United States Endoscopy Devices Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Endoscopy Devices Market Trends & Summary

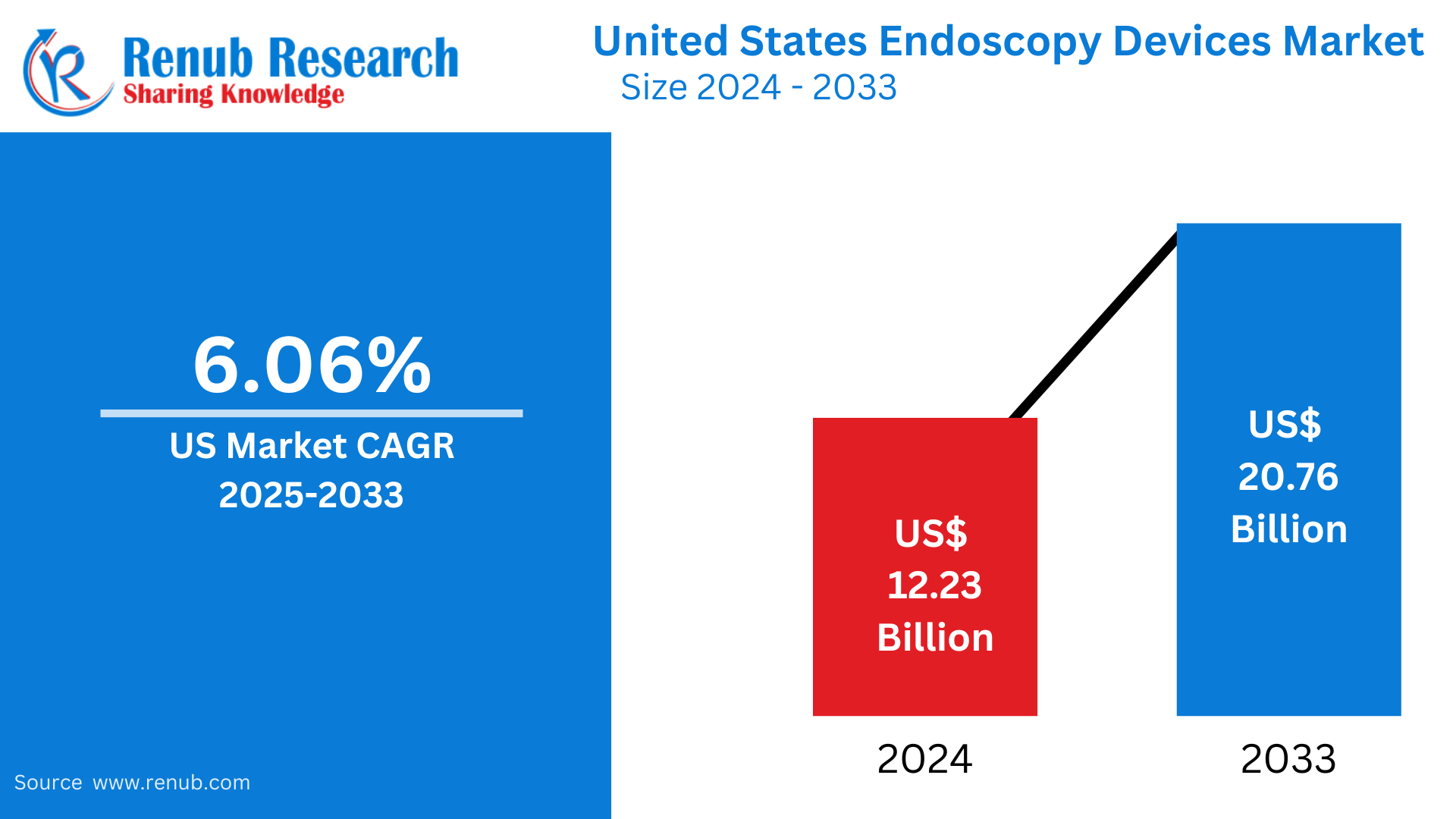

United States Endoscopy Devices market is expected to reach US$ 20.76 billion by 2033 from US$ 12.23 billion in 2024, with a CAGR of 6.06% from 2025 to 2033. Rapid developments in imaging technologies, the rise in chronic disease prevalence, the growing use of minimally invasive procedures, the expansion of outpatient care settings, and the increased need for disposable endoscopes to maintain patient safety and infection control are all contributing factors to the market's strong growth.

The report United States Endoscopy Devices Market & Forecast covers by Product Type (Endoscopes, Visualization & Documentation Systems, Mechanical Endoscopic Equipment, Accessories, Other Endoscopy Equipment), Application (Bronchoscopy, Arthroscopy, Laparoscopy, Urology endoscopy, Neuroendoscopy, Gastrointestinal endoscopy, Gynecology endoscopy, ENT endoscopy, Others), Hygiene (Single Use, Reprocessing, Sterilization), End-User (Hospitals, Ambulatory Surgery Centers, Others), States and Company Analysis 2025-2033.

United States Endoscopy Devices Industry Overview

The growing frequency of chronic diseases that require minimally invasive diagnostic and therapeutic treatments, including as neurological problems, colorectal cancer, and gastrointestinal disorders, is driving considerable growth in the US market. Continuous technical improvements in endoscopic equipment, such as 3D visualization, AI-assisted diagnostics, and high-definition imaging, are improving procedural accuracy and increasing provider usage. For example, UC Davis Health opened a cutting-edge endoscopy suite in January 2023 to improve patient care and increase diagnostic capacity. The need for sophisticated endoscopic treatments is also being fueled by the aging population, which is increasingly vulnerable to these illnesses. Because improved visualization capabilities not only improve diagnostic accuracy but also enable more effective therapeutic interventions, the integration of advanced imaging technology in endoscopy facilities is driving improved detection and treatment of gastrointestinal conditions in the United States, strengthening the market's growth trajectory.

The growing trend of moving from inpatient treatment and hospital outpatient departments to ASCs, where endoscopic procedures are routinely performed, is another factor propelling the market. The need for invasive surgical procedures with shorter recovery times and less suffering for patients is also rising due to improvements in healthcare facilities, which is propelling the market's expansion. The growing senior population and the increased prevalence of chronic diseases brought on by changing lifestyles are the main causes of the US's increased demand for endoscopic devices. Furthermore, 2021 CDC research states that 58.5 million persons in the US suffer from arthritis, making it the largest cause of disability. Similarly, by the end of 2023, there will likely be 24,810 new cases of spinal cord tumors or malignant brain in the US, according to data released by the Cancer Society America in January 2023.

Growth Drivers for the United States Endoscopy Devices Market

Growing Obesity and Bariatric Endoscopy Prevalence

The need for endoscopic tools used in bariatric surgeries is being driven by the rising obesity rates in the US. Endoscopic bariatric procedures, such as endoscopic sleeve gastroplasty and intragastric balloon implantations, are becoming more popular as less invasive weight-management methods. These methods fit with the growing need for non-surgical weight loss alternatives and are less dangerous than traditional surgical interventions. Endoscopic bariatric procedures are being used by medical professionals more frequently because of their positive results and quicker recovery periods. Further promoting the use of these procedures and propelling the market for endoscopic devices are increased awareness campaigns and increased insurance reimbursement for obesity-related therapies.

Growing Interest in Throwaway Endoscopes

The need for disposable endoscopes is growing as a result of the increased emphasis on infection control in healthcare. Disposable solutions are being actively supported by regulatory organizations, which is encouraging hospitals and clinics to use them. These gadgets are now more widely available due to improvements in production technology that allow for cost-effective manufacturing without compromising quality. Their ease of use and lower sterilizing requirements complement the growing focus on operational effectiveness in healthcare settings. NTT Corporation and Olympus Corporation began a collaborative demonstration of a cloud-based endoscopic system on March 27, 2024. In order to improve endoscopic performance and maintainability, this system makes use of Olympus' sophisticated endoscopic knowledge and NTT's fast, low-latency IOWN APN technology to enable real-time image processing on the cloud. Disposable endoscopes are becoming a popular option as healthcare professionals place a higher priority on patient safety and infection control. This is encouraging their incorporation into standard procedures and driving the expansion of the endoscopic equipment market in the United States.

AI Integration in Endoscopy Equipment

The United States market is expanding thanks to the use of artificial intelligence (AI) in endoscopic technology. The FDA authorized ANX Robotica's CapsuleX system on January 3, 2024. It is an AI-powered endoscopy tool that improves small bowel imaging and intends to increase the efficiency and accuracy of diagnostics in gastrointestinal treatment. Additionally, AI-powered endoscopic technologies enhance vision, lowering diagnostic mistakes and facilitating early gastrointestinal problem diagnosis. Due to patient preferences and clinical advantages, there is a growing need for minimally invasive procedures, which these developments support. Additionally, using AI encourages innovation in the creation of devices, drawing capital and broadening product offerings. The adoption of AI-enabled endoscopy solutions is speeding up as healthcare providers place a higher priority on accuracy and efficiency, which is driving the expansion of the endoscopic equipment market in the United States.

Challenges in the United States Endoscopy Devices Market

Competition and Market Saturation

Companies like Olympus, Medtronic, and Stryker are among the well-known firms that dominate the fiercely competitive US market for endoscopic devices. It is difficult for smaller businesses to succeed because of these big organizations' substantial resources, wide distribution networks, and well-known brands. When competing on price, quality, or cutting-edge technology, smaller companies frequently find it difficult to set their products apart from the competition. For these businesses to create specialized technologies that meet certain needs or carve out niche markets, innovation is essential. Regulatory obstacles and hefty R&D expenses, however, may make it more difficult for them to effectively compete. Smaller businesses may therefore find it challenging to achieve sustainable growth or acquire a sizable market share in this crowded sector.

Regular Maintenance and Reprocessing

For best results and patient safety, endoscopic devices—especially reusable ones—need to be maintained and sterilized on a regular basis. For healthcare providers, cleaning, disinfecting, and reprocessing these equipments is an expensive and time-consuming procedure. Infections, device failures, or cross-contamination brought on by improper reprocessing can have a serious negative influence on patient outcomes and result in legal ramifications. Operational costs are further increased by the need for specialized equipment and skilled workers to maintain the high standards of reprocessing and sterilizing. One major obstacle in the endoscopy industry is that healthcare facilities, particularly smaller ones, may find it difficult to afford the resources needed for appropriate maintenance. Some hospitals and clinics use single-use gadgets because of these worries, which can raise overall healthcare expenses even though they are more convenient.

Endoscopes are key devices for diagnostic and therapeutic procedures in the U.S.

Endoscopes represent one of the foremost product types in the United States endoscopy device market. This is due to their versatility and widespread application across clinical specialties. These devices enable minimally invasive visualization and intervention in various body cavities, which include the gastrointestinal tract, respiration system, and urinary tract. With non-stop technological improvements, endoscopes offer high-definition imaging, healing abilities, and more suitable maneuverability, making them indispensable for analysis and treatment. Their pivotal function in present-day healthcare drives sizable demand, cementing endoscopes as essential U.S. endoscopy device market additives.

Gastrointestinal endoscopy is widely used for diagnostics and treatment in the U.S.

Gastrointestinal endoscopy has emerged as one of the most utilized applications in the United States endoscopy device market. With millions of processes conducted yearly, it is a cornerstone in diagnosing and treating digestive disorders like ulcers, polyps, and cancers. Endoscopic techniques provide unprecedented visualization and healing skills in the gastrointestinal tract, facilitating minimally invasive interventions and enhancing patient outcomes. As the need for particular diagnostic and healing processes continues to push upward, gastrointestinal endoscopy remains a primary cognizance, driving the increase in the U.S. endoscopy device market.

Single-use endoscopy devices are a growing segment in the U.S. market

Single-use endoscopy devices are one of the considerable sections in the United States market. This is because of their inherent benefits in infection control, convenience, and cost-effectiveness. With a heightened emphasis on patient protection and lowering healthcare-associated infections, single-use devices provide a sterile, disposable alternative to conventional reusable systems. This eliminates the need for reprocessing, reducing the hazard of cross-contamination and streamlining workflow. Also, the cost efficiencies related to single-use devices attract healthcare centers looking to optimize operational efficiency while maintaining excessive care requirements.

Hospitals are key sectors driving growth in the U.S. endoscopy market

Hospitals constitute one of the dominant segments in the United States endoscopy device market. This is attributed to their excessive patient magnitude and numerous medical specialties. Hospitals are primary customers of endoscopy devices. Endoscopic procedures, including gastroenterology, pulmonology, and urology, are routinely done throughout departments. The need for a superior endoscopic system to cater to varied clinical wishes solidifies hospitals' importance in the market.

United States Endoscopy Devices by States

By state, the United States endoscopy device market is divided into California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, North Carolina, Massachusetts, Virginia, Michigan, Maryland, Colorado, Tennessee, Indiana, Arizona, Minnesota, Wisconsin, Missouri, Connecticut, South Carolina, Oregon, Louisiana, Alabama, Kentucky, and the Rest of United States. California stands out as one of the most prevalent states in the United States endoscopy device market.

California Endoscopy Devices Market

Driven by the increasing need for minimally invasive procedures, the California endoscopic equipment market represents a sizeable portion of the healthcare sector. As technology advances, endoscopic equipment such as surgical scopes, video endoscopes, and therapeutic tools are being used more and more for diagnosis and treatment in a variety of specialties, such as urology, gastroenterology, and pulmonology. California's aging population, extensive healthcare system, and research facilities all support the market's growth. The expanding need for outpatient procedures, the incidence of chronic diseases, and developments in robotics and imaging technologies are some of the main motivators. A strong regulatory framework supports the market and encourages innovation. California continues to dominate the global market for endoscopic devices as a center for medical technology.

Texas Endoscopy Devices Market

The market for endoscopy equipment in Texas is expanding rapidly due to improvements in minimally invasive treatments and growing healthcare demands. In urology, gastroenterology, pulmonology, and other disciplines, endoscopy equipment is frequently utilized for diagnosis and treatment. Texas is a major market for endoscopic equipment because of its sizable population and developing healthcare system. The need for diagnostic and therapeutic endoscopic equipment is fueled by the rising incidence of chronic illnesses like cancer, respiratory conditions, and gastrointestinal disorders. Furthermore, technology advancements like robotically assisted surgery, high-definition imaging, and less invasive procedures are improving patient outcomes and driving market expansion. Texas is a key location for suppliers and manufacturers of endoscopic devices because of its robust healthcare industry and medical research facilities.

New York Endoscopy Devices Market

Due to the state's sophisticated medical infrastructure and sizable population, the market for endoscopic devices in New York is one of the largest in the US healthcare sector. The need for diagnostic and therapeutic endoscopic operations is significant in New York's healthcare industry, especially in specialties like cancer, pulmonology, and gastroenterology. With a large number of hospitals and medical research institutes, the state's concentration on healthcare innovation benefits the market. Technological innovations including 3D endoscopy, robotic-assisted systems, and high-definition imaging are boosting patient outcomes and procedure efficacy. New York is a major player in the U.S. market for endoscopic equipment because of the aging population and rising incidence of chronic diseases, which further fuel demand for minimally invasive therapies.

Florida Endoscopy Devices Market

The market for endoscopic equipment in Florida is rising quickly due to the state's sizable and diversified population as well as the growing healthcare industry. Florida is a major market for endoscopic devices because to the strong need for minimally invasive procedures in disciplines including urology, pulmonology, and gastroenterology. The need for diagnostic and therapeutic endoscopic treatments is greatly increased by the aging population, which is more vulnerable to chronic ailments like cancer, respiratory problems, and gastrointestinal diseases. Further improving patient outcomes are technological advancements like robotic-assisted endoscopy, 4K video systems, and high-definition imaging. The development and uptake of cutting-edge endoscopic technologies are facilitated by Florida's renowned medical centers, research institutes, and healthcare networks. Florida is therefore very important to the U.S. market for endoscopic devices.

Product Type – Market breakup in 5 viewpoints:

1. Endoscopes

2. Visualization & Documentation Systems

3. Mechanical Endoscopic Equipment

4. Accessories

5. Other Endoscopy Equipment

Application – Market breakup in 9 viewpoints:

1. Bronchoscopy

2. Arthroscopy

3. Laparoscopy

4. Urology endoscopy

5. Neuroendoscopy

6. Gastrointestinal endoscopy

7. Gynecology endoscopy

8. ENT endoscopy

9. Others

Hygiene – Market breakup in 3 viewpoints:

1. Single Use

2. Reprocessing

3. Sterilization

End-User – Market breakup in 3 viewpoints:

1. Hospitals

2. Ambulatory Surgery Centers

3. Others

States – Market breakup in 29 viewpoints:

1. California

2. Texas

3. New York

4. Florida

5. Illinois

6. Pennsylvania

7. Ohio

8. Georgia

9. New Jersey

10. Washington

11. North Carolina

12. Massachusetts

13. Virginia

14. Michigan

15. Maryland

16. Colorado

17. Tennessee

18. Indiana

19. Arizona

20. Minnesota

21. Wisconsin

22. Missouri

23. Connecticut

24. South Carolina

25. Oregon

26. Louisiana

27. Alabama

28. Kentucky

29. the Rest of United States

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Johnson & Johnson

2. Stryker

3. Boston Scientific

4. CONMED

5. Medtronic Plc

6. Fujifilm Holdings

7. Smith and Nephew

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Application, Hygiene, End User and States |

| States Covered | 1. California 2. Texas 3. New York 4. Florida 5. Illinois 6. Pennsylvania 7. Ohio 8. Georgia 9. New Jersey 10. Washington 11. North Carolina 12. Massachusetts 13. Virginia 14. Michigan 15. Maryland 16. Colorado 17. Tennessee 18. Indiana 19. Arizona 20. Minnesota 21. Wisconsin 22. Missouri 23. Connecticut 24. South Carolina 25. Oregon 26. Louisiana 27. Alabama 28. Kentucky 29. the Rest of United States |

| Companies Covered | 1. Johnson & Johnson 2. Stryker 3. Boston Scientific 4. CONMED 5. Medtronic Plc 6. Fujifilm Holdings 7. Smith and Nephew |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the expected market size of the United States Endoscopy Devices market in 2033?

-

What is the compound annual growth rate (CAGR) of the market from 2025 to 2033?

-

What are the key factors driving the growth of the United States Endoscopy Devices market?

-

Which product type dominates the United States Endoscopy Devices market?

-

What role does AI integration play in the growth of the endoscopy devices market in the U.S.?

-

Which state holds the largest market share in the United States Endoscopy Devices market?

-

How does the aging population contribute to the demand for endoscopy devices in the U.S.?

-

What is the impact of single-use endoscopy devices on the market?

-

How do advancements in imaging technologies like 3D visualization affect the market?

-

What are the challenges faced by smaller companies in the competitive endoscopy devices market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Endoscopy Device Market

6. Market Share

6.1 By Product Type

6.2 By Application

6.3 By Hygiene

6.4 By End Users

6.5 By States

7. Product Type

7.1 Endoscopes

7.2 Visualization & Documentation Systems

7.3 Mechanical Endoscopic Equipment

7.4 Accessories

7.5 Other Endoscopy Equipment

8. Application

8.1 Bronchoscopy

8.2 Arthroscopy

8.3 Laparoscopy

8.4 Urology endoscopy

8.5 Neuroendoscopy

8.6 Gastrointestinal endoscopy

8.7 Gynecology endoscopy

8.8 ENT endoscopy

8.9 Others

9. Hygiene

9.1 Single Use

9.2 Reprocessing

9.3 Sterilization

10. End Users

10.1 Hospitals

10.2 Ambulatory Surgery Centers

10.3 Others

11. States

11.1 California

11.2 Texas

11.3 New York

11.4 Florida

11.5 Illinois

11.6 Pennsylvania

11.7 Ohio

11.8 Georgia

11.9 New Jersey

11.10 Washington

11.11 North Carolina

11.12 Massachusetts

11.13 Virginia

11.14 Michigan

11.15 Maryland

11.16 Colorado

11.17 Tennessee

11.18 Indiana

11.19 Arizona

11.20 Minnesota

11.21 Wisconsin

11.22 Missouri

11.23 Connecticut

11.24 South Carolina

11.25 Oregon

11.26 Louisiana

11.27 Alabama

11.28 Kentucky

11.29 Rest of United States

12. Porter’s Five Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Company Analysis

14.1 Johnson & Johnson

14.1.1 Overview

14.1.2 Recent Development

14.1.3 Revenue

14.2 Stryker

14.2.1 Overview

14.2.2 Recent Development

14.2.3 Revenue

14.3 Boston Scientific

14.3.1 Overview

14.3.2 Recent Development

14.3.3 Revenue

14.4 CONMED

14.4.1 Overview

14.4.2 Recent Development

14.4.3 Revenue

14.5 Medtronic Plc

14.5.1 Overview

14.5.2 Recent Development

14.5.3 Revenue

14.6 Fujifilm Holdings.

14.6.1 Overview

14.6.2 Recent Development

14.6.3 Revenue

14.7 Smith and Nephew

14.7.1 Overview

14.7.2 Recent Development

14.7.3 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com