Vegan Food Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowVegan Food Market Trends & Summary

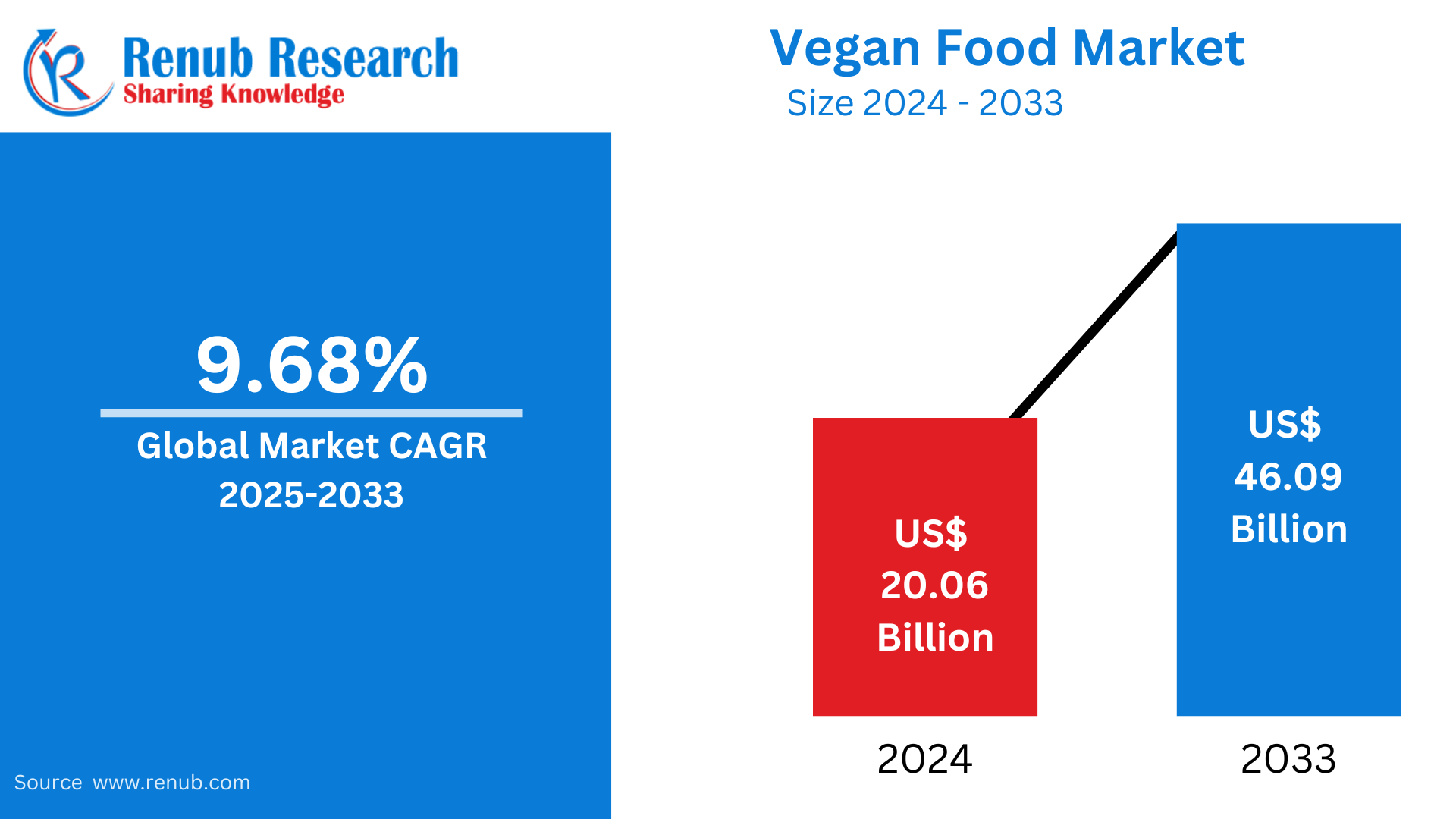

Vegan Food Market Size is estimated to be USD 20.06 billion in 2024 and will grow up to USD 46.09 billion in 2033 with a CAGR of 9.68% between 2025 and 2033. Growth is being backed by consumer awareness for health, sustainability, and animal welfare. Rising demand for plant-based food and beverage alternatives around the globe are major growth factors for this market.

The report Global Vegan Food Market & Forecast covers by Product (Dairy Alternatives, Meat Substitutes, Others), Source (Almond, Soy, Oats, Wheat, Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others) Company and Company Analysis 2025-2033.

Global Outlooks of Vegan Food Markets

Vegan food refers to plant-based foods that are devoid of any products from animal origin, which means no meat, dairy, eggs, and honey. This diet is majorly based on vegetables, fruits, legumes, grains, nuts, seeds, and also the plant-based substitutes for meats and dairy like tofu, tempeh, plant milk, and vegan cheese. This diet has recently gained lots of popularity since it has drawn awareness about environmental and ethical consequences of animal agriculture along with its benefits on health.

Climatological concerns over the years have been on the increase, thereby boosting the popularity of vegan food as many look to reduce their carbon footprint. Veganism also comes with various health benefits like weight management and reduced risk of chronic diseases; it also leads to improved digestion. The emergence of social media and celebrity endorsement has also fueled plant-based diets. The food industry has responded with a growing variety of vegan products, making it easier for people to adopt this lifestyle, which is contributing to the rapid growth of the global vegan food market.

Growth Drivers in the Vegan Food Market

Health Consciousness and Wellness Trends

The increased awareness of health benefits associated with vegan diets has contributed greatly to the growth of the market. Studies have demonstrated that plant-based diets reduce the risk of chronic diseases such as heart disease, diabetes, and cancer. With more emphasis on personal health and wellness through healthier eating patterns, vegan food is becoming the best lifestyle option. Vegan alternatives have lower saturated fats and greater fiber content; therefore, a demand is now increasing across the age groups for market growth. Recently, lifestyle veganism has significantly increased. There are estimated 88 million people who follow the vegan lifestyle as of 2024, according to the Vegan Society. India, the country with the highest percentage, boasts an 11% population who claims to be a vegan, while the United States and China come second at 4%. Of these vegans, 27% are from Gen Z and millennials, while Gen X is around 23%.

Environmental Sustainability

Increasingly, consumers have been focusing their attention on the environmental sustainability of foodstuffs. In this regard, animal agriculture ranks as one of the primary factors causing greenhouse gases, deforestation, and water pollution. A vegan foodstuff provides an environment-friendly option where plant-based foodstuffs tend to have significantly lower carbon emissions compared to animal-based counterparts. As awareness of climate change and sustainability increases, so does the uptake of vegan food to reduce carbon footprint, creating demand and further growth in the vegan food market. For instance, ShelfNow, the food retailer online, recorded a 156% increase in vegetable meal sales and a 150% increase in vegan meal sales, with a significant rise in the vegan food market in various food store operators.

Advancement in Product Innovation

Vegan food is witnessing a revolution of innovations, with more and improved plant-based products coming into the market. Meat alternatives, dairy-free substituents, and other plant-based innovations, mimicked close to the taste and mouthfeel of traditional animal-based products, are the highlighted sectors of this innovation cycle. With consumer demand for tasty, convenient, and high-quality vegan products, firms are heavily investing in research and development. This product innovation has attracted health-conscious consumers and people who are transitioning into plant-based diets, thereby opening up the market and encouraging wider adoption of vegan food. For instance, Shiru, Inc., which is based in the US, recently launched OleoPro, a plant-based fat ingredient created using its proprietary AI-driven platform, Flourish, which gives insights on novel plant proteins.

Challenges in the Vegan Food Market

High Price of Vegan Products

While popularity is increasing, the cost of vegan food may be a major deterrent to widespread adoption. Many plant-based products, especially meat and dairy alternatives, are significantly more expensive than their animal-based counterparts. Production costs are often higher, the scale is limited, and specialized ingredients add to the price difference. This price gap may discourage some consumers from fully embracing a vegan lifestyle, limiting the growth of the market, particularly in lower-income households and developing regions.

Perceptual and cultural barriers

Many places consider veganism to be a niche or alternative lifestyle associated with particular demographics or subcultures. Besides, social and cultural norms promoting the consumption of meat can raise opposition to the intake of vegan food. Several traditional diets around the world heavily depend on animal products, so transitioning to a more plant-based diet is hard. So far, perceptions and cultural resistance are one of the significant hurdles in encouraging global adoption of vegan food.

Dairy Alternatives Vegan Food Market

Dairy alternatives, the segment within the vegan food market, is gaining a significant momentum as more consumers seek to reduce their lactose intake and substitute with plant-based products. Milks made from plants such as almond, soy, oat, and coconut milk are finding more takers as dairy alternatives, thanks to health benefits and numerous flavors available in the market. The trend toward dairy-free diets, often for reasons of lactose intolerance, veganism, and health, is driving the demand for dairy-free substitutes, which is expanding this market segment.

Almond Vegan Food Market

The almond-based vegan food market is booming because of the popularity of almond milk, a dairy-free alternative. Almonds are also used in various vegan food products, such as almond butter, almond-based cheeses, and snacks. The health advantages of almonds, such as its rich content of healthy fats, protein, and fibers, contribute to the expanding demand for such goods that almond-based has gained within the healthy-conscious consumers. As the demand for plant-based diets continues to increase, the growth of the almond vegan food market is anticipated to continue.

Wheat Vegan Food Market

Wheat-based products, for example wheat gluten or seitan, are particularly common in the vegan food market. Wheat gluten is a protein-riche material prepared from wheat dough that can resemble the look and texture of meat. Due to the increasing demand for plant-based protein intake, wheat-based vegan products have become in fashion. Wheat-based bread, pasta, and bread products are also wide spread throughout the diet of vegans, thus making it the most versatile ingredient in the expansion of the market.

Vegan Food Supermarkets and Hypermarkets Market

Supermarkets and hypermarkets have been the most essential distribution channels for vegan food products. As consumer demand for plant-based products rises, many supermarkets are expanding their vegan offerings to cater to the growing market segment. This encompasses dedicated vegan sections, plant-based meat and dairy alternatives, snacks, and ready-to-eat meals. The convenience of shopping for vegan food in large, mainstream stores is attracting more customers and making vegan food more accessible, which contributes to the market's growth.

Online Store Vegan Food Market

Online stores that sell vegan food are on the rise. Through online stores, the consumer gets the convenience of accessing vegan food items in the most easy way through online stores for grocery and meal kits, and snack and supplements products. The growth of online platforms has also enabled companies to reach a broader audience, including those in regions where vegan options may be limited in physical stores. This shift to online shopping is further driving the expansion of the vegan food market.

Vegan Food Market Overview by Regions

United States Vegan Food Market

The United States is one of the largest markets for vegan food, with a growing number of consumers adopting plant-based diets. With the growing awareness of health and environmental issues, more Americans are opting for vegan food products, such as meat and dairy alternatives, snacks, and ready-to-eat meals. The availability of vegan products in major supermarkets and restaurants is also driving market growth. The U.S. market is expected to continue growing as plant-based options become more mainstream. Israeli startup Chunk Foods began selling vegan steak whole-cuts made from cultured soy in select U.S. restaurants in 2023. The steaks are now sold in retail stores in New York City and Los Angeles, with a nationwide rollout planned for 2025, according to VegOut Magazine.

United Kingdom Vegan Food Market

In the UK, there is a considerable rise in veganism, as people opt for a plant-based diet for health and ethical reasons. Vegan food can be easily sourced in supermarkets, restaurants, and online stores. With the emergence of vegan celebrities, influencers, and social media campaigns, it has contributed much to the growing market. The UK is among the leading markets for vegan food in Europe.

India Vegan Food Market

The Indian vegan food market is growing fast, mainly because of increased awareness about the health benefits of plant-based diets and concerns about animal welfare. Traditionally, India is a vegetarian country, and many consumers are already familiar with plant-based ingredients. The surging popularity of veganism, especially in urban youth, creates a high demand for vegan products - dairy alternatives, plant-based meat, and snacks. In addition, the trend of vegan restaurants and shopping websites contributes to market growth. Dec 2024, Vezlay Soya Chikka, Healthy and delicious vegan product with quick preparation at home. It's a game changer for those who want tasty and nutritious meals and can make various dishes.

Saudi Arabia Vegan Food Market

Demand for vegan food is growing in Saudi Arabia, as more and more consumers seek healthier, sustainable, and ethical dietary options. Increasing awareness of the environmental impact of animal agriculture, coupled with increasing health consciousness, drives the popularity of plant-based diets. Meat and dairy alternative food products that are vegan in nature have been gaining momentum in major cities, and it is expected that the market would increase with younger people embracing veganism and a plant-based lifestyle. August 2023: The vegan food scene in Saudi is growing. Restaurants and cafes offer plant-based options. Ayla's Choice revolutionized the market for it allowed its customers to purchase locally made plant-based products from its shop for use at home.

Vegan Food Market Segments

Product – Market breakup in 3 viewpoints:

- Dairy Alternatives

- Meat Substitutes

- Others

Source – Market breakup in 5 viewpoints:

- Almond

- Soy

- Oats

- Wheat

- Others

Distribution Channel – Market breakup in 5 viewpoints:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Country – Market breakup in 25 viewpoints:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

All the key players have been covered from 5 Viewpoints:

- Overview

- Key Persons

- Recent Development & Strategies

- Product Portfolio

- Financial Insights

Company Analysis

- Beyond Meat Inc.

- Danone S.A

- The Archer Daniels Midland Company

- Tofutti Brands Inc.

- Vitasoy Australia Products Pty Ltd.

- SunOpta

- Daiya Foods, Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Source, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size for the global vegan food market in 2033?

-

What is the compound annual growth rate (CAGR) expected for the vegan food market from 2025 to 2033?

-

Which factors are driving the growth of the vegan food market?

-

How does the vegan food market benefit health-conscious consumers?

-

What is the primary reason for the increasing popularity of vegan food globally?

-

What challenges are impacting the widespread adoption of vegan food?

-

Which distribution channels are contributing to the growth of the vegan food market?

-

What are some examples of dairy alternatives in the vegan food market?

-

How is the United States vegan food market performing, and what trends are influencing it?

-

Who are some of the major companies operating in the vegan food market, according to the report?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Vegan Market

6. Market Share Analysis

6.1 Product

6.2 Source

6.3 Distribution Channel

6.4 Country

7. Product

7.1 Dairy Alternatives

7.2 Meat Substitutes

7.3 Others

8. Source

8.1 Almond

8.2 Soy

8.3 Oats

8.4 Wheat

8.5 Others

9. Distribution Channel

9.1 Supermarkets and Hypermarkets

9.2 Convenience Stores

9.3 Specialty Stores

9.4 Online Stores

9.5 Others

10. Country

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia

10.3.5 South Korea

10.3.6 Thailand

10.3.7 Malaysia

10.3.8 Indonesia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 South Africa

10.5.2 Saudi Arabia

10.5.3 UAE

11. Porter’s Five Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Company Analysis

13.1 Beyond Meat Inc.

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Product Portfolio

13.1.5 Financial Insights

13.2 Danone S.A

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Product Portfolio

13.2.5 Financial Insights

13.3 The Archer Daniels Midland Company

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Product Portfolio

13.3.5 Financial Insights

13.4 Tofutti Brands Inc.

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Product Portfolio

13.4.5 Financial Insights

13.5 Vitasoy Australia Products Pty Ltd.

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Product Portfolio

13.5.5 Financial Insights

13.6 SunOpta

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Product Portfolio

13.6.5 Financial Insights

13.7 Daiya Foods, Inc.

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Product Portfolio

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com