United States Molecular Diagnostics Market Report Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Molecular Diagnostics Market Trends & Summary

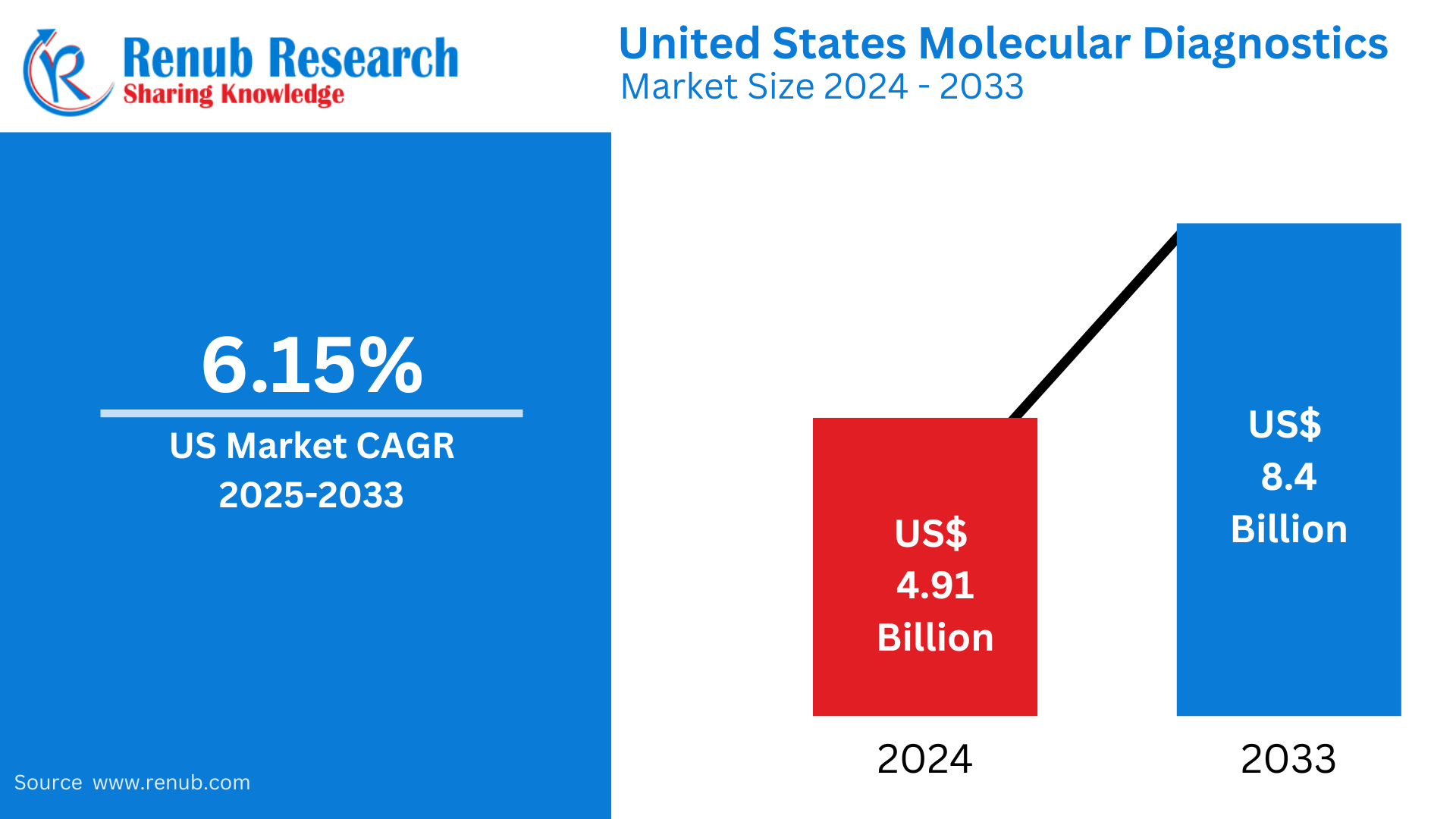

The United States molecular diagnostics market stood at USD 4.91 billion in 2024 and is expected to reach USD 8.40 billion by 2033, growing at a CAGR of 6.15% from 2025 to 2033. This is fueled by the development of diagnostic technologies, rising demand for personalized medicine, and an increased incidence of infectious diseases and cancer, making the U.S. a leading force in the world market.

United States Molecular Diagnostics Market Report by Technology (Chips and Microarrays, In Situ Hybridization, Sequencing, Mass Spectrometry (MS), PCR, and Other Technologies), Application (Pharmacogenomics, Infectious Disease, Genetic Disease Screening, Oncology, Blood Screening, Microbiology, and Human Leukocyte Antigen Typing), Product (Instruments, Reagents, and Other Products), End User (Hospitals, Laboratories, and Other End Users), and Company Analysis 2025-2033

US Molecular Diagnostics Market Outlooks

Molecular diagnostics is an emerging branch of medical testing that examines DNA, RNA, and proteins to identify diseases, determine genetic mutations, and inform treatment. Molecular diagnostics employs advanced technologies like polymerase chain reaction (PCR), next-generation sequencing (NGS), and microarrays to yield very precise and fast results, transforming disease management and personalized medicine.

In the US, molecular diagnostics plays a vital role in the detection of infectious diseases like COVID-19, HIV, and influenza. It is also extensively utilized in oncology to detect cancer biomarkers, which allows for targeted therapies in breast and lung cancer conditions. Molecular diagnostics is also vital in genetic screening, prenatal testing, and pharmacogenomics, which personalizes medications according to a patient's genetic makeup. As the U.S. healthcare system focuses on the early detection of diseases and precision medicine, molecular diagnostics are increasingly being adopted across hospitals, diagnostic centers, and research centers, which is further enhancing patient outcomes and fuelling medical innovation.

Growth Drivers of the U.S. Molecular Diagnostics Market

Rising Infectious Disease and Cancer Incidence

The increasing prevalence of infectious diseases such as COVID-19, influenza, and HIV, and the increasing number of cancer cases are fueling demand for molecular diagnostics in the U.S. Early and accurate detection of disease is essential for successful treatment, and molecular diagnostics offers quick and accurate results. Genetic testing in oncology identifies specific biomarkers for targeted therapy. The increasing usage of liquid biopsy and next-generation sequencing (NGS) also contributes to the growth of the market. The U.S. is expected to have 2,041,910 new cancer cases and 618,120 cancer deaths in 2025. The death rate for cancer has decreased since 1991, preventing nearly 4.5 million deaths because of declining smoking, increased early detection, and better treatments. Yet, there are still major gaps, with Native Americans having two to three times the mortality for some cancers as White people, and Black people having twice the mortality for prostate, stomach, and uterine corpus cancer.

Technological Innovation and Automation of Molecular Testing

Ongoing innovation in molecular diagnostic technologies like digital PCR, CRISPR-based diagnostics, and AI-enabled data analysis are revolutionizing the market. Automated diagnostic systems enhance efficiency, minimize human errors, and support high-throughput testing, bringing molecular diagnostics to the masses. Firms are investing in point-of-care (POC) molecular diagnostic platforms that are easy to use, portable, and affordable, which provide quicker results and improved disease management. The innovations drive acceptance across hospitals, laboratories, and research centers. Jan 2024, Diagnostics firm 3EO Health makes its low-cost COVID-19 test available to U.S. physicians and consumers.

Increasing Focus on Personalized Medicine

The American healthcare system is moving towards personalized medicine, in which treatments are individualized according to a patient's genetic makeup. Molecular diagnostics plays an important role in pharmacogenomics, assisting in determining the right drugs and dosages for a given patient. Targeted therapies in oncology based on molecular diagnostics enhance the effectiveness of treatment and reduce side effects. With personalized medicine gaining more popularity, the need for molecular diagnostic tests is likely to increase drastically. FDA approved 16 new personalized drugs for rare disease patients in 2023, compared to six in 2022. The new personalized drugs approved in 2023 also cover seven cancer medications and three for other diseases and conditions.

Challenges in the U.S. Molecular Diagnostics Market

High Costs and Reimbursement Issues

Molecular diagnostic tests tend to need costly equipment, reagents, and highly trained professionals, making the tests expensive. Insurance coverage has increased, but reimbursement policies by healthcare providers are still complex and variable. Medicare or private insurance does not cover many sophisticated molecular tests comprehensively, thus denying them to some patients. The cost constraint to healthcare facilities and patients hinders the widespread use of molecular diagnostics in the U.S.

Regulatory and Compliance Hurdles

The U.S. molecular diagnostics market is faced with strict FDA and other government regulatory requirements. The process for the approval of new molecular diagnostic tests is lengthy and expensive, which can cause delays in entering the market. Regulatory uncertainty concerning laboratory-developed tests (LDTs) also poses a challenge to manufacturers and clinical labs. Adhering to changing standards, quality control procedures, and data protection regulations also complicates market expansion.

United States Chips and Microarrays Molecular Diagnostics Market

The microarray and chips segment has extensive applications in molecular diagnostics to profile gene expression, detect mutation, and screen for disease. In the United States, such technologies play important roles in the diagnosis of cancer, pharmacogenomics, and infectious disease tests. Microarray-based testing offers high-throughput analysis of genetic material, making it more efficient and accurate. Increased demand for personalized medicine and improvements in bioinformatics are accelerating growth in the segment.

United States PCR Molecular Diagnostics Market

Polymerase chain reaction (PCR) is still the gold standard in molecular diagnostics, used extensively for the detection of infectious diseases, genetic disorders, and cancer biomarkers. PCR testing played a crucial role in controlling the COVID-19 pandemic in the U.S., resulting in huge market growth. Ongoing innovations, including digital PCR and multiplex PCR, have enhanced sensitivity and efficiency. The growing demand for rapid and accurate diagnostic solutions is driving demand in this segment.

United States Molecular Diagnostics Infectious Disease Market

Pressure for the timely detection of pathogens propels the infectious disease area in the molecular diagnostics market of the U.S. PCR, next-generation sequencing, and point-of-care molecular tests are among the commonly employed methods for identifying COVID-19, HIV, hepatitis, and respiratory infections. Emphasis on pandemic readiness and antimicrobial resistance has heightened governmental funding and investment from the private sector, speeding up the demand for molecular diagnostic solutions to contain infectious diseases as well.

United States Molecular Diagnostics Oncology Market

Molecular diagnostics is transforming cancer detection and treatment in the United States by facilitating precision medicine and targeted therapy. Liquid biopsies, NGS, and biomarker testing facilitate the detection of early-stage cancer and inform treatment decisions. Improved survival rates have been achieved through developments in tumor profiling and genetic screening. With growing cases of cancer and more widespread use of companion diagnostics, the molecular oncology market in the United States is seeing robust growth.

United States Instruments Molecular Diagnostics Market

The instruments segment comprises PCR machines, sequencing platforms, microarray systems, and other diagnostic equipment required for molecular testing. In the United States, there is a rising demand for high-throughput and automated diagnostic instruments as a result of mounting laboratory workloads and the necessity for quick testing. Firms are investing in portable and easy-to-use molecular diagnostic instruments, broadening their application in clinical environments, research laboratories, and point-of-care, fueling market growth.

Investment in the United States Molecular Diagnostics Market

Jan 2025, The DDDI FY2022 investment was $263 million for advanced product development and regulatory clearance, including diagnostics for Biothreats, Antimicrobial Resistance, Biodosimetry, Influenza, COVID-19, and Respiratory Protection Devices. DDDI invests in testing systems and medical devices appropriate for a variety of settings, such as hospitals, outpatient clinics, nursing homes, and homes. The emphasis is on products at any stage of development, from late-stage research to FDA clearance.

Top United States Molecular Diagnostics Company News

Jan 2024, ELITechGroup releases the GI Bacterial PLUS ELITe MGB® Kit, expanding its diagnostic portfolio. The in vitro test is aimed at significant bacterial pathogens such as Campylobacter spp., Clostridium difficile, Salmonella spp., Shigella spp., and Yersinia enterocolitica, which are leading causes of food- and waterborne disease and hospital-acquired gastrointestinal illness.

In August 2023, QIAGEN obtained the U.S. FDA clearance for the Therascreen PDGFRA RGQ PCR kit. It helps doctors detect patients with gastrointestinal stromal tumors (GIST).

In January 2023, the U.S. FDA approved EUA for the VIASURE Monkeypox Virus Real-Time PCR Reagents from BD and CerTest Biotec to detect the Mpox virus.

Lucira Health introduced the initial and sole at-home COVID-19 and flu tests in the U.S. in March 2023. The U.S. FDA issued the COVID-19 & Flu Home Test the first and sole Emergency Use Authorization (EUA) for at-home and other non-lab use OTC.

United States Molecular Diagnostics Market Segments

Technology

- Chips and Microarrays

- In Situ Hybridization

- Sequencing

- Mass Spectrometry (MS)

- PCR

- Other Technologies

Application

- Pharmacogenomics

- Infectious Disease

- Genetic Disease Screening

- Oncology

- Blood Screening

- Microbiology

- Human Leukocyte Antigen Typing

Product

- Instruments

- Reagents

- Other Products

End User

- Hospitals

- Laboratories

- Other End Users

All the Key players have been covered from 5 Viewpoints:

- Overview

- Key persons

- Recent Development

- Revenue

Key Players Analysis

- F Hoffmann-la Roche Ltd

- Illumina Ltd

- Hologic Corporation

- Agilent Technologies Inc.

- Qiagen NV

- Myriad Genetics

- Abbott Laboratories

- Danaher Corporation

- Becton, Dickinson and Company

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Technology, By Application, By Product and By End User |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What was the market size of the U.S. molecular diagnostics market in 2024?

-

What is the projected market size of the U.S. molecular diagnostics market by 2033?

-

What is the CAGR (Compound Annual Growth Rate) for the U.S. molecular diagnostics market from 2025 to 2033?

-

What are the primary technologies used in molecular diagnostics in the U.S.?

-

What are the key applications of molecular diagnostics in the U.S. healthcare system?

-

Which segment of molecular diagnostics is projected to experience the most significant growth in the U.S.?

-

What are the main drivers of growth in the U.S. molecular diagnostics market?

-

What challenges are faced by the U.S. molecular diagnostics market?

-

How is personalized medicine influencing the demand for molecular diagnostics in the U.S.?

-

Who are the leading companies in the U.S. molecular diagnostics market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

4.3 Opportunities

5. United States Molecular Diagnostics Market

6. Market Share Analysis

6.1 By Technology

6.2 By Application

6.3 By Product

6.4 By End User

7. Technology

7.1 Chips and Microarrays

7.2 In Situ Hybridization

7.3 Sequencing

7.4 Mass Spectrometry (MS)

7.5 PCR

7.6 Other Technologies

8. Application

8.1 Pharmacogenomics

8.2 Infectious Disease

8.3 Genetic Disease Screening

8.4 Oncology

8.5 Blood Screening

8.6 Microbiology

8.7 Human Leukocyte Antigen Typing

9. Product

9.1 Instruments

9.2 Reagents

9.3 Other Products

10. End User

10.1 Hospitals

10.2 Laboratories

10.3 Other End Users

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 F Hoffmann-la Roche Ltd

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Illumina Ltd

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 Hologic Corporation

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Agilent Technologies Inc.

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Qiagen NV

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Myriad Genetics

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Abbott Laboratories

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 Danaher Corporation

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

13.9 Becton, Dickinson and Company

13.9.1 Overviews

13.9.2 Key Person

13.9.3 Recent Developments

13.9.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com