United States Nutraceuticals Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Nutraceuticals Market Trends & Summary

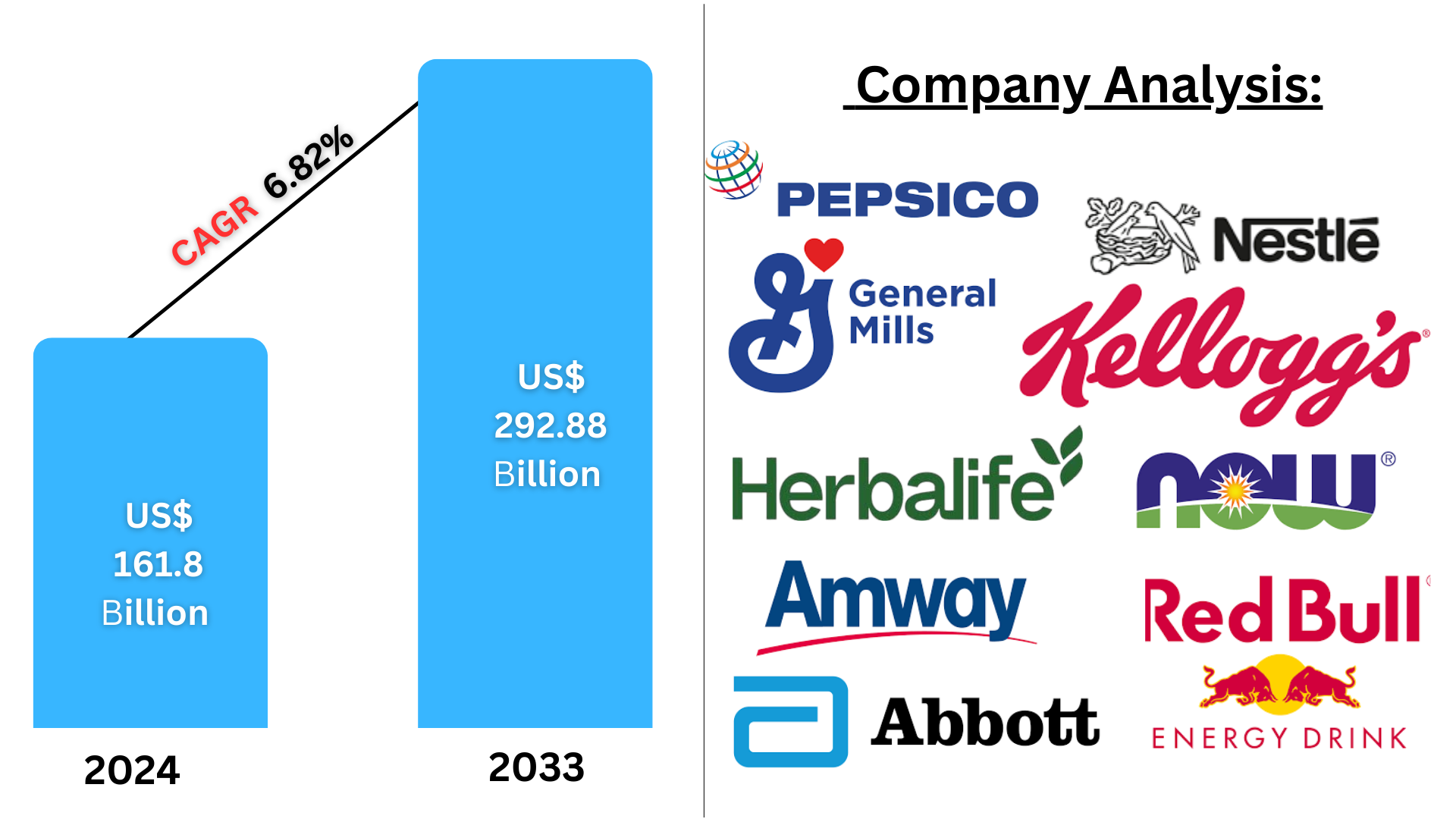

The United States market for nutraceuticals is anticipated to produce revenue of US$ 161.8 billion in 2024 and grow to US$ 292.88 billion in 2033 at a compound annual growth rate (CAGR) of 6.82% between 2025 and 2033. It is fueled by higher demand from consumers for functional food, dietary supplements, and natural health products spurred by a heightened level of awareness about health as well as trends in preventive care.

United States Nutraceuticals Market Forecast Report by Product Type (Functional Food (Cereal, Bakery and Confectionary, Dairy, Snack, Other Functional Foods), Functional Beverage (Energy Drink, Sports Drink, Fortified Juice, Dairy and Dairy Alternative Beverage, Other Functional Beverages), Dietary Supplements (Vitamins, Minerals, Botanicals, Enzyme, Fatty Acids, Proteins, Other Dietary Supplements), Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, Drug Stores/Pharmacies, Online Retail Stores, Other Distribution Channels), Regions and Company Analysis 2025-2033.

United States Nutraceuticals Market Outlooks

Nutraceuticals are food products that contain benefits in addition to basic nutrition. They comprise dietary supplements, functional foods, and beverages with medicinal or physiological benefits. Some examples of common nutraceuticals are vitamins, minerals, probiotics, herbal extracts, and fortified foods.

Nutraceuticals have an important place in preventive healthcare in the United States. With increasing health awareness, customers look for foods that enhance immunity, digestion, heart health, and overall health. Functional foods like omega-3-fortified foods, protein supplements, and probiotics are popularly consumed. Moreover, dietary supplements also address the gaps in nutrients, enhance brain function, and ensure healthy aging. Nutraceutical demand in the United States is fueled by an aging population, hectic lifestyles, and growing demand for natural health products. Customers prefer plant-based, organic, and scientifically researched products. As the incidence of chronic diseases such as obesity, diabetes, and cardiovascular diseases increases, nutraceuticals increasingly become a dominant part of an improved lifestyle.

Drivers of United States Nutraceuticals Market Growth

Health Consciousness on the Rise and Preventive Care

Heightened health awareness has driven the consumption of nutraceuticals in the U.S. Consumers are increasingly taking proactive steps towards avoiding chronic diseases like obesity, diabetes, and cardiovascular diseases by adding dietary supplements and functional foods to their daily lives. Consequently, companies are launching new products with natural, organic, and plant-based ingredients to meet the needs of health-aware consumers. Moreover, government programs encouraging nutrition and wellness also contribute to the growth of the nutraceutical market. July 2024, Zeam Health & Wellness, a multi-specialty clinic with offices in Sacramento, Roseville, and Folsom, will be opening in Northern California. Pacific Heartwood Wellness and Zeam Medical Group established it to offer holistic, personalized mental health care that merges empathy and research.

Increasing Aging Population and Need for Functional Foods

With an aging population of the United States, there is a rising need for nutraceuticals that improve longevity and correct age-related health issues. Functional foods with joint health, cognitive function, bone strength, and heart health products are gaining popularity. Foods fortified with omega-3 fatty acids, probiotics, and vitamins are popular across the globe. Increased demand for convenience has created the popularity of fortified cereals, energy drinks, and milk products as a part of daily nutrition. The U.S. population is likely to age as life expectancy increases and birth rates decline. Today, an estimated 62 million adults 65 and older comprise 18% of the population. In 2054, this segment is estimated to increase to 84 million, or 23% of the population.

Growth of E-commerce and Direct-to-Consumer Sales

Growth in online shopping and direct-to-consumer channels has played an important role in developing the U.S. nutraceuticals industry. Shoppers have greater access to a larger range of products online, enabling them to compare ingredients, read reviews, and make educated choices. E-commerce has allowed brands to connect with niche consumer bases and provide subscription-based services, guaranteeing ongoing consumer interaction. Digital marketing, social media, and influencer promotions further enhance the demand for nutraceuticals. July 2024, Nuherbs is a third-generation family-owned company that manufactures, imports, and distributes Chinese herbs and supplements. They have just rolled out a wholesale B2B E-commerce site named Spree, which has a mobile-first user interface optimized for repeat customers as well as new customers. Spree is integrated with an ERP solution for smooth order fulfillment and automated accounting, built and supported by Spark Solutions.

Difficulties in the United States Nutraceuticals Industry

Compliance with Regulations and Labeling Woes

The U.S. nutraceuticals industry is governed by strict regulation by the FDA and other bodies. Product safety, proper labeling, and adherence to health claims are required. Manufacturers may face difficulties with recurrent changes in rules, which increases research, formulation, and testing for compliance at a higher cost. Misleading statements or non-compliance with guidelines can have legal repercussions and loss of customer confidence.

High Competition and Price Sensitivity

The U.S. nutraceuticals industry is very competitive, with many players having a range of products. Consumers are exposed to a wide range of options, and it becomes difficult for brands to stand out. Price sensitivity among consumers also affects sales, particularly for premium products. Firms must spend on branding, innovation, and value-added features to retain customer loyalty and support premium pricing.

United States Cereal Nutraceuticals Market

Convenient and nutritional advantages are pushing cereal-based nutraceuticals to greater prominence. Cereals that have been fortified with fiber, vitamins, minerals, and probiotics are suitable for those searching for a healthy morning meal. Oatmeal and whole grains and protein-enriched cereals are most desired because they have a function to maintain weight as well as help heart health. As breakfast with sugars loses preference among consumers, demand for highly nutritious cereals is rising consistently.

United States Dairy Nutraceuticals Market

Dairy nutraceuticals, such as fortified cheese, yogurt, and milk, are a notable part of the U.S. market. Such products are richly fortified with probiotics, calcium, vitamin D, and omega-3 fatty acids for digestive health, bone density, and overall wellness. With functional dairy demand growing, firms are experimenting with plant-based, lactose-free, and immune-building formulations.

United States Energy Drink Nutraceuticals Market

Energy drinks with vitamins, amino acids, and natural stimulants are popular in the U.S. market. People, particularly younger generations, look for energy drinks to enhance productivity, sports performance, and concentration. As consumers become increasingly concerned about artificial ingredients and sugar levels, companies are introducing healthier options, such as plant-based and low-calorie energy drinks, to address changing consumer tastes.

United States Fortified Juice Nutraceuticals Market

Fortified juices supplemented with vitamins, antioxidants, and plant extracts are increasingly popular in the U.S. Consumers are turning towards functional drinks that not only provide hydration but also confer health benefits. Juice companies are concentrating on immune support, detox, and digestive health by adding ingredients such as vitamin C, turmeric, and prebiotics. Sales of organic and natural juices are also increasing.

United States Vitamins Nutraceuticals Market

The American vitamins market is still an important part of the nutraceuticals market. Multivitamins, single-nutrient supplements, and gummy formats address various needs of consumers such as immune health, skin wellness, and brain function. Trends in personalized nutrition are also boosting demand for personalized-formulated vitamin supplements depending on specific health objectives and deficiencies.

United States Minerals Nutraceuticals Market

Mineral supplements like calcium, magnesium, and iron are crucial for general well-being. The U.S. market experiences high demand for these supplements owing to nutritional deficiencies and the growing incidence of bone disorders. Sports persons, pregnant women, and elderly people especially gain from mineral-fortified products. Functional drinks and fortified foods also help in market growth.

United States Nutraceuticals Specialty Stores Market

Specialty stores are an important channel for the distribution of nutraceuticals, providing a carefully selected range of health-oriented products. Specialty stores address the needs of niche consumers by selling organic, plant-based, and high-quality dietary supplements. Personalized advice, expert guidance, and loyalty schemes make the shopping experience more enjoyable, and specialty stores become the first choice for health-oriented consumers.

United States Nutraceuticals Drug Stores/Pharmacies Market

Pharmacies and drug stores are a significant distribution channel for nutraceuticals in the U.S. Customers rely on these stores for buying supplements with professional recommendations. Most pharmacies provide private-label nutraceuticals, increasing their product offerings. The increasing trend of dietary supplements recommended by pharmacists has increased sales in this category.

East United States Nutraceuticals Market

The eastern part of the U.S. experiences high demand for nutraceuticals in light of urbanization and high awareness of health. Key cities such as New York and Boston make a contribution to the growing market, with customers demanding innovative well-being products. The existence of health-aware populations and consumption of organic and functional foods fuels market growth in this area.

West United States Nutraceuticals Market

The western United States is a prime market for nutraceuticals, with California being at the forefront of health and wellness trends. The region's emphasis on plant-based diets, fitness, and holistic health has driven demand for dietary supplements, functional beverages, and fortified foods. The presence of tech-enabled health solutions and sustainable product innovations further solidifies the market's growth.

United States Nutraceuticals Market Segments

Product Type

Functional Food

- Cereal

- Bakery and Confectionary

- Dairy

- Snack

- Other Functional Foods

Functional Beverage

- Energy Drink

- Sports Drink

- Fortified Juice

- Dairy and Dairy Alternative Beverage

- Other Functional Beverages

Dietary Supplements

- Vitamins

- Minerals

- Botanicals

- Enzyme

- Fatty Acids

- Proteins

- Other Dietary Supplements

Distribution Channel

- Specialty Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Drug Stores/Pharmacies

- Online Retail Stores

- Other Distribution Channels

By Region

- East

- West

- North

- South

All the Key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Revenue

Key Players Analysis

- PepsiCo, Inc.

- General Mills, Inc.

- Nestlé S.A.

- Kellogg Company

- Herbalife International of America, Inc.

- Danone S.A.

- Now Health Group, Inc. (NOW Foods)

- Alticor Inc (Amway Corporation)

- Red Bull GmbH

- Abbott Laboratories

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Distribution Channel and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Nutraceuticals Market

6. Market Share

6.1 By Product Type

6.2 By Distribution Channel

6.3 By Region

7. Product Type

7.1 Functional Food

7.1.1 Cereal

7.1.2 Bakery and Confectionary

7.1.3 Dairy

7.1.4 Snack

7.1.5 Other Functional Foods

7.2 Functional Beverage

7.2.1 Energy Drink

7.2.2 Sports Drink

7.2.3 Fortified Juice

7.2.4 Dairy and Dairy Alternative Beverage

7.2.5 Other Functional Beverages

7.3 Dietary Supplements

7.3.1 Vitamins

7.3.2 Minerals

7.3.3 Botanicals

7.3.4 Enzyme

7.3.5 Fatty Acids

7.3.6 Proteins

7.3.7 Other Dietary Supplements

8. Distribution Channel

8.1 Specialty Stores

8.2 Supermarkets/Hypermarkets

8.3 Convenience Stores

8.4 Drug Stores/Pharmacies

8.5 Online Retail Stores

8.6 Other Distribution Channels

9. By Region

9.1 East

9.2 West

9.3 North

9.4 South

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 PepsiCo, Inc.

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development

12.1.4 Revenue

12.2 General Mills, Inc.

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development

12.2.4 Revenue

12.3 Nestlé S.A.

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development

12.3.4 Revenue

12.4 Kellogg Company

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development

12.4.4 Revenue

12.5 Herbalife International of America, Inc.

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development

12.5.4 Revenue

12.6 Danone S.A.

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development

12.6.4 Revenue

12.7 Now Health Group, Inc. (NOW Foods)

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development

12.7.4 Revenue

12.8 Alticor Inc (Amway Corporation)

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development

12.8.4 Revenue

12.9 Red Bull GmbH

12.9.1 Overview

12.9.2 Key Persons

12.9.3 Recent Development

12.9.4 Revenue

12.10 Abbott Laboratories

12.10.1 Overview

12.10.2 Key Persons

12.10.3 Recent Development

12.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com