United States Soup Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Soup Market Trends & Summary

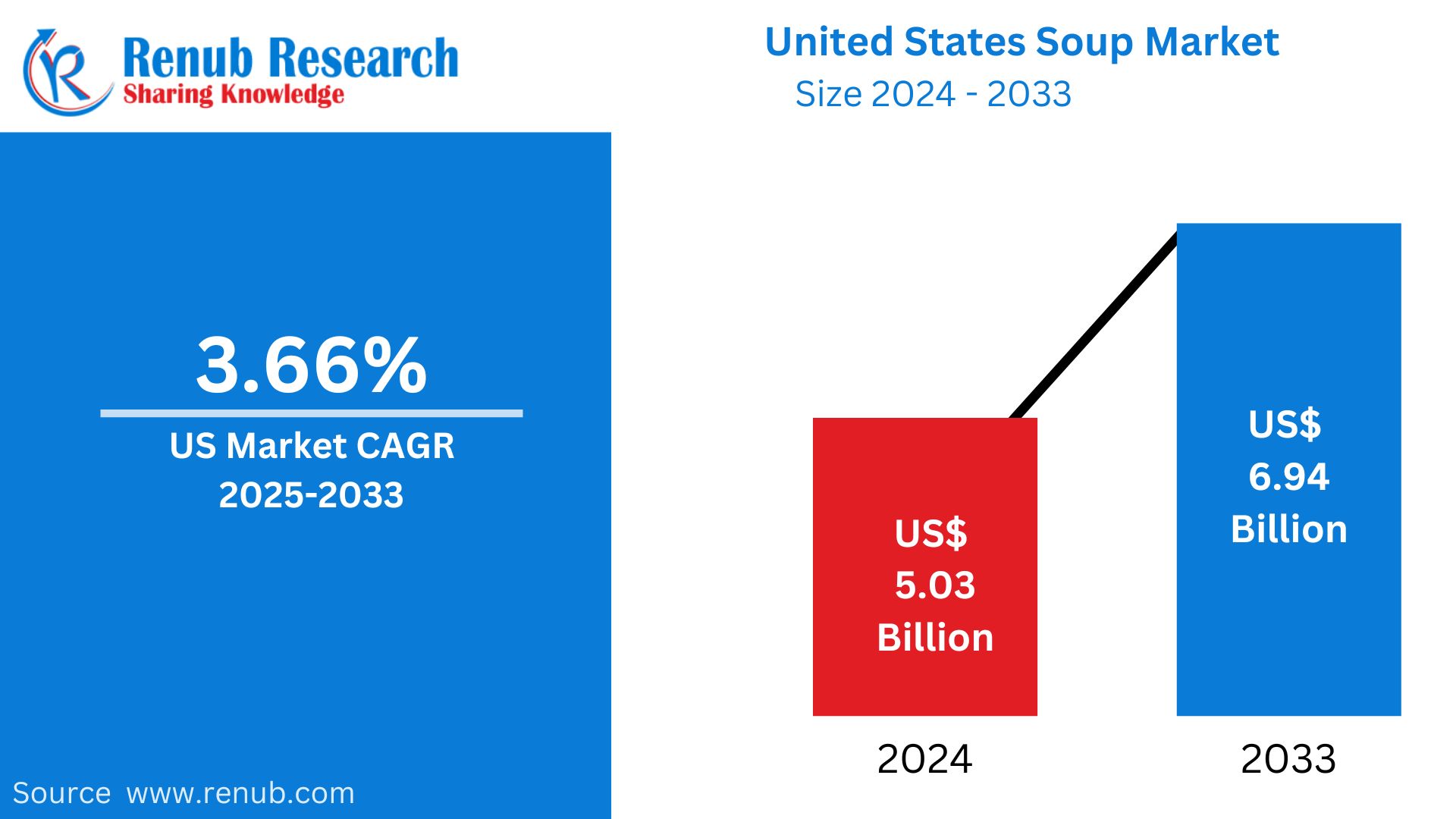

United States soup market stood at around US$ 5.03 billion in 2024 and is anticipated to reach around US$ 6.64 billion in 2033, exhibiting a compound annual growth rate of 3.66% between 2025 and 2033. This is fueled by the rising consumer demand for convenient and healthful meal sources that translate into increased consumption of soups.

The report United States Soup Market Forecast covers by Product (Ready-to-eat Wet, Condensed Wet, Dry, Frozen/Refrigerated, Wet Broths/Stocks), Distribution channel (Food Service, Retail, Online stores), Region (East, West, North, South), Company Analysis 2025-2033.

United States Soup Market Outlooks

Soup is a liquid dish prepared by simmering food materials like vegetables, meat, cereals, and spices in liquid broth, water, or milk. It varies from brothy and light to creamy and thick, thus qualifying as a complete meal. Its common forms include chicken noodle, tomato, minestrone, clam chowder, and bisques. Soups are either served hot or cold, depending upon the ingredients used and the cooking method.

Soup is a common feature in restaurants and homes in the United States because of its convenience, comfort, and health benefits. Soup is commonly eaten during winter and is linked with health, especially when recovering from colds or flu. Increasing demand for organic, plant-based, and ready-to-eat soups has driven market expansion. With new packaging and flavor innovations, soup remains a preferred meal option. The impact of global cuisines, such as ramen, pho, and tortilla soup, has also boosted its popularity, and soup has become a favorite among all age groups.

Drivers of Growth in the United States Soup Market

Growing Demand for Healthy and Convenient Meal Options

As the population's busy lifestyles continue to grow, they want to have meal options that are convenient and healthy. Ready-to-eat (RTE) soups, microwave bowls, and single-serve packaging are in vogue because of the convenience they offer. Health-aware consumers also insist on soups made from natural ingredients, less sodium, and no added chemicals. Clean eating has further contributed to the popularity of organic, gluten-free, and plant-based soups. With companies finding ways to develop healthier and convenient soup options, this segment will see huge growth in the future years. December 2024, Panera Bread introduces its limited-release holiday soup cup collection, perfect for winter. The collection features two new soups for Autumn 2024: Hearty Fireside Chili and Rustic Baked Potato Soup, and timeless favorites, as the chain serves more than 140 million servings a year.

Growing Trend of Premium and Functional Soups

Consumers are moving away from standard canned soups towards higher-end, better-quality products with restaurant-quality taste and functional value. Soups containing bone broth, collagen, and superfoods like turmeric, ginger, and kale have become popular. Brands are also launching gourmet global-inspired flavors, such as Thai, Mediterranean, and Korean soups. Such products appeal to consumers who are looking for indulgence and health value. With trends in functional food continuing to soar, the upscale soup segment should see ongoing expansion. Jan 2022, Zoup! is coming home to its soup roots with an all-new portfolio of gourmet, shelf-stable soups. Developed by a 20+ year soup industry expert, Zoup! Good, Really Good® Soups capture the company's iconic simmered flavor without sacrificing ease and convenience with heat-and-eat options.

Development of Plant-Based and Vegan Soup Options

The plant-based food revolution has had a major influence on the soup market, with more and more consumers choosing meat-free options. Lentil, chickpea, and plant-protein-based vegan and vegetarian soups have become mainstream. Dairy-free creamy soups and vegetable-based broths are being added to product lines by brands. Consumers are also attracted to sustainability, with consumers choosing soups that have ethically sourced ingredients and environmentally friendly packaging. As more consumers embrace flexitarian, vegetarian, or vegan lifestyles, plant-based soups lead the way in market growth. Nov 2024, organic and natural food leader Amy's Kitchen launches five new soups with international cuisine and Southern favorites, crafted from scratch using organic ingredients and fresh vegetables.

Obstacles in United States Soup Market

Fading Popularity of Traditional Canned Soups

Though convenient, old-fashioned canned soups experience falling demand because consumers worry about high sodium levels, additives, and man-made ingredients. Fresh, organic, and minimally processed alternatives are the choice of newer generations. Stagnation in the canned soup category resulted from this trend, which compelled traditional brands to reformulate products, create new packaging, and enhance nutritional profiles. Constant innovation is a requirement for companies to hold on to market share with evolving consumer tastes.

Increasing Competition from Alternative Meal Solutions

The soup category faces competition from an increasing number of alternative meal occasions, such as meal kits, protein shakes, and grab-and-go salads. With consumers looking for variety in what they eat, soups compete not just with other soup brands but also with other convenient meal occasions. Moreover, plant-based and functional food trends have created more alternatives like smoothie bowls and high-protein snacks that can divert consumers away from the traditional soup products.

United States RTE Wet Soup Market

Ready-to-eat (RTE) wet soups are increasingly popular among consumers who look for fresh and high-quality options instead of traditional canned soups. Refrigerated and microwave soups provide the taste of home and improved nutritional content, making them a first choice. Companies like Panera Bread and Campbell's Fresh Reserve have launched high-end RTE soups with clean-label ingredients. The need for restaurant-style soups at home has also spurred the growth of this category, with advances in packaging and shelf life extension increasing convenience.

United States Dry Soup Market

Dry soups such as instant soups, powder mixes, and dehydrated soup varieties are still in vogue because they have a longer shelf life and are easy to prepare. Individuals who look for quick and affordable meal options go for dry soup products. Advances in freeze-drying technology have enhanced flavor and nutrition, making them more desirable. Health-conscious brands are also creating clean-label dry soups using organic, non-GMO ingredients and lower sodium levels. This category continues to gain traction among price-sensitive shoppers and disaster food supply seekers.

United States Frozen/Refrigerated Soup Market

The frozen and refrigerated soup market has expanded considerably driven by consumer demand for fresher, less processed substitutes to canned soup. Customers view refrigerated soups as healthier and more akin to home-cooked meals. Marketers are reacting with gourmet flavor introductions, organic variations, and global-influenced recipes. Frozen soups provide long shelf life without the use of preservatives, and the convenience appeals to health-oriented consumers. This category has been a consistent growth factor in grocery stores as well as direct-to-consumer meal delivery.

United States Food Service Soup Market

The food service soup industry is aided by the growing visibility of soups within restaurants, cafés, and quick-service restaurants. Soups are flexible menu offerings, appealing to cost-conscious and health-conscious consumers. Seasonal and locally prepared soup options are popular in many establishments with the objective of winning customers over. The demand for convenience store and gas station grab-and-go soups has also grown. With the foodservice market growing every year, soups continue to be a fixture on menus because of their profitability and wide popularity with consumers.

United States Retail Soup Market

Retailers are concentrating on selling premium, variety, and healthy soup options in response to consumers' needs. The growth of private-label offerings in large supermarket chains has created high-quality and affordable alternatives to national brands. Supermarkets also are expanding shelf space for refrigerated and plant-based soups. E-commerce has contributed to the growth of the retail soup market by enabling consumers to purchase specialty and international soups on the web. With the advancement in ingredients, flavors, and packaging, the retail soup business remains on the move.

East United States Soup Market

Eastern U.S. also experiences high demand for soups, fueled by cold climates and local gastronomic traditions. Manhattan-style soups, New England clam chowder, and lobster bisque are the leading favorites of the region. Diverse immigrant groups also add an international twist in terms of the flavors with the presence of pho, borscht, and ramen. Premium and artisanal brands are preferred among the consumers here, especially farm-to-table and local ingredient brands.

West United States Soup Market

Western U.S. soup demand is influenced by health-and-nature-focused consumers. California is at the forefront of organic, non-GMO, and plant-based soup demand. The rise of vegan and gluten-free lifestyles has had a direct impact on soup innovation in this market, with brands creating new, nutrient-rich solutions. Western consumers also favor fresh, refrigerated, and locally made soups instead of the more traditional canned offerings. Clean-label transparency and sustainability are also the driving factors for purchasing in this market.

North United States Soup Market

The North U.S. witnesses high soup consumption, particularly during winter seasons. They take a liking to filling and comforting soups like beef stew, chicken noodle, and split pea soup. Ready-to-eat soups and frozen soups are most favored given their convenience and comforting nature in offering protection from severe winters. The cultural attachment in the region towards European and Midwestern comfort food impacts the pattern of soups, thereby necessitating rich and creamy high-protein-based forms. To stay abreast with the evolving eating habits of people, food firms are recrafting original soups for nutrition requirements that reflect the modern diets.

United States Soup Market Segments

Product

- Ready-to-eat Wet Soups

- Condensed Wet Soups

- Dry Soups

- Frozen/Refrigerated Soup

- Wet Broths/Stocks

Distribution channel

- Food Service

- Retail

- Online stores

Region

- East

- West

- North

- South

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Company Analysis

- The Campbell's Company

- Kellanova

- PepsiCo

- Nestlé

- General Mills Inc.

- The Kraft Heinz Company

- Hain Celestial Group

- Cargill Incorporated

- Con Agra Brands, Inc.

- Greencore

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Distribution channel and Region |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the U.S. soup market by 2033?

-

What is the expected compound annual growth rate (CAGR) of the U.S. soup market between 2025 and 2033?

-

Which factors are driving the growth of the U.S. soup market?

-

What are the key challenges facing the traditional canned soup segment?

-

How is the rising demand for plant-based and vegan soups influencing the market?

-

What are the major product segments in the U.S. soup market?

-

Which distribution channels are dominating the U.S. soup market?

-

How are premium and functional soups contributing to market growth?

-

What role do regional preferences play in shaping soup consumption trends in the U.S.?

-

Who are the key players in the U.S. soup market, and how are they innovating?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Soup Market

6. Market Share

6.1 By Product

6.2 By Distribution channel

6.3 By Region

7. Product

7.1 Ready-to-eat Wet Soups

7.2 Condensed Wet Soups

7.3 Dry Soups

7.4 Frozen/Refrigerated Soup

7.5 Wet Broths/Stocks

8. Distribution channel

8.1 Food Service

8.2 Retail

8.3 Online stores

9. Region

9.1 East

9.2 West

9.3 North

9.4 South

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 The Campbell's Company

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development

12.1.4 Revenue

12.2 Kellanova

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development

12.2.4 Revenue

12.3 PepsiCo

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development

12.3.4 Revenue

12.4 Nestlé

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development

12.4.4 Revenue

12.5 General Mills Inc.

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development

12.5.4 Revenue

12.6 The Kraft Heinz Company

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development

12.6.4 Revenue

12.7 Hain Celestial Group

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development

12.7.4 Revenue

12.8 Cargill, Incorporated

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development

12.8.4 Revenue

12.9 Con Agra Brands, Inc.

12.9.1 Overview

12.9.2 Key Persons

12.9.3 Recent Development

12.9.4 Revenue

12.10 Greencore

12.10.1 Overview

12.10.2 Key Persons

12.10.3 Recent Development

12.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com