United States Toys Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Toys Market Trends & Summary

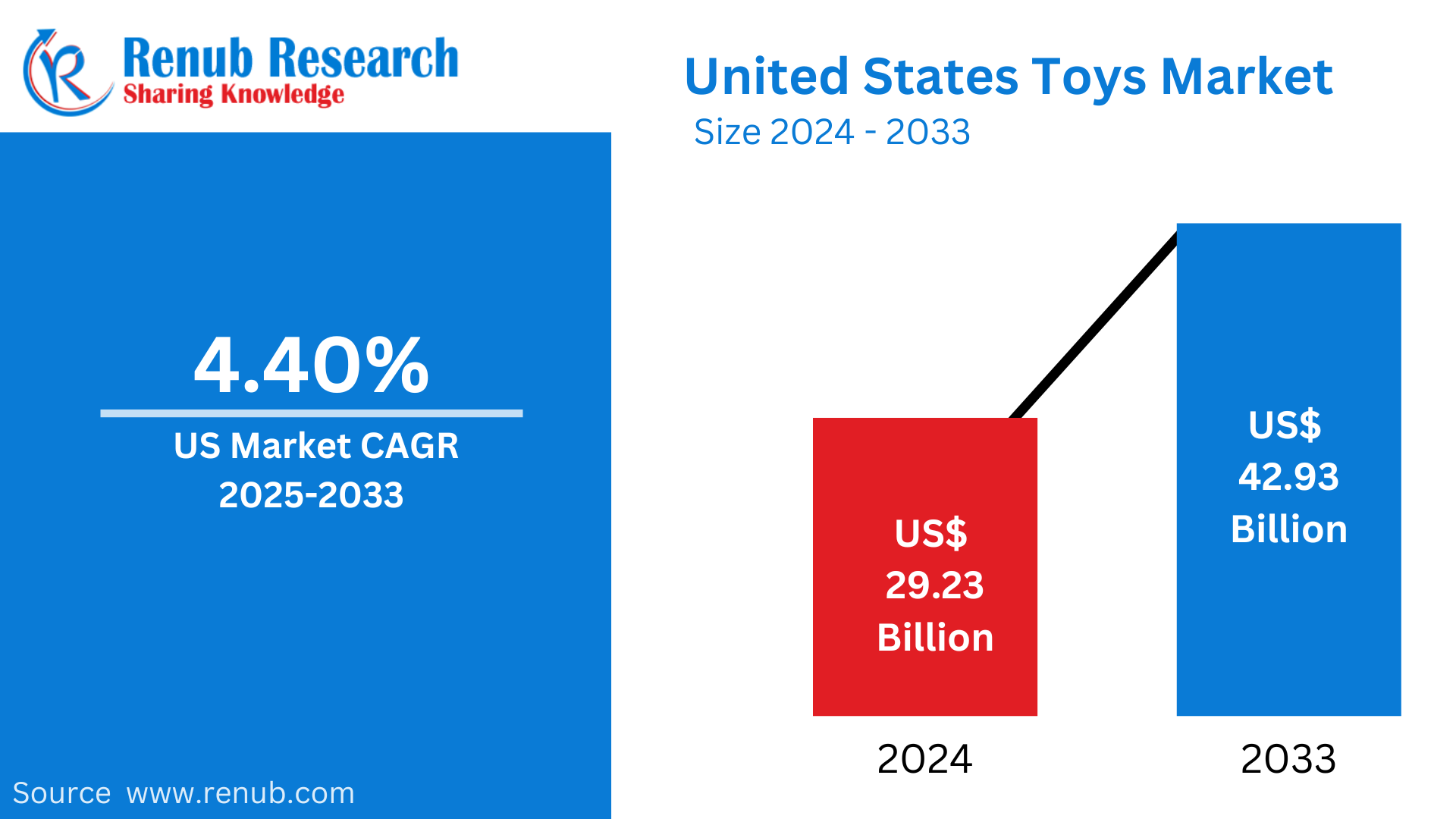

The United States toys market size is expected to reach around US$ 42.93 billion by 2033. This will be up from US$ 29.23 billion in 2024. The market will grow at a compound annual growth rate (CAGR) of 4.40% from 2025 to 2033. Increased demand for new and interactive toys, as well as an emphasis on educational toys for children, fuels the growth in the market.

The report United States Toys Market & Forecast covers by Toys Segmentation (Action Figures & Accessories, Arts & Crafts, Building Sets, Dolls, Explorative & Others Toys, Games/Puzzles, Infant/Toddler/Preschool Toys, Outdoor & Sports Toys, Plush, Vehicles, Youth Electronics), Sales Channel (E-commerce, Specialty, Discounters, Department Stores, Others), and Company Analysis 2025-2033.

United States Toys Market Outlooks

A toy is a plaything; it is used for entertainment or education. Often, toys are made for kids, but every age group finds a way to enjoy them. Toys include everything from the classics, such as dolls, action figures, and puzzles, to the more tech-savvy toys, such as drones and augmented reality items. Toys contribute significantly to children's development through creativity, thinking, and socialization.

In the United States, toys are immensely popular as they are a cornerstone of childhood experiences and family bonding. The U.S. toy market is one of the largest globally, with consumers driving demand for innovative, safe, and educational products. The popularity of toys is fueled by cultural events like Christmas, birthdays, and other holidays where gifting is everyday. Licensing encompasses the entertainment franchises Disney, Marvel, and Star Wars; these have major sales impacts for action figures and collectibles. Additionally, a growing number of STEM (science, technology, engineering, and mathematics) toys indicates that the interest in play as learning has increased. To date, toys are a core and ever-changing part of American culture. By 2024, there are expected to be approximately 74.6 million children in the United States. The Congressional Budget Office (CBO) projects that the US population will increase from 342 million in 2024 to 383 million in 2054.

Growth Drivers in the United States Toys Market

Increasing Focus on STEM Education

As educational toys continue to gain popularity, there is a growing emphasis on STEM (Science, Technology, Engineering, and Mathematics) toys. These products are designed to encourage creativity, critical thinking, and problem-solving skills among children. Parents are spending on toys that not only entertain but also offer learning experiences due to the rising demand for educational tools. Growth in the U.S. toy market is promoted by the development of STEM toys, which not only help children develop their minds but also equip them with knowledge that can prepare them for their future careers in technology and science. October 2023 sees the OpenEnded product range marked by Toycra as its milestone in educative toys designed to heighten excitement and stimulate skill development among every child.

Expansion of Digital-Interactive Toys

The latest achievements in technology were reflected in various digital and interactive toys like the smart toys or robotic kits which combined the time-honoured play with present-day digital appeal, hence proving to be fascinating for the youngsters. The integration of augmented reality (AR), artificial intelligence (AI), and interactive features into toys has significantly boosted market growth. As children become more tech-savvy, parents increasingly seek out toys that provide a blend of entertainment and educational value, driving the demand for tech-integrated toys in the U.S. market. October 2024 saw the release of an educational toy line from Ms. Rachel that focused on sensory toys like plush farms, puzzles, and tummy time mats, where engaging experiences could contribute to cognitive and motor skill development.

Growing Collectible and Franchise-Based Toys

Franchise-based and collectible toys that are connected with popular movies, TV shows, and video games have a good hold in the U.S. toy market. The market will always remain valid with the products since children and collectors alike have always been attracted to action figures, dolls, and accessories that inspire their interest in Marvel, Star Wars, and Disney franchises. Demand for intellectual property (IP)-based toys will ensure these products continue to grow as relevant market shares. Moreover, collectible toys trigger repeated purchase because children and collectors keep searching to complete their collections, further increasing market size. March 2023, The firm signed a deal with PlayMonster to add more Playskool variants to its portfolio in 2024. Playskool is the education toy line owned by Hasbro.

Issues within the U.S. Toys Industry

Supply Chain and Production Problems

There are issues of supply chain disruptions within the U.S. market for toys, mainly during peak demand seasons like holidays. Most of the toys are made overseas. A shortage in raw materials, delays in shipping, and lack of labor will create stockouts and higher prices. Retailers find it difficult to keep up with demand. Parents may also have a problem getting popular toys for their children. To alleviate such problems, manufacturers of toys are looking for more localized production and diversified supply chains, though such efforts are still in the developmental stages.

Greater Regulatory Oversight and Safety Issues

The toy-making industry in the United States faces strict safety measures to ensure its products are child-friendly. Among these are safety measures against choking, non-toxic materials, and age-appealing designs. However, the complexity of safety standards as well as changes in them is a challenge to toy companies, especially small companies. Moreover, safety issues relating to product recall and potential risks can harm brands, leading to loss of customer confidence and declining sales.

United States Action Figures & Accessories Market

The U.S. action figures and accessories market is one of the key components of the larger toy industry, powered by consumer demand for character-driven toys related to popular franchises. From Marvel and DC superheroes, Star Wars and Transformers, kids and adult collectors are on a quest for the action figures that bring the story to life in their imagination. These toys are often accompanied by accessories, such as vehicles, playsets, and weapons, enhancing the play experience. The growth of franchises and licensed products, along with the rise of collector-driven demand, ensures the continued expansion of this niche market.

United States Dolls Market

The U.S. dolls market remains a prominent segment in the toy industry, fueled by the long-standing popularity of dolls as a staple toy for children. Dolls of all the types, from a fashion doll like Barbie to baby dolls and action figures continue entertaining young minds. Recently, there has emerged a persistent trend toward exclusively focusing on diverse and inclusive dolls, reflecting more ethnicities, body types, and disabilities in general. This attains the social representation aspect in the toys, empowering children with this ability to embrace diversity, which is driving the market further.

United States Games/Puzzles Market

The games and puzzles market in the United States has seen steady growth, as these products are favored by families for interactive play. Board games, card games, and jigsaw puzzles are popular options that provide both entertainment and cognitive development. The interest for strategy-based games and competitive activities increases, but families find themselves shifting towards it in order to have some family socialization with less screen exposure and still a form of play. Also, with the advancement to buying online games, there are now so many more selections for these toys to reach larger demographics.

E-commerce Toy Market of United States

The e-commerce toy market in the United States has grown rapidly in recent years. This has been due to online shopping and its convenience, besides having a huge collection of products under one platform. Retailers like Amazon, Walmart, and small toy stores are using digital platforms to target customers. Many parents prefer shopping online because of the convenience of being able to compare prices and check reviews. In addition, targeted marketing and promotions-holiday savvy, to be specific-enhance consumer spending on toys and expand the market's digital footprint. Sept 2024. Macy's and Toys"R"Us® are kicking off the holiday season with Geoffrey's Hot Toy List for 2024, featuring 150 must-have toys for all ages from brands like Barbie®, Hot Wheels, Pokémon, LEGO®, and Bluey. Top amongst those are the specialty exclusive Geoffrey with a Christmas Tree FUNKO and popular Toys"R"Us brands like Fast Lane and You & Me. One other specialist toy from top brands such as Transformers and Teenage Mutant Ninja Turtles is also available exclusively only at Toys"R"Us in Macy's across the United States.

Specialty Toys Store in the United States

Specialty toys in the United States focuses on individualistic, high-quality, or even education-based products that have become a niche of the broader toy industry. Some of the examples of specialty toys include handcrafted toys, eco-friendly toys, and toys that are made to stress on educational activities involving STEM or creativity. These products are available within boutique stores or online platforms targeting parents seeking non-mainstream options. This market is experiencing growth in specialty toys, as increasingly discerning consumers who care more about quality rather than mass production seek developmental toys that can either encourage imaginative play or teach a specific skill. September 2023, Melissa & Doug opened its first physical store at The Westchester mall in White Plains, New York. In a space measuring about 1,600 square feet, they select the company's best-sellings-from their learning toys and puzzles, their arts and crafts.

United States Toys Market Segments

By Toys Segmentation – Market is broken up into 11 viewpoints:

1. Action Figures & Accessories

2. Arts & Crafts

3. Building Sets

4. Dolls

5. Explorative & Others Toys

6. Games/Puzzles

7. Infant/Toddler/Preschool Toys

8. Outdoor & Sports Toys

9. Plush

10. Vehicles

11. Youth Electronics

By Sales Channel – Market is broken up into 5 viewpoints:

1. E-commerce

2. Specialty

3. Discounters

4. Department Stores

5. Others

All companies have been covered from 3 viewpoints:

• Overview

• Recent Development

• Revenue

Company Analysis:

1. Mattel Inc.

2. Hasbro Inc.

3. LEGO

4. Spin Master Corp.

5. Vtech

6. Nintendo Company Ltd.

7. Funko Inc.

8. JAKKS Pacific

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Segments, and Sales Channel |

| Toys Segmentation Covered |

1. Action Figures & Accessories |

| Companies Covered |

1. Mattel Inc. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Toys Market

6. Market Share Analysis

6.1 By Toys Segmentations

6.2 By Sales Channel

7. Toys Segmentations

7.1 Action Figures & Accessories

7.2 Arts & Crafts

7.3 Building Sets

7.4 Dolls

7.5 Explorative & Others Toys

7.6 Games/Puzzles

7.7 Infant/Toddler/Preschool Toys

7.8 Outdoor & Sports Toys

7.9 Plush

7.10 Vehicles

7.11 Youth Electronics

8. Sales Channel

8.1 E-commerce

8.2 Specialty

8.3 Discounters

8.4 Department Stores

8.5 Others

9. Import and Trade Regulations in United States

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 Mattel Inc.

12.1.1 Overviews

12.1.2 Recent Developments

12.1.3 Revenues

12.2 Hasbro Inc.

12.2.1 Overviews

12.2.2 Recent Developments

12.2.3 Revenues

12.3 LEGO

12.3.1 Overviews

12.3.2 Recent Developments

12.3.3 Revenues

12.4 Spin Master Corp.

12.4.1 Overviews

12.4.2 Recent Developments

12.4.3 Revenues

12.5 Vtech

12.5.1 Overviews

12.5.2 Recent Developments

12.5.3 Revenues

12.6 Nintendo Company Ltd.

12.6.1 Overviews

12.6.2 Recent Developments

12.6.3 Revenues

12.7 Funko Inc.

12.7.1 Overviews

12.7.2 Recent Developments

12.7.3 Revenues

12.8 JAKKS Pacific

12.8.1 Overviews

12.8.2 Recent Developments

12.8.3 Revenues

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com