United States Used Car Market & Volume by Types (Sedan, SUV, Micro Van, Trailer, Motorcycle, Others), Size, Vehicle age, Distribution Channels, Region, Pricing, Company Analysis

Buy NowGet Free Customization in this Report

The demand for used cars is high among consumers in the United States; this is due to favourable policies and changing consumer behaviour. United States consumers have become more comfortable in buying a used car due to rising car inventories. The growth in the number of franchised and independent car dealer with a better deal and competitive price for cars is also attracting Used Car Market in the United States. According to Renub Research analysis, United States Used Car Market is forecasted to be more than US$ 885 Billion by the end of the year 2026.

Companies like Penske Automotive, CarMax, Asbury Automotive Group and AutoNation are attracting used car consumer with aggressive advertisements, dedicated websites, lucrative offers and additional facilities. All these growth factors are propelling Used Car Market in the United States.

COVID-19 is boosting Used Car Market in the United States

The used car market has been boosted from COVID-19 as people are avoiding mass transportation such as buses, trains and even taxi services. Most of the consumers are buying used cars due to sudden economic crisis created by this pandemic and saving money in an uncertain economy is the priority. The difference between the prices of the used car versus the new car plays the most significant role in this market.

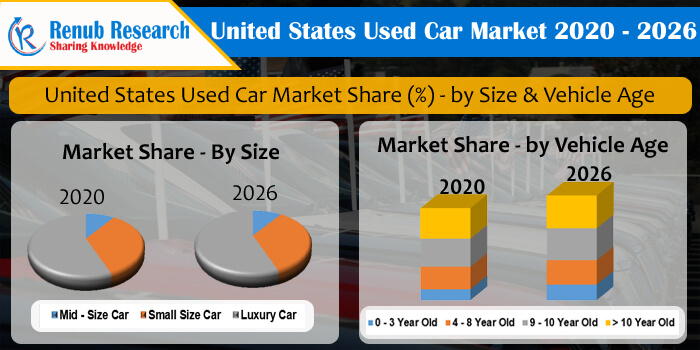

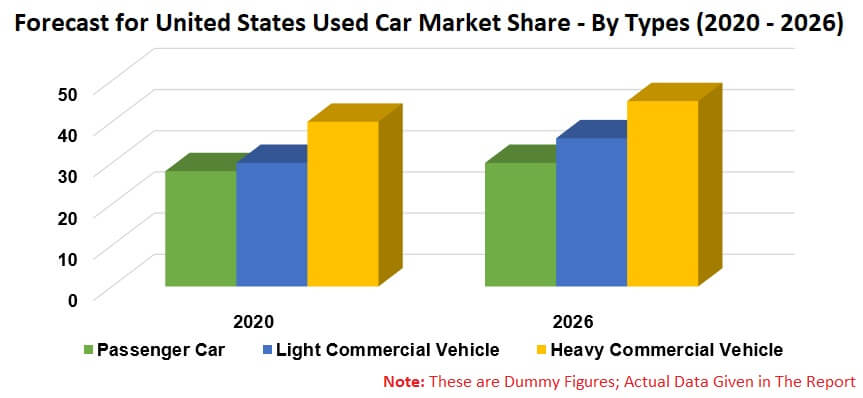

Renub Research report titled “United States Used Car Market by Types (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), Market & Volume by Size (Mid - Size Car, Small Size Car, Luxury Car), Market of Vehicle by Age (0- 3 Year, 4 - 8 Year, 9-10 Year, > 10 Year), Market & Volume by Distribution Channels (Franchised, Independent Car Dealers and Others), Market & Volume by Region (South East US, South West US, North East US, Mid West US and West US), Company Analysis (Penske Automotive Group Inc, CarMax Inc, Asbury Automotive Group Inc, AutoNation Inc, Amazon.com Inc, EBay Inc, and Alibaba Group Holding Ltd)” provides a complete analysis of United States Used Car Market.

Type – United States Used Car Market

• Passenger Car

• Light Commercial Vehicle

• Heavy Commercial Vehicle

Size – United States Used Car Market and Volume

• Mid - Size Car

• Small Size Car

• Luxury Car

Vehicle Age – United States Used Car Market

• 0 - 3 Year Old

• 4 - 8 Year Old

• 9 - 10 Year Old

• > 10 Year Old

Distribution Channels – United States Used Car Market and Volume

• Franchised

• Independent Car Dealers

• Others

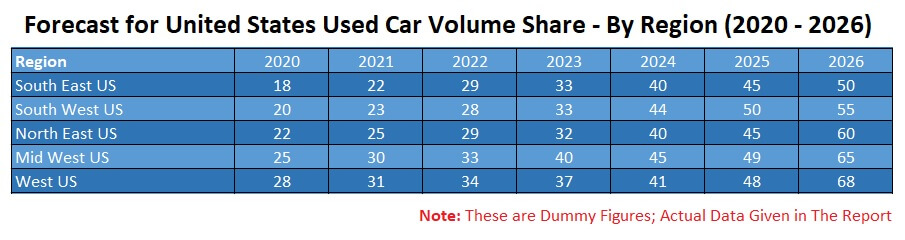

Region – United States Used Car Market and Volume

• South East US

• South West US

• North East US

• Mid West US

• West US

Company Analysis provided in the Research Report

• Penske Automotive Group Inc

• CarMax Inc

• Asbury Automotive Group Inc

• AutoNation Inc

• Amazon.com Inc

• EBay Inc

• Alibaba Group Holding Ltd

If the information you seek is not included in the current scope of the study kindly share your specific requirements with our custom research team at info@renub.com

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Key Challenges

5. United States Used Car Policy

6. United States Used Car Market

7. United States Used Car Units

8. Market Share – United States Used Car

8.1 By Types

8.2 By Size

8.3 By Vehicle Age

8.4 By Distribution channels

8.5 By Region

9. Type – United States Used Car Market

9.1 Passenger Car

9.2 Light Commercial Vehicle

9.3 Heavy Commercial Vehicle

10. Size – United States Used Car Market and Volume

10.1 Mid - Size Car

10.1.1 Market

10.1.2 Volume

10.2 Small Size Car

10.2.1 Market

10.2.2 Volume

10.3 Luxury Car

10.3.1 Market

10.3.2 Volume

11. Vehicle Age – United States Used Car Market

11.1 0- 3 Year old

11.2 4 - 8 Year old

11.3 9-10 Year old

11.4 > 10 year old

12. Distribution Channels – United States Used Car Market

12.1 Franchised

12.1.1 Market

12.1.2 Volume

12.2 Independent Car Dealers

12.2.1 Market

12.2.2 Volume

12.3 Others

12.3.1 Market

12.3.2 Volume

13. Region – United States Used Car Market

13.1 South East US

13.1.1 Market

13.1.2 Volume

13.2 South West US

13.2.1 Market

13.2.2 Volume

13.3 North East US

13.3.1 Market

13.3.2 Volume

13.4 Mid West US

13.4.1 Market

13.4.2 Volume

13.5 West US

13.5.1 Market

13.5.2 Volume

14. Merger & Acquisitions

15. Company Analysis

15.1 Penske Automotive Group Inc.

15.1.1 Overview

15.1.2 Recent Development & Strategy

15.1.3 Revenue Analysis

15.2 CarMax Inc.

15.2.1 Overview

15.2.2 Recent Development & Strategy

15.2.3 Revenue Analysis

15.3 Asbury Automotive Group Inc.

15.3.1 Overview

15.3.2 Recent Development & Strategy

15.3.3 Revenue Analysis

15.4 AutoNation Inc.

15.4.1 Overview

15.4.2 Recent Development & Strategy

15.4.3 Revenue Analysis

15.5 Amazon.com Inc.

15.5.1 Overview

15.5.2 Recent Development & Strategy

15.5.3 Revenue Analysis

15.6 EBay Inc.

15.6.1 Overview

15.6.2 Recent Development & Strategy

15.6.3 Revenue Analysis

15.7 Alibaba Group Holding Ltd.

15.7.1 Overview

15.7.2 Recent Development & Strategy

15.7.3 Revenue Analysis

List of Figures:

Figure-01: United States – Used Car Market (Billion US$), 2019 – 2026

Figure-02: United States – Used Car Sales Volume (Million Units), 2019 – 2026

Figure-03: United States – Car Market (Billion US$), 2015 – 2019

Figure-04: United States – Forecast for Used Car Market (Billion US$), 2020 – 2026

Figure-05: United States – Used Car Volume (Million of Units), 2015 – 2019

Figure-06: United States – Forecast for Used Car Volume (Million of Units), 2020 – 2026

Figure-07: United States – Used Car Market Share Analysis by Types (Percent), 2015 – 2019

Figure-08: United States – Forecast for Used Car Market Share Analysis by Types (Percent), 2020 – 2026

Figure-09: United States – Used Car Market Share Analysis by Size (Percent), 2015 – 2019

Figure-10: United States – Forecast for Used Car Market Share Analysis by Size (Percent), 2020 – 2026

Figure-11: United States – Used Car Market Share Analysis by Car Age (Percent), 2015 – 2019

Figure-12: United States – Forecast for Used Car Market Share Analysis by Car Age (Percent), 2020 – 2026

Figure-13: United States – Used Car Market Share Analysis by Distribution Channel (Percent), 2015 – 2019

Figure-14: United States – Forecast for Used Car Market Share Analysis by Distribution Channel (Percent), 2020 – 2026

Figure-15: United States – Used Car Market Share Analysis by Region (Percent), 2015 – 2019

Figure-16: United States – Forecast for Used Car Market Share Analysis by Region (Percent), 2020 – 2026

Figure-17: United States – Used Passenger Car Market (Billion US$), 2015 – 2019

Figure-18: United States – Forecast for Used Passenger Car Market (Billion US$), 2020 – 2026

Figure-19: United States – Used Light Commercial Vehicle Market (Billion US$), 2015 – 2019

Figure-20: United States – Forecast for Used Light Commercial Vehicle Market (Billion US$), 2020 – 2026

Figure-21: United States – Used Heavy Commercial Vehicle Market (Billion US$), 2015 – 2019

Figure-22: United States – Forecast for Used Heavy Commercial Vehicle Market (Billion US$), 2020 – 2026

Figure-23: United States – Used Mid - Size Car Market (Billion US$), 2015 – 2019

Figure-24: United States – Forecast for Used Mid - Size Car Market (Billion US$), 2020 – 2026

Figure-25: United States – Used Mid - Size Car Volume (Million Units), 2015 – 2019

Figure-26: United States – Forecast for Used Mid - Size Car Volume (Million Units), 2020 – 2026

Figure-27: United States – Used Small Size Car Market (Billion US$), 2015 – 2019

Figure-28: United States – Forecast for Used Small Size Car Market (Billion US$), 2020 – 2026

Figure-29: United States – Used Small Size Car Volume (Million Units), 2015 – 2019

Figure-30: United States – Forecast for Used Small Size Car Volume (Million Units), 2020 – 2026

Figure-31: United States – Used Luxury Car Market (Billion US$), 2015 – 2019

Figure-32: United States – Forecast for Used Luxury Car Market (Billion US$), 2020 – 2026

Figure-33: United States – Used Luxury Car Volume (Million Units), 2015 – 2019

Figure-34: United States – Forecast for Used Luxury Car Volume (Million Units), 2020 – 2026

Figure-35: United States – Used 0- 3 Year Old Car Market (Billion US$), 2015 – 2019

Figure-36: United States – Forecast for Used 0- 3 Year Old Car Market (Billion US$), 2020 – 2026

Figure-37: United States – Used 4 - 8 Year Old Car Market (Billion US$), 2015 – 2019

Figure-38: United States – Forecast for Used 4 - 8 Year Old Car Market (Billion US$), 2020 – 2026

Figure-39: United States – Used 9 - 10 Year Old Car Market (Billion US$), 2015 – 2019

Figure-40: United States – Forecast for Used 9 - 10 Year Old Car Market (Billion US$), 2020 – 2026

Figure-41: United States – Used > 10 year Old Car Market (Billion US$), 2015 – 2019

Figure-42: United States – Forecast for Used > 10 year Old Car Market (Billion US$), 2020 – 2026

Figure-43: United States – Used Car Market by Franchised Distribution (Billion US$), 2015 – 2019

Figure-44: United States – Forecast for Used Car Market by Franchised Distribution (Billion US$), 2020 – 2026

Figure-45: United States – Used Car Volume by Franchised Distribution (Million Units), 2015 – 2019

Figure-46: United States – Forecast for Used Car Volume by Franchised Distribution (Million Units), 2020 – 2026

Figure-47: United States – Used Car Market by Independent Car Dealers (Billion US$), 2015 – 2019

Figure-48: United States – Forecast for Used Car Market by Independent Car Dealers (Billion US$), 2020 – 2026

Figure-49: United States – Used Car Volume by Independent Car Dealers (Million Units), 2015 – 2019

Figure-50: United States – Forecast for Used Car Volume by Independent Car Dealers (Million Units), 2020 – 2026

Figure-51: United States – Used Car Market by Others Distribution (Billion US$), 2015 – 2019

Figure-52: United States – Forecast for Used Car Market by Others Distribution (Billion US$), 2020 – 2026

Figure-53: United States – Used Car Volume by Others Distribution (Million Units), 2015 – 2019

Figure-54: United States – Forecast for Used Car Volume by Others Distribution (Million Units), 2020 – 2026

Figure-55: South East US – Used Car Market (Billion US$), 2015 – 2019

Figure-56: South East US – Forecast for Used Car Market (Billion US$), 2020 – 2026

Figure-57: South East US – Used Car Volume (Million Units), 2015 – 2019

Figure-58: South East US – Forecast for Used Car Volume (Million Units), 2020 – 2026

Figure-59: South West US – Used Car Market (Billion US$), 2015 – 2019

Figure-60: South West US – Forecast for Used Car Market (Billion US$), 2020 – 2026

Figure-61: South West US – Used Car Volume (Million Units), 2015 – 2019

Figure-62: South West US – Forecast for Used Car Volume (Million Units), 2020 – 2026

Figure-63: North East US – Used Car Market (Billion US$), 2015 – 2019

Figure-64: North East US – Forecast for Used Car Market (Billion US$), 2020 – 2026

Figure-65: North East US – Used Car Volume (Million Units), 2015 – 2019

Figure-66: North East US – Forecast for Used Car Volume (Million Units), 2020 – 2026

Figure-67: Mid West US – Used Car Market (Billion US$), 2015 – 2019

Figure-68: Mid West US – Forecast for Used Car Market (Billion US$), 2020 – 2026

Figure-69: Mid West US – Used Car Volume (Million Units), 2015 – 2019

Figure-70: Mid West US – Forecast for Used Car Volume (Million Units), 2020 – 2026

Figure-71: West US – Used Car Market (Billion US$), 2015 – 2019

Figure-72: West US – Forecast for Used Car Market (Billion US$), 2020 – 2026

Figure-73: West US – Used Car Volume (Million Units), 2015 – 2019

Figure-74: West US – Forecast for Used Car Volume (Million Units), 2020 – 2026

Figure-75: Global Penske Automotive Group Inc. Revenue (In Billion US$) 2015 – 2019

Figure-76: Forecast for Global Penske Automotive Group Inc. Revenue (In Billion US$) 2020 – 2026

Figure-77: Global CarMax Inc. Revenue (In Billion US$) 2015 – 2019

Figure-78: Forecast for Global CarMax Inc. Revenue (In Billion US$) 2020 – 2026

Figure-79: Global Asbury Automotive Group Inc. Revenue (In Billion US$) 2015 – 2019

Figure-80: Forecast for Global Asbury Automotive Group Inc. Revenue (In Billion US$) 2020 – 2026

Figure-81: Global AutoNation Inc. Revenue (In Billion US$) 2015 – 2019

Figure-82: Forecast for Global AutoNation Inc. Revenue (In Billion US$) 2020 – 2026

Figure-83: Global Amazon Revenue (In Billion US$) 2015 – 2019

Figure-84: Forecast for Global Amazon Revenue (In Billion US$) 2020 – 2026

Figure-85: Global Ebay Revenue (In Billion US$) 2015 – 2019

Figure-86: Forecast for Global Ebay Revenue (In Billion US$) 2020 – 2026

Figure-87: Global Alibaba Revenue (In Billion US$) 2015 – 2019

Figure-88: Forecast for Global Alibaba Revenue (In Billion US$) 2020 – 2026

List of Tables:

Table-01: Luxury Car Markers and their Brands

Table-02: South East US Car Sales Position

Table-03: Automotive Deal, Merger & Acquisitions in Year 2020

Table-04: Recent Acquisition by Amazon

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com