United States Organic Food Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Organic Food Market Trends & Summary

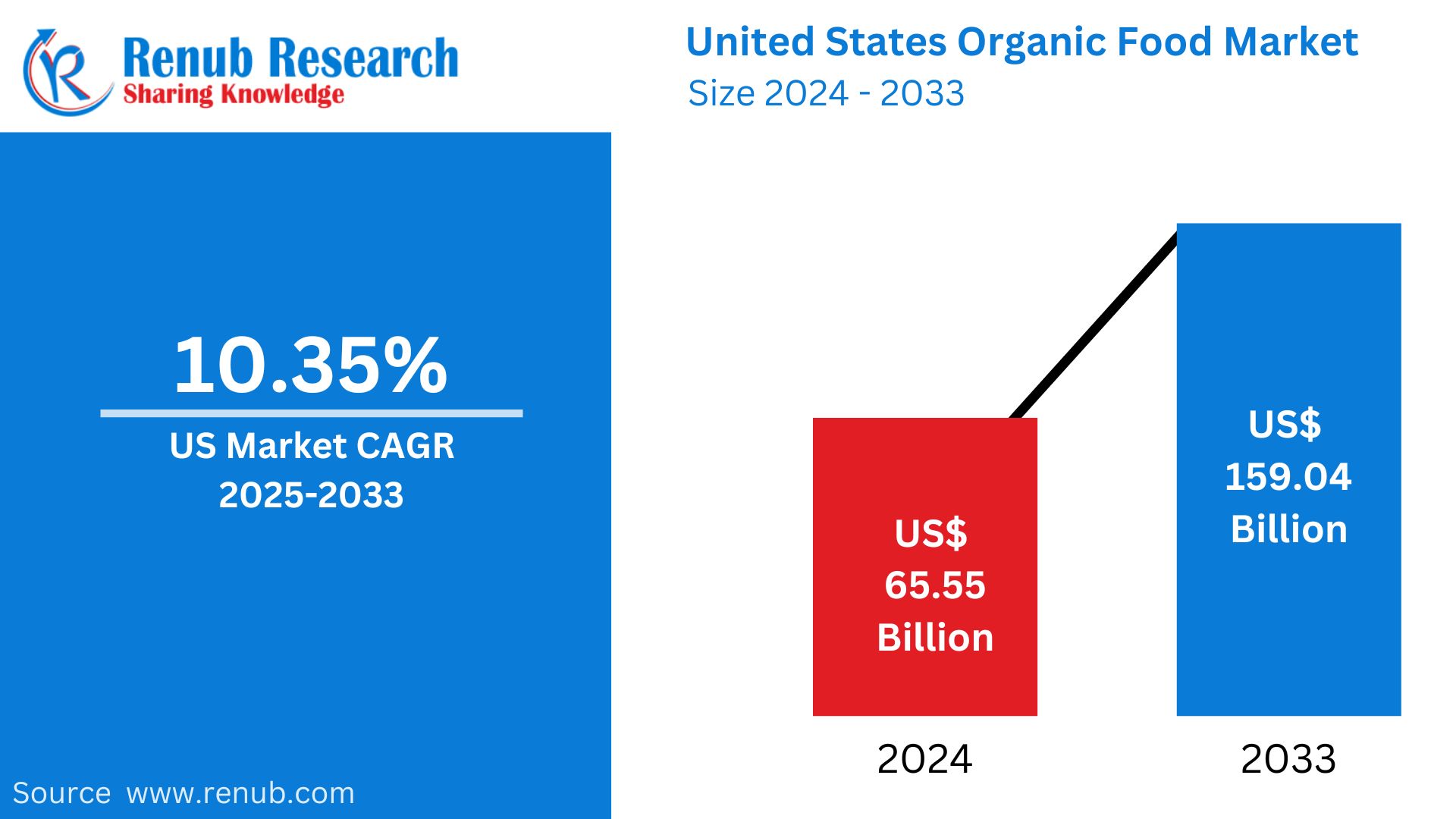

The United States organic food market is estimated to be around US$ 65.55 Billion in 2024. Growing health consciousness and sustainable practice will see the market grow at a CAGR of 10.35% during 2025-2033 and is expected to reach around US$ 159.04 Billion by 2033. Increasing demand for organic fruits, vegetables, dairy, and processed foods are pushing this growth with an emphasis on health, wellness, and eco-friendly agriculture.

The report United States Organic Food Market & Forecast covers by Product Type (Organic Fruits and Vegetables, Organic Meat, Poultry and Dairy, Organic Processed Food, Organic Bread and Bakery, Organic Beverages, Organic Cereal and Food Grains, and Others), Distribution Channel (Supermarkets/ Hypermarkets, Specialty Stores, Convenient Stores, Online Retail Stores, and Others), States and Company Analysis 2025-2033.

United States Organic Food Market Outlooks

Organic food refers to agricultural products obtained and processed without adding synthetic pesticides and fertilizers. GMOs and antibiotics, are not allowed or added. For that matter artificial additives. As organic farming relies on sustainability as well as for soil health or biodiversity, people support it based on an organic agriculture system.

The organic food market in the United States has been on the rise due to heightened health awareness and a demand for natural, chemical-free products. Consumers are choosing organic options because they believe them to have better nutritional value, taste, and a reduced presence of harmful chemicals. Organic products are in high demand among millennials, health-conscious consumers, and parents with young children. Supermarkets, specialty stores, farmers' markets, and online platforms form the large part of organic food distribution by reaching a significant population. Though premium pricing, organic food remains to be the favorite among customers, as consumer tastes are changing toward sustainable and healthy diets.

Growth Drivers in the United States Organic Food Market

Growing Health Consciousness Among Consumers

The rising focus on health and wellness is a major driver of the organic food market in the U.S. Consumers are becoming more conscious of the link between diet and overall well-being, prompting them to opt for chemical-free, non-GMO, and nutrient-rich food options. Organic food is perceived to reduce exposure to harmful pesticides and synthetic additives, aligning with the growing demand for healthier lifestyles. Natural organic food products gain significant traction particularly among millennials and generation-Z. As consumer health awareness and education continue growing, demand in organic products can be expected. In 2023, Top Organic Food brands in the U.S. – according to brand awareness - included very well-known products. Trader Joe's topped that list with an awareness rating of 72%

Expanding Distribution Channels

Organic food has become more accessible through supermarkets, specialty stores, farmers' markets, and e-commerce platforms. Retail giants such as Walmart, Kroger, and Whole Foods Market have expanded their organic product offerings, thus making them accessible to a wider audience. The online grocery platforms have also further increased sales, as they offer easy access to organic products, especially in urban areas. This widespread availability ensures that organic food is no longer limited to niche markets, driving its adoption among mainstream consumers and contributing to the market's growth. Nov. 2022, Planet Based Foods Global Inc. is pleased to announce that the company has entered into distribution agreements with KeHE Distributors, United Natural Foods, Inc., and DPI Specialty Foods, effective immediately.

Government Support and Certifications

Organic farming has been supported by the government with initiatives promoting the practice. High standards in organic certification also increased consumer confidence in organic food products. Organic food is covered under the programs and guidelines offered by the USDA. These initiatives ensure that food sold as organic is authentic and of good quality, which prompts more farmers to cultivate organic food. Subsidies and funding for organic agriculture also make it more feasible for farmers to transition to organic methods. Increased awareness of USDA organic certifications among consumers reinforces confidence in the market, further fueling its growth. May 2023, The U.S. Department of Agriculture (USDA) is enhancing support for the organic market and producers seeking certification. These funding opportunities are part of the USDA's Organic Transition Initiative, launched in fall 2022, to help current organic farmers and those transitioning to organic production.

Challenges in the United States Organic Food Market

High Cost of Organic Products

One of the major challenges facing the U.S. organic food market is the premium pricing of organic products compared to conventional alternatives. Organic farming involves higher production costs, including labor-intensive practices, limited use of synthetic chemicals, and expensive organic certifications. These factors result in elevated prices, which can deter budget-conscious consumers, particularly in economically uncertain times. Efforts to reduce costs while maintaining quality are critical to making organic food more affordable and accessible to a broader population.

Supply Chain Limitations

Supply chain inefficiencies are the biggest challenges in the organic food market, which include limited availability of organic raw materials and complexity in adhering to stringent certification standards. Organic farmers often lack the resources and distribution networks to meet demand. Moreover, the integrity of organic certifications throughout the supply chain is challenging, leading to potential trust issues among consumers. All these weaknesses need to be addressed with better infrastructure, technology, and support for the farmer.

USA Organic Fruits and Vegetables Market

The USA organic fruits and vegetables market is growing fast as consumers are getting more and more attracted towards healthy and chemical-free food products. Such products are believed to be rich in nutritional values, more flavorful, and free from the dangers of pesticides. Health consciousness and environmental concerns are driving demand for organics. Distribution is mainly through supermarkets, farmers' markets, and e-commerce sites. Higher prices have not deterred the market, as certification by agencies such as the USDA helps to maintain the quality and therefore the trust of consumers.

U.S. Organic Processed Food Marke

The U.S. organic processed food market is growing steadily due to the increased demand for healthier and more sustainable food options. Consumers are opting for organic processed foods such as cereals, snacks, frozen meals, and beverages that contain no synthetic additives, GMOs, or artificial preservatives. This trend is fueled by convenient yet health-conscious eating options among millennials and urban populations. Organic offerings on retail channels, which include supermarkets and online stores, have increased accessibility. Consumer demand for clean-label and eco-friendly products continues to drive growth amid challenges such as increased production costs and premium pricing.

Organic food supermarkets/ hypermarkets market in the United States

Market growth for organic supermarkets and hypermarkets in the United States remains strong due to the rise of consumer demands for natural, sustainable, and chemical-free products. Such stores provide organic produce, dairy products, meats, and processed food items, thus catering to health-conscious consumers seeking healthier alternatives. The growing demand for organic products in mainstream grocery stores has also increased their availability. Dedicated organic sections or stores continue to expand as well. Shopping for organic products along with other groceries at supermarkets and hypermarkets is also an added convenience and is contributing to sales. Organic will increasingly emerge as an inevitable need among such consumers due to rising awareness related to sustainability and transparency in operations.

Market in California- Organic Food

California organic food market is regarded as one of the biggest, dynamic, in the United States due to increased awareness in state about health combined with its attitude toward sustainability. California ranks one of the top producers in organic fruits, vegetables, dairy, and processed foods, focusing on eco-friendly and ethical farming practices. Growing awareness about health benefits, environmental concerns, and USDA-certified organic standards drive demand for organic products. Los Angeles, San Francisco, and San Diego are among the major cities with high sales in this market. The supermarket, farmers' markets, and specialty stores also support organic products across a vast scale. Expansion in the market continues due to innovation, education for consumers, and growing expenditure of consumers on organic food.

Texas Organic Food Market

The Texas organic food market is growing at a tremendous rate, with an increasing demand for healthy, sustainable, and locally sourced products. Texas has a large and diverse population, and consumers are becoming more health-conscious and environmentally aware, leading to an increase in the adoption of organic fruits, vegetables, dairy, and other processed foods. Other related trends include leading urban centers: Austin, Houston, and Dallas, where most consumers seek out organic products out of a presumed health benefit while minimizing exposure to synthetic chemicals. Retailers continue to expand product lines at their supermarkets, farmers' markets, and specialty stores. Furthermore, the need for sustainability and ethical sourcing will drive the market's growth further, making Texas a leader in the U.S. organic food industry.

New York Organic Food Market

Organic food is experiencing steady growth in New York, driven by the health-conscious population of New York City as well as demands for sustainable and natural products. New Yorkers are increasingly seeking organic fruits, vegetables, dairy, meats, and processed foods. This is primarily because of growing concerns over food quality, environmental sustainability, and the health benefits associated with organic consumption. As a result, supermarkets, specialty stores, farmers' markets, and online platforms are providing ample opportunities for the market to be accessible to urban residents. In addition, New York's wellness and eco-friendly lifestyle also drives the demand for organic products, making the state a leader in the organic food market.

Florida Organic Food Market

The Florida organic food market is growing rapidly due to consumer demand for healthier, sustainable, and locally produced food. Awareness on health and wellness is on the rise in Florida. The demand for organic fruits, vegetables, dairy, and other organic products increases among its residents. Leading this pack are Miami, Orlando, and Tampa cities where consumers are after fresh, clean, non-GMO, and chemical-free foods. The opportunities for consuming organic products through supermarket outlets, farmers' markets, and online platforms proliferate and become available to a more significant population. The state's commitment to environmental sustainability and local farming also encourages the growth of organic agriculture, a factor in organic food becoming very popular in Florida.

United States Organic Food Market Segments

Product Type – Market breakup in 7 viewpoints:

1. Organic Fruits and Vegetables

2. Organic Meat, Poultry and Dairy

3. Organic Processed Food

4. Organic Bread and Bakery

5. Organic Beverages

6. Organic Cereal and Food Grains

7. Others

Distribution Channel – Market breakup in 5 viewpoints:

1. Supermarkets/ Hypermarkets

2. Specialty Stores

3. Convenient Stores

4. Online Retail Stores

5. Others

States – Market breakup of 29 States:

1. California

2. Texas

3. New York

4. Florida

5. Illinois

6. Pennsylvania

7. Ohio

8. Georgia

9. New Jersey

10. Washington

11. North Carolina

12. Massachusetts

13. Virginia

14. Michigan

15. Maryland

16. Colorado

17. Tennessee

18. Indiana

19. Arizona

20. Minnesota

21. Wisconsin

22. Missouri

23. Connecticut

24. South Carolina

25. Oregon

26. Louisiana

27. Alabama

28. Kentucky

29. Rest of United States

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Danone S.A.

2. General Mills Inc.

3. Sprouts Farmers Market Inc.

4. The Hain Celestial Group Inc.

5. The Kroger Company

6. United Natural Foods Inc.

7. Dole Food Company Inc.

8. Newman's Own

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Distribution Channel, and States |

| States Covered |

1. California |

| Companies Covered |

1. Danone S.A. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the United States organic food market by 2033?

-

What is the expected compound annual growth rate (CAGR) of the market from 2025 to 2033?

-

What factors are driving the growth of the organic food market in the U.S.?

-

What are the key product categories in the organic food market?

-

Which distribution channels are most commonly used for organic food sales in the U.S.?

-

How does government support and USDA certification impact the organic food market?

-

What challenges does the U.S. organic food market face?

-

Which U.S. states have the largest organic food markets?

-

Who are the key players in the U.S. organic food industry?

-

How does consumer demand for health-conscious and eco-friendly food influence the organic market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Organic Food Market

6. United States Organic Food Market Share Analysis

6.1 Product Type

6.2 Distribution Channel

6.3 States

7. Product Type

7.1 Organic Fruits and Vegetables

7.2 Organic Meat, Poultry and Dairy

7.3 Organic Processed Food

7.4 Organic Bread and Bakery

7.5 Organic Cereal and Food Grains

7.6 Others

8. Distribution Channel

8.1 Supermarkets/ Hypermarkets

8.2 Specialty Stores

8.3 Convenient Stores

8.4 Online Retail Stores

8.5 Others

9. States

9.1 California

9.2 Texas

9.3 New York

9.4 Florida

9.5 Illinois

9.6 Pennsylvania

9.7 Ohio

9.8 Georgia

9.9 New Jersey

9.10 Washington

9.11 North Carolina

9.12 Massachusetts

9.13 Virginia

9.14 Michigan

9.15 Maryland

9.16 Colorado

9.17 Tennessee

9.18 Indiana

9.19 Arizona

9.20 Minnesota

9.21 Wisconsin

9.22 Missouri

9.23 Connecticut

9.24 South Carolina

9.25 Oregon

9.26 Louisiana

9.27 Alabama

9.28 Kentucky

9.29 Rest of United States

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players

12.1 Danone S.A.

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue

12.2 General Mills Inc.

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue

12.3 Sprouts Farmers Market Inc.

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue

12.4 The Hain Celestial Group Inc.

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue

12.5 The Kroger Company

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue

12.6 United Natural Foods Inc.

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue

12.7 Dole Food Company Inc.

12.7.1 Overview

12.7.2 Recent Development

12.7.3 Revenue

12.8 Newman's Own

12.8.1 Overview

12.8.2 Recent Development

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com