United States Fast Food and Quick Services Restaurants Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Fast Food & Quick Service Restaurant Market Trends & Summary

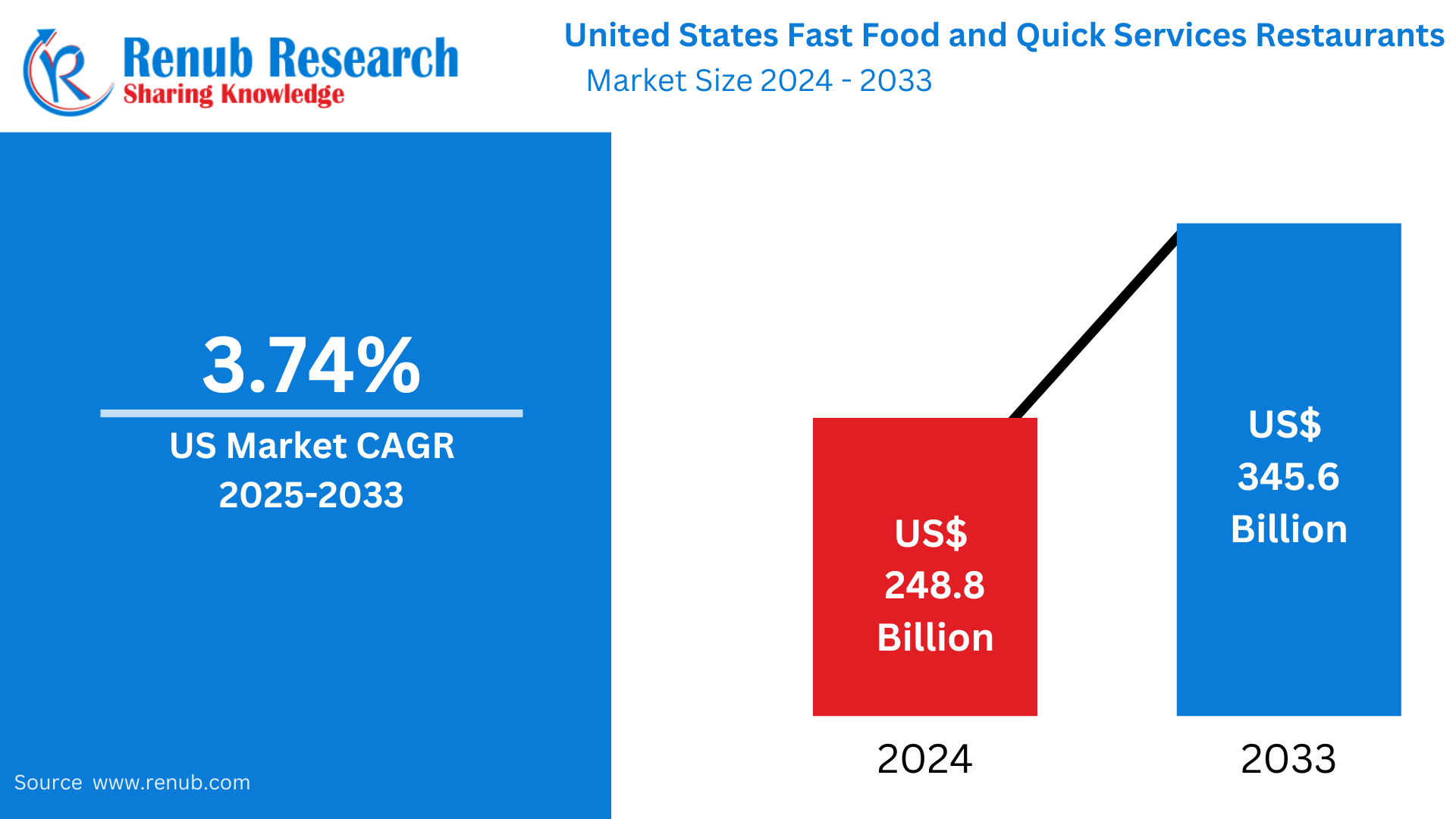

The United States Fast Food & Quick Service Restaurant Market size was valued at US$ 248.8 billion in 2024 and is anticipated to rise at a CAGR of 3.74% from 2025 to 2033 and reach US$ 345.6 billion by 2033. The market is influenced by evolving consumer lifestyles, the growth of digital ordering, and consumer demand for convenient and affordable dining. Growing menu innovation and healthy fast food further drive the growth of the market.

The report United States Fast Food & Quick Service Restaurant Market Forecast covers by Product (Hamburgers, Sandwich, Pizza, Mexican, Others), Region (East, West, North, South), Company Analysis 2025-2033.

United States Fast Food & Quick Service Restaurant Market Outlooks

Fast food and quick service restaurants (QSRs) are restaurants that serve food quickly, frequently with little or no table service and emphasis on convenience. Standardized menus, low prices, and speedy service at the drive-thru windows, through kiosks, and mobile ordering are typical. Burgers, fries, pizza, fried chicken, and sandwiches are well-known fast foods that appeal to a range of consumer tastes.

In the United States, QSRs and fast food have become the leading segment of the food sector because of time-strapped lives, urbanization, and the urgency of instant meal options. Large chains like McDonald's, Subway, and Taco Bell keep growing, while new brands focus on healthy choices and vegetable-based offerings. Advances in technology through mobile applications and delivery have driven market growth further. The demand for fast food is still strong because it is affordable, convenient, and offers a wide variety of menu items, which is why it is the go-to option for millions of Americans every day.

Growth Drivers in the United States Fast Food & Quick Service Restaurants Market

Growing Demand for Convenience and On-the-Go Eating

The busy lifestyle of American consumers has driven the need for quick and convenient meals. With increased work hours, hectic lifestyles, and a desire for little meal preparation, fast food and quick service restaurants (QSRs) offer the perfect solution. Drive-thrus, mobile ordering, and third-party delivery options like DoorDash and Uber Eats have further increased convenience, enabling customers to indulge in fast food without waiting for long periods of time. The increasing popularity of contactless payment methods and digital menus has also enhanced service efficiency, making QSRs a go-to option for millions of consumers. Perkins American Food Co. introduced "Perkins Griddle Go," a fast-casual concept for quick on-the-go meals, in 2024, with the first store opening in late October.

Expansion of Healthier Menu Options

With health-conscious food trends on the upswing, fast food and QSR chains are expanding their menus to offer healthier options. Customers demand plant-based options, low-calorie foods, and organic products, leading big brands such as McDonald's, Burger King, and Subway to add salads, grilled foods, and meat alternatives. The need for nutritional transparency has also led fast-food chains to list calorie counts and offer personalized meal options. This transition towards healthier options has benefited QSRs in bringing a wider base of customers, such as those with a focus on nutrition and dietary needs. June 2024 – During the National Rural Grocer's Summit, the U.S. Agriculture Secretary made a new initiative announcement under the Healthy Food Financing Initiative (HFFI) to enhance access to healthy foods for underserved populations. The Food Access and Retail Expansion Fund (FARE Fund) is paid for by the American Rescue Plan Act.

Technological Advances and Digital Ordering

Integrating technology into fast food and QSRs has greatly enhanced customer experience and operational efficiency. Mobile applications, automated self-service kiosks, and AI-driven ordering allow for faster service and tailored promotions. Chains such as Starbucks and Chick-fil-A have used loyalty schemes and mobile payments to improve customer loyalty. The emergence of AI-driven inventory management and food preparation automation is cutting operational expenses and wait times. Moreover, virtual brands and ghost kitchens for online orders are reshaping the fast food industry, allowing restaurants to cope with increasing demand for delivery services. Feb 2024, My Place Hotels of America has collaborated with Grubhub to enhance guest experience through online food ordering and delivery. Customers can also scan QR codes to go directly into the Grubhub marketplace, which streamlines location and drop-off information at checkout.

United States Fast Food & Quick Service Restaurants Market Challenges

Higher Food and Labor Costs

One of the largest challenges for the fast food and QSR sector is the rising cost of ingredients and labor. Inflation, supply chain issues, and increased wages due to staffing shortages have driven up operational costs. Most restaurants have increased menu prices to cover expenses, which can affect customer spending behavior. Also, keeping employees in a high-turnover business continues to be difficult, with QSRs requiring competitive wages and benefits to secure employees. Increased costs of sustainable packaging and adherence to government regulations contribute to financial burdens.

Increasing Competition and Market Saturation

The U.S. fast food and QSR industry is intensely competitive, with regional and national brands vying for customer loyalty. Established behemoths like McDonald's and Wendy's are increasingly being challenged by new fast-casual names like Shake Shack and Chipotle, which provide high-quality ingredients and more flexible dining options. Moreover, independent fast food restaurants and international chains expanding into the market drive competition. As consumer preferences evolve, QSRs must constantly innovate their menus, marketing strategies, and customer service models to maintain market share.

-

United States Fast Food & Quick Service Restaurants Hamburgers Market

The hamburger category continues to be the backbone of America's fast food market, dominated by large chains such as McDonald's, Burger King, and Wendy's. Demand for high-end-style burgers with upscale ingredients has also picked up, and chains such as Five Guys and Shake Shack continue to grow in presence. Shoppers look for fresh, quality meat, vegetables, and vegan alternatives, along with customizable toppings. Introducing new products such as the Impossible Burger and Beyond Meat patties has also increased the segment's popularity among health-aware and vegetarian customers. Hamburgers, despite increased competition, continue to be a fast food staple in American culture.

United States Fast Food & Quick Service Restaurants Pizza Market

The pizza segment continues to hold its own, with market leaders such as Domino's, Pizza Hut, and Papa John's controlling the market. Quick-service pizza places provide speedy delivery, carryout, and dine-in, making them accessible to consumers. Expansion facilitated by the presence of third-party delivery companies has further promoted accessibility to pizza chains. Customization through build-your-own pizzas and healthier crusts like cauliflower and gluten-free crusts has helped the segment expand. Also, take-and-bake and frozen pizza products have become more popular, enabling QSRs to appeal to consumers looking for easy at-home meal options.

United States Fast Food & Quick Service Mexican Restaurants Market

Mexican fast food has been rapidly gaining momentum in the United States, thanks to the popularity of tacos, burritos, and nachos. Large QSR brands like Taco Bell, Chipotle, and Qdoba are market leaders with a combination of classic and innovative menu offerings. Customers are attracted to Mexican fast food restaurants by fresh ingredients, strong flavors, and flexible meals. The increased demand for plant-based and protein-based foods like sofritas and grilled meats has also driven market growth. With a high Hispanic cultural influence and growing demand for international food, the segment keeps growing.

East United States Fast Food & Quick Service Restaurants Market

The Eastern U.S. has some of the nation's largest cities, such as New York, Washington, D.C., and Boston, where fast food and QSRs are popular because of high population density. The landscape is dominated by a blend of international fast-food chains and regional brands appealing to varied consumer tastes. Increased adoption of digital ordering and delivery has further increased the consumption of fast food in cities. Furthermore, the demand for healthier alternatives is on the rise, which has led QSRs in the region to bring more organic and plant-based items to address changing dietary patterns. The National Restaurant Association says that the Far West, encompassing California (83,501 restaurants) and Washington (16,379 restaurants), contains a high population of restaurants, and it is this that fuels online meal delivery. In 2022, Uber Eats partnered with 825,000 restaurants, as per corporate reports, improving online delivery services within the US.

West United States Fast Food & Quick Service Restaurants Market

Western U.S. boasts a strong fast food culture, with California as the origin of legendary chains In-N-Out Burger and Jack in the Box. The health- and eco-conscious culture of the region has fueled demand for fast food that is organic, locally grown, and plant-based. Los Angeles and San Francisco host trendy QSR concepts that address vegetarian, vegan, and green consumers. Furthermore, the technology-based market of the West Coast has resulted in fast acceptance of digital ordering systems, mobile payment, and automation in fast food businesses.

North United States Fast Food & Quick Service Restaurants Market

Seasonal dietary habits and multiculturalist consumer preferences influence the Northern U.S. market. Since the climate is colder, fast food outlets in the region tend to serve warm, heavy foods like burgers, soups, and sandwiches. Regional chains and fast-casual models such as Culver's and Tim Hortons have emerged in popularity as well as old-style fast-food brands. Coffee-based QSRs such as Dunkin' and Starbucks also feature prominently, being highly in demand in the region. Ghost kitchens and delivery services have also found favor among urban centers of the North for coping with rising demand for speedy and convenient meal consumption.

South United States Fast Food & Quick Service Restaurants Market

The South U.S. has a rich heritage of fast food, where fried chicken, barbecue, and biscuits are all-important in local cuisine. Chain QSRs such as Chick-fil-A, Popeyes, and Bojangles control the market. The population increase in the South, especially in states such as Texas and Florida, has accelerated the growth of fast food chains. Southern customers love strong flavors and comfort foods, which creates the demand for indulgent items on the menu. Concurrently, the growing health-conscious trend is persuading QSRs in the South to provide lighter, grilled, and fresh ingredient-based options to attract more consumers.

United States Fast Food and Quick Services Restaurants Market Segments

Product

- Hamburgers

- Sandwich

- Pizza

- Mexican

- Others

Region

- East

- West

- North

- South

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Company Analysis

- McDonald's

- Pizza Hut, LLC

- KFC Corporation

- Domino’s Pizza, Inc.

- Taco Bell IP Holder, LLC

- CFA Properties, Inc.

- Subway IP LLC

- Chipotle Mexican Grill

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What was the market size of the U.S. Fast Food & Quick Service Restaurant market in 2024?

-

What is the projected market size of this industry by 2033?

-

What is the expected compound annual growth rate (CAGR) for the market from 2025 to 2033?

-

What are some key factors driving the growth of the U.S. Fast Food & Quick Service Restaurant market?

-

How has digital ordering and technological advances influenced the industry?

-

What challenges are faced by the U.S. Fast Food & Quick Service Restaurant market?

-

Which product categories are covered in the market analysis (e.g., hamburgers, sandwiches, pizza)?

-

What are some regional trends in the U.S. Fast Food & Quick Service Restaurant market?

-

How is the growing demand for healthier menu options impacting the industry?

-

Who are some of the major companies analyzed in the market report?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Fast Food and Quick Services Restaurants Market

6. Market Share

6.1 By Product

6.2 By Region

7. Product

7.1 Hamburgers

7.2 Sandwich

7.3 Pizza

7.4 Mexican

7.5 Others

8. Region

8.1 East

8.2 West

8.3 North

8.4 South

9. Porter’s Five Analysis

9.1 Bargaining Power of Buyers

9.2 Bargaining Power of Suppliers

9.3 Degree of Rivalry

9.4 Threat of New Entrants

9.5 Threat of Substitutes

10. SWOT Analysis

10.1 Strength

10.2 Weakness

10.3 Opportunity

10.4 Threat

11. Company Analysis

11.1 McDonald's

11.1.1 Overview

11.1.2 Key Persons

11.1.3 Recent Development

11.1.4 Revenue

11.2 Pizza Hut, LLC

11.2.1 Overview

11.2.2 Key Persons

11.2.3 Recent Development

11.2.4 Revenue

11.3 KFC Corporation

11.3.1 Overview

11.3.2 Key Persons

11.3.3 Recent Development

11.3.4 Revenue

11.4 Domino’s Pizza, Inc.

11.4.1 Overview

11.4.2 Key Persons

11.4.3 Recent Development

11.4.4 Revenue

11.5 Taco Bell IP Holder, LLC

11.5.1 Overview

11.5.2 Key Persons

11.5.3 Recent Development

11.5.4 Revenue

11.6 CFA Properties, Inc.

11.6.1 Overview

11.6.2 Key Persons

11.6.3 Recent Development

11.6.4 Revenue

11.7 Subway IP LLC

11.7.1 Overview

11.7.2 Key Persons

11.7.3 Recent Development

11.7.4 Revenue

11.8 Chipotle Mexican Grill

11.8.1 Overview

11.8.2 Key Persons

11.8.3 Recent Development

11.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com