United States Movie Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Movie Market Trends & Summary

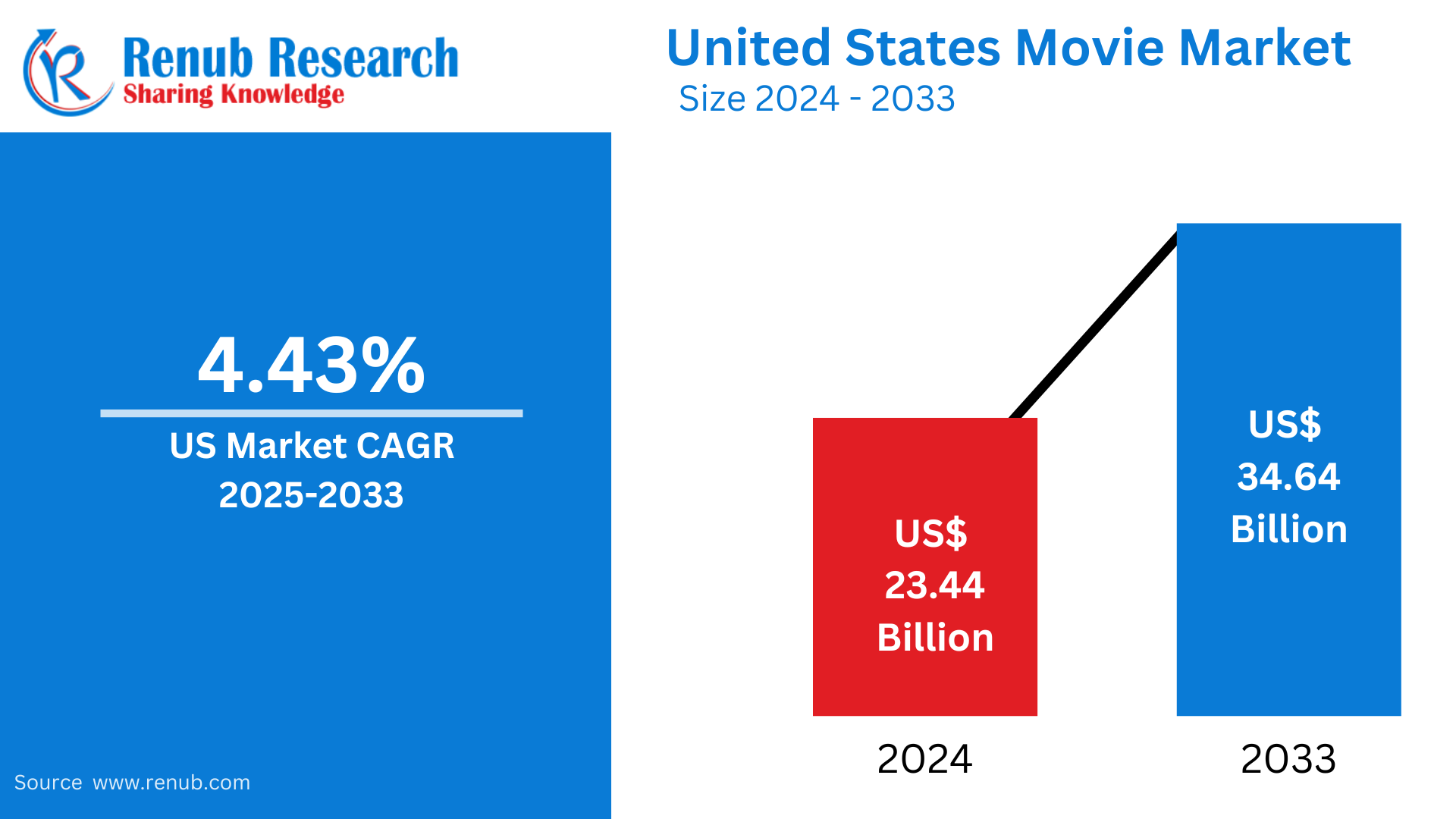

The US movie market is expected to stand at about US$ 34.64 Billion by 2033, with growth from US$ 23.44 Billion in 2024 at a CAGR of 4.43% during 2025-2033. This growth is compounded by higher consumer demand for diverse content, increased investments in streaming, and advancements in cinematic technologies, which positions the US as an important player in the global entertainment industry.

The report United States Movie Market & Forecast covers by Distribution Income (Income from the sale of movie tickets, Advertisement Income, Sale of Food & Beverages), Screen Type (Digital non -3D, Digital 3D, Others), Gender (Male, and Female), Age-Group (Age Group 2-11, Age Group 12-17, Age Group 18-24, Age Group 25-39, Age Group 40-49, Age Group 50-59, and Age Group 60 plus), and Company Analysis 2025-2033.

United States Movie Market Outlook

A movie, also called a film, is a visual story that is used in entertaining, educating, or inspiring people by the use of moving images, sound, and dialogue. Movies are created through artistic and technical processes, such as scriptwriting, directing, acting, cinematography, and editing. They include genres like action, comedy, drama, and science fiction, thus appealing to various tastes and preferences. Movies are watched in theaters, streaming platforms, or through physical media, such as DVDs.

Movies play a significant role in American culture because they reflect the face of society and thereby dictate the popular narratives. The United States is home to Hollywood, an international hub of film production, where blockbusters are produced each year which attract millions of viewership. The number of streaming sites has once again increased access, where people can watch movies anytime, and anywhere. Movies are preferred in American society because of their entertainment, narrative, and ability to harmonize masses together, thus being the base of national recreation.

Drivers for Growth in United States Movie Industry

Technological Advancements in Film Production and Distribution

With the advent of high-definition visual effects, computer-generated imagery, and immersive audio systems, films have become better than ever to watch. But with the creation of streaming websites and distribution channels, movie viewing has reached a new frontier, allowing customers to view any movie from home. These innovations facilitate more interaction and higher viewership, contributing to the increasing U.S. movie industry. August 2024, Cosmo Films, a specialist LMS leader, is unveiling seven new products in the U.S. market at Label Expo Americas 2024, with the aim to innovate and capture the market for these products.

Franchise Movies Gaining Momentum

Franchise films, including superhero sagas and multi-sequel blockbusters, dominate the box office. These movies have a loyal fan base, which ensures consistent demand. The interconnected storytelling and expansive universes create anticipation and drive repeat viewership, making franchise films a cornerstone of market growth.

Shift Toward Streaming Platforms

The streaming services like Netflix, Disney+, and Amazon Prime Video have transformed the market by offering content that is different and exclusive to their respective services. This has further led to the U.S. movie market being propelled by changing consumer preferences for on-demand entertainment.

In Jan 2024. Netflix agreed to a ten-year, $5 billion deal with WWE to exclusively broadcast Monday Night Raw worldwide from 2025. It also agreed to a $150 million deal with the NFL for the global broadcast rights to at least one live Christmas Day game over the next three years. The company also acquired exclusive rights to broadcast the next two editions of the FIFA Women's World Cup in the US.

Challenges in the US Movie Market

Declining Theatre Attendance

Attendance in the theatres of the US has reduced because of streaming services, as well as because of the increasing ticket price. The trend was accelerated during the COVID-19 pandemic since audiences became used to watching the new releases from home. The shift is very challenging for traditional movie theatres and the market.

Piracy and Content Leakage

The U.S. movie market is gravely being affected by online piracy and content leaks, which find illegal ways to distribute films.

This heavily hits the box office revenue and also the streaming subscriptions, and thus, deprives studios and distributors of profitability.

Combating piracy remains a persistent challenge.

United States Movie Market Overview by Regions

Arizona Movie Market

Arizona’s movie market is experiencing steady growth, driven by its scenic landscapes, tax incentives, and a supportive film community. Cities like Phoenix and Tucson offer diverse filming locations, from deserts to urban settings. Local festivals, including the Phoenix Film Festival, showcase emerging talent and independent films. Arizona's affordability and warm weather year-round attract indie filmmakers and significant productions, contributing to its growing presence in the national film industry.

California Movie Market

California is the heart of the U.S. film industry, with Hollywood as its epicenter. Los Angeles continues to attract top talent, studios, and major productions, supported by an extensive infrastructure for film and TV production. Streaming services like Netflix, Amazon, and Disney+ have further fueled demand for content creation. California offers vast landscapes and lively film festivals like Sundance, where all types of genres and independent films get the platform, placing it on the global scale of film hubs. New York Movie Market

New York has a richly diverse film industry. From the beautiful skyscrapers to the rural lands, it offers a wide range of filming locations.

The state offers excellent incentives to filmmakers and has a good infrastructure of studios and production houses. The cities include New York City, Buffalo, and Rochester. Big blockbusters as well as small independent films are shot here. Other events such as the Tribeca Film Festival showcase the city as a place of creativity and innovation in filmmaking. Washington Movie Market Washington’s movie market is gaining traction, driven by its lush landscapes, vibrant cities, and supportive film incentives.

Seattle, in particular, serves as a hub for independent filmmakers and larger productions, with growing opportunities for new talent.

Tax incentives and a strong film community attract filmmakers to the state, offering a variety of genres and productions. Events like the Seattle International Film Festival provide a platform for showcasing films, solidifying Washington’s position in the evolving U.S. movie market.

United States Movie Market Segments

Distribution Income – Market breakup from 4 viewpoints:

1. Income from the sale of movie tickets

2. Advertisement Income

3. Sale of Food & Beverages

4. Others

Screen Type – Market breakup from 3 viewpoints:

1. Digital non -3D

2. Digital 3D

3. Others

Gender – Market breakup from 2 viewpoints:

1. Male

2. Female

Age-Group – Market breakup from 7 viewpoints:

1. Age Group 2-11

2. Age Group 12-17

3. Age Group 18-24

4. Age Group 25-39

5. Age Group 40-49

6. Age Group 50-59

7. Age Group 60 plus

States – Market breakup from 38 viewpoints:

1. Alabama

2. Arizona

3. California

4. Colorado

5. Connecticut

6. Florida

7. Georgia

8. Idaho

9. Illinois

10. Indiana

11. Iowa

12. Kansas

13. Maine

14. Maryland

15. Massachusetts

16. Michigan

17. Minnesota

18. Mississippi

19. Missouri

20. Nebraska

21. Nevada

22. New Hampshire

23. New Jersey

24. New York

25. North Carolina

26. Ohio

27. Oregon

28. Pennsylvania

29. Rhode Island

30. South Carolina

31. South Dakota

32. Tennessee

33. Texas

34. Utah

35. Virginia

36. Washington

37. Wyoming

38. Others

All companies have been covered from 3 viewpoints:

• Overview

• Recent Developments

• Revenue

Company Analysis:

1. Cinemark Holding, Inc.

2. Regal Cinemas

3. CGV Cinemas

4. AMC Theatres

5. Marcus Theatres

6. B&B Theatres

7. AMC

8. Empire Cinema

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Distribution Income, Screen Type, Gender, Age-Group and States |

| States Covered | 1. Alabama 2. Arizona 3. California 4. Colorado 5. Connecticut 6. Florida 7. Georgia 8. Idaho 9. Illinois 10. Indiana 11. Iowa 12. Kansas 13. Maine 14. Maryland 15. Massachusetts 16. Michigan 17. Minnesota 18. Mississippi 19. Missouri 20. Nebraska 21. Nevada 22. New Hampshire 23. New Jersey 24. New York 25. North Carolina 26. Ohio 27. Oregon 28. Pennsylvania 29. Rhode Island 30. South Carolina 31. South Dakota 32. Tennessee 33. Texas 34. Utah 35. Virginia 36. Washington 37. Wyoming 38. Others |

| Companies Covered | 1. Cinemark Holding, Inc. 2. Regal Cinemas 3. CGV Cinemas 4. AMC Theatres 5. Marcus Theatres 6. B&B Theatres 7. AMC 8. Empire Cinema |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the expected market size of the United States movie market by 2033?

-

What is the compound annual growth rate (CAGR) of the U.S. movie market between 2025 and 2033?

-

Which distribution income sources contribute to the U.S. movie market?

-

How has the shift towards streaming platforms influenced the U.S. movie market?

-

What technological advancements have played a role in the growth of the movie industry?

-

How have franchise movies impacted box office revenues in the U.S.?

-

What are the challenges that the U.S. movie industry faces, especially in terms of piracy?

-

Which states are showing the highest movie market activity and growth?

-

How do movie theaters in Arizona, California, and New York contribute to the U.S. movie market?

-

What are the major trends in the U.S. movie market based on gender, age groups, and screen type?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Movie Market

6. Market Share

6.1 By Distribution Income

6.2 By Screen Types

6.3 By Gender

6.4 By Age Groups

6.5 By States

7. Distribution Income

7.1 Income from the sale of movie tickets

7.2 Advertisement Income

7.3 Sale of Food & Beverages

7.4 Others

8. Screen Types

8.1 Digital non -3D

8.2 Digital 3D

8.3 Others

9. Gender

9.1 Male

9.2 Female

10. Age Groups

10.1 Age Group 2-11

10.2 Age Group 12-17

10.3 Age Group 18-24

10.4 Age Group 25-39

10.5 Age Group 40-49

10.6 Age Group 50-59

10.7 Age Group 60 plus

11. States

11.1 Alabama

11.2 Arizona

11.3 California

11.4 Colorado

11.5 Connecticut

11.6 Florida

11.7 Georgia

11.8 Idaho

11.9 Illinois

11.10 Indiana

11.11 Iowa

11.12 Kansas

11.13 Maine

11.14 Maryland

11.15 Massachusetts

11.16 Michigan

11.17 Minnesota

11.18 Mississippi

11.19 Missouri

11.20 Nebraska

11.21 Nevada

11.22 New Hampshire

11.23 New Jersey

11.24 New York

11.25 North Carolina

11.26 Ohio

11.27 Oregon

11.28 Pennsylvania

11.29 Rhode Island

11.30 South Carolina

11.31 South Dakota

11.32 Tennessee

11.33 Texas

11.34 Utah

11.35 Virginia

11.36 Washington

11.37 Wyoming

11.38 Others

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Key Players Analysis

14.1 Cinemark Holding, Inc.

14.1.1 Overview

14.1.2 Recent Development

14.2 Regal Cinemas

14.2.1 Overview

14.2.2 Recent Development

14.3 CGV Cinemas

14.3.1 Overview

14.3.2 Recent Development

14.4 AMC Theatres

14.4.1 Overview

14.4.2 Recent Development

14.5 Marcus Theatres

14.5.1 Overview

14.5.2 Recent Development

14.6 B&B Theatres

14.6.1 Overview

14.6.2 Recent Development

14.7 AMC

14.7.1 Overview

14.7.2 Recent Development

14.8 Empire Cinema

14.8.1 Overview

14.8.2 Recent Development

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com