United States Hospital & Nursing Home Probiotics Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Hospital & Nursing Home Probiotics Market Trends & Summary

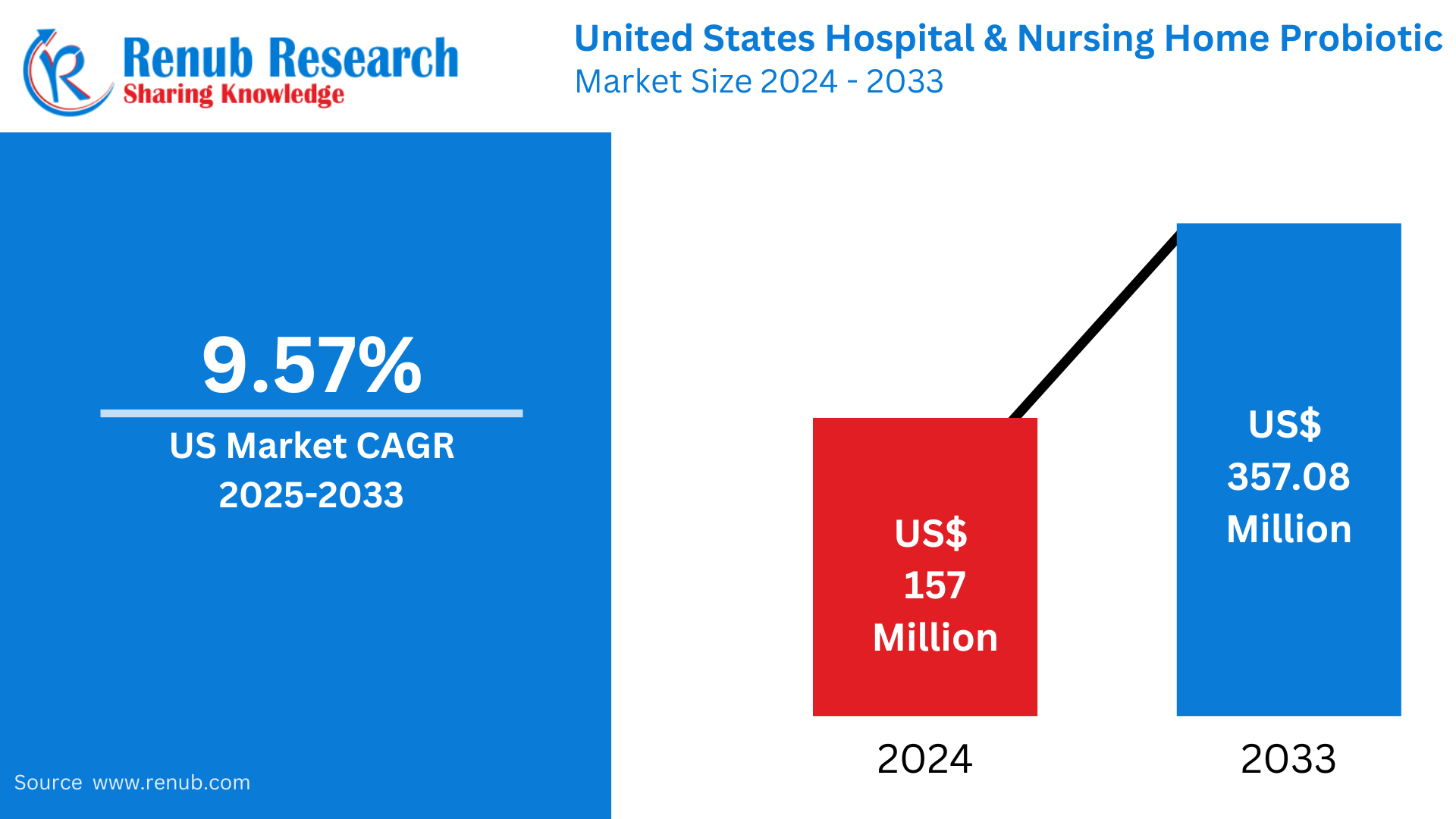

The United States Hospital & Nursing Home Probiotics Market was worth US$ 157 million in 2024 and is anticipated to reach US$ 357.08 million in 2033, expanding at a CAGR of 9.57% from 2025 to 2033. The market is being propelled by heightened awareness of gut health, mounting demand for probiotic-based therapy, and increasing emphasis on infection control and boosting immunity in healthcare centers.

U.S. Hospital And Nursing Home Probiotics Market Forecast Report by Hospital ((Number of Beds (1-199, 200-299, 300-499, 500+), Payer (Medicare, Medicaid, Self-pay, Private, Others), Location (Rural, Urban)), Nursing Home( Number of Beds (Less than 50, 50-99, 100-199, 199+), Payer (Medicare, Medicaid, Dual), Location (Rural, Urban), By Application (Gut Health, Immunity, Wellness, Others), Region And Company Analysis 2025 – 2033.

United States Hospital & Nursing Home Probiotics Market Forecasts

Hospital & nursing home probiotics are advantageous live microbes taken by patients and elderly in-patients in healthcare facilities to promote gut health, immunity, and overall health. These probiotics, usually given in supplements, fortified foods, or beverages, ensure the balance of the gut microbiome, eliminating chances of infections, diarrhea, and antibiotic-related issues.

In the USA, the popularity of probiotics in hospitals and nursing homes has been growing due to increased awareness of their health benefits. Healthcare providers are incorporating probiotics into patient care to enhance digestive health, prevent Clostridium difficile infections, and support immune function. The aging population, particularly in nursing homes, benefits from probiotics as they help manage gastrointestinal disorders and improve nutrient absorption. Besides, the increase in the use of antibiotics has created a need for probiotics to reinstate gut flora. Probiotics are increasingly becoming essential to preventive healthcare in hospitals across the country with research cementing their effectiveness.

Drivers of Growth in the United States Hospital & Nursing Home Probiotics Market

Increased Healthcare Awareness of Gut Health

Nursing homes and hospitals are now aware of the significance of gut health on a patient's general wellbeing. Probiotics support a healthy gut microbiome, lowering the risk of gastrointestinal disorders, antibiotic-associated diarrhea, and infections like Clostridium difficile. With preventive care becoming the priority for healthcare providers, probiotics are now included in treatment protocols, particularly for older patients with compromised digestive systems. The increasing number of clinical studies attesting to the health benefits of probiotics in healthcare facilities is also driving their use in hospitals and nursing homes. May 2023, A recent Ipsos poll for MDVIP reveals that many Americans lack knowledge about the gut microbiome and its effects on health. The survey shows that many people live with digestive issues, with one in five feeling stuck after trying various solutions. Half of Americans have practiced mindful eating for gut health, while two in five have used over-the-counter remedies like laxatives or probiotics. Variations in experiences and perceptions are common across gender, income, and age.

Increasing Elderly Population and Occurrence of Chronic Diseases

An aging population within the United States is growing and increasing elderly patient populations in hospital and nursing facility settings. Seniors are increasingly susceptible to gut issues, reduced immunity, and antibiotic exposure, and thus a beneficial remedy can be probiotics to address such health issues. Moreover, chronic diseases like diabetes, cardiovascular diseases, and gastrointestinal disease are increasing, leading health professionals to employ probiotics as adjunct therapy to treat and promote gut well-being and overall health. Jan 2024, The number of Americans 65 and older is expected to increase from 58 million in 2022 to 82 million in 2050, growing their proportion of the population from 17% to 23%.

Greater Antibiotic Utilization and Microbiome Restoration Need

Antibiotics are widely administered in hospitals and nursing facilities, but overuse of these drugs can upset the gut microbiome, resulting in gastrointestinal disorders. Probiotics restore helpful bacteria, suppressing antibiotic-associated diarrhea and secondary infection risk. With an increasing focus on patient safety and infection prevention, healthcare facilities are adding probiotics as an adjunct therapy to preserve gut equilibrium and improve patient recovery, thus fueling demand in hospitals and nursing homes. In 2022, 236.4 million antibiotic prescriptions filled from U.S. community pharmacies were prescribed by healthcare providers, approximately 7 prescriptions for each 10 individuals in the outpatient environment.

Challenges in the United States Hospital & Nursing Home Probiotics Market

Regulatory Uncertainty and Lack of Standardization

Although the use of probiotics is becoming increasingly accepted, regulatory issues continue to be a major obstacle. The FDA deems probiotics as dietary supplements, not as pharmaceuticals, which creates disparities in quality control, labeling, and claims of efficacy. Hospitals and nursing facilities need standardized formulations supported by clinical data to maintain patient safety. Uncertainty about guidelines for probiotic use in healthcare facilities makes it challenging for healthcare professionals to safely incorporate them into treatment plans.

Excessive Expenses and Limited Insurance Coverage

Probiotic foods and supplements may be expensive, and widespread implementation in nursing homes and hospitals can be costly. Most insurance companies, such as Medicare and Medicaid, do not cover probiotics as part of standard treatment, which restricts their use for long-term care patients. Furthermore, financial limitations in healthcare facilities can limit the purchase of high-quality probiotic products, limiting market growth even though they have established health benefits.

United States Hospital Probiotics Number of Beds Market

The need for probiotics in hospitals differs based on the number of beds within a facility. Larger hospitals with more beds have greater patient volume, including those that need long-term antibiotic therapy, and thus probiotics are an essential component of patient care. Hospitals with more than 500 beds tend to have specialized nutrition and gastroenterology units that facilitate the use of probiotics. In the meantime, smaller hospitals are increasingly adopting probiotics in their nutritional regimens, particularly for the treatment of digestive disorders. The Definitive Healthcare HospitalView product monitors 7,378 active U.S. hospitals as of April 2024. The hospital facilities are sourced from close to 40 distinct public, private, and proprietary sources. United States Hospital Probiotics Medicare Market

Medicare, which mainly insures elderly and disabled patients, is instrumental in hospitals' use of probiotics. With older patients more susceptible to gastrointestinal problems and infections, hospitals that treat Medicare patients increasingly use probiotics as part of their treatment protocols. Still, limited insurance coverage for probiotic products is a hurdle. Attempts to add probiotics to Medicare-covered nutritional therapies would further stimulate market growth, making them more available to older patients.

United States Urban Hospital Probiotics Market

Urban hospitals also have increased probiotic adoption because they receive improved funding, have access to more advanced medical research, and incorporate new trends in healthcare. Urban hospitals cater to a varied population of patients, including those looking for preventive healthcare options. Urban hospitals having specialized gastroenterology and nutrition programs aids the use of probiotics. Collaborations with pharmaceutical and biotech firms also ease research and development of probiotic formulations specific to hospital use.

United States Nursing Home Probiotics Number of Beds Market

Probiotic demand directly depends on the number of beds in a nursing home. Nursing homes with over 200 beds provide more beds for residents that need constant medical attention, where probiotics form an integral part of dietary and healthcare strategies. Even smaller nursing homes acknowledge the importance of probiotics in strengthening digestive health and immunity, paving the way for incremental market growth. Geriatric and palliative care facilities incorporate probiotics in daily nutritional therapy particularly.

United States Nursing Home Probiotics Medicaid Market

Medicaid is also important in the provision of medical coverage for low-income and elderly patients who live in nursing homes. Though Medicaid pays for most medical bills, probiotic coverage is limited. Nevertheless, with healthcare professionals fighting for probiotics to be included in nutritional support plans, the future offers hope for broader Medicaid coverage. Greater clinical research that proves the cost-effectiveness of probiotics in avoiding infection and hospitalization could lead to increased Medicaid reimbursement in the future.

United States Rural Nursing Home Probiotics Market

Rural nursing homes are confronted with specific challenges to adopt probiotics, such as less access to specialist healthcare professionals and fewer financial opportunities. Nonetheless, knowledge about probiotics is spreading, particularly in areas where the population is aging. Telemedicine and online marketplaces are assisting rural nursing homes in accessing probiotic products, enhancing the digestive and immune health of residents. As healthcare infrastructure develops in rural regions, probiotic implementation in nursing homes will increase progressively.

United States Hospital & Nursing Home Probiotics Gut Health Market

Their function in intestinal health is one of the top reasons that hospitals and nursing facilities are implementing them. Patients who receive treatments that interfere with the gut flora, such as chemotherapy, antibiotic treatment, or abdominal surgery, can greatly benefit from probiotic use. Probiotics depend on older adults in nursing homes with gastrointestinal disease for increased nutrient uptake and relief. The growing awareness of gut health's relationship to overall health fuels demand for probiotics in medical facilities.

United States Hospital & Nursing Home Probiotics Immunity Market

Probiotics enhance immunity, hence their use is crucial in hospitals and nursing homes. Weakened immunity patients, such as postoperative patients, cancer patients on treatment, and the aged, are helped by probiotics that avert infections. The COVID-19 pandemic further raised the profile of immunity-strengthening solutions, leading hospitals and nursing homes to seek probiotics as a complementary patient care option. The trend is forecasted to continue pushing market growth.

North United States Hospital & Nursing Home Probiotics Market

The northern part of the United States is densely populated with top-notch healthcare centers, and therefore, it is a major hospital and nursing home probiotics market. New York, Massachusetts, and Illinois are among the states that have highly developed hospitals focusing on innovative healthcare, including probiotic therapy. The increasing population of elderly individuals in northern states also adds to higher demand for probiotics in nursing homes, where digestive and immune health are the primary concerns among long-term care residents.

South United States Hospital & Nursing Home Probiotics Market

The American South, which has states such as Florida and Texas, also has a high percentage of elderly people, and probiotics are in high demand in nursing homes. Digestive health products are fueled by warm weather and high numbers of retirement communities. Southern healthcare facilities are implementing probiotics in patient recovery programs as well. The market continues to grow with increasing awareness and the more widespread adoption of probiotics in dietary plans and treatment programs in healthcare institutions.

United States Hospital & Nursing Home Probiotics Market Segments

Hospital Probiotics Channel

Number of Beds

- 1-199

- 200-299

- 300-499

- 500+

Payer

- Medicare

- Medicaid

- Self-pay

- Private

- Others

Location

- Rural

- Urban

Nursing home Probiotics Channel

Number of Beds

- Less than 50

- 50-99

- 100-199

- 199+

Payer

- Medicare

- Medicaid

- Dual

Location

- Rural

- Urban

Application

- Gut Health

- Immunity

- Wellness

- Others

Region

- East

- West

- North

- South

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Company Analysis

- American Lifeline Inc.

- Rising Pharmaceuticals

- BD

- Dietary Pros Inc.

- Dr. Joseph Mercola

- Probi

- Lallemand Inc

- Biocodex

- Probiotical S.p.A.

- Protexin

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Application and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What was the market size of the U.S. Hospital & Nursing Home Probiotics Market in 2024?

-

What is the projected market size for this sector by 2033?

-

What is the compound annual growth rate (CAGR) for the market from 2025 to 2033?

-

What factors are driving the growth of the probiotics market in U.S. hospitals and nursing homes?

-

How are probiotics contributing to infection control and immunity enhancement in healthcare facilities?

-

How is the aging population in the U.S. influencing the demand for probiotics in hospitals and nursing homes?

-

What challenges are impacting the growth of the U.S. Hospital & Nursing Home Probiotics Market?

-

How does the use of probiotics help in managing antibiotic-associated diarrhea and gastrointestinal disorders in patients?

-

Which geographic regions in the U.S. are seeing higher adoption of probiotics in healthcare settings?

-

Who are some of the major companies operating in the U.S. Hospital & Nursing Home Probiotics Market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Hospital & Nursing Home Probiotics Market

6. Market Share

6.1 By Application

6.2 By Region

7. Hospital Probiotics Channel

7.1 Number of Beds

7.1.1 1-199

7.1.2 200-299

7.1.3 300-499

7.1.4 500+

7.2 Payer

7.2.1 Medicare

7.2.2 Medicaid

7.2.3 Self-pay

7.2.4 Private

7.2.5 Others

7.3 Location

7.3.1 Rural

7.3.2 Urban

8. Nursing home Probiotics Channel

8.1 Number of Beds

8.1.1 Less than 50

8.1.2 50-99

8.1.3 100-199

8.1.4 199+

8.2 Payer

8.2.1 Medicare

8.2.2 Medicaid

8.2.3 Dual

8.3 Location

8.3.1 Rural

8.3.2 Urban

9. Application

9.1 Gut Health

9.2 Immunity

9.3 Wellness

9.4 Others

10. Region

10.1 East

10.2 West

10.3 North

10.4 South

11. Porter’s Five Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Company Analysis

13.1 American Lifeline Inc.

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development

13.1.4 Revenue

13.2 Rising Pharmaceuticals

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development

13.2.4 Revenue

13.3 BD

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development

13.3.4 Revenue

13.4 Dietary Pros, Inc.

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development

13.4.4 Revenue

13.5 Dr. Joseph Mercola

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development

13.5.4 Revenue

13.6 Probi

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development

13.6.4 Revenue

13.7 Lallemand Inc.

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development

13.7.4 Revenue

13.8 Biocodex

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development

13.8.4 Revenue

13.9 Probiotical S.p.A.

13.9.1 Overview

13.9.2 Key Persons

13.9.3 Recent Development

13.9.4 Revenue

13.10 Protexin

13.10.1 Overview

13.10.2 Key Persons

13.10.3 Recent Development

13.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com