United States E-Commerce Payment Market Size and Share Analysis - Growth Trends and Forecast Report 2024-2032

Buy NowUnited States E-Commerce Payment Market Trends & Summary

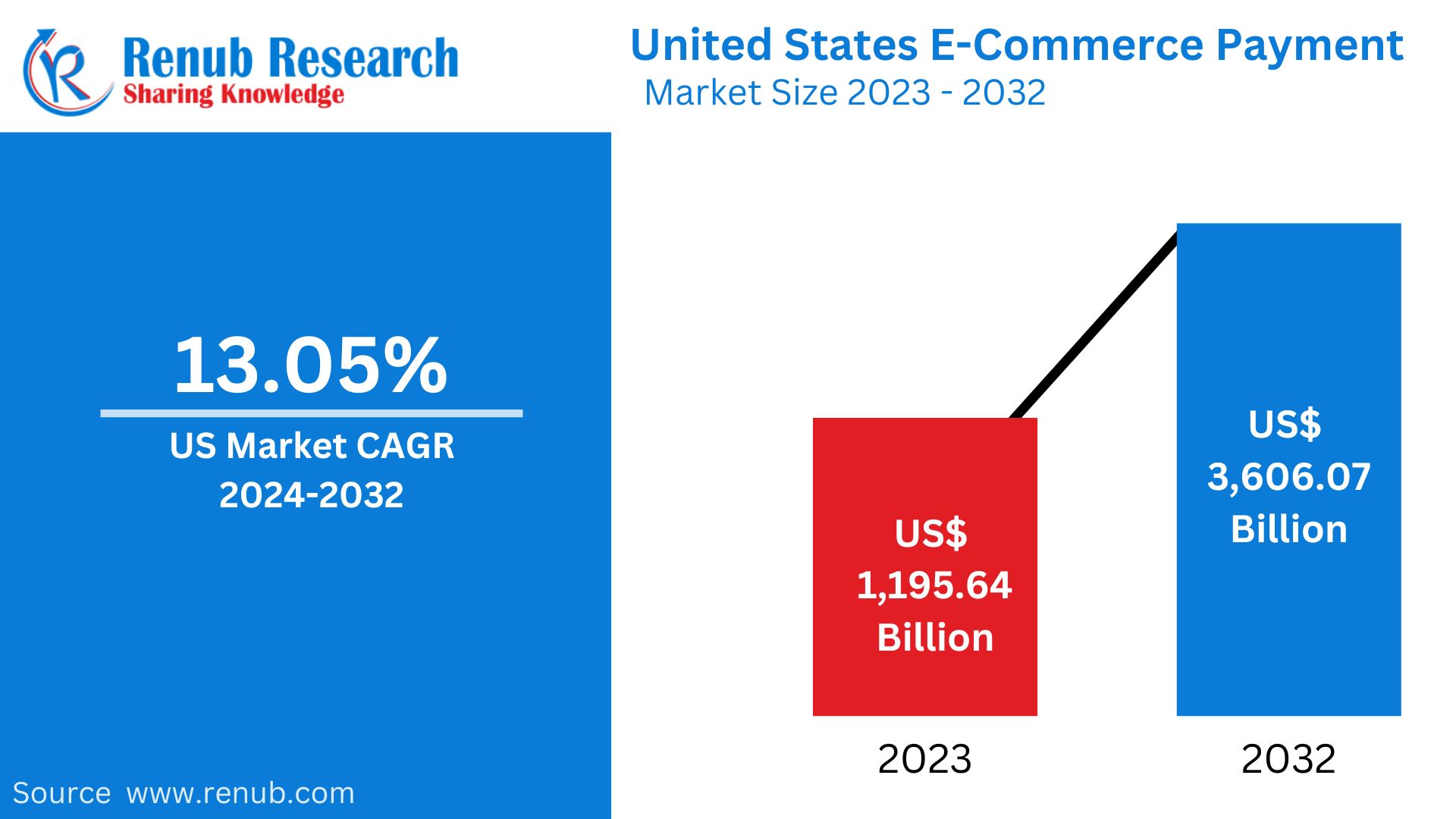

United States E-Commerce Payment market is expected to reach US$ 1,195.64 Billion in 2023 to US$ 3,606.07 Billion by 2032, with a CAGR of 13.05% from 2024 to 2032. The growing use of smartphones and increased accessibility to the internet is driving growth in the e-commerce payment industry. Additionally, it is anticipated that the e-commerce payment business would expand significantly over the course of the projection period due to the expanding population of bankers and digitalization.

The report United States E-Commerce Payment Market & Forecast covers by Type (Digital Wallet, Credit Card, Debit Card, Account-to-Account (A2A), Buy now pay later (BNPL), Cash on Delivery (CoD), PrePay), Application (Electronics & Media, Food & Personal Care, Fashion Accessories, Furniture & Appliances, Others), States and Company Analysis 2024-2032.

United States E-Commerce Payment Overview

E-commerce payment is a billing technique that allows online retailers to handle payments instantly. Usually referred to as an online mobile payment network, it is categorized as an e-commerce payment system. Either cash or checks are not required for this kind of digital payment. Thanks to paperless e-commerce facilities, labor costs, delivery fees, and general documentation have decreased, changing the nature of online payments. It has been shown that this payment greatly improves the digital payment service's efficiency and provides extra benefits like improved customer satisfaction, fraud protection, and currency conversion, all of which are beneficial to the US e-commerce payment market overall.

The majority of American internet users now shop primarily through mobile devices. Our research indicates that mobile apps are the most popular platform for online grocery shopping, with almost 80 percent of users expected to make purchases through these apps in 2021. Additionally, the average value of online orders placed in the United States is higher on desktop computers than on mobile devices. Consequently, mobile commerce is quickly emerging as the channel of choice for customers to shop through, though daily usage of apps for online stores is becoming increasingly important year over year.

Growth Drivers in the United States E-Commerce Payment Market

Increased Adoption of Digital Payment Methods

The growing reliance on digital wallets, contactless payments, and mobile banking has significantly boosted the U.S. e-commerce payment market. Consumers prefer seamless, secure, and quick transactions, leading to greater adoption of platforms like PayPal, Apple Pay, and Google Pay. Businesses also integrate these payment options to enhance customer experience and drive sales. The rise of use of smartphones along with fintech innovations further complements the advancement from cash toward digital payments. In 2023, an estimated 71% of adult U.S. citizens used the service of PayPal, which emerges as the first digital wallet being used in the United States to date.

Availability of Buy Now, Pay Later (BNPL) Services

BNPL platforms, including Klarna, Afterpay, as well as Affirm, has been changing face of e-payment in the America. These services allow consumers to purchase goods and pay in installments without interest, making online shopping more attractive. Retailers benefit from increased conversion rates and higher average order values, while customers appreciate the financial flexibility. This trend is robust among younger consumers who prefer alternative credit options over traditional credit cards. April 2024, Walmart's fintech startup One is starting to offer buy now, pay later loans on big-ticket items like electronics and power tools in select U.S. stores.

E-commerce and Cross-Border Transactions Growth

The growth of online shopping has led to increased demand for safe and efficient payment solutions. The U.S. e-commerce market continues to grow due to advances in technology and globalization. Cross-border e-commerce transactions are also increasing and thus increasing the demand for multi-currency options, fraud protection, and smooth international payment processing for the payment service providers. Hence, security, speed, and transaction efficiency innovations are driven by the demand for optimized digital payment infrastructure. In September 2024, PayPal has expanded its partnership with Shopify to process credit and debit payments for Shopify Payments in the United States.

Challenges in the United States E-Commerce Payment Market

Rising Cybersecurity Threats and Fraud Risks

Due to the rise of digital transactions, the threat posed by cyber-attacks in terms of payment fraud, identity theft, and phishing attacks has seen a surge. Hackers continue to find ways to break financial data, hence putting consumers and businesses at risk. Advanced encryption and fraud detection technologies notwithstanding, e-commerce firms must continually fortify security standards to maintain consumer confidence and also meet the highly stringent regulatory compliance requirements such as PCI DSS and GDPR.

Regulatory and Compliance Issues

The U.S. e-commerce payment sector is strictly regulated by financial regulations and compliance requirements, including anti-money laundering (AML) laws and Know Your Customer (KYC) policies. With the increase in digital transactions, regulatory authorities keep introducing new rules to prevent fraud and financial crimes. E-commerce businesses and payment providers have to navigate through evolving legal frameworks, which can increase operational costs and create complexities in payment processing, especially for international transactions.

United States E-commerce Digital Wallet Payments Market

The digital wallet payment market has evolved the U.S. e-commerce payment landscape dramatically by providing customers with seamless, secure, and quick transactions. Market leaders for this platform are Apple Pay, Google Pay, and PayPal that enable consumers to store multiple options for payment under one roof. Increased smartphone penetration and contactless payments have really pushed the scale for digital wallet adoption. More importantly, biometric authentication and tokenization increase the security factor so that digital wallets are becoming increasingly popular among the online shoppers. In 2024, it launched Fastlane, a new one-click checkout feature for the US businesses to make the process of buying fast and easy.

United States Electronics & Media E-Commerce Payment Market

The electronics and media segment of the U.S. e-commerce payment market has seen a lot of growth, especially through online sales of gadgets, streaming services, and digital content. Consumers like to have flexible and secure payments such as credit cards, digital wallets, and BNPL services. High-ticket electronic items are also a driving force for financing options. Furthermore, subscription-based payments for digital media platforms like Netflix, Spotify, and Apple Music also help expand this market.

United States Fashion Accessories E-Commerce Payment Market

The U.S. fashion accessories e-commerce payment market is positively impacted by a rising demand for online shopping, influencer-led buying, and sales events that take place seasonally. The transactions are simplified with credit/debit cards, BNPL services, and digital wallets. Many retailers offer AI-powered checkout experiences and one-click payment solutions to increase the ease of purchase. In addition, loyalty programs and cashback offers drive repeated purchases, so flexible and secure payment solutions play a critical role in the growth of the sector.

California E-commerce Payment Market

California is an e-commerce transaction hub since many companies are highly related to a technologically driven economy and have high digital adoption. The e-commerce companies, fintech firms, and other tech giants in Silicon Valley are always driving payment innovations. There are digital wallets, cryptocurrency payments, and BNPL. The state has diverse consumers with substantial disposable income and cross-border trade; hence, it shows a dynamic e-commerce payment landscape. Cybersecurity remains the central focus area for businesses in this market.

New York E-Commerce Payment Market

New York’s e-commerce payment market thrives due to its large population, financial sector presence, and high consumer spending. The demand for fast, secure, and contactless transactions has accelerated the adoption of the digital wallet and BNPL. Additionally, the rise of online retail giants, fashion brands, and financial services platforms in the state further drives payment innovations. However, businesses must navigate complex financial regulations and cybersecurity challenges to maintain seamless customer payment experiences.

Florida E-Commerce Payment Industry

Over the past ten years, the Florida e-commerce payment market has grown remarkably because to changes in consumer behavior and technology improvements. Florida has a diverse population and is a popular destination for tourists, therefore there is a growing need for easy online payment options. Companies of all sizes, from start-ups to multinational corporations, have embraced digital payment methods quickly in response to the changing expectations of their clients, who want ease and security from their transactions.

Fintech firms, payment processors, and large financial institutions are some of the primary participants in Florida's e-commerce payment market. Businesses in the state are served by companies like PayPal, Square, and Stripe, which have made a name for themselves by offering a variety of payment options like digital wallets, integrated payment gateways, and mobile payments. This environment of competition fosters efficiency and innovation, which is advantageous to both customers and retailers.

Additionally, Florida's consumer protection laws and regulatory improvements have had a significant impact on the development of the e-commerce payment sector. The state's emphasis on guaranteeing dependable and safe payment systems promotes customer confidence and aids in the expansion of the digital economy. Florida's payment sector is well-positioned to adjust and prosper in this changing environment as e-commerce continues to develop.

United States E-Commerce Payment Company News

In June 2023, Amazon Pay and BNPL retailer Affirm announced their alliance. Through this agreement, small company owners who use Amazon Pay's online store can take advantage of buy-now-pay-later (BNPL) services.

In March 2023, Apple Inc. released Apple Pay. Subsequently, in the United States, purchases can be divided into four equal installments, spaced out over six weeks, with no fees or interest, all planned with the consumers' financial well-being in mind. With Apple Wallet, users can conveniently track, manage, and return their Apple Pay later loans all in one handy location.

United States E-Commerce Payment Market Segments

Type- Industry is divided into 8 viewpoints:

- Digital Wallet

- Credit Card

- Debit Card

- Account-to-Account (A2A)

- Buy now pay later (BNPL)

- Cash on Delivery (CoD)

- PrePay

- Others

Application- Industry is divided into 5 viewpoints:

- Electronics & Media

- Food & Personal Care

- Fashion Accessories

- Furniture & Appliances

- Others

States: Industry is divided into 11 States

- Florida

- Texas

- South Carolina

- North Carolina

- California

- Iowa

- New York

- Illinois

- Arizona

- Wisconsin

- Others

All companies have been covered with 5 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Product Portfolio

- Financial Insight

Company Analysis

- com Inc.

- American Express Company

- Apple Inc.

- Fiserv Inc.

- Mastercard Incorporated

- Paypal Holdings Inc.

- Visa Inc.

Report Details:

| Report Features | Details |

| Base Year |

2023 |

| Historical Period |

2019 - 2023 |

| Forecast Period |

2024 - 2032 |

| Market |

US$ Billion |

| Segment Covered | Type, Application and States |

| States Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the U.S. e-commerce payment market by 2032?

-

What is the expected CAGR of the U.S. e-commerce payment market from 2024 to 2032?

-

Which payment method was the most widely used digital wallet service in the U.S. in 2023?

-

How is the "Buy Now, Pay Later" (BNPL) service impacting the e-commerce payment industry?

-

What are the major challenges faced by the U.S. e-commerce payment market?

-

Which U.S. state is considered a hub for e-commerce transactions due to its tech-driven economy?

-

How do cybersecurity threats impact the e-commerce payment sector?

-

What role does mobile commerce play in the growth of e-commerce payments in the U.S.?

-

What are some of the key companies analyzed in the U.S. e-commerce payment market report?

-

How are cross-border transactions influencing the U.S. e-commerce payment market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States E-Commerce Payment Market

6. Market Share

6.1 Type

6.2 Application

6.3 States

7. Type

7.1 Digital Wallet

7.2 Credit Card

7.3 Debit Card

7.4 Account-to-Account (A2A)

7.5 Buy now pay later (BNPL)

7.6 Cash on Delivery (CoD)

7.7 PrePay

7.8 Others

8. Application

8.1 Electronics & Media

8.2 Food & Personal Care

8.3 Fashion Accessories

8.4 Furniture & Appliances

8.5 Others

9. States

9.1 Florida

9.2 Texas

9.3 South Carolina

9.4 North Carolina

9.5 California

9.6 Iowa

9.7 New York

9.8 Illinois

9.9 Arizona

9.10 Wisconsin

9.11 Others

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Amazon.com Inc.

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Product Portfolio

12.1.5 Financial Insight

12.2 American Express Company

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Product Portfolio

12.2.5 Financial Insight

12.3 Apple Inc.

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Product Portfolio

12.3.5 Financial Insight

12.4 Fiserv Inc.

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Product Portfolio

12.4.5 Financial Insight

12.5 Mastercard Incorporated

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Product Portfolio

12.5.5 Financial Insight

12.6 Paypal Holdings Inc.

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Product Portfolio

12.6.5 Financial Insight

12.7 Visa Inc.

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Product Portfolio

12.7.5 Financial Insight

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com