United States Energy Drink Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Energy Drink Market Trends & Summary

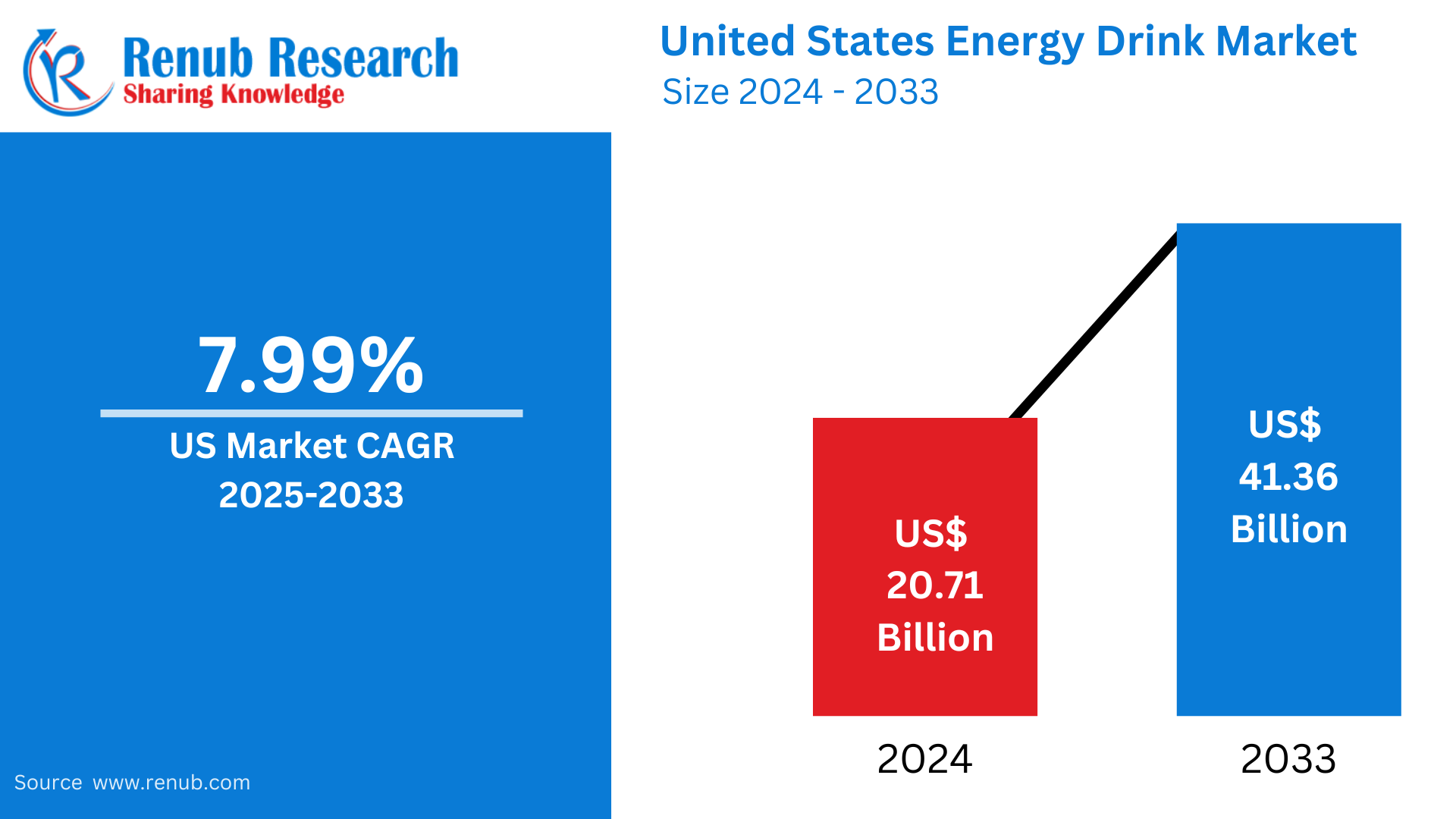

The United States energy drinks market is estimated to grow from US$ 20.71 billion in 2024 to US$ 41.36 billion by 2033, at a CAGR of 7.99% from 2025 to 2033. This growth is influenced by the increasing demand for energy-boosting beverages among young adults, athletes, and professionals. Innovations in flavors, sugar-free options, and functional ingredients contribute to market expansion as energy drinks gain popularity for physical and mental performance enhancement.

The report United States Energy Drink Market & Forecast covers by Type (Alcoholic and Non-Alcoholic), Product (Non-Organic, Organic, and Natural), Packaging (Plastic, Glass, Metal, and Others), End-User (Kids, Adults, and Teenagers), Gender (Women and Men), Distribution channel (Convenience Stores, Foodservice, Mass Merchandisers, Supermarkets), Company Analysis 2025-2033.

United States Energy Drink Market Outlooks

Energy drinks are functional beverages aimed at providing improved physical and mental performance, that increase energy, alertness, and concentration. They normally consist of caffeine, sugar, amino acids, vitamins, and other stimulants such as taurine and guarana. All these ingredients help to counteract fatigue, improve concentration, and enhance athletic performance.

Over the past decade, there has been significant consumption of energy drinks in the USA among young adults, athletes, and others with demanding lifestyles. Consumers want a quick boost to energy and performance levels while undertaking physical and mental activities. Many consumers rely on these energy drinks, including college students and professionals, for their long hours of work or study sessions. Although the drinks have been popular, energy drinks are facing several health-related issues. Energy drinks that contain high caffeine and sugar can cause such effects like jitteriness, rapid heartbeat, and difficulty in sleep. Thereby, this issue has also gained more consciousness among consumers and has brought more regulations for energy drink ingredients in the USA.

Growth Driver in the United States Energy Drink Market

Increasing Demand for Convenient Energy Solutions

The increasing demand for convenient energy-boosting beverages is a key driver in the U.S. energy drink market. Due to busy lifestyles, consumers are on the lookout for quick, easy ways to combat fatigue and improve alertness. Energy drinks are an accessible solution, particularly for young professionals, students, and athletes who require sustained energy throughout the day. The portability of energy drinks and their availability in various sizes and flavors make them an ideal choice for on-the-go consumption, further fueling the market's expansion in the U.S. August 2024, 7-Eleven, Inc., the largest convenience retailer in the world, has launched new beverages: 7-Select Fusion Energy, an energy drink, and 7-Select Rehydrate, a premium hydration option. Both are designed for customers on the go and are now available at 7-Eleven®, Speedway®, and Stripes® stores nationwide.

Growing Popularity Among Health-Conscious Consumers

Another key driver is the growing demand for functional beverages. Consumers in the U.S. are becoming more health-conscious and looking for energy drinks that provide additional health benefits. In response, energy drink manufacturers are launching products with less sugar, added vitamins, electrolytes, and natural ingredients. These healthier options appeal to fitness enthusiasts, athletes, and individuals looking for better performance and well-being. This trend towards healthier and more functional options is driving the energy drinks market. In Sept 2024, GURU Organic Energy Corp announced that it would be launching its Zero Sugar line in the US on Amazon, Life Time, and at select retailers.

Innovations in Product Offerings and Marketing

Continuous innovation in product offerings, ranging from new flavors to sugar-free varieties and plant-based or natural energy drinks, are other factors that contribute to market growth. Companies are expanding their products to meet niche markets through organic, low-calorie, or performance-enhancing energy drinks. Marketing strategies that are being effective for the brands as they target the younger audiences, mainly through social media influencers and sports sponsorships, have increased brand and consumer engagement. This creative approach in both product development and marketing is increasing the market reach of energy drinks in the U.S. Oct 2024, Nutrabolt, owner of C4, the leading global pre-workout brand and a rapidly growing energy drink brand, will unveil new products and entertain entrepreneur and comedian Kevin Hart at the NACS Show in Las Vegas.

Problems in the United States Energy Drink Market

Health and Regulatory Issues

One of the critical issues in the U.S. energy drink market is growing health concerns over the high level of caffeine, sugar, and other stimulants in such beverages. Overconsumption has been associated with side effects such as heart palpitations, insomnia, and jitteriness. These side effects are a significant concern for vulnerable consumers such as adolescents. Increasing health concerns have led to growing scrutiny from health organizations and regulatory bodies. There are also demands for greater regulation, including age limits and clearer labeling, which may influence sales and push companies to reformulate their products in line with new standards.

Market Saturation and Intense Competition

The U.S. energy drink market is highly competitive and saturated, with many brands competing for consumer attention. This intense competition has made it hard for companies to differentiate themselves and maintain their market share. Established brands are compelled to innovate constantly, while new entrants find it hard to establish a base. Price wars, heavy promotional activities, and discounting practices have reduced the profit margins, making it hard for businesses to sustain their growth in such a competitive rivalry.

United States Non-alcoholic energy drinks market

The market for non-alcoholic energy drinks is expected to grow the fastest in the market. This is due to several factors, such as the rising popularity of energy drinks made from herbal extracts and taurine amino acids. In addition, major companies are launching wide-ranging advertisements to attract consumers. Another factor driving the growth of the energy drinks market in the United States is that investments by major players to develop innovative flavors for non-alcoholic energy drinks are on the rise.

United States Organic Drinks Energy Market

The organic energy drink market is likely to increase significantly over the next several years. As people continue to grow increasingly health-conscious, they seek organic choices as alternatives to conventional energy drinks because of the increased concerns in consuming heavily processed ingredients and the health risk that might result from pesticides and antibiotics. A highly significant shift in consumer behavior is driving up the demand for organic energy drinks because it reflects the general tendency toward healthier lifestyle choices with more natural choices. The appeal of these products lies not only in their clean ingredient profile but also in a promise for more sustainable, ethical production practices, pushing them up the ranks to dominate this competitive beverage space.

United States Cans Energy Drink Market

The cans segment is going to continue holding its number one position across the United States energy drinks market. As consumers become more discerning about their beverage choices, there is a noticeable trend toward energy drinks over alternatives such as canned wine and other alcoholic options. This trend is especially prevalent among younger consumers who prefer metal cans for their portability and durability, preferring them over fragile glass containers that can easily shatter. Along with the convenience aspect, many consumers are now interested in functional energy drinks- products that can boost energy levels with added benefits such as vitamins or electrolytes. These innovative beverages have been increasingly sold in cans. With the rising demand, manufacturers are very eager to penetrate this market segment. New products in convenient and attractive can formats are launched to attract and satisfy consumers' changing tastes.

United States Adult Energy Drink Market

The adult segment is likely to dominate the energy drinks market during the forecast period.

A growing working population and lifestyle habit changes primarily drive this trend. More adult consumers are looking to sustain a sharp mind and improve performance while exercising, which contributes to the growth of energy drink consumption. On the contrary, the teenager segment is expected to have a relatively high compound annual growth rate. This is because celebrities and other social media influencers are marketing them extensively, and healthy organic and zero-sugar energy drinks are also recently introduced in the market for women United States Energy Drink Market

The women's segment of energy drinks market in the United States is very high.

The market for sales of energy drinks has typically been very much male-young consumer based, although this trend is changing. In recent years, sales increases have often reached triple-digit levels, and are largely the result of growing numbers of women entering the energy drink category. With this trend, new fitness energy brands are strategically innovating and marketing their products to avoid conventional practices, such as using high-sugar formulations and standard advertising methods. USA Supermarket Energy Drink Market

The supermarket segment dominates, capturing the largest share due to several compelling factors.

One significant driver is the growing demand for energy and sports drinks free from artificial sweeteners, reflecting a broader trend towards healthier beverage options. Major players in the industry are increasing their investments, which further enhances this segment's dominance. The huge range of flavors available in supermarkets, along with a feeling of reliability and trust that consumers have towards these retail houses, is playing a vital role in propelling the growth of the energy drinks market in the United States. Key Players

The major companies that make up the US energy drink market include Red Bull, Monster Beverage Corporation, PepsiCo, National Beverage Corp, Suntory Holdings Limited, The Coca-Cola Company, Campbell Soup Co., and Amway Corporation.

GHOST energy drinks were widely accepted since their launch. In 2024, it launched a series of products, such as Beyond Berry, FAZE UP, and GHOST HYDRATION. FAZE UP was launched in collaboration with FaZe Clan, a North American esports organization.

Rockstar in January 2024 released an added energy drink, which will enhance its current lineup, dubbed Rockstar Focus, providing consumers with a mental and energy boost to improve their focus.

Type – Market breakup in 2 viewpoints:

1. Alcoholic

2. Non-Alcoholic

Product – Market breakup in 3 viewpoints:

1. Non-Organic

2. Organic

3. Natural

Packaging – Market breakup in 4 viewpoints:

1. Plastic

2. Glass

3. Metal

4. Others

End-User – Market breakup in 3 viewpoints:

1. Kids

2. Adults

3. Teenagers

Gender – Market breakup in 2 viewpoints:

1. Men

2. Women

Distribution Channel – Market breakup in 5 viewpoints:

1. Convenience Stores

2. Foodservice

3. Mass Merchandisers

4. Supermarkets

5. Others

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Red Bull

2. Monster Beverage Corporation

3. PepsiCo

4. National Beverage Corp

5. Suntory Holdings Limited

6. The Coca-Cola Company

7. Campbell Soup Co.

8. Amway Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Product, Packaging, End-User, Gender, and Distribution Channel |

| Distribution Channel Covered | 1. Convenience Stores 2. Foodservice 3. Mass Merchandisers 4. Supermarkets 5. Others |

| Companies Covered | 1. Red Bull 2. Monster Beverage Corporation 3. PepsiCo 4. National Beverage Corp 5. Suntory Holdings Limited 6. The Coca-Cola Company 7. Campbell Soup Co. 8. Amway Corporation |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the U.S. energy drink market in 2033?

-

What is the estimated Compound Annual Growth Rate (CAGR) for the market from 2025 to 2033?

-

Which demographic groups are driving the growth in energy drink consumption in the U.S.?

-

What are the main ingredients typically found in energy drinks?

-

What are some key health concerns associated with energy drink consumption?

-

How is consumer demand for healthier energy drinks impacting market trends?

-

What is the market share of non-alcoholic energy drinks in the U.S. energy drink market?

-

Which packaging formats are most popular for energy drinks in the U.S. market?

-

What innovations have companies made in energy drink product offerings?

-

Which companies are the leading players in the U.S. energy drink market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Energy Drink Market

6. Market Share

6.1 By Type

6.2 By Product

6.3 By Packaging

6.4 End User

6.5 By Gender

6.6 By Distribution Channel

7. Type

7.1 Alcoholic

7.2 Non-Alcoholic

8. Product

8.1 Non Organic

8.2 Organic

8.3 Natural

9. Packaging

9.1 Plastic

9.2 Glass

9.3 Metal

9.4 Others

10. End User

10.1 Kids

10.2 Adults

10.3 Teenagers

11. Gender

11.1 Women

11.2 Man

12. Distribution Channel

12.1 Convenience Stores

12.2 Foodservice

12.3 Mass Merchandisers

12.4 Supermarket

12.5 Others

13. Porter’s Five Forces Analysis

13.1 Bargaining Power of Buyers

13.2 Bargaining Power of Suppliers

13.3 Degree of Rivalry

13.4 Threat of New Entrants

13.5 Threat of Substitutes

14. SWOT Analysis

14.1 Strength

14.2 Weakness

14.3 Opportunity

14.4 Threat

15. Key Players Analysis

15.1 Red Bull

15.1.1 Overview

15.1.2 Recent Development

15.1.3 Revenue Analysis

15.2 Monster Beverage Corporation

15.2.1 Overview

15.2.2 Recent Development

15.2.3 Revenue Analysis

15.3 PepsiCo

15.3.1 Overview

15.3.2 Recent Development

15.3.3 Revenue Analysis

15.4 National Beverage Corp

15.4.1 Overview

15.4.2 Recent Development

15.4.3 Revenue Analysis

15.5 Suntory Holdings Limited

15.5.1 Overview

15.5.2 Recent Development

15.5.3 Revenue Analysis

15.6 The Coca-Cola Company

15.6.1 Overview

15.6.2 Recent Development

15.6.3 Revenue Analysis

15.7 Campbell Soup Co.

15.7.1 Overview

15.7.2 Recent Development

15.7.3 Revenue Analysis

15.8 Amway Corporation

15.8.1 Overview

15.8.2 Recent Development

15.8.3 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com