

11. Company Analysis

11.1 Danaher Corporation

11.1.1 Overview

11.1.2 Initatives

11.1.3 Sales

11.2 Dentsply Sirona

11.2.1 Overview

11.2.2 Initatives

11.2.3 Sales

11.3 Henry Schein

11.3.1 Overview

11.3.2 Initatives

11.3.3 Sales

11.4 Zimmer Holdings Inc.

11.4.1 Overview

11.4.2 Initatives

11.4.3 Sales

11.5 Biolase

11.5.1 Overview

11.5.2 Initatives

11.5.3 Sales

List Of Figures:

Figure-01: US - Dental Implant and Equipment Market ( USD Billion), 2019 - 2025

Figure-02: US Cosmetic Dentistry Revenue Growth (2013 – 2016)

Figure-03: Dental Fee And Reimbursement Rate (2005 -2014)

Figure-04: United States Dental Market (USD Billion), 2015 – 2020

Figure-05: Forecast for – United States Dental Market (USD Billion), 2021 – 2027

Figure-06: USA Dental Market (Spending) (Billion US$) for Preventive, 2015 – 2020

Figure-07: Forecast for – USA Dental Market (Spending) (Billion US$) for Preventive, 2021 – 2027

Figure-08: USA Dental Market (Spending) (Billion US$) for Restorative, 2015 – 2020

Figure-09: Forecast for – USA Dental Market (Spending) (Billion US$) for Restorative, 2021 – 2027

Figure-10: USA Dental Market (Spending) (Billion US$) for Implants, 2015 – 2020

Figure-11: Forecast for – USA Dental Market (Spending) (Billion US$) for Implants, 2021 – 2027

Figure-12: USA Dental Market (Spending) (Billion US$) for Titanium, 2015 – 2020

Figure-13: Forecast for – USA Dental Market (Spending) (Billion US$) for Titanium, 2021 – 2027

Figure-14: USA Dental Market (Spending) (Billion US$) for Zirconium, 2015 – 2020

Figure-15: Forecast for – USA Dental Market (Spending) (Billion US$) for Zirconium, 2021 – 2027

Figure-16: USA Dental Market (Spending) (Billion US$) for Prosthetics, 2015 – 2020

Figure-17: Forecast for – USA Dental Market (Spending) (Billion US$) for Prosthetics, 2021 – 2027

Figure-18: USA Dental Market (Spending) (Billion US$) for Endodontics, 2015 – 2020

Figure-19: Forecast for – USA Dental Market (Spending) (Billion US$) for Endodontics, 2021 – 2027

Figure-20: USA Dental Market (Spending) (Billion US$) for Orthodontics, 2015 – 2020

Figure-21: Forecast for – USA Dental Market (Spending) (Billion US$) for Orthodontics, 2021 – 2027

Figure-22: USA Dental Market (Spending) (Billion US$) for Equipments, 2015 – 2020

Figure-23: Forecast for – USA Dental Market (Spending) (Billion US$) for Equipment, 2021 – 2027

Figure-24: USA Dental Market (Spending) (Billion US$) for Dental Radiology Equipments, 2015 – 2020

Figure-25: Forecast for – USA Dental Market (Spending) (Billion US$) for Dental Radiology Equipments, 2021 – 2027

Figure-26: USA Dental Market (Spending) (Billion US$) for Dental Lasers, 2015 – 2020

Figure-27: Forecast for – USA Dental Market (Spending) (Billion US$) for Dental Lasers, 2021 – 2027

Figure-28: USA Dental Market (Spending) (Billion US$) for Systems & Parts, 2015 – 2020

Figure-29: Forecast for – USA Dental Market (Spending) (Billion US$) for Systems & Parts, 2021 – 2027

Figure-30: USA Dental Market (Spending) (Billion US$) for Laboratory Machines, 2015 – 2020

Figure-31: Forecast for – USA Dental Market (Spending) (Billion US$) for Laboratory Machines, 2021 – 2027

Figure-32: USA Dental Market (Spending) (Billion US$) for Hygiene Maintenance Device, 2015 – 2020

Figure-33: Forecast for – USA Dental Market (Spending) (Billion US$) for Hygiene Maintenance Device, 2021 – 2027

Figure-34: USA Dental Market (Spending) (Billion US$) for Other Equipments, 2015 – 2020

Figure-35: Forecast for – USA Dental Market (Spending) (Billion US$) for Other Equipments, 2021 – 2027

Figure-36: USA Dental Market (Spending) (Billion US$) for Private Insurance, 2015 – 2020

Figure-37: Forecast for – USA Dental Market (Spending) (Billion US$) for Private Insurance, 2021 – 2027

Figure-38: USA Dental Market (Spending) (Billion US$) for Out of Pocket, 2015 – 2020

Figure-39: Forecast for – USA Dental Market (Spending) (Billion US$) for Out of Pocket, 2021 – 2027

Figure-40: USA Dental Market (Spending) (Billion US$) for Medicaid, 2015 – 2020

Figure-41: Forecast for – USA Dental Market (Spending) (Billion US$) for Medicaid, 2021 – 2027

Figure-42: USA Dental Market (Spending) (Billion US$) for Public Health, 2015 – 2020

Figure-43: Forecast for – USA Dental Market (Spending) (Billion US$) for Public Health, 2021 – 2027

Figure-44: USA Dental Market (Spending) (Billion US$) for Others, 2015 – 2020

Figure-45: Forecast for – USA Dental Market (Spending) (Billion US$) for Others, 2021 – 2027

Figure-46: USA Dental Market (Spending) (Billion US$) for Private, 2015 – 2020

Figure-47: Forecast for – USA Dental Market (Spending) (Billion US$) for Private, 2021 – 2027

Figure-48: USA Dental Market (Spending) (Billion US$) for Public, 2015 – 2020

Figure-49: Forecast for – USA Dental Market (Spending) (Billion US$) for Public, 2021 – 2027

Figure-50: USA Dental Market (Spending) (Million US$) for Danaher Corporation, 2015 – 2020

Figure-51: Forecast for – USA Dental Market (Spending) (Million US$) for Danaher Corporation, 2021 – 2027

Figure-52: USA Dental Market (Spending) (Million US$) for Dentsply Sirona, 2015 – 2020

Figure-53: Forecast for – USA Dental Market (Spending) (Million US$) for Dentsply Sirona, 2021 – 2027

Figure-54: USA Dental Market (Spending) (Million US$) for Henry Schein, 2015 – 2020

Figure-55: Forecast for – USA Dental Market (Spending) (Million US$) for Henry Schein, 2021 – 2027

Figure-56: USA Dental Market (Spending) (Million US$) for Zimmer Holdings Inc., 2015 – 2020

Figure-57: Forecast for – USA Dental Market (Spending) (Million US$) for Zimmer Holdings Inc., 2021 – 2027

Figure-58: USA Dental Market (Spending) (Million US$) for Biolase Inc., 2015 – 2020

Figure-59: Forecast for – USA Dental Market (Spending) (Million US$) for Biolase Inc., 2021 – 2027

List Of Tables:

Table-01: USA Dental Market Segments Share Analysis (Percent), 2015 – 2020

Table-02: Forecast for – USA Dental Market Segments Share Analysis (Percent), 2021 – 2027

Table-03: USA Dental Equipment Types Market Share Analysis (Percent), 2015 – 2020

Table-04: Forecast for – USA Dental Equipment Types Market Share Analysis (Percent), 2021 – 2027

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com