United States Nicotine Pouches Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Nicotine Pouches Market Trends & Summary

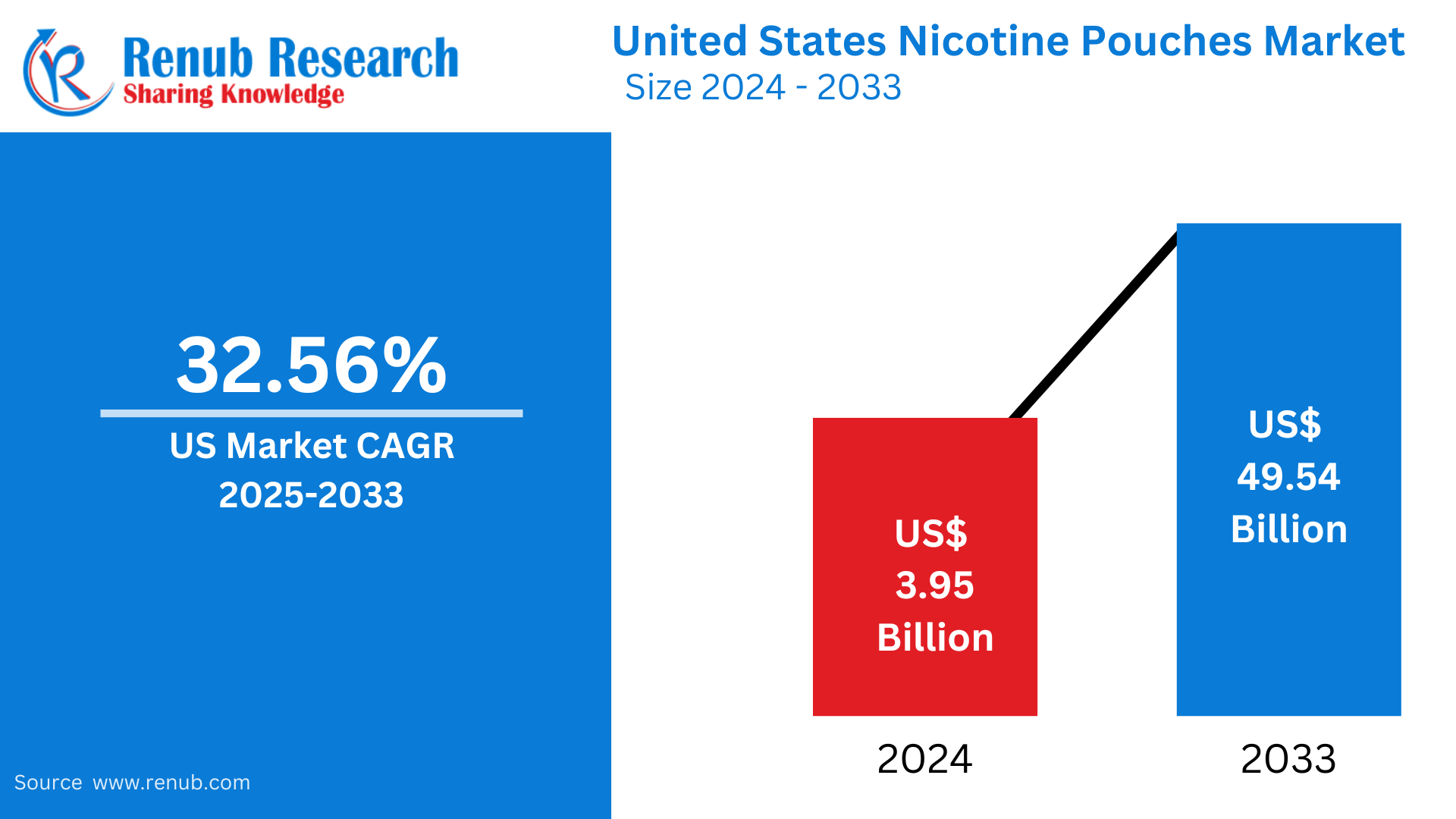

The United States nicotine pouches market accounted for around USD 3.95 billion in 2024 and is expected to grow to around USD 49.54 billion by 2033 at a compound annual growth rate of 32.56% during the period from 2025 to 2033. The growth is fueled by the growing health awareness of consumers and the trend towards smoke-free products. Synthetic nicotine products introduction by large firms, including British American Tobacco's Velo Plus, is also fueling growth in the market.

The report United States Nicotine Pouches Market Forecast covers by Product (Tobacco derived, Synthetic), Flavor ((Original/UnflavoredFlavored), (Fruit, Mint, Coffee, Cinnamon, Others (Cool Cider, Licorice, etc.)), Strength (Light (2 mg/pouch), Normal (3 mg/pouch), Strong (4-6 mg/pouch), Extra Strong (More than 8 mg/pouch)), Distribution channel (Offline, Online), Region and Company Analysis 2025 – 2033.

United States Nicotine Pouches Market Outlooks

Nicotine pouches are tobacco-free, smokeless products that deliver nicotine in a hidden and convenient manner. These small pouches are pre-measured and filled with synthetic or extracted nicotine, flavorings, and plant fibers. They do not involve smoking or chewing like traditional tobacco products. Users just put the pouch between the gum and the lip, and the nicotine is absorbed by the oral mucosa.

In the US, nicotine pouches have become increasingly popular as a smoke-free alternative to chewing tobacco, vapes, and cigarettes. They are widely used by those who want to minimize their exposure to toxic combustion-related chemicals but still get their nicotine fix. Nicotine pouches are popular among consumers due to their convenience, odorlessness, and the fact that they can be used in public areas where smoking or vaping is prohibited. The market is expanding at a fast pace, fueled by demand for healthier nicotine consumption and a greater variety of flavors and nicotine strengths to suit different user needs.

Growth Drivers in the United States Nicotine Pouches Market

Increasing Demand for Smoke-Free Options

With increasing consumers looking for healthier nicotine consumption, nicotine pouches have become increasingly popular as a smokeless and tobacco-free option. Numerous users are turning away from the conventional cigarette and vaping to pouches because of lung health concerns and secondhand smoke. Ease of use in public areas and workplaces where smoking is banned also increases market demand. With increasing health awareness and government restrictions on smoking, nicotine pouches are an attractive harm-reduction alternative. Nov 2024, Philip Morris International Inc. marks the 10th year of its smoke-free product, IQOS, a milestone towards the company's vision for a future without cigarettes.

Broadening Product Range and Flavors

The diversity of nicotine pouch flavors such as fruit, mint, coffee, and tobacco has driven market growth. Manufacturers are constantly introducing new flavors and levels of nicotine to suit varying consumer tastes. Flavored nicotine pouches appeal to a wide age group, such as former smokers and new consumers seeking a pleasurable experience. The range enhances brand loyalty and leads more consumers to switch from conventional tobacco products to nicotine pouches. September 2023, Premier Manufacturing Inc. collaborated with Enorama Pharma Inc. to introduce tobacco-free nicotine pouches, NIC-S, in the United States. They are available in unflavored and flavored varieties such as mint, berry, orange, cinnamon, and wintergreen, in 3 mg, 6 mg, and 9 mg strengths.

Greater Availability Via Online and Retail Sales

Growth of nicotine pouch availability on both the online and offline retail fronts has increased their availability to consumers. Some brands sell directly to consumers via e-commerce, with subscription services and coupons. Convenience stores, filling stations, and supermarkets have also expanded shelf space for nicotine pouches, which are leading to impulse buying. With deepening retail penetration and direct-to-consumer sales strategies, the market is posting steady growth across various consumer segments. September 2024, Tucker Carlson will introduce a new brand, Alp, in November 2024, with nicotine pouches in four distinctive flavors and three strengths, one of which is 33% stronger than ZYN's strongest offering.

Nicotine Pouches Market Challenges in the United States

Regulatory Uncertainty and FDA Scrutiny

The market for nicotine pouches is challenged by regulation as the FDA continues to assess its long-term health effects. Although nicotine pouches are marketed as a reduced-risk product, fear of possible addiction and youth attraction has prompted stricter regulations. Flavour bans and advertising restrictions could constrain market growth. Uncertainty over future regulation poses challenges to manufacturers, needing to balance compliance with consumer attraction.

Increasing Worries Over Youth Adoption

Nicotine pouches, particularly flavored ones, have been at the center of controversy regarding potential youth appeal. Although positioned as an adult nicotine product to smoking, there has been fear of flavors such as fruit and candy appealing to under-age consumers. This has driven regulatory pressure as well as lobbying by advocacy groups demanding tighter age verification controls and marketing bans. Mitigating these issues is essential to support sustainable market development.

United States Tobacco-Derived Nicotine Pouches Market

Tobacco-derived nicotine pouches have nicotine derived from tobacco leaves but no actual tobacco plant material. The pouches are popular among consumers who want an alternative to cigarettes but still want nicotine from conventional sources. Companies selling these products highlight lower harm in comparison to combustible tobacco. The segment is expanding as increasing numbers of smokers switch to smokeless products but retain their preference for nicotine intake. As per CDC statistics released in September 2024, nearly 2.9% of American adults used nicotine pouches, thereby fueling the expansion of the nicotine pouches market in the United States.

United States Flavored Nicotine Pouches Market

The market is controlled by flavored nicotine pouches as they can provide a more pleasurable and personalized experience. Flavors like mint, citrus, coffee, and berry are highly sought after by a large customer base. The range of flavors appeals to current nicotine consumers as well as new customers seeking a substitute for conventional tobacco products. Potentially, regulatory prohibitions against flavored nicotine products might affect future expansion. As of July 2024, CDC figures indicate that almost 67.7% of adults in the United States are interested in quitting smoking, with approximately half trying to do so within the last year. Health-aware consumers are switching to safer options, including nicotine pouches, which come in different brands and flavors, fueling market growth.

United States Fruit Nicotine Pouches Market

Fruit-flavored nicotine pouches like mango, berry, and citrus are the top-selling flavor variants available in the market. These give a refreshing flavor that covers the bitterness of nicotine, making them more desirable for use. Most consumers like fruit-flavored pouches as a refreshing option compared to regular tobacco or menthol-based products. This segment is likely to continue growing, particularly among younger adult consumers.

United States Coffee Nicotine Pouches Market

Coffee-flavored nicotine pouches appeal to consumers who enjoy the taste of coffee while seeking a nicotine boost. These pouches mimic the rich, bold flavors of coffee, making them a favorite among working professionals and coffee enthusiasts. The combination of nicotine and coffee flavors provides a familiar and satisfying experience. As coffee culture remains strong in the U.S., this segment continues to expand.

United States Normal (3 mg/pouch) Nicotine Pouches Market

The 3 mg/pouch nicotine segment is also a very popular segment with casual and moderate users of nicotine. This strength of nicotine gives a balanced experience without being too strong, so it is best for those moving from vaping or smoking. Most brands have their 3 mg offerings as the default for daily use, so they are easily found in online and offline stores. In August 2022, ZYN (Swedish Match AB) introduced tobacco-flavored nicotine pouches in strengths of 3 mg and 6 mg, and several 3 mg flavors such as cool mint, citrus cool mint, original, apple mint, gold sweet tobacco, and bellini.

United States Offline Nicotine Pouches Market

Offline nicotine pouch demand is fueled by the growing presence of products on the shelves of physical retail stores like gas stations, supermarkets, and convenience stores. Most customers like buying nicotine pouches in-store because they are available instantly and can test various brands. Physical stores continue to increase the variety of nicotine pouches they sell, further driving the overall market growth. In August 2022, Haypp Group launched a warehouse in Missouri City, Texas, to enhance the distribution of nicotine pouches in the southern United States.

East United States Nicotine Pouches Market

The East U.S. is in great demand for nicotine pouches, led by major cities like New York, Boston, and Washington, D.C. The customers in this area prefer convenience and ease of access, resulting in high sales through retail outlets and online channels. The availability of tobacco-free campaigns and smoking bans also promotes the use of nicotine pouches as a substitute for conventional smoking.

West United States Nicotine Pouches Market

The Western United States, especially California and Washington, is a promising market for nicotine pouches because the region emphasizes health and wellness. People in this region are more likely to shift to smokeless products to minimize health hazards of smoking. The increasing popularity of tech-friendly and e-commerce-based buying habits also helps to fuel the demand for nicotine pouches in this region.

North United States Nicotine Pouches Market

In the North U.S., cold weather restricts outdoor smoking in winter, and nicotine pouches provide a convenient means of consumption for those seeking an indoor way to use nicotine. The market experiences consistent demand, especially across states such as Illinois, Minnesota, and Michigan. Since there is an increase in the preference for smokeless products, the North U.S. remains a prominent segment for selling nicotine pouches.

United States Nicotine Pouches Market Segments

Product

- Tobacco derived

- Synthetic

Flavor

- Original/ Unflavored

- Flavored

- Fruit

- Mint

- Coffee

- Cinnamon

- Others (Cool Cider, Licorice, etc.)

Strength

- Light (2 mg/pouch)

- Normal (3 mg/pouch)

- Strong (4-6 mg/pouch)

- Extra Strong (More than 8 mg/pouch)

Distribution Channel

- Offline

- Online

Region

- East

- West

- North

- South

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Company Analysis

- Velo (British American Tobacco p.l.c)

- On! (Altria Group, Inc.)

- ZYN (Swedish Match AB)

- ZONE (Imperial Brands plc)

- Swisher (Rogue Holdings, LLC)

- FRE POUCH

- Black Buffalo

- Sesh Products

- Cotton Mouth Nicotine

- JUICE HEAD

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Flavor, Strength, Distribution Channel and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the United States nicotine pouches market by 2033?

-

What is the compound annual growth rate (CAGR) expected for the nicotine pouches market from 2025 to 2033?

-

Which factors are contributing to the growing demand for nicotine pouches in the United States?

-

How do nicotine pouches differ from traditional tobacco products in terms of consumption?

-

What are the major flavors offered in the nicotine pouches market?

-

What is the role of synthetic nicotine products in the market's growth?

-

How do government regulations and FDA scrutiny affect the growth of the nicotine pouches market?

-

What are some key challenges the market faces, such as concerns over youth adoption and flavor bans?

-

Which regions in the United States are seeing the highest demand for nicotine pouches?

-

What are some of the major companies operating in the nicotine pouches market in the U.S.?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Nicotine Pouches Market

6. Market Share

6.1 By Product

6.2 By Flavor

6.3 By Strength

6.4 By Distribution channel

6.5 By Region

7. Product

7.1 Tobacco derived

7.2 Synthetic

8. Flavor

8.1 Original/ Unflavored

8.2 Flavored

8.2.1 Fruit

8.2.2 Mint

8.2.3 Coffee

8.2.4 Cinnamon

8.2.5 Others (Cool Cider, Licorice, etc.)

9. Strength

9.1 Light (2 mg/pouch)

9.2 Normal (3 mg/pouch)

9.3 Strong (4-6 mg/pouch)

9.4 Extra Strong (More than 8 mg/pouch)

10. Distribution channel

10.1 Offline

10.2 Online

11. Region

11.1 East

11.2 West

11.3 North

11.4 South

12. Porter’s Five Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Company Analysis

14.1 Velo (British American Tobacco p.l.c)

14.1.1 Overview

14.1.2 Key Persons

14.1.3 Recent Development

14.1.4 Revenue

14.2 On! (Altria Group, Inc.)

14.2.1 Overview

14.2.2 Key Persons

14.2.3 Recent Development

14.2.4 Revenue

14.3 ZYN (Swedish Match AB)

14.3.1 Overview

14.3.2 Key Persons

14.3.3 Recent Development

14.3.4 Revenue

14.4 ZONE (Imperial Brands plc)

14.4.1 Overview

14.4.2 Key Persons

14.4.3 Recent Development

14.4.4 Revenue

14.5 Swisher (Rogue Holdings, LLC)

14.5.1 Overview

14.5.2 Key Persons

14.5.3 Recent Development

14.5.4 Revenue

14.6 FRE POUCH

14.6.1 Overview

14.6.2 Key Persons

14.6.3 Recent Development

14.6.4 Revenue

14.7 Black Buffalo

14.7.1 Overview

14.7.2 Key Persons

14.7.3 Recent Development

14.7.4 Revenue

14.8 Sesh Products

14.8.1 Overview

14.8.2 Key Persons

14.8.3 Recent Development

14.8.4 Revenue

14.9 Cotton Mouth Nicotine

14.9.1 Overview

14.9.2 Key Persons

14.9.3 Recent Development

14.9.4 Revenue

14.10 JUICE HEAD

14.10.1 Overview

14.10.2 Key Persons

14.10.3 Recent Development

14.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com