United States Organic Dairy Market by Segment (Milk, Yogurt, Cheese), Milk Type (Whole, Reduced & Low Fat, Flavored), Packaging, Distribution Channel, Company Analysis

Buy NowGet Free Customization in this Report

United States organic dairy industry is projected to show good growth during 2020-2026. In United States, milk is related to the vast majority of organic dairy purchases, which are followed by butter and yogurt. Organic dairy items are made from organic milk, which is collected from cattle reared through organic farming methods. organic dairy industry is experiencing good growth in the United States as they are free from preservatives, antibiotics, synthetic chemicals, etc. According to Renub Research report, United States Organic Dairy Market is expected to be USD 18.9 Billion by the year 2026.

Benefits of Organic Milk over Conventional Milk

There are many benefits such that customers should switch from conventional milk to organic milk, including concerns about antibiotic and hormone use, animal health, farming's environmental effects. The U.S. federal government is promoting organic farming practices among traditional farmers by initiating educational programs and offering both technical and monetary assistance.

Besides, enhancing the delivery and supply chain of organic dairy products in confluence with the emerging online food retail market is increasing the accessibility of organic dairy products throughout the United States. However, technical developments in the production of novel goods with low fat and reduced sodium and sugar levels are expected to fuel demand in the coming years. Other than this, organic dairy offer health benefits such as boosting metabolism, strengthening immune system, lowering the risk of cancer, and heart diseases and reducing muscle and joint pain.

Renub Research report titled “United States Organic Dairy Market by Segment (Organic Milk, Organic Yogurt, Organic Cheese), Type (Whole Milk, Reduced Fat Milk (2%), Low Fat Milk (1%), Fat-Free Milk -Skim, Flavored Fat-Reduced Milk), by Fluid Beverage Milk (Whole Milk Sales, Fat Reduced Milk (Reduced Fat Milk (2%), Low Fat Milk (1%), Fat-Free Milk (Skim), Flavored Fat-Reduced Milk), Packaging (Cups, Tubs, Drinks, Tubes), Distribution Channel (Grocery Stores, Walmart, Club, Mass Merchandisers, and Military Stores, Convenience Stores, Drug Store), Cheese Volume, Company Analysis (Nestle USA, Inc, Dean Foods Company, Danone S. A., Dairy Farmers of America, The Kraft Heinz Company)” provides a complete analysis of united states organic dairy industry.

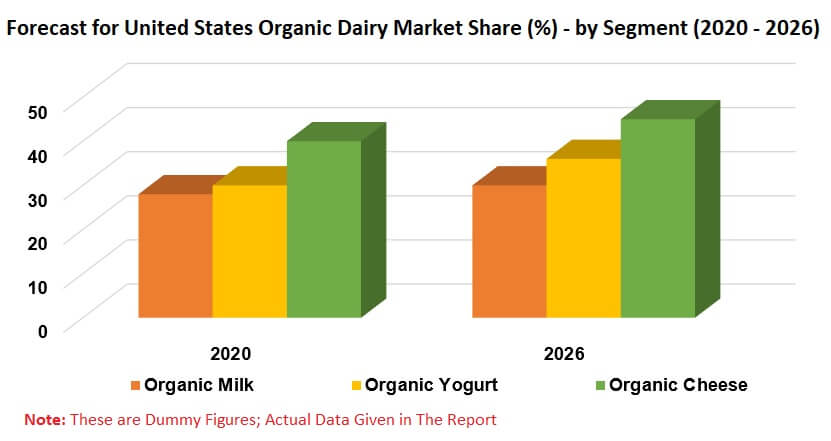

Segment - United States organic dairy market has been studied from 3 segments

• Organic Milk

• Organic Yogurt

• Organic Cheese

Milk Types & Sub-types Market & Volume – The milk types market and volume have been divided into two types and it has been further sub-divided into 4 sub-types

1. Whole Milk Sales

2. Fat Reduced Milk

a. Reduced Fat Milk (2%)

b. Low Fat Milk (1%)

c. Fat-Free Milk (Skim)

d. Flavored Fat-Reduced Milk

Packaging Type Volume – Report provides Organic Yogurt Packing Volume in 4 Types

1. Cups

2. Tubs

3. Drinks

4. Tubes

Channel Distribution – Report covers Organic Yogurt Volume by Distribution

1. Grocery Stores

2. Walmart, Club, Mass Merchandisers, and Military Stores

3. Convenience Store

4. Drug Store

All the 5 Companies have been sstudied from three points

• Overview

• Recent Developments & Strategy

• Sales Analysis

Companies Covered

1. Nestle USA, Inc

2. Dean Foods Company

3. Danone S. A.

4. Dairy Farmers of America

5. The Kraft Heinz Company

If the information you seek is not included in the current scope of the study kindly share your specific requirements with our custom research team at info@renub.com

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. SWOT Analysis

6. United States Organic Dairy Analysis

6.1 Market

6.2 Volume

7. Volume Share Analysis

7.1 Fluid Beverage Milk Sales

7.2 Share Analysis by Segment

7.3 Organic Fat-reduced Milk Share by Type

7.4 Organic Yogurt Share by Packaging Type

7.5 Organic Yogurt Share by Distribution Channel

8. Organic Dairy Market by Segment

8.1 Organic Milk

8.2 Organic Yogurt

8.3 Organic Cheese

9. Organic Milk Market Type

9.1 Whole Milk Sales

9.2 Fat Reduced Milk

9.2.1 Reduced Fat Milk (2%)

9.2.2 Low Fat Milk (1%)

9.2.3 Fat-Free Milk (Skim)

9.2.4 Flavored Fat-Reduced Milk

10. United States Organic Fluid Beverage Milk Sales by Segment

10.1 Whole Milk Sales

10.2 Fat-Reduced Milk

10.2.1 Reduced Fat Milk (2%)

10.2.2 Low Fat Milk (1%)

10.2.3 Fat-Free Milk (Skim)

10.2.4 Flavored Fat-Reduced Milk

11. Organic Yogurt Sales by Packaging Type

11.1.1 Cups

11.1.2 Tubs

11.1.3 Drinks

11.1.4 Tubes

12. Organic Yogurt Sales by Distribution Channel

12.1.1 Grocery stores

12.1.2 Walmart, club, mass merchandisers, and military stores

12.1.3 Convenience store

12.1.4 Drug Store

13. Organic cheese Volume Sales

14. Key Players

14.1 Nestlé USA, Inc

14.1.1 Overview

14.1.2 Recent Development & Strategy

14.1.3 Revenue

14.2 Dean Foods Company

14.2.1 Overview

14.2.2 Recent Development & Strategy

14.2.3 Revenue

14.3 Danone S.A.

14.3.1 Overview

14.3.2 Recent Development & Strategy

14.3.3 Revenue

14.4 Dairy Farmers of America

14.4.1 Overview

14.4.2 Recent Development & Strategy

14.4.3 Revenue

14.5 The Kraft Heinz Company

14.5.1 Overview

14.5.2 Recent Development & Strategy

14.5.3 Revenue

List of Figures:

Figure-01: United States – Organic Dairy Market (Million US$), 2019 - 2026

Figure-02: Organic Yogurt Distributor Channels in (percentage) 2019

Figure-03: Rising per capita consumption of soft dairy products

Figure-04: Increasing per capita disposable income and people are well aware of the nutritional value of the organic dairy product

Figure-05: United States – Organic Dairy Market (Million US$), 2017 – 2019

Figure-06: United States – Forecast for Organic Dairy Market (Million US$), 2020 – 2026

Figure-07: United States – Organic Dairy Volume (Million Pound), 2017 – 2019

Figure-08: United States – Forecast for Organic Dairy Volume (Million Pound), 2020 – 2026

Figure-09: United States – Organic Fluid Beverage Milk Sales Share (%) by Segment, 2017 – 2019

Figure-10: United States – Forecast for Organic Fluid Beverage Milk Sales Share (%) by Segment, 2020 – 2026

Figure-11: United States – Organic Fat Reduced Milk Share (%) by Type, 2017 – 2019

Figure-12: United States – Forecast for Organic Fat Reduced Milk Share (%) by Type, 2020 – 2026

Figure-13: United States – Organic Yogurt Share (%) by Packaging Type, 2017 – 2019

Figure-14: United States – Forecast for Organic Yogurt Share (%) by Packaging Type, 2020 – 2026

Figure-15: United States – Organic Milk Market (Million US$), 2017 – 2019

Figure-16: United States – Forecast for Organic Milk Market (Million US$), 2020 – 2026

Figure-17: United States – Organic Yogurt Market (Million US$), 2017 – 2019

Figure-18: United States – Forecast for Organic Yogurt Market (Million US$), 2020 – 2026

Figure-19: United States – Organic Cheese Market (Million US$), 2017 – 2019

Figure-20: United States – Forecast for Organic Cheese Market (Million US$), 2020 – 2026

Figure-21: United States – Organic Whole Milk Market (Million US$), 2017 – 2019

Figure-22: United States – Forecast for Organic Whole Milk Market (Million US$), 2020 – 2026

Figure-23: United States – Fat Reduced Milk Market (Million US$), 2017 – 2019

Figure-24: United States – Forecast for Fat Reduced Milk Market (Million US$), 2020 – 2026

Figure-25: United States – Fat-Reduced Milk (2%) Market (Million US$), 2017 – 2019

Figure-26: United States – Forecast for Fat-Reduced Milk (2%) Market (Million US$), 2020 – 2026

Figure-27: United States – Organic Low fat Milk (1%) Market (Million US$), 2017 – 2019

Figure-28: United States – Forecast for Organic Low fat Milk (1%) Market (Million US$), 2020 – 2026

Figure-29: United States – Organic Fat Free (Skim) Milk Market (Million US$), 2017 – 2019

Figure-30: United States – Forecast for Organic Fat Free (Skim) Milk Market (Million US$), 2020 – 2026

Figure-31: United States – Flavored Organic Fat-Reduced Milk Market (Million US$), 2017 – 2019

Figure-32: United States – Forecast for Flavored Organic Fat-Reduced Milk Market (Million US$), 2020 – 2026

Figure-33: United States – Organic Whole Milk Sales Volume (Million Pound), 2017 – 2019

Figure-34: United States – Forecast for Organic Whole Milk Sales Volume (Million Pound), 2020 – 2026

Figure-35: United States – Organic Fat Reduced Milk Sales Volume (Million Pound), 2017 – 2019

Figure-36: United States – Forecast for Organic Fat Reduced Milk Sales Volume (Million Pound), 2020 – 2026

Figure-37: United States – Organic Reduced Fat Milk Sales Volume (Million Pound), 2017 – 2019

Figure-38: United States – Forecast for Organic Reduced Fat Milk Sales Volume (Million Pound), 2020 – 2026

Figure-39: United States – Organic Low Fat Milk Sales Volume (Million Pound), 2017 – 2019

Figure-40: United States – Forecast for Organic Low Fat Milk Sales Volume (Million Pound), 2020 – 2026

Figure-41: United States – Organic Fat Free Milk Sales Volume (Million Pound), 2017 – 2019

Figure-42: United States – Forecast for Organic Fat Free Milk Sales Volume (Million Pound), 2020 – 2026

Figure-43: United States – Organic Flavored Fat Reduce Milk Sales Volume (Million Pound), 2017 – 2019

Figure-44: United States – Forecast for Organic Flavored Fat Reduce Milk Sales Volume (Million Pound), 2020 – 2026

Figure-45: United States – Organic Yogurt Volume by Cups (Million Pound), 2017 – 2019

Figure-46: United States – Forecast for Organic Yogurt Volume by Cups (Million Pound), 2020 – 2026

Figure-47: United States – Organic Yogurt Volume by Tubs (Million Pound), 2017 – 2019

Figure-48: United States – Forecast for Organic Yogurt Volume by Tubs (Million Pound), 2020 – 2026

Figure-49: United States – Organic Yogurt Volume by Drinks (Million Pound), 2017 – 2019

Figure-50: United States – Forecast for Organic Yogurt Volumes by Drinks (Million Pound), 2020 – 2026

Figure-51: United States – Organic Yogurt Volume by Tubes (Million Pound), 2017 – 2019

Figure-52: United States – Forecast for Organic Yogurt Volume by Tubes (Million Pound), 2020 – 2026

Figure-53: United States – Organic Yogurt Volume by Grocery Store (Million Pound), 2017 – 2019

Figure-54: United States – Forecast for Organic Yogurt Volume by Grocery Store (Million Pound), 2020 – 2026

Figure-55: United States – Organic Yogurt Volume by Walmart, club, Mass Merchandisers, and Military stores (Million Pound), 2017 – 2019

Figure-56: United States – Forecast for Organic Yogurt Volume by Walmart, club, mass merchandisers, and military stores (Million Pound), 2020 – 2026

Figure-57: United States – Organic Yogurt Volume by Convenience stores (Million Pound), 2017 – 2019

Figure-58: United States – Forecast for Organic Yogurt Volume by Convenience stores (Million Pound), 2020 – 2026

Figure-59: United States – Organic Yogurt Volume by Drug stores (Million Pound), 2017 – 2019

Figure-60: United States – Forecast for Organic Yogurt Volume by Drug stores (Million Pound), 2020 – 2026

Figure-61: United States – Organic Cheese Volume (Million Pound), 2017 – 2019

Figure-62: United States – Forecast for Organic Cheese Volume (Million Pound), 2020 – 2026

Figure-63: Global – Nestle Revenue (Million US$), 2015 – 2019

Figure-64: Global – Forecast for Nestle Revenue (Million US$), 2015 – 2019

Figure-65: Global – Dean Foods Company Revenue (Million US$), 2015 – 2019

Figure-66: Global – Forecast for Dean Foods Company Revenue (Million US$), 2020 – 2026

Figure-67: Global – Danone S.A Revenue (Billion US$), 2015 – 2019

Figure-68: Global – Forecast for Danone S.A Revenue (Billion US$), 2020 – 2026

Figure-69: Global – Dairy Farmers of America Revenue (Billion US$), 2015 – 2019

Figure-70: Global – Forecast for Dairy Farmers of America Revenue (Billion US$), 2020 – 2026

Figure-71: Global – The Kraft Heinz Company Revenue (Million US$), 2015 – 2019

Figure-72: Global – Forecast for The Kraft Heinz Company Revenue (Million US$), 2020 – 2026

List of Tables:

Table-01: United States – Organic Dairy Products Share (%) by Segment, 2017 – 2019

Table-02: United States – Forecast for Organic Dairy Products Share (%) by Segment, 2020 – 2026

Table-03: United States – Organic Yogurt Share (%) by Distribution Channel, 2017 – 2019

Table-04: United States – Forecast for Organic Yogurt Share (%) by Distribution Channel, 2020 – 2026

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com