United States Online Grocery Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Online Grocery Market Trends & Summary

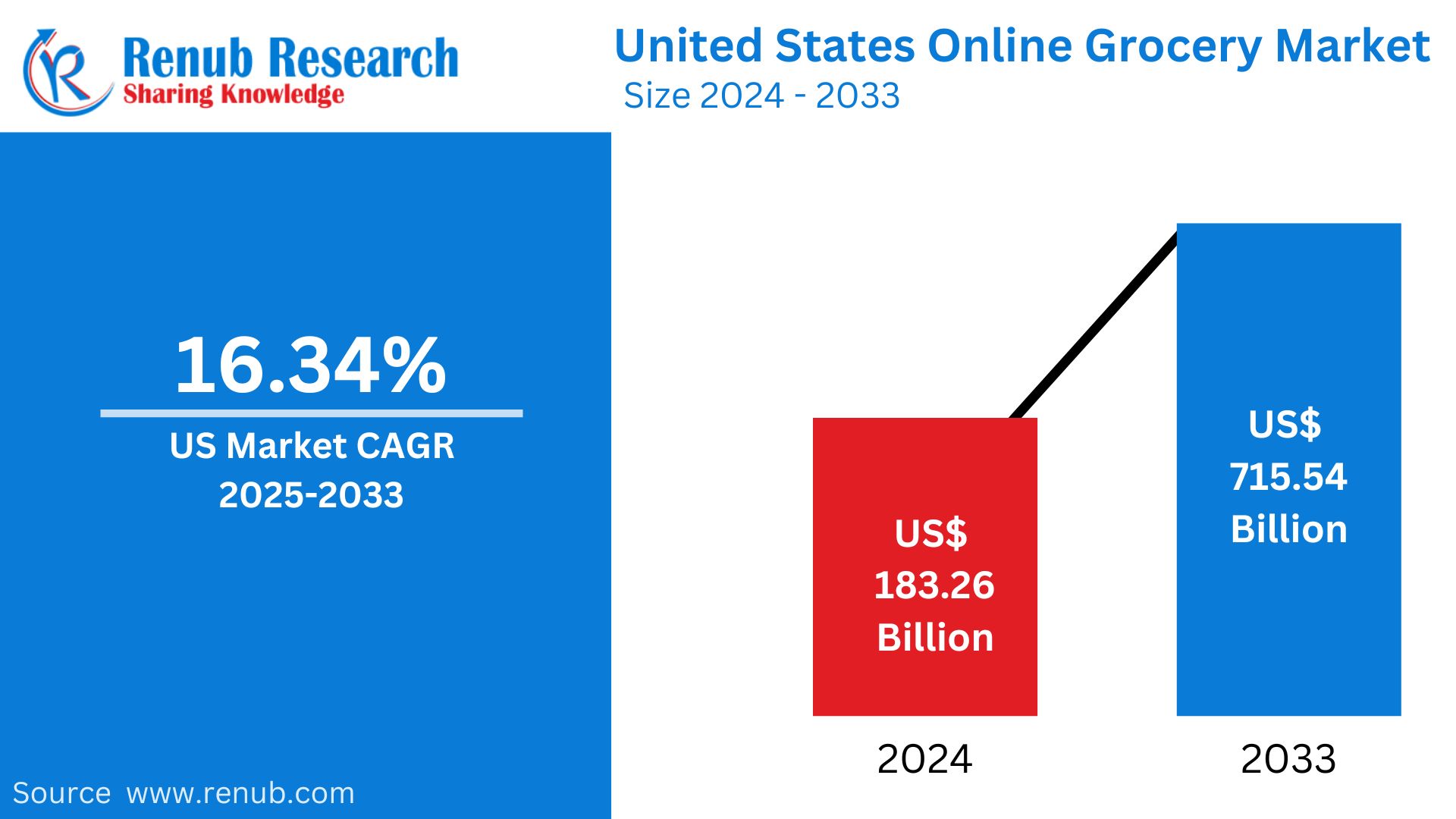

The United States online grocery market is expected to grow from US$ 183.26 Billion in 2024 to reach US$ 715.54 Billion by 2033. The compound annual growth rate for the United States online grocery market is 16.34% between 2025 and 2033. A growing demand by consumers for easy convenience, technical advancements, and digital payments are the forces driving this increase.

The report United States Online Grocery Market & Forecast covers by Product (Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat & Seafood, Others), Purchaser Type (Subscription Purchase, One Time Purchase), Delivery Type (Click & Collect, Home Delivery) and Company Analysis 2025-2033.

United States Online Grocery Market Outlooks

Online grocery is the process of buying food, drinks, and household groceries over internet-based platforms or mobile apps rather than physically in a store. In America, this phenomenon has also gained immense popularity due to its convenience, saving of time, and wider availability of products.

Online grocery services let consumers browse and select items conveniently from their home, with an option for home delivery or curbside pickup. This method proves to be versatile and accessible for busy people, seniors, and people with a disability. Some platforms also come with features that include personalized recommendations, subscription services, and discount offers, further enhancing the experience of shopping online. TECHNOLOGICAL ADVANCEMENTS Online grocery shopping in the United States has been helped by technology. The improvement of inventory control, real-time order tracking, and shopping assistants powered by AI have driven online grocery shopping. More features, including better merchandise and product offerings through online grocery platforms are constantly added to suit the needs of various customers.

Growth Driver in the United States Online Grocery Market

Increasing Consumer Preference for Convenience

The growing preference for convenience is one of the key drivers of the United States online grocery market. Busy lifestyles and the need for time-saving solutions have led to an increase in the number of consumers adopting online grocery platforms. Such platforms allow features such as home delivery, curbside pickup, and easy accessibility, so customers can shop from the comfort of their homes. The system also has the best solutions with advance technology being self-integrated into personalized recommendations and automatic re-ordering, thereby making the convenience factor attractive to a more diverse group of shoppers. According to Meets Click and Mercatus Grocery Shopping Survey, November 2024, 77.8 million households bought groceries online. This surpassed a record set in the first full month of the COVID-19 pandemic, April 2020 when the figure stood at 76.7 million. In addition, in November, 72% of all MAUs used just one fulfillment method.

Technological Advancements and Digital Payment Solutions

Technological advancements are playing a significant role in the growth of the online grocery market. Innovations like artificial intelligence, machine learning, and automated inventory management are improving the efficiency and personalization of services. Furthermore, digital payment options like mobile wallets and contactless payments have increased faster and more secure ways of transactions, which push people to adopt more. With such advancements, the shopping experience for the consumer becomes seamless, increasing customer loyalty and market penetration for these online grocery stores. Dec 2023, Instacart, the leading grocery technology company in North America and Fairway Market announced the "Fairway Now," a new fast home delivery service powered by Instacart that lets Fairway Market customers access last-minute groceries and household essentials in as fast as 30-minutes.

Growing Acceptance of Subscription Services and Loyalty Programs

Online grocery market is growing due to the increasing adoption of subscription services and loyalty programs. These programs offer their customers exclusive discounts, personalized offers, and the comfort of automatic deliveries. With growing consumerism demanding more value for money, a subscription model presents an attractive avenue for repeat purchasing and long-term engagement. Besides, loyalty membership helps in maintaining customers through unique experiences and contributes to higher customer satisfaction and market penetration. Loyalty membership is on the rise in the US as the consumers seek to get personalized deals and discounts. US consumers owned an average of 19 loyalty program memberships per individual in 2024, the highest rate of 10 years, The Bond Loyalty Report reported.

United States Online Grocery Market Challenges

Intense Competition and Price Sensitivity

High competition is another significant challenge in the United States online grocery market, with many players offering the same services. The numerous options available to customers make them sensitive to price, which complicates the maintenance of profit margins for retailers. With easy comparison across different platforms, pressure mounts to offer competitive prices and more frequent discounts, which can stretch the profit margins. Moreover, the smaller grocery retailers face challenges in competing with the well-established giants, hence limiting their market share.

Logistical and Delivery Challenges

Logistics and delivery still pose a huge challenge to the online grocery market. The proper management of massive distribution networks, timely delivery, and the freshness of perishable items require enormous investments in the supply chain infrastructure. Ineffective delivery processes will lead to delay, increased operational cost, and dissatisfied customers. Furthermore, last-mile delivery challenges in rural or underdeveloped areas inhibit market growth and limit accessibility to certain demographics.

United States Online Vegetables and Fruits Grocery Market

The U.S. market for online groceries in vegetables and fruits is rising rapidly, on account of more and more demands from consumers on fresh, healthy, and convenience options. Along with busy lifestyle and preference toward contactless shopping, this market is rapidly shifting toward grocery purchases online from their preferred places. These platforms provide shoppers with a selection of organic locally sourced and sustainable fruits and vegetables, along with a personalized in-store experience. The technology improves the shopping process with real-time inventory updates as well as access to subscription-based services. Secondly, health and wellness awareness is propelling the fresh produce online grocery platforms in the U.S. July 2024, The Fresh Market specialty fresh food retailer reports that it will open two new stores in the Washington, D.C. region.

United States Online Subscription Purchase Grocery Market

The United States online subscription purchase grocery market is growing rapidly with the increasing need for convenience, variety, and customized services among the consumers. The subscription model is also able to cater to customers who order groceries, meal kits, and specialty items at regular intervals for busy lifestyles and health-conscious consumers. The platform also provides the customers with a wide range of options, discounts, and flexibility to make their shopping experience worthwhile. In addition, advancements in technology such as AI-driven recommendations and smart ordering also fuel this market's growth. More convenient and tailored grocery solutions are making subscription-based services a preferred choice, further increasing the growth in the U.S. market. In April 2024, Amazon launched a new grocery delivery subscription in the United States for members of its Prime program and customers who are recipients of the government food assistance benefits.

United States Click & Collect Grocery Market

The United States Click & Collect grocery market is expanding rapidly. This model is providing consumers with a convenient means of ordering groceries online and picking them up at a designated location. It integrates the ease of online shopping with the flexibility of in-store pickup, reducing wait times and ensuring that customers receive their items on their schedule. Click & Collect services are especially popular among busy people and families who want to shop with minimal hassle. Furthermore, technological advancements, including real-time inventory management and personalized order suggestions, improve the efficiency of the service. The demand for contactless solutions and the increasing focus on convenience are driving further adoption of Click & Collect in the U.S. grocery market. In May 2022, Walmart's aerial announced that it will collaborate with DroneUp to reach new heights by launching expanded drone delivery services. This would enable them to serve potential clients in about 4 million homes across six US states.

United States Online Grocery Market Segments

Product

1. Vegetables and Fruits

2. Dairy Products

3. Staples and Cooking Essentials

4. Snacks

5. Meat & Seafood

6. Others

Purchaser Type

1. Subscription Purchase

2. One Time Purchase

Delivery Type

1. Click & Collect

2. Home Delivery

All the companies have been studied from three points

1. Overview

2. Recent Development

3. Revenue Analysis

Key Players

1. Tesco Plc.

2. Walmart Inc.

3. Instacart

4. The Kroger Co.

5. Costco Wholesale Corporation

6. Target Corporation

7. FreshDirect

8. Peapod Online Grocer, LLC

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Purchase Type, and Delivery Type |

| Product Covered |

1. Vegetables and Fruits |

| Companies Covered |

1. Tesco Plc. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the expected market size of the United States online grocery market by 2033?

-

What is the compound annual growth rate (CAGR) of the U.S. online grocery market from 2025 to 2033?

-

What are the key factors driving the growth of the online grocery market in the U.S.?

-

What are the main product categories covered in the U.S. online grocery market report?

-

What are the two types of purchase methods in the online grocery market?

-

What delivery methods are available for online grocery shoppers in the U.S.?

-

How has technology contributed to the growth of the online grocery market?

-

What are some challenges faced by the online grocery market in the U.S.?

-

What role do subscription services and loyalty programs play in the market's growth?

-

Which major companies are key players in the U.S. online grocery market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Online Grocery Market

6. Market Share

6.1 By Product

6.2 By Purchase Type

6.3 By Delivery Type

7. Product

7.1 Vegetables and Fruits

7.2 Dairy Products

7.3 Staples and Cooking Essentials

7.4 Snacks

7.5 Meat & Seafood

7.6 Others

8. Purchaser Type

8.1 Subscription Purchase

8.2 One Time Purchase

9. Delivery Type

9.1 Click & Collect

9.2 Home Delivery

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players

12.1 Tesco Plc.

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development

12.1.4 Revenue Analysis

12.2 Walmart Inc.

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development

12.2.4 Revenue Analysis

12.3 Instacart

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development

12.3.4 Revenue Analysis

12.4 The Kroger Co.

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development

12.4.4 Revenue Analysis

12.5 Costco Wholesale Corporation

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development

12.5.4 Revenue Analysis

12.6 Target Corporation

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development

12.6.4 Revenue Analysis

12.7 FreshDirect

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development

12.8 Peapod Online Grocer, LLC

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com