United States Liquid Biopsy Market Size, Share and Forecast Report 2025-2033

Buy NowUnited States Liquid Biopsy Market Trends & Forecast 2025-2033

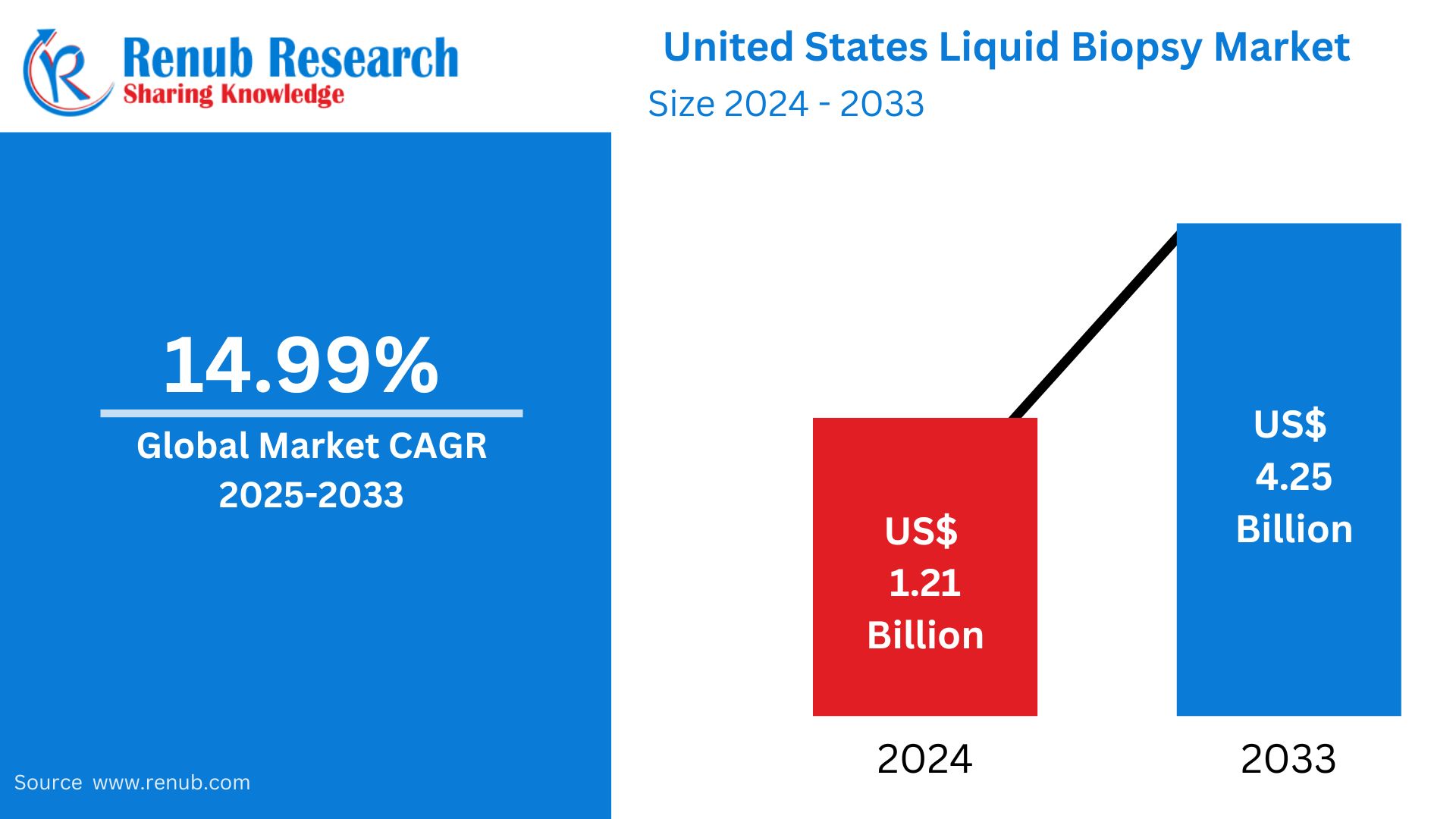

The United States liquid biopsy market is expected to be around US$ 4.25 billion by 2033. It is expected to grow at a robust CAGR of 14.99% from 2025 to 2033, from US$ 1.21 billion in 2024. The rising prevalence of cancer, the emergence of non-invasive diagnostic technologies, and increasing precision medicine are factors that boost growth. Liquid biopsies find further application in oncology, prenatal testing, and transplant monitoring, among others.

The report United States Liquid Biopsy Market & Forecast covers by Cancer types (Lung, Breast, Colorectal, Prostate, Liver, and Other), Products (Kits & Reagents, Platforms & Instruments, and Services), Application (Early Diagnosis, Patient Monitoring, and Recurrence Monitoring), Biomarkers (Circulating Tumor Cells, Circulating Tumor DNA, Extracellular Vehicles, and Other Types), Sample types (Blood, Urine, and Others), End-Users (Hospitals & Laboratories and Governments & Academic Research Centers), and Company Analysis 2025-2033.

United States Liquid Biopsy Market Overviews

The United States liquid biopsy market has been developing rapidly due to tremendous progress made in non-invasive diagnostic technologies. Liquid biopsy is an emerging technology that has used blood, urine, and other body fluids to detect biomarkers associated with cancer, like circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), and exosomes. This non-invasive method is increasingly preferred over traditional tissue biopsies, as it reduces patient risk, eliminates the need for surgery, and provides a more comprehensive view of the tumor's genetic makeup. The market is expanding due to the growing demand for early cancer detection and monitoring, as liquid biopsies offer a promising tool for diagnosing cancer at an early stage.

The US liquid biopsy market is expanding based on growing cancer diagnoses, increased healthcare awareness, genomics and molecular biology advances, and a movement toward personalized medicine tailored to an individual's genetic profile. Liquid biopsy can more precisely make treatment decisions, monitor the response to therapy, and detect minimal residual disease; due to a robust pipeline of companies and academic institutions in the United States, this country remains the forerunner in liquid biopsy technology. Regulatory support from agencies like the FDA further strengthens the growth potential of the market, opening up a bright future for both healthcare providers and patients. According to the American Cancer Society, in 2024, an estimated 2,001,140 new cancer cases and 611,720 cancer deaths are expected to occur in the United States.

Growth Drivers for the United States Liquid Biopsy Market

Rising Cancer Prevalence and Early Detection Demand

The increasing number of cancer cases in the United States is driving the liquid biopsy market. Cancer is one of the leading causes of death, and early detection is the key to improving survival rates. Liquid biopsy provides a non-invasive and effective way to detect tumors early, allowing for timely treatment and better outcomes. As more people understand the importance of early diagnosis, patients and healthcare providers opt for liquid biopsy to diagnose cancer more precisely, which propels the growth of the market. According to the National Cancer Institute, in 2024, approximately 14,910 children and adolescents aged 0 to 19 will be diagnosed with cancer, and 1,590 will die from it. As of 2022, there are approximately 18.1 million cancer survivors in the United States, and the number is likely to increase to 22.5 million by 2032.

Advancements in Genomic and Molecular Technologies

Recent developments in genomic and molecular biology have fueled the expansion of the liquid biopsy market. With NGS and PCR, liquid biopsies have become more precise and sensitive for detecting cancer biomarkers. These devices enable the investigation of tiny portions of DNA or cells from liquid blood samples with precise information on the genetic identity of a tumor. As more people use these technologies to discover cancer and check for treatment efficacy, the demand will increase market growth. Next-generation sequencing is essential in genetics research, states NCBI. In contrast, NGS can readily analyze millions of DNA fragments and in detail inform genomic information, genetic variations, gene expression, and genomic alterations. The newest advances focus on the acceleration of sequencing speed and accuracy, along with a reduction in cost and enhancement of data analysis.

Growing Personalized Medicine

The US liquid biopsy market has been dramatically escalated by the rise of interest in personalized medicine. Liquid biopsies assist doctors in identifying particular genetic mutations and changes in tumors. They will, therefore, be able to create a personalized treatment plan for each patient. Patients with complicated or advanced cancers will benefit significantly from this trend toward personalized care. The role of liquid biopsies in personalized medicine increases as healthcare becomes more specialized. They can track how patients are responding to the treatment and identify resistant mutations. This ability supports the continued growth of the market.

Challenges in the United States Liquid Biopsy Market

Regulatory and Reimbursement Challenges

The complex regulatory environment is one of the key challenges facing the United States liquid biopsy market. Although liquid biopsy technology has shown great promise, FDA approval can be lengthy and rigorous. Many liquid biopsy tests are yet to be approved. The regulations will vary depending on the type of biomarker or type of cancer the test is applied to. Pay policies for liquid biopsy procedures also appear to be shrouded in mystery, placing financial hurdles for healthcare providers and patients. Poor payment practices are the main hindrance to liquid biopsy technology use; they make the process less accessible and expensive in many areas.

Technological and Standardization Limitations

Liquid biopsy has been an improvement, though it is not easy to be widely used yet due to certain challenges. This is a very promising technology with the ability to diagnose the various types of cancer with a wide range of variability in accuracy from one technology to another. And no standard performance, analysis, and interpretation, hence variable results. This lack of consistency makes it more difficult to have reliable tests by healthcare professionals, which slows the usage of these tests in clinics. Other technologies, as well as how to detect the biomarkers, can influence how well the tests work.

United States Breast Cancer Liquid Biopsy Market

New non-invasive techniques for breast cancer diagnosis are driving rapid growth in the US market for liquid biopsies. Liquid biopsy is testing blood or other bodily fluids for cancer markers, including circulating tumor DNA (ctDNA) and circulating tumor cells (CTCs). This technique provides a possible alternative to conventional tissue biopsies. It allows the follow-up of minimal residual disease, assessment of responses to therapy, and detection of diseases at an early stage. The demand for early diagnostic technologies is increasing with the fact that breast cancer continues to be among the most frequently diagnosed tumors within the United States. Additionally, increased interest in personalized medicine-from treatments tailored towards specific genetic patient profiles-is making liquid biopsy-based technologies increasingly favorable for breast cancer care. With the further development of genomic technology and support from the regulatory side, the US breast cancer liquid biopsy market is ready for tremendous growth and promises better results for patients and health care providers. As per nationalbreastcancer.org, 1 in 8 women in the United States will be diagnosed with breast cancer sometime during their lifetime. In 2024, an estimated 310,720 women and 2,800 men will be diagnosed with invasive breast cancer.

United States Kits & Reagents Liquid Biopsy Market

The market for kits and reagents in liquid biopsies is growing rapidly in the United States, driven by the increasing demand for non-invasive diagnostic tools in oncology and personalized medicine. Liquid biopsies use blood, plasma, or other fluids to detect cancer biomarkers, thereby providing advantages like early detection, monitoring treatment responses, and identification of genetic mutations. The key drivers include advancements in molecular diagnostics, increased prevalence of cancer, and growing awareness among healthcare providers. The leading players are focusing on developing innovative assays and expanding applications beyond oncology, such as prenatal testing and organ transplant monitoring, which is fostering market expansion. Regulatory support further boosts adoption and industry innovation.

United States Circulating Tumor Cells Liquid Biopsy Market

United States circulating tumor cells (CTCs) liquid biopsy market is on the rise, as demand for minimally invasive cancer diagnostics grows. CTCs are those cells shed from tumors into the bloodstream, giving critical insights about the progression of cancer, metastasis, and treatment efficacy. Technological advances in the field of CTC isolation, enumeration, and analysis drive the market forward, facilitating early detection and personalized treatment strategies. Key applications include monitoring the response to oncology treatments and identifying actionable genetic mutations. Increased cancer prevalence and the adoption of precision medicine continuously fuel the market. Major players are concentrating on innovative technologies and partnerships to bring better diagnostics, thus improving patient outcomes and competitiveness within the market.

United States Patient Monitoring Liquid Biopsy Market

The United States patient monitoring liquid biopsy market is seeing tremendous growth from real-time, non-invasive oncology and chronic disease management diagnostic tools. Liquid biopsies enable continuous tracking of disease progression and treatment response through biomarkers in blood and other bodily fluids. Advances in next-generation sequencing and digital PCR have improved accuracy and reliability, which is driving their adoption in the clinic. It is not only used for cancer but also in organ transplant monitoring and prenatal screening. The factors driving the market growth are rising chronic diseases, adoption of personalized medicine, and innovation in healthcare.

United States Blood Liquid Biopsy Market

The United States blood liquid biopsy market is rapidly growing, driven by advancements in non-invasive diagnostic technologies and the increasing prevalence of cancer. Blood liquid biopsies analyze circulating tumor cells (CTCs), cell-free DNA (cfDNA), and other biomarkers to detect, monitor, and manage diseases. This approach enables early cancer detection, real-time monitoring of treatment efficacy, and identification of genetic mutations for targeted therapies. Drivers for growth include the adoption of precision medicine, increasing applications in oncology and beyond, and technological innovation in molecular diagnostics. Collaboration between biotech firms, research institutions, and healthcare providers further promotes market adoption and innovation.

United States Liquid Biopsy Hospitals & Laboratories Market

The United States liquid biopsy hospitals and laboratories market is growing at a healthy pace as liquid biopsy technologies are increasingly being adopted in healthcare settings. Hospitals and laboratories utilize liquid biopsies for the non-invasive detection of cancer, treatment monitoring, and genetic profiling, which allows for faster and more accurate diagnosis compared to traditional methods. Increasing incidence of cancer, new molecular diagnostic equipment, and personalized medicine are considered to be drivers of this market. Additionally, hospitals focus on integrating liquid biopsy solutions to improve patient outcomes, while laboratories invest in expanding capabilities for biomarker analysis, supporting the market's expansion and driving healthcare innovation.

United States Liquid Biopsy Market Segments

Cancer Types

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Prostate Cancer

- Liver Cancer

- Other Cancer

Products

- Kits & Reagents

- Platforms & Instruments

- Services

Application

- Early Diagnosis

- Patient Monitoring

- Recurrence Monitoring

Biomarkers

- Circulating Tumor Cells (CTCs)

- Circulating Tumor DNA (ctDNA)

- Extracellular Vesicles (EVs)

Sample Types

- Blood

- Urine

- Others

End-Users

- Hospitals & Laboratories

- Governments & Academic Research Centers

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

- Thermo Fisher Scientific Inc.

- Roche Diagnostics

- Bio-Rad Laboratories Inc.

- Biocept, Inc.

- Biocartis

- Myriad Genetics, Inc.

- Exact Sciences (Genomic Health)

- NeoGenomics Laboratories

- Quest Diagnostic Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Cancer Types, Product, Biomarkers, Application, Sample Types & End User |

| Cancer Types Covered | 1. Lung Cancer 2. Breast Cancer 3. Colorectal Cancer 4. Prostate Cancer 5. Liver Cancer 6. Other Cancer |

| Companies Covered | 1. Thermo Fisher Scientific Inc. 2. Roche Diagnostics 3. Bio-Rad Laboratories Inc. 4. Biocept, Inc. 5. Biocartis 6. Myriad Genetics, Inc. 7. Exact Sciences (Genomic Health) 8. NeoGenomics Laboratories 9. Quest Diagnostic Inc. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Liquid Biopsy Market

6. Market Share

6.1 By Cancer Types

6.2 By Product

6.3 By Biomarkers

6.4 By Application

6.5 By Sample Types

6.6 By End User

7. Cancer Types

7.1 Lung Cancer

7.2 Breast Cancer

7.3 Colorectal Cancer

7.4 Prostate Cancer

7.5 Liver Cancer

7.6 Other Cancer

8. Products

8.1 Kits & Reagents

8.2 Platforms & Instruments

8.3 Services

9. Biomarkers

9.1 Circulating Tumor Cells (CTCs)

9.2 Circulating Tumor DNA (ctDNA)

9.3 Extracellular Vesicles (EVs)

9.4 Other Biomarker Types

10. Application

10.1 Early Diagnosis

10.2 Patient Monitoring

10.3 Recurrence Monitoring

11. Sample Types

11.1 Blood

11.2 Urine

11.3 Others

12. End User

12.1 Hospitals & Laboratories

12.2 Governments & Academic Research Centers

13. Porter's Five Forces Analysis

13.1 Bargaining Power of Buyers

13.2 Bargaining Power of Suppliers

13.3 Degree of Competition

13.4 Threat of New Entrants

13.5 Threat of Substitutes

14. SWOT Analysis

14.1 Strength

14.2 Weakness

14.3 Opportunity

14.4 Threats

15. Key Players Analysis

15.1 Thermo Fisher Scientific Inc.

15.1.1 Overview

15.1.2 Recent Development

15.1.3 Revenue

15.2 Roche Diagnostics

15.2.1 Overview

15.2.2 Recent Development

15.2.3 Revenue

15.3 Bio-Rad Laboratories Inc.

15.3.1 Overview

15.3.2 Recent Development

15.3.3 Revenue

15.4 Biocept, Inc.

15.4.1 Overview

15.4.2 Recent Development

15.4.3 Revenue

15.5 Biocartis

15.5.1 Overview

15.5.2 Recent Development

15.5.3 Revenue

15.6 Myriad Genetics, Inc.

15.6.1 Overview

15.6.2 Recent Development

15.6.3 Revenue

15.7 Exact Sciences (Genomic Health)

15.7.1 Overview

15.7.2 Recent Development

15.7.3 Revenue

15.8 NeoGenomics Laboratories

15.8.1 Overview

15.8.2 Recent Development

15.8.3 Revenue

15.9 Quest Diagnostic Inc.

15.9.1 Overview

15.9.2 Recent Development

15.9.3 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com