United States Household Appliances Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Household Appliances Market Trends & Summary

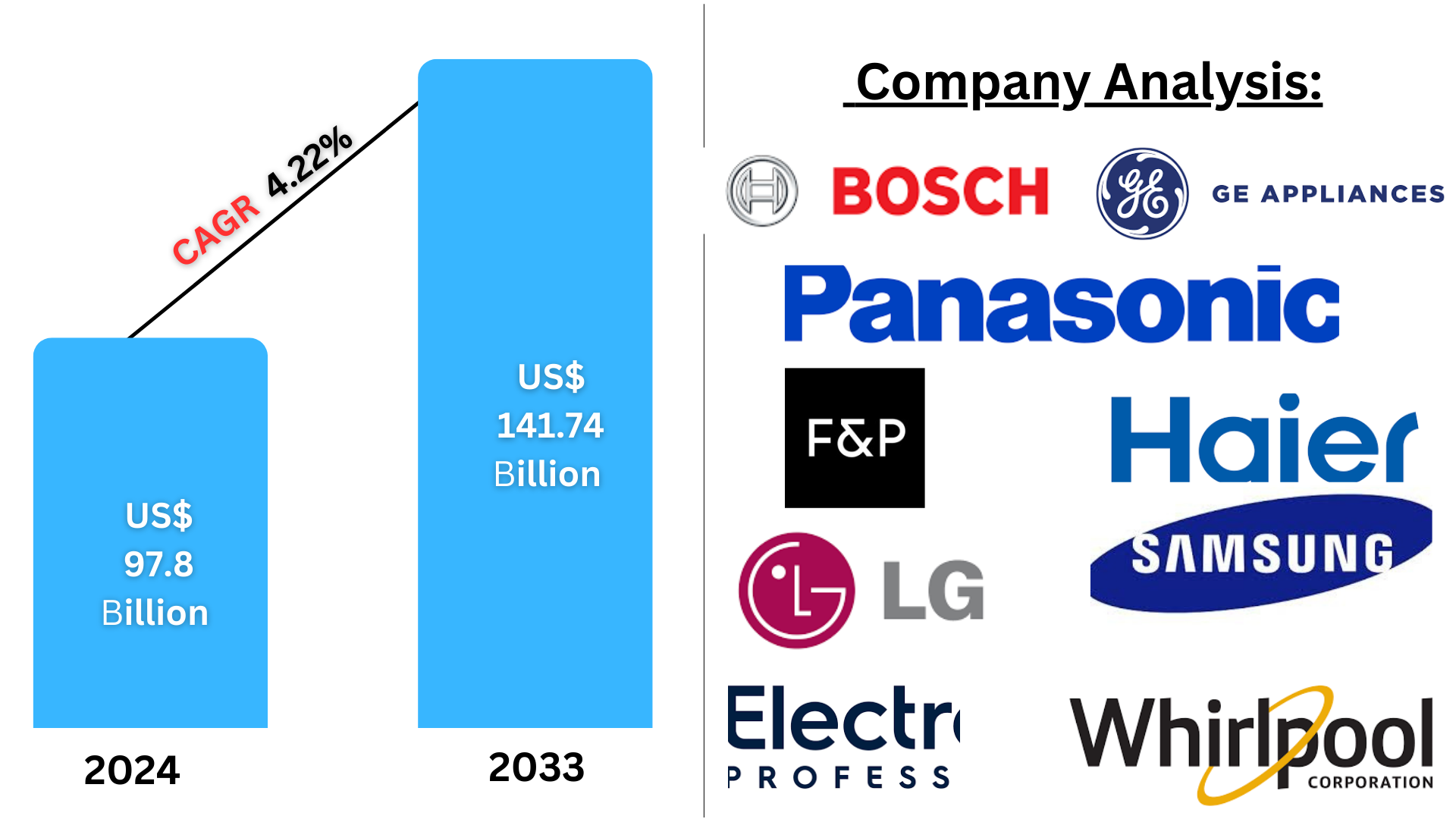

The United States Household Appliances Market is set to grow immensely, reaching USD 141.74 million in 2033 from USD 97.8 million in 2024, with a CAGR of 4.22% from 2025 to 2033. The growth is fueled by growing disposable income, advances in technology, and heightened demand for energy-efficient and smart appliances. The growth of e-commerce and evolving lifestyles of consumers add to the expansion of the market.

The report United States Household Appliances Market Forecast covers by Appliances (Major Appliances (Water Heater, Dishwasher, Refrigerator, Cooktop, Cooking Range, Microwave, and Oven, Vacuum Cleaner, Washing Machine and Dryers, Air Conditioner), Small Appliances (Coffee Makers, Toasters, Juicers, Blenders and Food Processors, Hair Dryers, Irons, Deep Fryers, Space Heaters, Electric Trimmers and Shavers, Air Purifiers, Humidifiers & Dehumidifiers, Rice Cookers & Steamers, Air Fryers), Distribution Channel (Hypermarkets & Supermarkets, Electronic Stores, Exclusive Brand Outlets, Online, Others), Region (East, West, North, South), Company Analysis 2025-2033.

United States Household Appliances Market Outlooks

Household appliances are electrical and mechanical appliances used to perform everyday household activities like cooking, cleaning, preservation of food, and air conditioning. Some of these include washing machines, refrigerators, air conditioners, ovens, microwaves, dishwashers, vacuum cleaners, and smart home systems. Contemporary household appliances have transformed with sophisticated technology, providing energy efficiency, automation, and connectivity, and hence are indispensable in American homes.

In the US, home appliances are very popular across households because of hectic lifestyles, growing disposable incomes, and escalating demands for convenience and efficiency. Smart home compatibility, voice operation, and Internet of Things-enabled appliances have witnessed huge popularity due to the drive from companies like Samsung, LG, Whirlpool, and GE. Energy-efficient and sustainable appliances have become more popular in addition to these drivers, promoted by government rebates and ecologism awareness. Besides, the large e-commerce platform presence has increased the ease of buying household appliances, also accelerating their usage in American homes. The market is expanding with continuing technology advancements.

United States Household Appliances Market Growth Drivers

Increasing Demand for Energy-Efficient and Smart Appliances

The use of smart home technology and energy-efficient appliances is increasing at a fast rate and is a key growth driver for the U.S. household appliances market. Consumers are seeking appliances with more sophisticated features like voice control, remote access through mobile apps, and AI-driven automation. Energy-saving appliances that save electricity and water are also in demand, fueled by environmental concerns and government policies encouraging green products. Large manufacturers are concentrating on innovation to meet this changing demand, further driving market growth. February 2024 – GE Appliances, a Haier subsidiary, debuts its innovative EcoBalance System, allowing consumers to optimize energy consumption and bring appliances, air conditioners, and water heaters from Monogram®, GE Profile™, and GE® brands together, as well as smart lighting and energy management solutions with partner Savant.

Expansion of E-Commerce and Online Retail Footprint

The growth of e-commerce sites has reshaped the retail purchase of household appliances. Online stores provide competitive prices, promotions, customer feedback, and home delivery, which make it easier for consumers. Industry giants such as Amazon, Best Buy, and Walmart have intensified their online presence, which has made appliances more accessible. The convenience of product comparison, provision of financing, and wide product range are the main drivers of online sales in the household appliances market. April 2024: Alibaba Group Holdings released a new shopping e-commerce app with 3D capabilities meant for the Vision Pro mixed-reality headset in the United States.

Urbanization and Changing Lifestyles

Accelerated urbanization and changing lifestyles have helped the demand for home appliances in the U.S. significantly. With more and more dual-income families and hectic working routines, there's a boosting demand for appliances that make everyday tasks easier and help save time. Small and multiple-function appliances are on the rise, especially in city apartments and small homes. Premium and luxury appliances are also on the rise as income levels increase, which promotes demand for sophisticated and design-oriented home solutions. Currently, 83% of the population of the U.S. resides in urban regions, an upswing from 64% in 1950. By 2050, 89% of the population of the U.S. and 68% of the world's population are expected to be living in urban regions. There are more than 325 urban regions in the United States with more than 100,000 residents, the largest being New York City with 8.34 million residents.

Issues in the United States Household Appliances Market

Supply Chain Supply Chain Disruptions and Increasing Raw Material Prices

The U.S. home appliance market is hit hard by supply chain disruptions and volatile raw material prices. The COVID-19 pandemic, geopolitics, and global shipping shortages have impacted the availability of key components like semiconductors, steel, and plastics. This has caused production delays and increased manufacturing expenses, leading to higher appliance prices. Manufacturers have to implement robust supply chain models and alternative sources of supply to counter these threats.

Severe Market Competition and Price Sensitivity

The U.S. market for household appliances is very competitive, with both established and new players competing for market share. Firms have to innovate constantly in order to stand out in an overcrowded market. Price sensitivity of consumers also makes competition fiercer, as most consumers value affordability over high-end features. Manufacturers have to be competitive by striking a balance between quality, innovation, and affordability while providing promotions and financing deals to lure price-sensitive consumers.

United States Household Dishwasher Market

The U.S. market for residential dishwashers is increasing through convenience, water savings, and hygiene advantages. Dishwashers with advanced functionalities like quiet performance, energy-saving, and intelligent connectivity are what consumers want. Busy lifestyles leading to the high penetration of built-in and portable dishwashers have driven growth in the market. Bosch, Whirlpool, and KitchenAid brands lead the category with innovative models featuring customizable cycles and green technologies.

United States Household Refrigerator Market

Refrigerators are a common home appliance in the United States, with demand fueled by advances in refrigeration technology, smart capabilities, and energy efficiency. French-door, side-by-side, and bottom-freezer refrigerators top the lists of best-selling models. Features such as touch-screen displays, temperature adjustment, and ample storage are what customers are looking for. Models certified with Energy Star are becoming increasingly popular as they consume less electricity. Samsung, LG, and GE are among the top-selling brands with innovative products and integration with smart homes.

United States Household Washing Machine and Dryers Market

The washer-dryer category keeps growing in the U.S. as a result of urbanization and rising consumer interest in automated laundry options. Top-load and front-load high-efficiency washing machines with intelligent features like app-operated settings and energy-conservation modes are best sellers. Washer-dryer combinations suit space-aware consumers. Brands like Whirlpool, Maytag, and Electrolux concentrate on sophisticated drum technologies and water conservation mechanisms.

United States Household Coffee Makers Market

Toast makers continue to be a household favorite in America, as demand for pod-based, espresso, and programmable toasters increases. Consumers are looking for convenience, customization, and energy efficiency in their toasters. Wi-Fi-enabled and voice-controlled smart toasters are also becoming popular. Companies such as Keurig, Nespresso, and Breville lead the market with high-quality and feature-rich toasters suitable for diverse consumer needs.

United States Household Toasters Market

The U.S. toaster market grows as consumers seek multifunctional and efficient breakfast machines. Toasters with variable settings, digital controls, and intelligent connectivity are increasingly popular. Air fryer, baking, and toaster ovens are also well sought. Cuisinart, Breville, and Hamilton Beach are investing in smaller, fashionable, and multifunctional toaster designs to win the hearts of modern buyers.

United States Household Air Purifiers Market

The increased need for indoor air quality has created a surge for air purifiers in U.S. homes. Customers are buying more air purifiers with HEPA filters, activated carbon filters, and UV technology to eliminate allergens, contaminants, and airborne viruses. Smart air purifiers with real-time indoor air quality monitoring and smartphone app connectivity are popular. Major players are Dyson, Honeywell, and Blueair, producing innovative and energy-efficient products.

United States Household Electronic Stores Appliances Market

Electronic stores remain a major distribution channel for household appliances in the U.S., offering a wide range of products from leading brands. Stores such as Best Buy, Home Depot, and Lowe’s provide consumers with in-person product demonstrations, expert assistance, and financing options. Exclusive deals and in-store promotions attract shoppers, while omnichannel retail strategies allow seamless integration of online and offline shopping experiences.

United States Household Hypermarkets & Supermarkets Appliances Market

Supermarkets and hypermarkets are among the most important players in the household appliances industry, delivering affordability and accessibility. Chains such as Walmart, Target, and Costco offer consumers a varied range of home appliances, ranging from small kitchen devices to personal care products and large household appliances. Price competitiveness, bundled deals, and one-stop shopping convenience all make this distribution channel an important driver of appliance sales in the United States.

East United States Household Appliances Market

The eastern U.S. market is a large market for home appliances, led by urban hubs such as New York, Boston, and Washington, D.C. Consumers here demand high-tech, energy-saving appliances that fit into sustainability agendas. The existence of high-income households and increased use of smart home technology support the increasing demand for high-end appliances. Retailers and manufacturers in this region continue to innovate product lines to address changing consumer demands.

West United States Household Appliances Market

The western United States is a trendsetter in household appliance technology, with California leading the way in smart home systems and environmentally friendly appliances. Energy saving and green living in the region drive demand for low-consumption and intelligent appliances. Online shopping and technology-based retailing solutions are key in product distribution. Key urban metropolises, such as Los Angeles and San Francisco, are major drivers of high market growth.

United States Household Appliances Market Segments

Appliances

Major Appliances

- Water Heater

- Dishwasher

- Refrigerator

- Cooktop, Cooking Range, Microwave, and Oven

- Vacuum Cleaner

- Washing Machine and Dryers

- Air Conditioner

Small Appliances

- Coffee Makers

- Toasters

- Juicers, Blenders and Food Processors

- Hair Dryers

- Irons

- Deep Fryers

- Space Heaters

- Electric Trimmers and Shavers

- Air Purifiers

- Humidifiers & Dehumidifiers

- Rice Cookers & Steamers

- Air Fryers

Distribution Channel

- Hypermarkets & Supermarkets

- Electronic Stores

- Exclusive Brand Outlets

- Online

- Others

Region

- East

- West

- North

- South

All the Key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Revenue

Key Players Analysis

- Fisher & Paykel Appliances Holdings Ltd.

- GE Appliances

- Haier Group

- LG Electronics

- Panasonic Corporation

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Electrolux AB

- Whirlpool Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Appliances, Distribution Channel and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Household Appliances Market

6. Market Share

6.1 By Appliances

6.2 By Distribution Channel

6.3 By Region

7. Appliances

7.1 Major Appliances

7.1.1 Water Heater

7.1.2 Dishwasher

7.1.3 Refrigerator

7.1.4 Cooktop, Cooking Range, Microwave, and Oven

7.1.5 Vacuum Cleaner

7.1.6 Washing Machine and Dryers

7.1.7 Air Conditioner

7.2 Small Appliances

7.2.1 Coffee Makers

7.2.2 Toasters

7.2.3 Juicers, Blenders and Food Processors

7.2.4 Hair Dryers

7.2.5 Irons

7.2.6 Deep Fryers

7.2.7 Space Heaters

7.2.8 Electric Trimmers and Shavers

7.2.9 Air Purifiers

7.2.10 Humidifiers & Dehumidifiers

7.2.11 Rice Cookers & Steamers

7.2.12 Air Fryers

8. Distribution Channel

8.1 Hypermarkets & Supermarkets

8.2 Electronic Stores

8.3 Exclusive Brand Outlets

8.4 Online

8.5 Others

9. Region

9.1 East

9.2 West

9.3 North

9.4 South

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 Fisher & Paykel Appliances Holdings Ltd.

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development

12.1.4 Revenue

12.2 GE Appliances

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development

12.2.4 Revenue

12.3 Haier Group

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development

12.3.4 Revenue

12.4 LG Electronics

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development

12.4.4 Revenue

12.5 Panasonic Corporation

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development

12.5.4 Revenue

12.6 Robert Bosch GmbH

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development

12.6.4 Revenue

12.7 Samsung Electronics Co., Ltd.

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development

12.7.4 Revenue

12.8 Electrolux AB

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development

12.8.4 Revenue

12.9 Whirlpool Corporation

12.9.1 Overview

12.9.2 Key Persons

12.9.3 Recent Development

12.9.4 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com