United States Motorcycle Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Motorcycle Market Trends & Summary

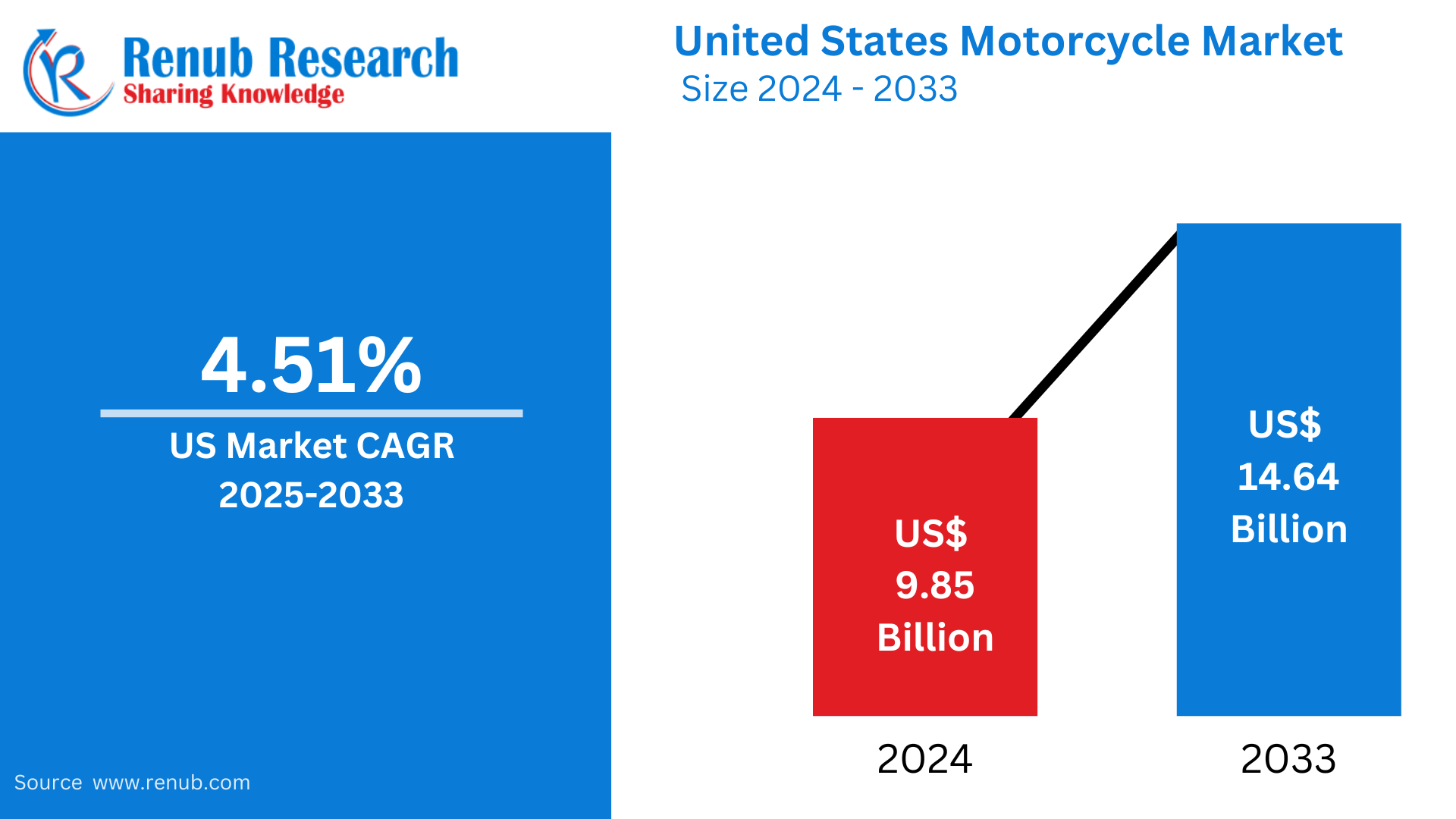

United States' motorcycle market stood at US$ 9.85 billion in 2024 and is anticipated to grow to US$ 14.64 billion by 2033. The market is forecasted to grow at a compound annual growth rate (CAGR) of 4.51% from 2025 to 2033. Growth is fueled by growing consumer popularity for recreational riding, escalating use of electric motorcycles, and technology growth related to safety and performance.

The report United States Motorcycle Market Forecast covers by Product (Motorbikes, Scooters, Mopeds), Type (Standard, Sports, Cruiser, Touring, Others), (Propulsion, ICE, Electric), Engine Capacity (Up to 200cc, 200cc to 400cc, 400cc to 800cc, More than 800cc), Region (East, West, North, South), Company Analysis 2025-2033.

United States Motorcycle Market Forecasts

Motorcycle is a two-wheeled motorbike meant for speed, agility, and efficiency on fuel. There are several categories of motorcycles like cruisers, sportbikes, touring, dirt, and electric bikes catering to diverse styles of riding. Motorcycles find extensive usage as a mode of commuting, overlong travel, and recreation.

Motorcycles are extremely popular in the United States because of the affordability factor, fuel economy, and excitement that comes from the ride. The nation boasts a vibrant motorcycle culture, with legendary brands such as Harley-Davidson, Indian, and Honda being the market leaders. Festivals like Daytona Bike Week and Sturgis Motorcycle Rally draw thousands of fans annually. Increased popularity of adventure touring and off-road riding has stimulated sales, and increased demand for electric motorcycles supports sustainability trends. Younger consumers are also attracted to customization possibilities and sophisticated safety features. With growing innovation and an avid riding culture, the U.S. motorcycle market remains on the upswing.

United States Motorcycle Market Growth Drivers

Growing Need for Fuel-Saving and Economical Transportation

Motorcycles are emerging as the mode of transportation for commuters owing to their fuel-saving nature and economy when compared with automobiles. As fuel costs rise and urban traffic worsens, riders turn to motorcycles as a budget-friendly transportation option. Entry-level motorcycles, especially in the 200cc to 400cc segment, offer lower upfront costs and fuel consumption, making them an attractive alternative. Additionally, rising interest in eco-friendly transportation solutions has further boosted the market for motorcycles, particularly among younger riders and city dwellers seeking efficient mobility options.

Growing Popularity of Recreational and Adventure Motorcycling

Recreational riding and adventure touring trend have played an important role in the expansion of the U.S. motorcycle market. Enthusiasts spend money on touring motorcycles, adventure motorcycles, and sports motorcycles to go on weekend getaways and cross-country excursions. Motorcycling events like Sturgis Motorcycle Rally and Daytona Bike Week keep on drawing thousands of riders, giving a boost to motorcycle culture. With technology improvements, such as improved suspension, enhanced fuel economy, and intelligent riding assistance, adventure motorcycling has become popular among riders seeking thrilling riding experiences. May 2024, CFMoto is slowly making a presence in the US and European motorcycle markets by providing well-spec'd models at affordable prices. Its success is also supported by a tie-up with KTM's parent company, Pierer Mobility, with shared parts and manufacturing facilities.

Growth of the Electric Motorcycle Market

The electric motorcycle business is expanding at a fast pace because of growing worries regarding emissions and government incentives for green mobility. Large players are making big investments in battery-powered motorcycles with longer ranges, quick charging, and smart connectivity options. Companies such as Zero Motorcycles and Harley-Davidson's LiveWire are spearheading the creation of high-performance electric motorcycles. Better charging infrastructure and increasing environmental consciousness among consumers are likely to fuel the demand for electric motorcycles, especially in cities where emission standards are tough. Oct 2023, Kawasaki launched its first electric motorcycles in the U.S., the Ninja e-1 and Z e-1. They utilize the same powertrain but have different looks: the Ninja e-1 is completely faired, and the Z e-1 is a naked bike.

Challenges facing the United States Motorcycle Industry

High Premium and Big-Engine Motorcycles Cost

The premium price of premium motorcycles, especially in the 400cc to 800cc and touring motorcycle categories, is a challenge to market growth. High-performance motorcycles need sophisticated engineering, high-quality materials, and cutting-edge features, which drive up their cost. Furthermore, insurance premiums and maintenance costs for luxury motorcycles discourage price-conscious consumers. While financing has become more attractive, the market still has challenges making large-engine and luxury motorcycles affordable to the masses.

Safety Issues and Regulatory Implications

Motorcycle safety is a top issue, and it affects market growth. Increased accident rates over cars, improper use of riding gear, and road safety laws deter consumers. Government regulations mandating stricter emissions, helmet mandates, and licensing requirements can also hinder market growth. Although safety technology advancements like ABS, traction control, and rider-assist systems are enhancing safety, consumer trust in motorcycle riding as a safe means of transportation is a top challenge.

United States Motorbikes Market

Motorbikes include a wide variety of two-wheelers such as scooters, standard motorcycles, and lightweight commuter motorcycles. They are designed for city dwellers and young working professionals seeking pocket-friendly and easy-to-drive vehicles. Increased usage of ride-sharing services and motorcycle rentals has also driven up demand for motorbikes, particularly in cities. Greater preference towards low-maintenance and fuel-efficient vehicles makes motorbikes an attractive choice among many first-time buyers. With enhanced designs, fuel economy, and affordability, the U.S. motorbike industry is likely to witness consistent expansion.

United States Sports Motorcycle Market

Sports bikes, with their high-performance engines, aerodynamic design, and speed, find takers in riders who love to ride fast and track racing. The top brands such as Yamaha, Kawasaki, and Ducati own this segment with sophisticated suspension systems, light frames, and top-of-the-line technology. The demand for track-day events, motorcycle racing series, and street bikers has fueled the growth of the segment. Entry-level sports bikes of smaller displacement have also brought performance biking into the reach of a larger population.

United States Touring Motorcycle Market

Touring motorcycles are built for cross-country travel, comfort, and performance. The motorcycles have big fuel tanks, comfortable seats, and large storage spaces. Increased cross-country travel and motorcycle tourism have driven the demand for touring motorcycles. Tourists like riders with sophisticated navigation, entertainment, and cruise control for a better riding experience. Harley-Davidson and BMW are the market leaders in the touring motorcycle category, providing luxury options for adventure riders.

United States Electric Motorcycle Market

The market for electric motorcycles is growing fast with increasing environmental awareness, government subsidies, and battery technology advancements. Firms such as Zero Motorcycles, LiveWire, and Energica are leading the development of electric two-wheelers with longer battery life, high-speed performance, and intelligent connectivity. Zero-emission mobility and growing charging stations are fueling customer demand. Electric motorcycles are in great demand among city commuters seeking a low-maintenance, environmentally friendly, and cost-effective option to conventional gas-guzzling bikes.

United States 200cc to 400cc Motorcycle Market

This segment is highly sought after by new riders, price-sensitive consumers, and urban commuters. Reasonable prices, convenience of handling, and fuel economy make these motorcycles suitable for daily use. Companies such as Honda, Yamaha, and KTM provide a series of light-weighted models suitable for young riders and new motorcycle buyers. Demand for this segment is increasing as more riders choose cost-effective, entry-level motorcycles that provide a mix of power and efficiency.

United States 400cc to 800cc Motorcycle Market

The 400cc to 800cc category is preferred by intermediate riders and long-distance commuters who desire more power and comfort without the weight of heavy-duty touring motorcycles. These models provide a balance of performance, highway ability, and fuel economy. Suzuki, Kawasaki, and Triumph are some of the popular brands that produce mid-range motorcycles with good acceleration, high-end features, and improved handling. With riders graduating from smaller bikes, this category is growing.

East United States Motorcycle Market

The Eastern U.S. motorcycle market is largely driven by urban commuters and recreational riders. Cities such as New York, Washington D.C., and Boston have a strong demand for motorbikes and electric motorbikes because of traffic flow and the demand for effective commuting solutions. Florida and North Carolina, on the other hand, are favorite spots for cruisers and touring motorcycles because of picturesque routes and favorable weather. The Eastern U.S. market is multi-brand, with a high concentration of commuter as well as premium motorcycle brands.

West United States Motorcycle Market

Adventure biking, touring, and off-road motorcycling are the thrives of the Western U.S. motorcycle market. California, Arizona, and Colorado are states that have a high motorcycling culture, with users choosing sports bikes, adventure motorcycles, and electric motorcycles. The presence of scenic highways, mountain roads, and desert terrain makes the Western area an ideal location for motorcycle users. California, specifically, is a hotspot for electric motorcycles and high-performance motorcycles, with a developing market for new, sustainable designs.

United States Motorcycle Market Segments

Product

- Motorbikes

- Scooters

- Mopeds

Type

- Standard

- Sports

- Cruiser

- Touring

- Others

Propulsion

- ICE

- Electric

Engine Capacity

- Up to 200cc

- 200cc to 400cc

- 400cc to 800cc

- More than 800cc

Region

- East

- West

- North

- South

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Company Analysis

- HARLEY-DAVIDSON

- Suzuki Motor Corporation

- Honda Motor Co., Ltd.

- BMW AG

- Yamaha Motor Co., Ltd

- Kawasaki Heavy Industries, Ltd

- Triumph Motorcycles

- Ducati Motor Holding S.p.A

- KTM AG

- Polaris Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Type, Propulsion, Engine Capacity and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the market size of the United States motorcycle market in 2024?

-

What is the expected compound annual growth rate (CAGR) for the market from 2025 to 2033?

-

What are the main categories of motorcycles in the U.S. market?

-

Which factors are driving the growth of the U.S. motorcycle market?

-

How has the popularity of electric motorcycles impacted the U.S. motorcycle market?

-

Which U.S. regions show the highest demand for motorcycles?

-

What challenges are faced by the U.S. motorcycle market in terms of high-cost motorcycles and safety concerns?

-

What are the key brands dominating the motorcycle market in the U.S.?

-

How does the demand for recreational and adventure motorcycling contribute to the market’s growth?

-

What are the key segments in the U.S. motorcycle market based on engine capacity and propulsion type?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Motorcycle Market

6. Market Share

6.1 By Product

6.2 By Type

6.3 By Propulsion

6.4 By Engine Capacity

6.5 By Region

7. Product

7.1 Motorbikes

7.2 Scooters

7.3 Mopeds

8. Type

8.1 Standard

8.2 Sports

8.3 Cruiser

8.4 Touring

8.5 Others

9. Propulsion

9.1 ICE

9.2 Electric

10. Engine Capacity

10.1 Up to 200cc

10.2 200cc to 400cc

10.3 400cc to 800cc

10.4 More than 800cc

11. Region

11.1 East

11.2 West

11.3 North

11.4 South

12. Porter’s Five Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Company Analysis

14.1 HARLEY-DAVIDSON

14.1.1 Overview

14.1.2 Key Persons

14.1.3 Recent Development

14.1.4 Revenue

14.2 Suzuki Motor Corporation

14.2.1 Overview

14.2.2 Key Persons

14.2.3 Recent Development

14.2.4 Revenue

14.3 Honda Motor Co., Ltd.

14.3.1 Overview

14.3.2 Key Persons

14.3.3 Recent Development

14.3.4 Revenue

14.4 BMW AG

14.4.1 Overview

14.4.2 Key Persons

14.4.3 Recent Development

14.4.4 Revenue

14.5 Yamaha Motor Co., Ltd

14.5.1 Overview

14.5.2 Key Persons

14.5.3 Recent Development

14.5.4 Revenue

14.6 Kawasaki Heavy Industries, Ltd

14.6.1 Overview

14.6.2 Key Persons

14.6.3 Recent Development

14.6.4 Revenue

14.7 Triumph Motorcycles

14.7.1 Overview

14.7.2 Key Persons

14.7.3 Recent Development

14.7.4 Revenue

14.8 Ducati Motor Holding S.p.A

14.8.1 Overview

14.8.2 Key Persons

14.8.3 Recent Development

14.8.4 Revenue

14.9 KTM AG

14.9.1 Overview

14.9.2 Key Persons

14.9.3 Recent Development

14.9.4 Revenue

14.10 Polaris Inc.

14.10.1 Overview

14.10.2 Key Persons

14.10.3 Recent Development

14.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com