United States Processed Meat Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Processed Meat Market Trends & Summary

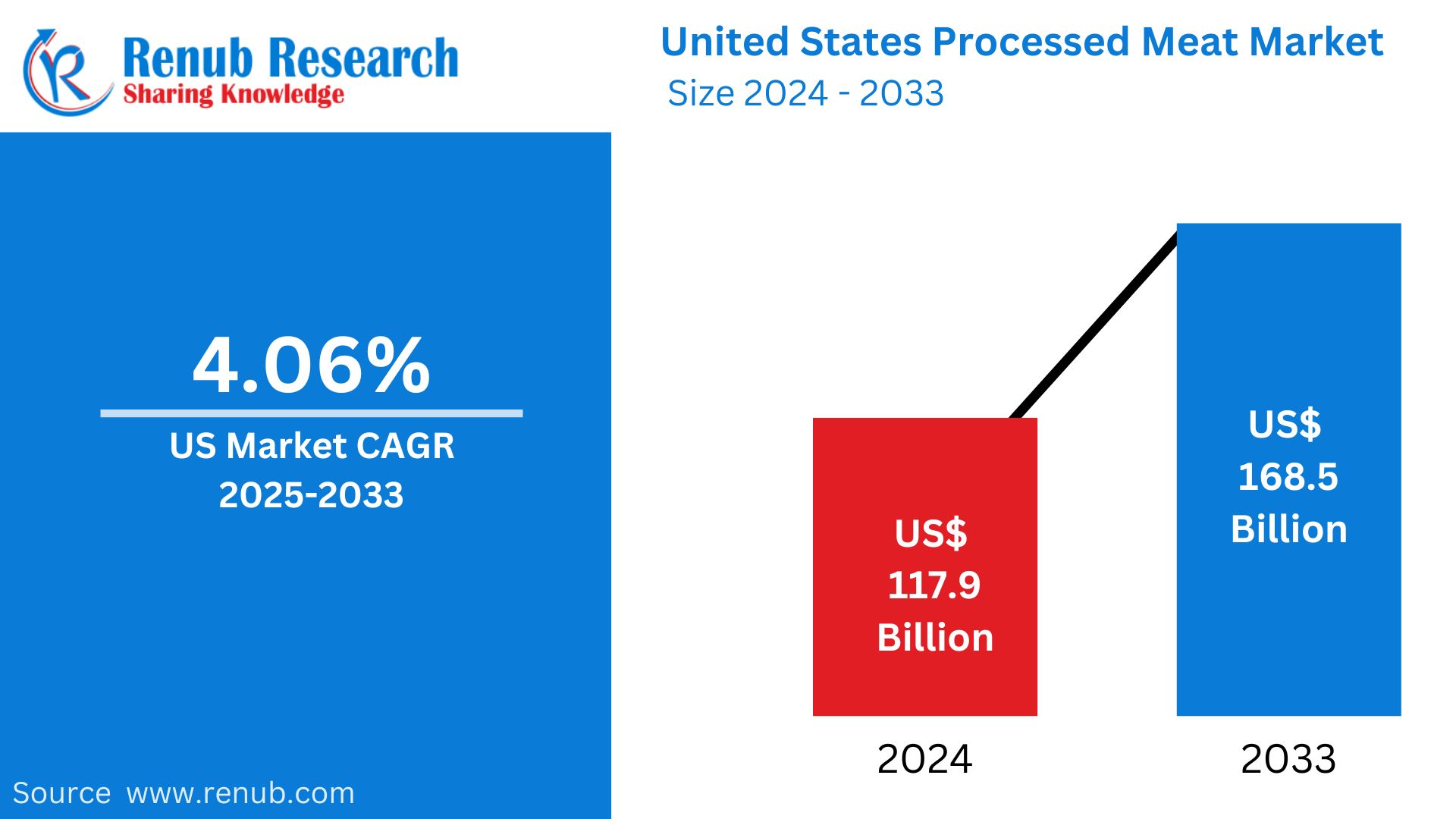

United States Processed Meat market is expected to reach US$ 168.5 billion by 2033 from US$ 117.9 billion in 2024, with a CAGR of 4.05% from 2025 to 2033. Market sales are increased by elements including accessibility, price, ease of use, and palatable flavor. There are numerous variations of the same product and ongoing innovation in the processed meat sector. In the processed category, clean-label and all-natural products are still popular. Popular claims on labels for processed meat products include low-sodium, low-fat, low-calorie, no MSG, and free of additives and preservatives.

The report United States Processed Meat Market & Forecast covers by Meat Type (Poultry, Beef, Pork, Others), Processed Type (Frozen, Chilled, Canned), Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Online Retail Stores) and Company Analysis 2025-2033.

United States Processed Meat Industry Overview

Meat that has been preserved by techniques like smoking, salting, fermenting, or adding chemicals to improve its flavor and shelf life is referred to as processed meat. Beef, hog, turkey, chicken, and lamb are frequently processed meats that are used to make sausages, jerky, pepperoni, and hot dogs. To stop bacteria and other microbes from causing these meats to expire, preservatives are applied. The market for processed meat is extensively used in institutional and retail contexts. Due to consumer preferences for shopping at supermarkets, hypermarkets, and online, retail sales are significant. Additionally, demand is driven by the food service business, specifically the HoReCa sector.

In order to meet the needs of animals for protein, vitamins, or minerals, forage-based diets are strategically supplemented by technology-driven meat manufacturers in the United States. With a nearly 30% market share in 2022, the US ranks among the world's top producers of beef. In 2022, the nation's beef production increased by 354.9 million pounds to 28.4 billion pounds. Missouri, Texas, Oklahoma, and Ohio are the leading beef-producing states in the United States. About 2.9 million cattle were killed in Ohio in 2022, making it one of the top beef-producing states in the country. Additionally, Ohio produced 2% more beef in 2022 than it did in 2021.

Additionally, Cargill Inc. acquired two meat facilities from longtime partner Ahold Delhaize USA in February 2024. To increase its production and supply merchants in the Northeast region of the nation with supermarket-case-ready beef and pork, the company has made investments in two processing facilities.

Growth Drivers for the United States Processed Meat Market

Rising Consumer Demand for Convenience

The market for processed meat in the United States is expanding due in large part to rising customer desire for convenience. Customers are looking for products that require little cooking time and rapid preparation because their lives are becoming more and more hectic. Processed meats that are ready to eat, such cold cuts, sausages, and deli meats, meet this need well and offer a convenient option for meals and snacks. Furthermore, frozen processed beef products are becoming more and more well-liked due to their extended shelf life and ease of meal preparation. The need for quick, easy food options has increased as more people work longer hours and value convenience. As a result of this change, processed meat sales have increased in supermarkets, convenience stores, and online marketplaces, bolstering the U.S. market's ongoing growth.

Increased Disposable Income

The US processed meat business is expanding as a result of customers' increased ability to spend more on high-end goods due to their increased disposable income. Consumers are willing to spend more for premium processed meats, like organic, grass-fed, and gourmet varieties, when family earnings improve. Consumer desires for quality and transparency in food sources are expanding, and these high-end items are perceived as healthier, more sustainable, and better tasting. Additionally, consumers are more likely to experiment with specialized meats like premium cuts, cured meats, and artisanal sausages as their discretionary income increases. This tendency is especially prevalent among wealthy, health-conscious consumers who are prepared to spend money on high-end foods, which is driving up demand for upscale processed beef products and opening up new markets.

Demand from Food Service Industry

One of the main factors propelling the processed meat market in the United States is the expanding demand from the food service sector. Processed meats are widely employed in a variety of menu items, such as sandwiches, burgers, wraps, salads, and breakfast options, as the fast-food and restaurant industries continue to grow. Popular processed meats including deli meats, bacon, sausage, and ham are used extensively in quick-service and fast-casual restaurants since they are essential to many restaurant recipes. Additionally, because processed meats are simple to handle, store, and cook in big numbers, the growing popularity of delivery and takeout services has increased the use of processed meats. The food service industry's increasing reliance on processed meats fosters market expansion and opens up new business prospects for producers.

Challenges in the United States Processed Meat Market

Rising Raw Material Costs

One of the main factors propelling the processed meat market in the United States is the expanding demand from the food service sector. Processed meats are widely employed in a variety of menu items, such as sandwiches, burgers, wraps, salads, and breakfast options, as the fast-food and restaurant industries continue to grow. Popular processed meats including deli meats, bacon, sausage, and ham are used extensively in quick-service and fast-casual restaurants since they are essential to many restaurant recipes. Additionally, because processed meats are simple to handle, store, and cook in big numbers, the growing popularity of delivery and takeout services has increased the use of processed meats. The food service industry's increasing reliance on processed meats fosters market expansion and opens up new business prospects for producers.

Intense Competition

The increased popularity of plant-based meat substitutes is a major factor driving the fierce competition in the US processed meat sector. Customers who are worried about the health hazards of processed meats, such as their high sodium content, preservatives, and saturated fats, are drawn to these substitutes, which are frequently promoted as better and more ecologically friendly options. Products derived from plants, such as soy, pea protein, and mushrooms, are thought to address these issues and satisfy consumers' growing need for cruelty-free and sustainable food sources. In order to stand out from the competition and hold onto market share, traditional processed meat companies are under pressure to innovate, whether through cleaner labels, healthier formulations, or new product offers. In order to remain competitive in a changing market, meat producers are being forced to reconsider their tactics due to the trend toward plant-based diets.

Beef's popularity and versatility may drive dominance in processed meats

Beef could be a dominant meat type in the U.S. processed meat market. This is because of its enormous reputation and adaptable utilization. With a wealthy flavor profile and diverse applications, beef merchandise attracts a broad purchaser base. Its adaptability in various processed meat forms, such as sausages, burgers, and deli meats, makes it a staple in American diets. Further, the established beef enterprise infrastructure ensures steady supply and quality, further solidifying beef's prominent role in the United States processed meat market.

Chilled processed meat's freshness and convenience may lead market dominance

Chilled processed meat holds the potential for the largest share of the United States processed meat. This is because of its freshness, enchantment, and convenience. With purchasers increasingly prioritizing convenience without compromising quality, chilled processed meat products provide stability in shelf life and freshness. These merchandises undergo minimal processing, retaining natural flavors and textures, which resonates nicely with health-aware consumers. Further, the extensive availability of refrigeration infrastructure guarantees the accessibility and preservation of chilled processed meat. This is contributing to its dominance in the U.S. processed meat market.

Hypermarkets and supermarkets drive significant sales in the processed meat market

Hypermarkets and supermarkets are among the leading sections of the United States processed meat market. This is because of their massive reach and various product offerings. These retail giants offer a wide selection of processed meat products under one roof, imparting comfort and range to purchasers. Also, their strategic locations and efficient supply chain control ensure regular availability and competitive pricing. The extensive client base and promotional activities further bolster their dominance, making hypermarkets and supermarkets the preferred destination for processed meat purchases in the U.S.

United States Processed Meat Market Segments

Meat Type – Market breakup in 4 viewpoints:

1. Poultry

2. Beef

3. Pork

4. Others

Processed Type – Market breakup in 3 viewpoints:

1. Frozen

2. Chilled

3. Canned

Distribution Channel – Market breakup in 4 viewpoints:

1. Hypermarkets and Supermarkets

2. Convenience Stores

3. Online Retail Stores

4. Others

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Hormel Foods

2. Tyson Foods

3. Conagra Brands Inc.

4. General Mills

5. Kraft Heinz Company

6. Cargill, Incorporated,

7. Pilgrim’s Pride Corp.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Meat Type, Processed Type, and Distribution Channel |

| Distribution Channel Covered | 1. Hypermarkets and Supermarkets 2. Convenience Stores 3. Online Retail Stores 4. Others |

| Companies Covered | 1. Hormel Foods 2. Tyson Foods 3. Conagra Brands Inc. 4. General Mills 5. Kraft Heinz Company 6. Cargill, Incorporated, 7. Pilgrim’s Pride Corp. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the U.S. processed meat industry by 2033?

-

What is the expected CAGR of the U.S. processed meat market from 2025 to 2033?

-

Which factors are driving the growth of the U.S. processed meat market?

-

What are the key segments of the U.S. processed meat market based on meat type?

-

Which distribution channel holds the largest market share in the U.S. processed meat industry?

-

How is the rising demand for convenience influencing the processed meat market in the U.S.?

-

What challenges does the U.S. processed meat market face?

-

How is the increasing popularity of plant-based meat alternatives affecting the industry?

-

Which companies are the major players in the U.S. processed meat market?

-

What role does the food service industry play in the growth of processed meat sales?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Unites States Processed Meat Market

6. Market Share

6.1 By Meat Types

6.2 By Processed Types

6.3 By Distribution Channels

7. Meat Types

7.1 Poultry

7.2 Beef

7.3 Pork

7.4 Others

8. Processed Types

8.1 Frozen

8.2 Chilled

8.3 Canned

9. Distribution Channels

9.1 Hypermarkets and Supermarket

9.2 Convenience Stores

9.3 Online Retail Stores

9.4 Others

10. Porter’s Five Forces

10.1 Bargaining Power of Buyer

10.2 Bargaining Power of Supplier

10.3 Threat of New Entrants

10.4 Rivalry among Existing Competitors

10.5 Threat of Substitute Products

11. SWOT Analysis

11.1 Strengths

11.2 Weaknesses

11.3 Opportunities

11.4 Threats

12. Key Players Analysis

12.1 Hormel foods

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue

12.2 Tyson Foods

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue

12.3 Conagra Brands Inc.

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue

12.4 General Mills

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue

12.5 The Kraft Heinz Company

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue

12.6 Cargill, Incorporated

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue

12.7 Pilgrim’s Pride Corp

12.7.1 Overview

12.7.2 Recent Development

12.7.3 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com