United States Honey Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Honey Market Trends & Summary

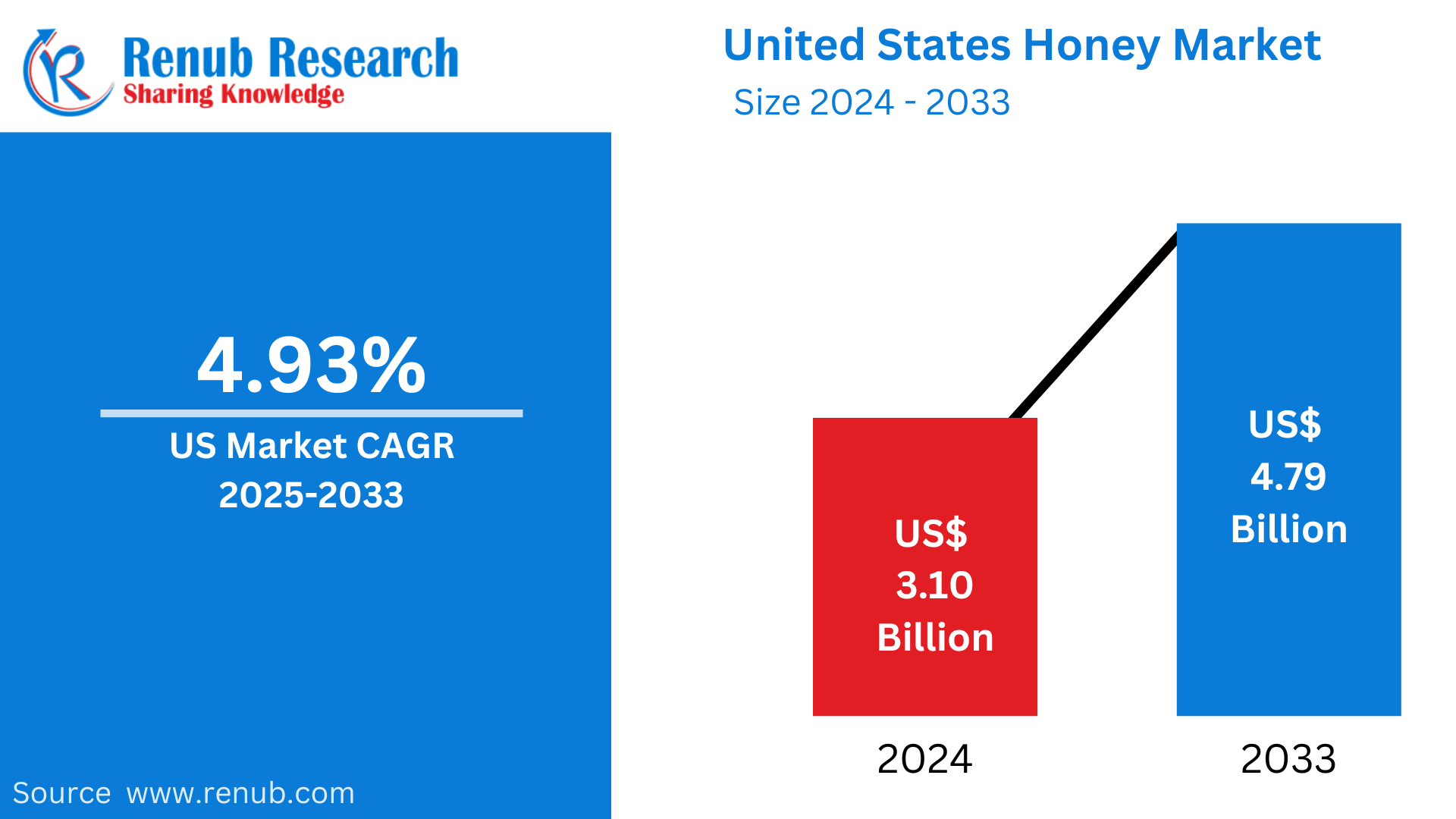

United States Honey market is expected to reach US$ 4.79 billion by 2033 from US$ 3.10 billion in 2024, with a CAGR of 4.93% from 2025 to 2033. For a number of reasons, consumers are becoming more interested in sugar alternatives, particularly natural sweeteners. One of the main causes is the rise in the number of people with diabetes, obesity, and high cholesterol who are always looking for healthier sugar substitutes. The market is expanding because a large variety of products are easily accessible and may provide food and drink items a pleasing flavor.

The report United States Honey Market & Forecast covers by Application (Food & Beverage, Personal Care & Cosmetics, Pharmaceuticals, and Others), Packaging (Glass jars, Bottles, Tubs, Tubes), Processing (Organic, and Conventional), Distribution Channels (Supermarkets/Hypermarkets, Convenience Stores, Online Retailers), States and Company Analysis 2025-2033.

United States Honey Industry Overview

Growing customer desire for natural, organic, and locally derived products has propelled the dynamic U.S. honey industry's constant expansion. Honey's popularity keeps growing as more people become health-conscious and look for natural substitutes for refined sugars because of its inherent sweetening capabilities and well-known health advantages, such as its antibacterial, anti-inflammatory, and antioxidant capabilities. Numerous honey varieties, including clover, wildflower, orange blossom, and buckwheat, are available in the U.S. market, and each has its own unique flavor. Although larger commercial producers still control the majority of the market, more consumers are flocking to small-scale, artisanal beekeepers as their taste for locally sourced and sustainable goods grows.

Variable honey yields are one of the difficulties facing the honey industry, though, especially as a result of environmental issues including pests, climate change, and bee population declines that impact pollination and honey production. Imported honey, particularly from nations like China, where honey is sometimes offered at lower costs, is another issue facing the American honey sector. Since some imported honey might not satisfy the Food and Drug Administration's (FDA) quality standards, this has raised persistent concerns about honey adulteration. Notwithstanding these challenges, consumer demand for healthier food options, rising recognition of the value of bees to the environment, and ongoing support for sustainable farming methods are all driving growth in the U.S. honey market.

In the past, the United States of America has been a leading producer of honey. The demand, however, is greater than the country's capacity for supply. The United States generated about 202,000 tons of honey a year in 2022. Consumption, however, is far higher. About 450,000 tons of honey are used annually by Americans, indicating a shortage that calls for significant imports.

Growth Drivers for the United States Honey Market

Health-Conscious Consumers

Compact One of the main factors propelling the US honey industry is the rising trend of health-conscious consumers. Honey is now seen as a natural substitute for refined sugars and artificial sweeteners due to growing understanding of its many health advantages, including its antibacterial, anti-inflammatory, and antioxidant qualities. Honey is a popular choice for people looking for better, more nutrient-dense solutions because it is high in vital vitamins, minerals, and enzymes. Honey's popularity as a healthy, minimally processed sweetener keeps growing as people grow more conscious of the negative health effects of processed foods. The increasing demand for natural and organic honey variations reflects this change, further securing honey's place in wellness and health-conscious diets.

Demand for Natural and Organic Products

One of the main factors propelling the US honey industry is the rising demand for natural and organic products. Honey is viewed as a healthier, more sustainable substitute for manufactured sweeteners as customers grow increasingly aware of the contents in their food and the effects their decisions have on the environment. Because they reflect the growing desire for pure, minimally processed foods, honey kinds that are raw, organic, and locally produced are especially well-liked. Because these honey varieties preserve more of their natural enzymes, vitamins, and antioxidants, they are thought to be more genuine and healthier. Further expanding the market for organic and ethically sourced honey is the increased demand for honey produced by nearby beekeepers due to growing interest in sustainable agricultural practices.

Rising Popularity of Specialty Honeys

One of the main factors propelling the U.S. honey market's expansion is the growing demand for specialized honeys. Customers who are looking for artisanal and locally sourced goods are becoming more interested in rare and high-quality honey kinds including manuka, tupelo, and wildflower. In contrast to mass-produced honeys, these specialized honeys are prized for their unique flavors, particular health advantages, and superior quality. For example, tupelo honey is valued for its low glycemic index and pleasant flavor, whereas manuka honey is well-known for its strong antimicrobial qualities. The demand for premium, specialized goods keep rising as people learn more about the origins and advantages of these honeys. The general movement to support local agriculture and small-scale, sustainable farmers is another factor propelling this trend.

Challenges in the United States Honey Market

Rise in Honey Adulteration

In the American honey market, honey adulteration is a serious problem, especially when it comes to imported honey. To lower production costs, some imported honey may be combined with less expensive sweeteners like rice syrup, corn syrup, or glucose. Furthermore, some filtration techniques eliminate pollen and other advantageous characteristics, which affects the nutritional content and genuineness of honey. Because tainted honey may be marketed as premium, organic, or pure honey, this approach not only compromises the quality of honey but also erodes consumer confidence. Due to price competition from lower-cost imports, the frequency of contaminated honey disadvantages indigenous producers. Stricter laws, improved testing procedures, and increased consumer knowledge of honey's authenticity—particularly in organic and premium categories—are all part of the fight against honey adulteration.

Competition from Imported Honey

The U.S. honey business is severely hampered by competition from imported honey, particularly for domestic producers. The United States imports a lot of its honey, especially from nations like China, where production prices are lower because of laxer laws and larger-scale operations. Due to price rivalry caused by these imported honey species' frequently cheaper prices, it is challenging for American beekeepers—especially small-scale producers—to stay competitive. Furthermore, cheaper sweeteners are occasionally used to adulterate imported honey, which lowers its price even more. The profitability of nearby beekeepers that value premium, responsibly produced honey is impacted by this pricing pressure. Efforts to assure product transparency, encourage local honey consumption, and increase knowledge of the advantages of honey produced domestically are essential in the fight against this.

The food and beverage sector in the United States depends heavily on honey

Food and beverages are among the most prominent applications in the United States honey market. This is due to honey's versatility and natural appeal. As a wholesome sweetener, it enhances the flavor profiles of myriad merchandise, from breakfast cereals to baked goods, sauces, and dressings. Its flavor and nutritional benefits make it a favored ingredient for health-conscious purchasers searching for natural alternatives to processed sugars. Moreover, honey's antimicrobial properties extend its shelf life in food items, contributing to its substantial use throughout the food and beverage industry, thereby driving the dominance of the honey market in the United States.

Glass jars might end up being the most popular option in the US honey market

Glass jars could dominate the United States honey market. This is because they hold honey's purity, stopping infection and keeping its natural flavors. The apparent nature of glass lets consumers assess honey quality, fostering belief visually. Moreover, glass is eco-friendly and recyclable, aligning with developing environmental worries. The aesthetic appeal of glass jars complements product presentation, influencing purchaser alternatives. Overall, the combination of renovation, transparency, environmental consciousness, and visual enchantment makes glass jars a primary need in the US honey market.

One of the most important sectors of the US honey market is conventional processing

Conventional processing has one of the most noteworthy shares in the US honey market. This is due to its accessibility, familiarity, and cost-effectiveness. This technique entails heating honey to dissolve crystals and improve readability, followed by filtration for particle elimination. While critics argue this process may additionally reduce some of honey's natural enzymes and antioxidants, it keeps consistency and extends shelf lives. Moreover, traditional processing aligns with regulatory standards, ensuring product protection and compliance. Its massive adoption through large-scale manufacturers and smaller beekeepers solidifies its function as a dominant processing section in the United States honey market.

The US honey market primarily depends on supermarkets and hypermarkets

Supermarkets and hypermarkets command one of the principal shares of the United States honey market. This is because of their widespread reach and comfort for consumers. These retail giants offer numerous honey kinds, catering to one-of-a-kind tastes and preferences. Supermarkets and hypermarkets are the go-to locations for people shopping for honey because they are readily handy and low-priced. They are found in urban and rural regions, making them a widespread consumer desire. This has given them a decisive US honey market function.

United States Honey Market by States

By states, the United States honey market is divided into California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, North Carolina, Massachusetts, Virginia, Michigan, Maryland, Colorado, Tennessee, Indiana, Arizona, Minnesota, Wisconsin, Missouri, Connecticut, South Carolina, Oregon, Louisiana, Alabama, Kentucky, and Rest of United States. California may become a frontrunner in the United States honey market.

California Honey Market

Due to the state's extensive agricultural base and wide range of consumer preferences, the California honey market represents a sizeable portion of the US honey market. One of the top states for honey production is California, which is especially well-known for its unusual types, including avocado, wildflower, and orange blossom honey. Growing consumer desire for pure, organic, and locally sourced honey as well as growing knowledge of its health advantages—such as its antioxidant and antibacterial qualities—are driving the market. The market has also grown as a result of California's increased emphasis on sustainable agricultural methods and the development of direct-to-consumer sales channels, such as farmer's markets and internet marketplaces. The market's stability is impacted by issues like bee population declines and environmental conditions that affect honey output.

Texas Honey Market

The Texas honey market is a major participant in the American honey market, thanks to the state's extensive agricultural sector and varied environment, which encourage the production of many kinds of honey, including mesquite, clover, and wildflower honey. A thriving market is supported by both small-scale and commercial beekeepers in Texas, one of the leading states for honey production. As consumers become more conscious of honey's health benefits, such as its antibacterial and antioxidant qualities, their desire for natural, organic, and locally produced honey is increasing. Market access is also being facilitated by the growth of online retail platforms and the popularity of beekeeping hobbyists. But issues like varying honey yields, climatic conditions that affect bee numbers, and competition from imported honey can alter the stability of the market.

New York Honey Market

Growing consumer demand for natural, locally sourced, and organic honey is fueling the growth of the New York honey business, a subset of the US honey sector. New York, which is well-known for its buckwheat, wildflower, and clover honey, enjoys a varied agricultural environment that accommodates both commercial and small-scale beekeepers. Growing consumer health consciousness and knowledge of honey's inherent advantages, such as its antibacterial and antioxidant qualities, further propel market expansion. Furthermore, the demand for artisanal and organic honey products is increased by the state's emphasis on sustainability and support for regional agriculture. Market stability, however, may be impacted by issues including bee population loss, climate change, and competition from imported honey. New York continues to play a significant role in the American honey business in spite of these obstacles.

Florida Honey Market

Due to the state's varied climate and abundant agricultural resources, which support a variety of honey varieties like orange blossom, tupelo, and wildflower honey, the Florida honey market is steadily expanding. With both commercial and small-scale beekeepers contributing significantly to its production, Florida is one of the top producers of honey in the United States. As consumers grow more health conscious and look for alternatives to processed sugars, the market is expanding due to rising consumer demand for natural, locally sourced, and organic honey. Honey's attraction is further enhanced by its rising popularity due to its antibacterial and antioxidant qualities. However, issues including bee population declines, environmental factors that affect honey production, and competition from imported honey could impair market stability and growth.

Application – Market breakup in 4 viewpoints:

1. Food & Beverage

2. Personal Care & Cosmetics

3. Pharmaceuticals

4. Others

Packaging – Market breakup in 5 viewpoints:

1. Glass jars

2. Bottles

3. Tubs

4. Tubes

5. Others

Processing – Market breakup in 2 viewpoints:

1. Organic

2. Conventional

Distribution Channels – Market breakup in 4 viewpoints:

1. Supermarkets/Hypermarkets

2. Convenience Stores

3. Online Retailers

4. Others

States – Market breakup of 29 States:

1. California

2. Texas

3. New York

4. Florida

5. Illinois

6. Pennsylvania

7. Ohio

8. Georgia

9. New Jersey

10. Washington

11. North Carolina

12. Massachusetts

13. Virginia

14. Michigan

15. Maryland

16. Colorado

17. Tennessee

18. Indiana

19. Arizona

20. Minnesota

21. Wisconsin

22. Missouri

23. Connecticut

24. South Carolina

25. Oregon

26. Louisiana

27. Alabama

28. Kentucky

29. Rest of United States

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Comvita Limited

2. Barkman Honey, LLC

3. Johnston Home

4. Dutch Gold Honey

5. Adee Honey Farms

6. The Big Island Bee Company, LLC

7. Glory Bee Inc.

8. Crockett Honey Co., Inc.

9. Miller's Honey Company

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Application, Packaging, Processing, Distribution Channel and States |

| States Covered | 1. California 2. Texas 3. New York 4. Florida 5. Illinois 6. Pennsylvania 7. Ohio 8. Georgia 9. New Jersey 10. Washington 11. North Carolina 12. Massachusetts 13. Virginia 14. Michigan 15. Maryland 16. Colorado 17. Tennessee 18. Indiana 19. Arizona 20. Minnesota 21. Wisconsin 22. Missouri 23. Connecticut 24. South Carolina 25. Oregon 26. Louisiana 27. Alabama 28. Kentucky 29. Rest of United States |

| Companies Covered | 1. Comvita Limited 2. Barkman Honey, LLC 3. Johnston Home 4. Dutch Gold Honey 5. Adee Honey Farms 6. The Big Island Bee Company, LLC 7. Glory Bee Inc. 8. Crockett Honey Co., Inc. 9. Miller's Honey Company |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Honey Market

6. Market Share

6.1 By Application

6.2 By Packaging

6.3 By Processing

6.4 By Distribution Channel

6.5 By States

7. Application

7.1 Food & Beverage

7.2 Personal Care & Cosmetics

7.3 Pharmaceuticals

7.4 Others

8. Packaging

8.1 Glass Jar

8.2 Bottle

8.3 Tub

8.4 Tube

8.5 Others

9. Processing

9.1 Organic

9.2 Conventional

10. Distribution Channel

10.1 Supermarkets/Hypermarkets

10.2 Convenience Stores

10.3 Online Retailers

10.4 Others

11. States

11.1 California

11.2 Texas

11.3 New York

11.4 Florida

11.5 Illinois

11.6 Pennsylvania

11.7 Ohio

11.8 Georgia

11.9 New Jersey

11.10 Washington

11.11 North Carolina

11.12 Massachusetts

11.13 Virginia

11.14 Michigan

11.15 Maryland

11.16 Colorado

11.17 Tennessee

11.18 Indiana

11.19 Arizona

11.20 Minnesota

11.21 Wisconsin

11.22 Missouri

11.23 Connecticut

11.24 South Carolina

11.25 Oregon

11.26 Louisiana

11.27 Alabama

11.28 Kentucky

11.29 Rest of United States

12. Porter’s Five Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Company Analysis

14.1 Comvita Limited

14.1.1 Overview

14.1.2 Recent Development

14.1.3 Revenue

14.2 Barkman Honey, LLC

14.2.1 Overview

14.2.2 Recent Development

14.3 Johnston Home

14.3.1 Overview

14.3.2 Recent Development

14.4 Dutch Gold Honey

14.4.1 Overview

14.4.2 Recent Development

14.5 Adee Honey Farms

14.5.1 Overview

14.5.2 Recent Development

14.6 The Big Island Bee Company, LLC

14.6.1 Overview

14.6.2 Recent Development

14.7 Glory Bee Inc.

14.7.1 Overview

14.7.2 Recent Development

14.8 Crockett Honey Co., Inc.

14.8.1 Overview

14.8.2 Recent Development

14.9 Miller's Honey Company

14.9.1 Overview

14.9.2 Recent Development

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com